by Calculated Risk on 11/24/2007 08:16:00 PM

Saturday, November 24, 2007

Merrill's Rosenberg: Recession

From Alan Abelson at Barron's: Skeleton at the Feast (hat tip Jas)

In a piece [Merrill Lynch's David Rosenberg] put out Friday, he says unequivocally that if you're looking for the earnings recession, you need look no more -- it's here. ...I believe Rosenberg is referring to operating earnings excluding the huge GM loss(1). S&P 500 operating earnings are off 8.5% from Q3, 2006 and off 12.4% from Q2 2007.

With the tally now encompassing 90% of the companies reporting, third-quarter earnings per share dropped 8.5% from the third quarter last year. ...

David stresses that profits drive the business cycle -- capital spending and employment feed off them. And he sighs: "It has always been thus." Hence, he's ineluctably forced to the conclusion that a recession in the economy "is either here or no more than two quarters away."

I'm not sure about the recession being "here now". There are signs of a slump in non-residential structure investment, but software and equipment investment still appears steady. And the all important holiday retail sales are apparently off to a healthy start: Retailers post robust start to holidays

According to ShopperTrak RCT Corp., which tracks sales at more than 50,000 retail outlets, total sales rose 8.3 percent to about $10.3 billion on Friday, the day after Thanksgiving, compared with $9.5 billion on the same day a year ago. ShopperTrak had expected an increase of no more than 4 percent to 5 percent.It is always hard to tell in real time when a recession has started, but I don't think the U.S. economy is in recession - yet.

Note 1: as reported earnings, including GM, are off 27.8% from Q3 2006.

ECB Takes Emergency Liquidity Action

by Calculated Risk on 11/24/2007 03:32:00 PM

From the Financial Times: ECB set to pump cash into money markets

Fresh emergency action to pump funds into the money markets was announced on Friday night by the European Central Bank amid renewed fears that liquidity in the credit markets is again starting to dry up.So much for decoupling.

On Friday night, the bank said it would inject an unspecified amount of extra liquidity next week, noting “re-emerging tensions” ... The new promise of intervention came as three-month US interbank rates rose for the eighth day in a row to 5.04 per cent, more than half a point higher than the US Fed Funds target rate of 4.5 per cent.

...

The credit squeeze is also showing signs of dragging down euro-zone economic growth,... Service business growth in the 13-country euro-zone slumped to the weakest level for more than two years ...

Subprime Reporting

by Calculated Risk on 11/24/2007 01:44:00 PM

The WSJ features a front page story this morning from Ruth Simon: Rising Rates to Worsen Subprime Mess

The subprime mortgage crisis is poised to get much worse.It is accurate to say the "subprime crisis is poised to get much worse". As is the mortgage crisis in general, including prime loans. As is the housing market crisis. As is the overall credit crisis.

Next year, interest rates are set to rise -- or "reset" -- on $362 billion worth of adjustable-rate subprime mortgages, according to data calculated by Bank of America Corp.

But the WSJ sticks to subprime, as David Einhorn noted:

"Subprime is not about us, for we are not subprime."This morning I drove through Laguna Beach, a very nice area of southern California. I saw house after house with "For Sale" signs, many with added teasers like "price reduced" or "seller motivated". I guarantee these desperate sellers didn't buy these multi-million dollar homes with subprime loans!

But the WSJ sticks to subprime reporting. Oh well ...

Ms. Simon does catch a glimpse of the real problem when she notes that resets weren't the primary driver for defaults this year:

Many of the subprime mortgages that have driven up the default rate went bad in their first year or so, well before their interest rate had a chance to go higher. Some of these mortgages went to speculators who planned to flip their houses, others to borrowers who had stretched too far to make their payments, and still others had some element of fraud.Forget flippers and fraud, the real driver for defaults over the next couple of years will be a combination of borrowers who "stretched too far" and falling home prices. Yes, subprime matters, and the coming resets will make the problem worse. But, the problem will be much more widespread than subprime.

Also, the WSJ article mentions a recent Bear Stearns research report:

The projected supply of foreclosed homes is equal to about 45% of existing home sales and could add four months to the supply of existing homes, says Dale Westhoff, a senior managing director at Bear Stearns. This is a "fundamental shift" in the housing supply, says Mr. Westhoff, who believes that home prices will drop further as lenders "mark to market" repossessed homes.As I noted on Oct 1st, in some neighborhoods of San Diego, a large percentage of homes on the market are already distressed (REOs, or offered as short sales):

I spoke with one of the top agents in San Diego this weekend, and she was analyzing one neighborhood for a client in the $375K to $450K price range. There were 70 listings (very high for that neighborhood and price range), but she was shocked to find that approximately 75% of the listings were short sales, and a similar percentage were vacant.So I'm not surprised that Bear expects a fairly large percentage of the existing home inventory to be distressed next year, but I'm not sure this will add four months to the overall inventory (as Bear Stearns suggests). As the number of REOs surge, I'd expect some of the less desperate homeowners to take their homes off the market.

Currently the months of supply for existing home inventory is at 10 months. As sales continue to fall, I wouldn't be surprised to see 12 months of inventory next year. Right now I don't expect to see another 4 months of inventory on top of that - but it is possible.

Friday, November 23, 2007

Roubini on Recoupling

by Calculated Risk on 11/23/2007 06:25:00 PM

Nouriel Roubini writes: Recoupling rather than Decoupling: the Forthcoming Contagion to China, East Asia and Emerging Markets

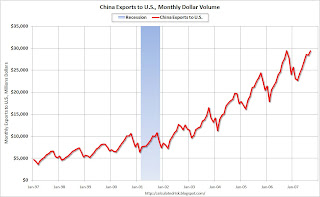

Paradoxically China is the one country that has, so far, decouple the most – both in real and financial terms from the U.S. but it will also be the first and most serious victim of a U.S. led recession. The decoupling of China is clear as its growth rate has not decelerated, in spite of the U.S. slowdown, and its financial markets have – so far – blissfully avoided (thanks in part to its financial system partially isolated via capital controls from the global one) the turmoil and volatility that hit the US and Europe since the summer. But the reason for the Chinese growth decoupling is that, until recently the US slowdown was still modest (short of the coming hard landing) and it was not concentrated in private consumption but rather housing: China is mostly exporting low-priced consumer goods to the U.S. and the recoupling of China will occur soon once the US consumer recession is in full swing. Thus, the biggest victim of a US consumer led recession will be the country – China - that, so far, has decoupled the most from the US.Let me add a couple of graphs:

...

No wonder that Chinese officials have started to express serious concerns about the current sharp slowdown in Chinese exports to the US, from an annualized growth rate of over 20% in Q1 to a rate of 12.4% in Q3 of this year ("If demand in the US drops further, Chinese exporters will be devastated by a rapid and continuous fall in orders," a Chinese official report said).

Click on graph for larger image.

Click on graph for larger image.The first graph shows the growth in China's exports to the U.S. over the last ten years. There is a clear seasonal pattern, and October is the peak month for Chinese exports to the U.S.

The second graph shows the Year-over-year change in Chinese exports to the U.S. Note: this graph uses a 3 month centered average to calculate the YoY change.

Since the last data point (trade data) is for September, and I'm using a 3 month centered average, the last plotted point is for August (9.5% YoY change).

Since the last data point (trade data) is for September, and I'm using a 3 month centered average, the last plotted point is for August (9.5% YoY change).Looking at data from the Ports of LA and Long Beach, the YoY change might be close to zero soon - something that hasn't happened since the 2001 recession.

Roubini argues for recoupling:

And once there is a sharp growth slowdown in China the next victims of this recoupling will be East Asia and commodity exporters.

UBS CPDO "Blows Up"

by Calculated Risk on 11/23/2007 01:53:00 PM

From Alea (via Reuters): World’s First : UBS Triple A CPDO Blows Up

Moody’s cut its rating on one tranche of a deal issued via UBS nine notches to “C,” one step above default, from “Ba2,” after unprecedented spread widening in credit default swaps on financial companies included in the deal hit triggers that required it to be unwound.This was a small deal, but there is probably more coming:

The unwind of the deal known as a Constant Proportion Debt Obligation (CPDO) caused an approximate 90 percent loss for investors, Moody’s said in a statement.

The downgrade impacts 11.5 million euros (US$17.04 million) of debt that was due in 2017. ... Moody’s has also placed under review for downgrade 340 million euros worth of debt from five CPDOs that are also exposed to financial companies.What is a CPDO? Just another complicated way to

“Constant proportion debt obligations” are the latest must-have for those dissatisfied with the paltry returns from traditional investments.Update: In the comments, the Rub suggests this PIMCO article from May 2007: Demystifying the Structured Credit Jargon and Identifying the Opportunities.

CPDOs take credit exposure in the derivatives market of up to 15 times the amount invested. The complex structures involve selling credit default swap protection on corporate credits using, for example, European iTraxx index contracts. Piling on leverage amplifies a meagre return of roughly 0.25 per cent a year to nearer 4 per cent. That covers the cost of the transaction, a healthy return to investors and a cushion. Meanwhile, investors’ money is in the bank earning interest. Early deals promised buyers a whopping 2 percentage point premium over Libor on structures that, partly thanks to the return cushion, were rated triple-A.

If everything goes smoothly, leverage falls as the instrument accumulates excess returns. Once it is sufficiently well funded to pay everyone over the instrument’s life of, say, 10 years, it holds just cash. But the reverse is also true. If a CPDO makes losses because of unexpected defaults or a worsening credit outlook, leverage can rise, up to a cap, in an effort to “win back” any shortfall.