by Calculated Risk on 11/23/2007 06:25:00 PM

Friday, November 23, 2007

Roubini on Recoupling

Nouriel Roubini writes: Recoupling rather than Decoupling: the Forthcoming Contagion to China, East Asia and Emerging Markets

Paradoxically China is the one country that has, so far, decouple the most – both in real and financial terms from the U.S. but it will also be the first and most serious victim of a U.S. led recession. The decoupling of China is clear as its growth rate has not decelerated, in spite of the U.S. slowdown, and its financial markets have – so far – blissfully avoided (thanks in part to its financial system partially isolated via capital controls from the global one) the turmoil and volatility that hit the US and Europe since the summer. But the reason for the Chinese growth decoupling is that, until recently the US slowdown was still modest (short of the coming hard landing) and it was not concentrated in private consumption but rather housing: China is mostly exporting low-priced consumer goods to the U.S. and the recoupling of China will occur soon once the US consumer recession is in full swing. Thus, the biggest victim of a US consumer led recession will be the country – China - that, so far, has decoupled the most from the US.Let me add a couple of graphs:

...

No wonder that Chinese officials have started to express serious concerns about the current sharp slowdown in Chinese exports to the US, from an annualized growth rate of over 20% in Q1 to a rate of 12.4% in Q3 of this year ("If demand in the US drops further, Chinese exporters will be devastated by a rapid and continuous fall in orders," a Chinese official report said).

Click on graph for larger image.

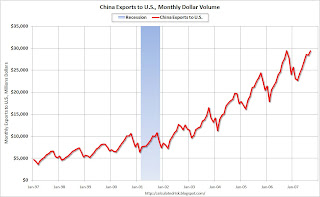

Click on graph for larger image.The first graph shows the growth in China's exports to the U.S. over the last ten years. There is a clear seasonal pattern, and October is the peak month for Chinese exports to the U.S.

The second graph shows the Year-over-year change in Chinese exports to the U.S. Note: this graph uses a 3 month centered average to calculate the YoY change.

Since the last data point (trade data) is for September, and I'm using a 3 month centered average, the last plotted point is for August (9.5% YoY change).

Since the last data point (trade data) is for September, and I'm using a 3 month centered average, the last plotted point is for August (9.5% YoY change).Looking at data from the Ports of LA and Long Beach, the YoY change might be close to zero soon - something that hasn't happened since the 2001 recession.

Roubini argues for recoupling:

And once there is a sharp growth slowdown in China the next victims of this recoupling will be East Asia and commodity exporters.

UBS CPDO "Blows Up"

by Calculated Risk on 11/23/2007 01:53:00 PM

From Alea (via Reuters): World’s First : UBS Triple A CPDO Blows Up

Moody’s cut its rating on one tranche of a deal issued via UBS nine notches to “C,” one step above default, from “Ba2,” after unprecedented spread widening in credit default swaps on financial companies included in the deal hit triggers that required it to be unwound.This was a small deal, but there is probably more coming:

The unwind of the deal known as a Constant Proportion Debt Obligation (CPDO) caused an approximate 90 percent loss for investors, Moody’s said in a statement.

The downgrade impacts 11.5 million euros (US$17.04 million) of debt that was due in 2017. ... Moody’s has also placed under review for downgrade 340 million euros worth of debt from five CPDOs that are also exposed to financial companies.What is a CPDO? Just another complicated way to

“Constant proportion debt obligations” are the latest must-have for those dissatisfied with the paltry returns from traditional investments.Update: In the comments, the Rub suggests this PIMCO article from May 2007: Demystifying the Structured Credit Jargon and Identifying the Opportunities.

CPDOs take credit exposure in the derivatives market of up to 15 times the amount invested. The complex structures involve selling credit default swap protection on corporate credits using, for example, European iTraxx index contracts. Piling on leverage amplifies a meagre return of roughly 0.25 per cent a year to nearer 4 per cent. That covers the cost of the transaction, a healthy return to investors and a cushion. Meanwhile, investors’ money is in the bank earning interest. Early deals promised buyers a whopping 2 percentage point premium over Libor on structures that, partly thanks to the return cushion, were rated triple-A.

If everything goes smoothly, leverage falls as the instrument accumulates excess returns. Once it is sufficiently well funded to pay everyone over the instrument’s life of, say, 10 years, it holds just cash. But the reverse is also true. If a CPDO makes losses because of unexpected defaults or a worsening credit outlook, leverage can rise, up to a cap, in an effort to “win back” any shortfall.

Stop the Subprime Meme!

by Calculated Risk on 11/23/2007 12:18:00 PM

From remarks by David Einhorn in October (hat tip Cal and NakedShorts)

... the credit issues aren't just about subprime. Subprime is what the media says. Subprime is what the financial establishment says. Subprime is about them - those people and the foolish people that made loans to them. The word subprime is pejorative. Subprime is not about us, for we are not subprime. How convenient to be able to pass the blame.Anyone who thinks this a subprime problem, doesn't understand what is happening.

Or, as Tanta wrote: We're all subprime now.

In Which Floyd Meets Nina

by Tanta on 11/23/2007 09:39:00 AM

And innocence is lost. I wonder what would happen if we told him about PIWs.

We're All Subprime Now

by Tanta on 11/23/2007 09:20:00 AM

A little cognitive dissonance with your coffee from The Arizona Republic, via our friends at Housing Doom:

The Valley's growing foreclosure problem is hitting the upper and middle class the hardest.Let's skip over the part about how those poor folk with no pride are "better prepared" than their wealthier brethren who face the horror of admitting to their equally overextended peers that they're in the same boat as the working poor but like to pretend otherwise. We have to skip over that part because it's still a holiday weekend and I don't need to get that cranky today.

Metro Phoenix homes in neighborhoods where prices range from $400,000 to $450,000 now have the highest foreclosure rate. . . .

All segments of the Valley's housing market have been hurt by falling home prices and rising interest rates and payments on adjustable-rate and subprime mortgages. But the problems are worse for homes in the $400,000-to-$450,000 range because many speculators bought in those neighborhoods, some families moved up beyond their means, and the recent credit crunch has made getting mortgages for more than $400,000 tougher. . . .

"The two groups of homeowners hit the hardest now are investors and those who overextended themselves," said Jay Butler, director of realty studies at Arizona State University's Morrison School. "That's why more people in higher-end neighborhoods are struggling now."

Also, there are more loan programs to help lower-income homeowners, while fewer lenders are eager to make loans above $417,000. Mortgage giants Fannie Mae and Freddie Mac are restricted to mainly [sic] investing in loans below $417,000.

"Often, people with lower incomes are better prepared to survive tough times and look for help," Butler said.

"People with higher incomes and bigger homes have a harder time telling neighbors and co-workers they can't afford their mortgage anymore."

Let us, instead, ask ourselves what constitutes the "upper and middle classes." If they "moved up beyond their means," then . . . their means are what, exactly? If 100% or near 100% financing is required to keep these neighborhoods stable (loans over $400,000 for houses in the $400,000-$450,000 price range), then in what sense are they neighborhoods of the "upper and middle classes"? Does our current definition of "middle class" (not to mention "upper class") include having insufficient cash assets to make even a token down payment on a home? Things seem to have changed since I did Econ 101.

What is the utility of this kind of thinking?

Homeowner's Insurance: Risk Shifting

by Tanta on 11/23/2007 08:32:00 AM

From the New York Times:

“It was a kind of avuncular, sleepy line of business,” said William R. Berkley, the chief executive of W. R. Berkley, a commercial insurer in Greenwich, Conn. “Then losses started to outstrip even what investment income might have been able to make up.”Yeah, yeah, that's what we used to say about the mortgage business.

Now what would really be cool is if all those people who took over risks from their insurers also had ARMs . . . wait . . .

Thursday, November 22, 2007

$2.13 Billion in Subprime Losses for Japan Banks

by Calculated Risk on 11/22/2007 11:36:00 PM

From MarketWatch: Japanese banks suffer 230 bln yen in subprime losses: report

Japanese financial institutions have had to write down about 230 billion yen ($2.13 billion) on holdings linked to the U.S. subprime mortgage market ... Japan's financial regulator, the Financial Services Agency, released the figure late Thursday saying it represented losses suffered by major and regional banks, credit associations and credit cooperatives as of Sept. 30, the Nikkei News reported in its Friday morning edition...I wonder what will happen when people realize this isn't just a subprime problem?

SIV Superfund Seeking Support

by Calculated Risk on 11/22/2007 11:21:00 PM

From the WSJ: SIV-Plan Founders to Seek More Support for Superfund

[Bank of America Corp., Citigroup Inc. and J.P. Morgan Chase & Co] ... are expected next week to start soliciting their industry brethren to pitch in with the effort ...The purpose of the Superfund is to buy time for a "more orderly demise" of many of these SIVs. To buy time, other institutions will have to get involved, so this will be interesting to follow.

... BlackRock Inc. is expected next week to be named the manager for the $75 billion to $100 billion fund ...

The participation of other banks will play a significant role in the fund's success. ... some banks have expressed informal interest ...

Thanks

by Tanta on 11/22/2007 09:05:00 AM

There are no better commenters on the net than the ones on this blog. This is an objective fact.

Wednesday, November 21, 2007

Tanta Writes Letters

by Calculated Risk on 11/21/2007 04:44:00 PM

Recommended reading: Tanta's letter to Treasury Secretary Paulson this morning: Dear Mr. Paulson

I'm from The Blogs and I'm here to help you.Enjoy.