by Calculated Risk on 2/04/2008 12:32:00 PM

Monday, February 04, 2008

Moody's Raises Loss Assumptions on CDOs

From Bloomberg: Moody's Raises Loss Assumption to Almost 18 Percent for CDOs (hat tips SC, Brian)

Moody's Investors Service raised its loss assumptions to as much as 17.8 percent on 2006 subprime bonds packaged into collateralized debt obligations, heralding further ratings downgrades as defaults increase.More downgrades coming.

Losses are assumed to be at least 14.8 percent, more than double its forecast of last April ...

FT: Leveraged loan market in “disarray”

by Calculated Risk on 2/04/2008 09:54:00 AM

From Stacy-Marie Ishmael and Henny Sender at the Financial Times: Loan market in ‘disarray’ after Harrah’s upset

The leveraged loan market begins the week in “disarray” following the collapse of efforts to syndicate $14bn of the debt used to finance the $30bn buy-out of Harrah’s Entertainment, bankers say.When a bank makes a bridge loan for a leveraged buy-out deal, and then can't syndicate the debt, it is known as a "pier loan"; a bridge that goes nowhere. With all the discussion of bad real estate debt, it is easy to forget that Wall Street is still saddled with pier loans from the LBO frenzy of 2007.

The group of banks backing buyers Apollo Management and Texas Pacific Group are having trouble selling on the leveraged buy-out debt to third parties. With the bulk of the debt remaining on their books, the banks are sitting on a sizeable loss.

...

Virtually every loan-backed buy-out deal done in the past few months is trading well below 90 cents on the dollar. With most investors concluding that the bottom is not yet in sight ...

“The market is in total disarray,” said the head of debt capital markets at one major Wall Street firm. Another senior banker involved in the deal added: “The last 10 days have been the worst ever. There is a complete buyers’ strike.”

As Yves Smith at naked capitalism comments:

In the late 1980s, bridge financing ... brought investment banks a heap of trouble. But there is no institutional memory.

Why Doesn't the IRS Just Use Pay Pal?

by Tanta on 2/04/2008 09:25:00 AM

All I can say is thank heavens that World Series thing is over so that those of us who couldn't care less about basketball can get back to important things, like deleting spam and serious economic analysis.

You know this whole idea is a scam just by the fact that the government -- which could just scale back what it withholds from our paychecks for a few weeks -- is making such a big show of putting checks in the mail. I wouldn't be surprised if they send Ed McMahon to our doors with those giant checks. Nothing would make me save for retirement more than seeing Ed McMahon in person and realizing that no matter what you do to your body, you might live into your mid-80s.

But the government doesn't want us to bank that money or use it to pay off debts. It believes we will go out and spend the money, and that will make our houses worth a lot again. The idea is this: Say, for instance, I got $600, and I spent it on strippers. Those strippers would then buy clothes at Bebe, and the person who owns Bebe would buy the crappy house I overpaid for and get me out of the financial predicament caused by unscrupulous mortgage lenders and not by my addiction to strip joints.

PE Firm on Monolines: "Don't pass ability-to-understand test"

by Calculated Risk on 2/04/2008 12:54:00 AM

Quote of the day from the Financial Times: Private equity firms unlikely to rescue Ambac and MBIA

"If we worry that we can get shot from the shadows by something we can't see coming, it is not for us," says the managing director in charge of financial service investments for one of the leading private equity funds.The downgrade watch continues.

"The financial guarantors pass neither the shadow test nor the ability-to-understand test."

Sunday, February 03, 2008

Components of Residental Investment

by Calculated Risk on 2/03/2008 04:06:00 PM

This is a follow up to the previous post regarding investment in home improvement.

This data is from the Bureau of Economic Analysis (BEA), supplemental tables. (see Section 5: Table 5.4.5AU. Private Fixed Investment in Structures by Type, near the bottom)

This graph shows the major components of residential investment (RI) normalized by GDP. Click on graph for larger image.

Click on graph for larger image.

The largest component of RI is investment in new single family structures. This includes both homes built for sale, and homes built by owner.

The second largest component of RI is home improvement. As I noted in the previous post (using inflation adjusted dollars), investment in home improvement has held up pretty well. This investment could be seriously impacted by declining mortgage equity withdrawal (MEW) over the next few quarters.

The third largest category (at least in recent years), has been broker's commissions. This is the only component of existing home sales included in residential investment, and the decline in broker's commissions follows the decline in existing home sales.

The only other major component of RI is multifamily structures. This includes apartments and some condo projects.

Most of the focus has been on declining investment in single family structures (declining new home sales) and broker's commissions (declining existing home sales). But so far, with strong MEW, home improvement has held up well.

Rob sent me this description of what he is seeing in the housing market in Western Washington state:

I want to echo the observations of the Bay Area home shopper.I'm sure these "pimped out" homes are all across the country. And MEW has probably been the primary source of funds for many of these homeowners. Now that it appears MEW lending is being tightened - especially for Home Equity Lines of Credit - this will probably impact home improvement spending.

...

In nearly every middle class house listing I view, I see upgraded kitchens with granite (usually slab) counter tops . I also see matching stainless steel appliances and high end cabinets.

Now, these houses and condos are all less than 15 years old, so the owners were not generally replacing worn out or really out-of-style stuff. And these houses did not come equipped like this. I also see living rooms and family rooms that have complete, matching sets of furniture, probably from places like Pottery Barn. Not just one or two pieces, but _every_ single_ piece_. It's like all living, dining and family room furniture was swapped out at exactly the same time. I contrast this with how houses used to be furnished: a piece here, a piece there, a gift from relatives, etc., gradually over the years. No more. Everyone is going for the "showroom" look. ...

I even see this phenomenon in the low-end condo development where I bought my "starter home" back in 1993. ... when I sold my unit in 2006 after renting it out for a few years, it was "stock." No new cabinets, appliances, granite counter tops, wood or laminate flooring, simple fixtures, etc. And it was in great shape. Well, I have found that many of the units in that development have also been "pimped out" with "designer paint schemes," granite counters, new kitchen cabinets, $300 faucets and appliances, pergo flooring, fancy new mill work, etc.

These condos were built in 1993 and 1994. The counters, cabinets, mill work and most appliances should have been in reasonably good condition and not too dated in appearance. Since those folks have very modest incomes, I know where the money [probably] came from.

Home Improvement Investment

by Calculated Risk on 2/03/2008 01:46:00 PM

I heard from a prospective homebuyer in the Bay Area of California this morning. She noted that almost every house she has viewed had recently remodeled kitchens and baths.

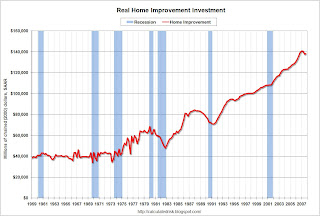

And that brings up an interesting point: Real spending on home improvement has held up pretty well so far (only off 2% in real terms from the peak). If this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.  Click on graph for larger image.

Click on graph for larger image.

This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in light blue (source: BEA)

Real spending on home improvement increased slightly in Q4 2007 after declining the previous two quarters. With declining MEW, it is very possible that home improvement spending will slump like in the early '80s and '90s.

Saturday, February 02, 2008

Shiller: Historic Housing Bust, Possible Severe Recession

by Calculated Risk on 2/02/2008 06:42:00 PM

UK: The Return of Negative Equity

by Calculated Risk on 2/02/2008 05:51:00 PM

From the Daily Mail: The return of negative equity:

Thousands Credit ratings agency Experian have drawn up a map showing which areas of the country are most at risk from a fall in prices.Negative equity limits mobility, prevents homeowners from selling, refinancing, or borrowing from their homes in case of an emergency. So it shouldn't be a surprise that negative equity is also highly correlated with foreclosures.

It found that in some parts of Britain, the average mortgage debt is more than 90 per cent of local property prices.

This leaves owners vulnerable to negative equity ...

The financial regulator, the Financial Services Authority, has warned tmore than a million families are in danger of losing their homes in the next 18 months.

Also in the UK, the WSJ reports: Citigroup Cuts Off Some U.K. Credit Cards

In a sign of more consumers losing access to loans, Citigroup Inc. has told some 161,000 credit-card customers in the U.K. that they can use their cards until the first week of March and then they'll no longer be able to tap the New York bank for credit.

San Diego REO / Short Sale Prevalence above 50%

by Calculated Risk on 2/02/2008 02:49:00 PM

Ramsey Su, an REO broker in San Diego, has sent me the following:

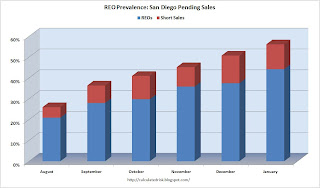

I started tracking REOs and short sales 6 months ago. It is alarming how consistently they climbed month after month. I do not remember any time in the history of SD real estate that REOs and short sales account for over 50% of all sales. This phenomenon is so negative, but ignored and under appreciated by analysts, economists and the media.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percentage of pending sales for REOs and short sales in San Diego. Combined they accounted for 56.1% of all pending sales in January.

For units sold, REOs and short sales combined for 51.7% of the total market in January, up sharply from 6 months ago (about 20%). Clearly the San Diego market is starting to be dominated by REOs.

I called one of the top agents in San Diego yesterday, and she told me that the housing market is steadily getting worse with the flood of REOs. She said the banks are still dragging their feet on lowering prices, and she expects prices to decline 40% to 50% from the peak in many areas of San Diego. She gave me an example of a house that sold for $500K in 2005. The bank foreclosed and is now asking $380K - with no offers - and she believes it will eventually sell for $300K or less.

Fitch Concerned about Borrowers 'Walking Away'

by Calculated Risk on 2/02/2008 01:35:00 PM

Via Housing Wire: Fitch Places $139 Billion of Subprime RMBS on Negative Watch, Cites ‘Walk Aways’

It’s worth noting some of the language in Fitch’s press statement — because it’s the first time any of the rating agencies have lended credence to the idea that borrowers are walking away from their homes [emphasis added]:A combination of falling prices (with millions of homeowners upside down on their homes), and changing social norms, could lead to staggering losses for lenders and investors.In Fitch’s opinion the contraction in the mortgage markets has contributed to an acceleration and deepening of home price declines, and has eliminated the option to sell or refinance a home to avoid foreclosure for many borrowers. Additionally, the apparent willingness of borrowers to ‘walk away’ from mortgage debt has contributed to extraordinarily high levels of early default, which is particularly noticeable in the 2007 vintage mortgages. As Fitch has described in recent research reports, this behavior appears to be largely attributable to the use of high risk mortgage products such as ‘piggy-back’ second liens and stated-income documentation programs, which in many instances were poorly underwritten and susceptible to borrower/broker fraud.