by Calculated Risk on 10/25/2007 10:40:00 AM

Thursday, October 25, 2007

More on September New Home Sales

For more graphs, please see my earlier post: September New Home Sales

Let's start with revisions. Last month I wrote:

The new homes sales number today [August] will probably be revised down too. Applying the median cumulative revision (4.8%) during this downtrend suggests a final revised Seasonally Adjusted Annual Rate (SAAR) sales number of 757 thousand for August (was reported as 795 thousand SAAR by the Census Bureau). Just something to remember when looking at the data.Sure enough, sales for August were revised down to 735 thousand. I believe the Census Bureau is doing a good job, but the users of the data need to understand what is happening (during down trends, the Census Bureau overestimates sales).

This makes a mockery of headlines like this from the AP: New Home Sales Rebound in September. Sales did not "rebound", in fact the September report was horrible, and the sales number will almost certainly be revised down.

For an analysis on Census Bureau revisions, see the bottom of this post.

Click on graph for larger image.

Click on graph for larger image.This graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession - possibly starting right now!

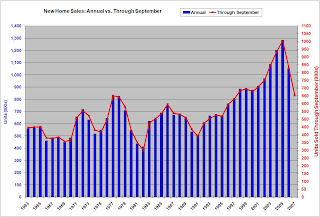

The second graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through August.

Typically, for an average year, about 78% of all new home sales happen before the end of September. Therefore the scale on the right is set to 78% of the left scale.

It now looks like New Home sales will be in the low 800s - the lowest level since 1997 (805K in '97). My forecast was for 830 to 850 thousand units in 2007 and that might be a little too high.

September New Home Sales

by Calculated Risk on 10/25/2007 10:00:00 AM

According to the Census Bureau report, New Home Sales in September were at a seasonally adjusted annual rate of 770 thousand. Sales for August were revised down to 735 thousand, from 795 thousand. Numbers for June and July were also revised down.

Click on Graph for larger image.

Sales of new one-family houses in September 2007 were at a seasonally adjusted annual rate of 770,000 ... This is 4.8 percent above the revised August rate of 735,000, but is 23.3 percent below the September 2006 estimate of 1,004,000.

The Not Seasonally Adjusted monthly rate was 60,000 New Homes sold. There were 80,000 New Homes sold in September 2006.

September '07 sales were the lowest September since 1995 (54,000).

The median and average sales prices are declining. Caution should be used when analyzing monthly price changes since prices are heavily revised and do not include builder incentives.

The median sales price of new houses sold in September 2007 was $238,000; the average sales price was $288,000.

The seasonally adjusted estimate of new houses for sale at the end of September was 523,000.

The 523,000 units of inventory is slightly below the levels of the last year.

Inventory numbers from the Census Bureau do not include cancellations - and cancellations are once again at record levels. Actual New Home inventories are probably much higher than reported - probably about 100K higher.

This represents a supply of 8.3 months at the current sales rate

This is another very weak report for New Home sales. The stunning - but not surprising - downward revision to the August sales numbers was extremely ugly. This is the second report after the start of the credit turmoil, and, as expected, the sales numbers are very poor.

I expect these numbers to be revised down too. More later today on New Home Sales.

Foreclosure Predictions

by Tanta on 10/25/2007 09:51:00 AM

This is what we refer to in the risk management business as "interesting." From the New York Times:

In a new report to be issued today, the Joint Economic Committee of Congress predicts about two million foreclosures by the end of next year on homes purchased with subprime mortgages. That estimate is far higher than the Bush administration’s prediction in September of 500,000 foreclosures, which in itself would be a tidal wave compared with recent years. Congressional aides provided details of the report yesterday to The New York Times.For those of you keeping score, back in October of 2006 Michael Perry predicted foreclosures "in the coming months" of around 2 million.

The Joint Economic Committee estimates that the lost of real estate wealth just from foreclosures on subprime loans will be about $71 billion. An additional $32 billion would be lost because foreclosed homes tend to drive down the prices of other houses in the neighborhood.

Those figures would cause a decline of $917 million in lost property tax revenue to state and local governments, which will also have to spend more on policing neighborhoods with vacant homes. The states most likely to be hard hit fall into two categories: those where prices had been rising fastest, like California and Florida, and Midwest states with weak economies, like Michigan and Ohio, where people with low or moderate incomes made heavy use of subprime loans to become homeowners and consolidate debts.

In December of 2006, the Center for Responsible Lending predicted 2.2 million foreclosures of subprime loans.

In March of 2007, First American predicted 1.1 million foreclosures in the next 6-7 years.

Anybody want to take 500,000 foreclosures by the end of 2007?

(Thanks, Clyde!)

WSJ: Commercial Construction May Slow

by Calculated Risk on 10/25/2007 02:13:00 AM

From the WSJ: Commercial Construction May Slow (hat tip Jim)

The pace of U.S. commercial-construction activity ... is showing signs of slowing and could drop next year for the first time since the early part of the decade ...

In a closely watched report expected to be released today, McGraw-Hill Construction will forecast that spending on commercial and manufacturing buildings, such as offices, warehouses and hotels, will decline 7% next year, in dollar volume, and 10% in the number of square feet of space built. That would be a sharp turnaround from this year, when commercial and manufacturing construction is expected to end the year up 11% in dollar volume.

Wednesday, October 24, 2007

Subprime: Winners are Losers, Too

by Tanta on 10/24/2007 06:37:00 PM

We haven't seen that many defenses of subprime lending recently. Long-time readers of the blog will remember a certain vogue earlier this year for the "but subprime helps the poor" schtick, which predictably got less fashionable as the losses racked up.

So it was interesting to see this Barron's column heaving out the old argument in order to scare us all about Barney Frank's proposed subprime mortgage regulation:

Some two million borrowers have taken subprime mortgages in the past few years, of which one-quarter astonishingly may go into foreclosure. That means 1.5 million Americans own homes that they wouldn't likely get to buy under Barney Frank's rules. They are lucky, indeed.What a ringing defense of the subprime industry: we have to make 500,000 disasters in order to get 1,500,000 successes, and apparently which group you're in is a matter of luck, since tighter standards would have eliminated all 2 million, not just the 500,000. I am curious: do other industries get away with results like that?

Then there's the "strivers" canard:

Immigrant and other minority borrowers would be most likely to be shut out. These strivers often have cash businesses and avail themselves of "no-doc" loans, even though they may have good incomes and assets. Frank's measure would end that.If there's an interpretation of that claim that isn't "Look, we know that brown people frequently cheat on their taxes, and tax cheats have great cash flow to make loan payments with!", would someone share it with me in the comments?

But this part is my favorite, and I think the key to Forsyth's real discomfort with Frank's proposed legislation:

Legislation introduced by Barney Frank, the Massachusetts Democrat who heads the House Financial Services Committee, would, among other things, permit subprime borrower to sue Wall Street firms that underwrote securities backed by those loans. No matter that Lehman, Merrill Lynch or any their cohorts weren't in the neighborhood when some slick mortgage broker [was?] selling an unsophisticated borrower on a lousy loan, the big Street firms can be deemed an accessory after the fact.Here's my modest proposal: you should not be allowed to opine on the subject of assignee liability if you do not understand that the definition of a broker (as opposed to a lender) is that a broker has no money to lend. Someone else must supply the money. Assignee liability is a matter of getting clear on who the "lender" really is in the first place. And you should also not use Lehman or Merrill as your example of innocent Wall Street bystanders when two minutes on Google would tell you they both own mortgage originators.

So there's your argument: people with capital to lend cannot be responsible for what kinds of loans get made, because they delegate the process of taking applications to brokers, and nothing that happens after the application is taken matters. This is true because apparently loan success or failure is unpredictable, a sheer matter of luck. That implies that you just have to produce 100 loans, and let God pick out the 75 that are blessed with homeownership. Drag and all about the 25, but as long as you change the disclosures to let everyone know that this is just a casino, the ones who lose can't complain. New motto: Subprime: The odds are better than blackjack!

For what it’s worth, a recent research report from Lehman* just caught my eye. The analysts looked at a pool of subprime ARM loans from older vintages that are current, and have always been current, but have never refinanced out of those old pools. This is a curious phenomenon, since these borrowers are paying very high interest rates (they’re in ARMs that have already adjusted), they didn’t necessarily start with a high CLTV, and in many cases their properties have probably not depreciated that much, or even appreciated at least some, since origination. Why wouldn’t they refi into a cheaper prime loan with a 24-48 month perfect mortgage payment history and a sliver of equity?

The analysis compared the borrowers’ FICO at origination of the loan with the borrower’s current FICO (presumably ordered for account monitoring purposes). Some 40% of subprime loans with a perfect 24-48 month mortgage history have FICOs that are unchanged or have dropped by as much as 75 points since the loan closed. The implication is that a significant number of current borrowers subsidized their mortgage payment shocks with credit cards: the high balance-to-limit or mounting delinquencies on consumer debt is offsetting the positive FICO effect of on-time mortgage payments. This is a recipe for a permanent subprime borrower: someone who “performs” on the mortgage by supplementing income shortfalls with credit card debt, keeping the FICO at a level that precludes ever becoming a prime mortgage borrower.

That should knock the last leg out from under the argument of subprime lenders that they are giving borrowers a chance to “cure” their credit problems. You have to wonder whether these folks would have been given a mortgage in the first place if they had been qualified on the fully-indexed, fully-amortizing payment and documented income; my guess is they probably wouldn’t. In that sense, they'd "lose out" under tighter mortgage regulation.

But they’re trapped: they’ve got some equity they don’t want to walk away from, yet they can maintain the mortgage payment only by racking up unsustainable consumer debt. Eventually they’ll have to sell the property: there’s only so long you can keep making your mortgage payment with a credit card. But in what sense will they then have been "successful" homeowners? They may never have had a mortgage delinquency, and they may have avoided foreclosure, but they still spent years paying too much for too little purpose.

Until we get straight on the idea that there's something wrong with holding a high-risk lottery to see who among first-time homebuyers gets to become middle-class, and that there's something wrong with a situation in which "success" is defined as quitting before you get fired, we're never going to get straight on what has to be done to reform the mortgage industry.

*Akhil Mago, Lehman, "Overview of the Subprime Sector," October 2007 (not available online)

Homebuilder Reports: Pulte and MDC

by Calculated Risk on 10/24/2007 06:21:00 PM

M.D.C. Holdings Announces Third Quarter 2007 Results

MDC received orders, net of cancellations, for 1,228 homes with an estimated sales value of $365.0 million during the 2007 third quarter, compared with net orders for 2,120 homes with an estimated sales value of $678.0 million during the same period in 2006. For the nine months ended September 30, 2007, the Company received net orders for 5,756 homes with a sales value of $1.92 billion, compared with orders for 8,658 homes with a sales value of $2.95 billion for the nine months ended September 30, 2006.Pulte Homes Reports Third Quarter 2007 Financial Results

During the third quarter and first nine months of 2007, the Company's approximate order cancellation rates were 57% and 44%, respectively, compared with rates of 49% and 40% experienced during the same periods in 2006.

Net new home orders for the third quarter were 4,582 homes, valued at $1.3 billion, which represent declines of 37% and 47%, respectively, from prior year third quarter results.Just plain ugly.

Added: Ryland Reports Results for the Third Quarter of 2007

New orders of 1,876 units for the quarter ended September 30, 2007, represented a decrease of 20.9 percent, compared to new orders of 2,372 units for the same period in 2006. For the third quarter of 2007, new order dollars declined 27.0 percent to $491.4 million from $673.2 million for the third quarter of 2006. Backlog at the end of the third quarter of 2007 decreased 36.6 percent to 4,334 units from 6,835 units at the end of the third quarter of 2006. At September 30, 2007, the dollar value of the Company’s backlog was $1.2 billion, reflecting a decline of 41.6 percent from September 30, 2006.

Tim Duy's Fed Watch

by Calculated Risk on 10/24/2007 01:11:00 PM

Mark Thoma says Tim Duy is losing sleep.

Fed Watch: Runaway Rate Cut Train?. Excerpts

... housing is bad. This morning we get existing home sales, which, considering the local reports I have seen, are almost certain to be simply dismal. I did a road trip to Bend last week, and can confidently report that close to half of central Oregon is for sale. Housing of course was the big topic; when will the downturn end, will prices fall, etc. My story of how bubble markets generally end badly, and don’t bounce back for years (look at the NASDAQ, I say), does not make me many friends.Although Dr. Duy sees spillover from housing into the general economy, it is not enough to concern him. He is more worried about the Fed cutting too much:

But when I pressed the business community (not realtors – they only tell you to wait two months, prices will be on the rise again) on the environment outside of sectors directly tied to housing, I continuously received the same story – no problem.

My expectation remains that the US economy will weather the housing rout better than expected, especially given the global pull, particularly from emerging markets. That leads me to believe that we are not on a runaway rate cut train in the US. Indeed, from an inflation standpoint, the last thing the global economy needs is a runaway rate cut train placing further downward pressure on the dollar.I'm not as sanguine as Tim, but his piece is an excellent overview.

More on September Existing Home Sales

by Calculated Risk on 10/24/2007 12:37:00 PM

For more existing home sales graphs, please see the previous post: September Existing Home Sales Plummet

To put the NAR numbers into perspective, here are the year-end sales, inventory and months of supply numbers, since 1969. This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the September inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the September inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

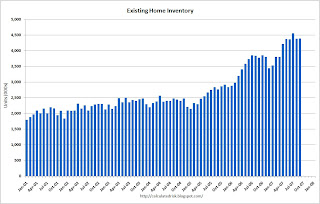

The current inventory of 4.399 million is just below the all time record set in July and well above the record year end inventory for any other year. The "months of supply" metric is 10.5 months. The "months of supply" is now above the level of the previous housing slump in the early '90s, but still below the worst levels of the housing bust in the early '80s.

Both the numerator and the denominator are moving in the wrong direction. Not only is inventory at record levels, but sales - though falling - are still somewhat above the normal range as a percent of owner occupied units.

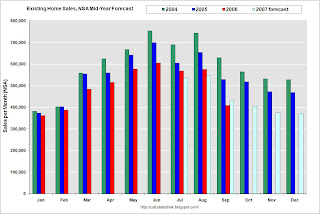

The second graph is an update to my mid-year forecast adding the actual results for July, August and September in 2007. My forecast was for sales to be between 5.6 and 5.8 million units.

My forecast was for sales to be between 5.6 and 5.8 million units.

At mid-year I updated my forecast to the lower end of the previous range (5.6 million units). Through September there have been 4.5 million units sold, and it looks like the total will be right around 5.6 million.

September Existing Home Sales Plummet

by Calculated Risk on 10/24/2007 10:00:00 AM

The NAR reports that Existing Home sales plummeted to 5.04 million in September, the lowest level since September 2001.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – fell 8.0 percent to a seasonally adjusted annual rate1 of 5.04 million units in September from a downwardly revised pace of 5.48 million in August, and are 19.1 percent below the 6.23 million-unit level in September 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the NSA sales per month for the last 3 years.

The impact of the credit crunch is obvious as sales in September declined sharply.

For existing homes, sales are reported at the close of escrow. So September sales were for contracts signed in July and August.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was flat at 4.4 million homes for sale in September.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was flat at 4.4 million homes for sale in September. Total housing inventory inched up 0.4 percent at the end of September to 4.40 million existing homes available for sale, which represents a 10.5-month supply at the current sales pace, up from a downwardly revised 9.6-month supply in August.This is basically the same inventory level as August, although the months of supply increased to 10.5 months because of the sharp drop in sales.

This is the normal historical pattern for inventory - inventory peaks at the end of summer and then stay fairly flat until the holidays (it then usually declines somewhat). This says nothing about the increasing anxiety of sellers and the rising foreclosure sales.

This wasn't true in 2005 - as inventory continued to increase throughout the year - and that was one of the indicators that the housing boom had ended.

For 2007, I expect that inventory levels are close to the peak level.

The third graph shows the monthly 'months of supply' metric for the last six years.

The third graph shows the monthly 'months of supply' metric for the last six years.Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline.

The fourth graph shows monthly sales (SAAR) since 1993.

This shows sales have now fallen to the level of September 2001 (when sales were impacted by 9/11).

This shows sales have now fallen to the level of September 2001 (when sales were impacted by 9/11). I wouldn't be surprised to see a small rebound in SAAR sales next month, but the trend is clearly down.

More later today on existing home sales.

Merrill Reports $8 Billion Write Down

by Calculated Risk on 10/24/2007 08:47:00 AM

From the WSJ: Merrill Lynch Posts Wide Loss, Discloses Bigger Write-Downs

Merrill Lynch & Co. swung to a wider-than-projected third-quarter net loss because of $7.9 billion in write-downs on collateralized debt obligations and subprime mortgages.Talk about a shocking visit to the confessional!

Merrill had warned earlier this month that it would post a net loss of up to 50 cents a share because of writing down $4.5 billion in collateralized debt obligations and subprime mortgages and recording a net $463 million on leveraged finance commitments.

But the CDO and subprime write-downs were much higher than that and even above that of some analysts who were projecting Merrill to record write-downs at or above $7 billion.