by Calculated Risk on 10/24/2007 06:21:00 PM

Wednesday, October 24, 2007

Homebuilder Reports: Pulte and MDC

M.D.C. Holdings Announces Third Quarter 2007 Results

MDC received orders, net of cancellations, for 1,228 homes with an estimated sales value of $365.0 million during the 2007 third quarter, compared with net orders for 2,120 homes with an estimated sales value of $678.0 million during the same period in 2006. For the nine months ended September 30, 2007, the Company received net orders for 5,756 homes with a sales value of $1.92 billion, compared with orders for 8,658 homes with a sales value of $2.95 billion for the nine months ended September 30, 2006.Pulte Homes Reports Third Quarter 2007 Financial Results

During the third quarter and first nine months of 2007, the Company's approximate order cancellation rates were 57% and 44%, respectively, compared with rates of 49% and 40% experienced during the same periods in 2006.

Net new home orders for the third quarter were 4,582 homes, valued at $1.3 billion, which represent declines of 37% and 47%, respectively, from prior year third quarter results.Just plain ugly.

Added: Ryland Reports Results for the Third Quarter of 2007

New orders of 1,876 units for the quarter ended September 30, 2007, represented a decrease of 20.9 percent, compared to new orders of 2,372 units for the same period in 2006. For the third quarter of 2007, new order dollars declined 27.0 percent to $491.4 million from $673.2 million for the third quarter of 2006. Backlog at the end of the third quarter of 2007 decreased 36.6 percent to 4,334 units from 6,835 units at the end of the third quarter of 2006. At September 30, 2007, the dollar value of the Company’s backlog was $1.2 billion, reflecting a decline of 41.6 percent from September 30, 2006.

Tim Duy's Fed Watch

by Calculated Risk on 10/24/2007 01:11:00 PM

Mark Thoma says Tim Duy is losing sleep.

Fed Watch: Runaway Rate Cut Train?. Excerpts

... housing is bad. This morning we get existing home sales, which, considering the local reports I have seen, are almost certain to be simply dismal. I did a road trip to Bend last week, and can confidently report that close to half of central Oregon is for sale. Housing of course was the big topic; when will the downturn end, will prices fall, etc. My story of how bubble markets generally end badly, and don’t bounce back for years (look at the NASDAQ, I say), does not make me many friends.Although Dr. Duy sees spillover from housing into the general economy, it is not enough to concern him. He is more worried about the Fed cutting too much:

But when I pressed the business community (not realtors – they only tell you to wait two months, prices will be on the rise again) on the environment outside of sectors directly tied to housing, I continuously received the same story – no problem.

My expectation remains that the US economy will weather the housing rout better than expected, especially given the global pull, particularly from emerging markets. That leads me to believe that we are not on a runaway rate cut train in the US. Indeed, from an inflation standpoint, the last thing the global economy needs is a runaway rate cut train placing further downward pressure on the dollar.I'm not as sanguine as Tim, but his piece is an excellent overview.

More on September Existing Home Sales

by Calculated Risk on 10/24/2007 12:37:00 PM

For more existing home sales graphs, please see the previous post: September Existing Home Sales Plummet

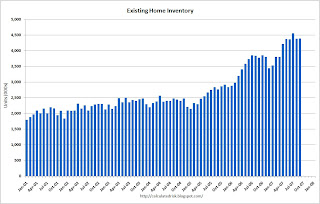

To put the NAR numbers into perspective, here are the year-end sales, inventory and months of supply numbers, since 1969. This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the September inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the September inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

The current inventory of 4.399 million is just below the all time record set in July and well above the record year end inventory for any other year. The "months of supply" metric is 10.5 months. The "months of supply" is now above the level of the previous housing slump in the early '90s, but still below the worst levels of the housing bust in the early '80s.

Both the numerator and the denominator are moving in the wrong direction. Not only is inventory at record levels, but sales - though falling - are still somewhat above the normal range as a percent of owner occupied units.

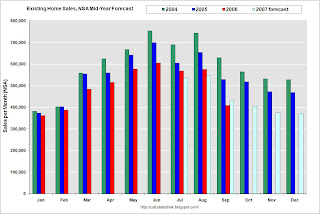

The second graph is an update to my mid-year forecast adding the actual results for July, August and September in 2007. My forecast was for sales to be between 5.6 and 5.8 million units.

My forecast was for sales to be between 5.6 and 5.8 million units.

At mid-year I updated my forecast to the lower end of the previous range (5.6 million units). Through September there have been 4.5 million units sold, and it looks like the total will be right around 5.6 million.

September Existing Home Sales Plummet

by Calculated Risk on 10/24/2007 10:00:00 AM

The NAR reports that Existing Home sales plummeted to 5.04 million in September, the lowest level since September 2001.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – fell 8.0 percent to a seasonally adjusted annual rate1 of 5.04 million units in September from a downwardly revised pace of 5.48 million in August, and are 19.1 percent below the 6.23 million-unit level in September 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the NSA sales per month for the last 3 years.

The impact of the credit crunch is obvious as sales in September declined sharply.

For existing homes, sales are reported at the close of escrow. So September sales were for contracts signed in July and August.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was flat at 4.4 million homes for sale in September.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was flat at 4.4 million homes for sale in September. Total housing inventory inched up 0.4 percent at the end of September to 4.40 million existing homes available for sale, which represents a 10.5-month supply at the current sales pace, up from a downwardly revised 9.6-month supply in August.This is basically the same inventory level as August, although the months of supply increased to 10.5 months because of the sharp drop in sales.

This is the normal historical pattern for inventory - inventory peaks at the end of summer and then stay fairly flat until the holidays (it then usually declines somewhat). This says nothing about the increasing anxiety of sellers and the rising foreclosure sales.

This wasn't true in 2005 - as inventory continued to increase throughout the year - and that was one of the indicators that the housing boom had ended.

For 2007, I expect that inventory levels are close to the peak level.

The third graph shows the monthly 'months of supply' metric for the last six years.

The third graph shows the monthly 'months of supply' metric for the last six years.Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline.

The fourth graph shows monthly sales (SAAR) since 1993.

This shows sales have now fallen to the level of September 2001 (when sales were impacted by 9/11).

This shows sales have now fallen to the level of September 2001 (when sales were impacted by 9/11). I wouldn't be surprised to see a small rebound in SAAR sales next month, but the trend is clearly down.

More later today on existing home sales.

Merrill Reports $8 Billion Write Down

by Calculated Risk on 10/24/2007 08:47:00 AM

From the WSJ: Merrill Lynch Posts Wide Loss, Discloses Bigger Write-Downs

Merrill Lynch & Co. swung to a wider-than-projected third-quarter net loss because of $7.9 billion in write-downs on collateralized debt obligations and subprime mortgages.Talk about a shocking visit to the confessional!

Merrill had warned earlier this month that it would post a net loss of up to 50 cents a share because of writing down $4.5 billion in collateralized debt obligations and subprime mortgages and recording a net $463 million on leveraged finance commitments.

But the CDO and subprime write-downs were much higher than that and even above that of some analysts who were projecting Merrill to record write-downs at or above $7 billion.

Tuesday, October 23, 2007

Prime Loans Gone Bad

by Calculated Risk on 10/23/2007 10:52:00 PM

From the WSJ: 'Option ARM' Delinquencies Bleed Into Profitable Prime Mortgages

Subprime mortgages aren't the only challenge facing Countrywide Financial Corp. ... Some loans classified as prime when they were originated are now going bad at a rapid pace.

These ... option ARMs ... typically have low introductory rates and allow minimal payments in the early years of the mortgage. Multiple payment choices include a minimum payment that covers none of the principal and only part of the interest normally due. If borrowers choose that minimum payment, their loan balances grow -- a phenomenon known as "negative amortization."

| Click on graph for larger image. This chart from Credit Suisse via the IMF shows the heavy subprime resets in 2008, plus it shows the reset problems with Alt-A and Option ARM loans in later years. |

... An analysis prepared for The Wall Street Journal by UBS AG shows that 3.55% of option ARMs originated by Countrywide in 2006 and packaged into securities sold to investors are at least 60 days past due. That compares with an average option-ARM delinquency rate of 2.56% for the industry as a whole and is the highest of six companies analyzed by UBS.These Option ARMs, especially the low doc, minimal downpayment Option ARMs, are ticking time bombs.

...

The deteriorating performance of option ARMs is evidence that lax underwriting that led to problems in subprime loans is showing up in the prime market, where defaults typically are minimal. Challenges could grow, as from 2009 to 2011, monthly payments on some $229 billion of option ARMs will be adjusted to include market-rate interest and principal, according to Moody's Economy.com.

...

It now appears that many borrowers who moved into option ARMs were attracted by the low payments and may have been staving off other financial problems. More than 80% of borrowers who are current on these loans make only the minimum payment, according to UBS. emphasis added

Axon SIV NAV Plummets, Ratings Cut

by Calculated Risk on 10/23/2007 07:34:00 PM

From Reuters: Moody's slashes Axon SIV as capital NAV plummets

Moody's Investors Service on Tuesday slashed its credit ratings on Axon Financial Funding, a structured investment vehicle (SIV), after its capital net asset value plummeted.OUCH.

Moody's said in a statement it has cut Axon's commercial paper to Not Prime from Prime-1. It has cut its medium term notes to Ba3, three notches below investment-grade status, from triple-A. And it has cut its mezzanine capital notes to Ca, 10 notches below investment-grade, from A1.

...

Moody's said Axon's capital net asset value had fallen to 39 percent on Oct. 18 from 96 percent on July 27.

More from Bloomberg: SIV Defaults May Prompt Others to Close Their Doors

Axon Financial Funding Ltd. LLC, a SIV with $9.8 billion of debt, had its credit ratings cut by Moody's today after its net asset value fell by more than half. The SIV, set up by New York- based hedge fund TPG-Axon Capital Management LP, had the rankings of its medium-term notes lowered by 12 steps to Ba3, three levels below investment grade, from Aaa, the highest-possible rating.

Centex Posts Large Loss

by Calculated Risk on 10/23/2007 05:33:00 PM

From the WSJ: Centex Posts $644 Million Loss Amid Continued Housing Woes

Centex Corp. reported a fiscal second-quarter loss, as the company recorded $983 million in impairments and other land charges, continuing a bloody season for U.S. home builders.The positive news is that Centex reduced their inventory "of unsold homes by 28% to 4,708" and their "cancellation rate decreased to 35.4%".

...

Revenue fell 21% to $2.22 billion.

...

"Market conditions were extremely challenging during the quarter, reflecting the serious disruptions in the credit and mortgage markets that occurred during that period," said Chairman and Chief Executive Tim Eller in a prepared statement late Tuesday. "In response, we meaningfully reduced prices in order to improve affordability for our home buyers."

Countrywide to Modify $16B in Loans

by Calculated Risk on 10/23/2007 02:04:00 PM

From AP: Countrywide to Modify $16B in Loans

Countrywide Financial Corp ... said Tuesday it will begin calling borrowers to offer refinancing or modifications on $16 billion in loans whose interest rate is set to adjust by the end of 2008. ...

...

The Calabasas, Calif.-based company said it would reach out to borrowers who are current on their loans but are facing an imminent rate reset to discuss options. Countrywide said it would refinance about $10 billion in loans and modify another $4 billion.

It also plans to contact borrowers of some $2.2 billion who are late on their loans and having trouble paying because of a recent rate reset.

In total Countrywide's plan would reach out to about 82,000 borrowers for some kind of relief.

Transportation Weakness: UPS and Burlington Northern

by Calculated Risk on 10/23/2007 12:54:00 PM

From the WSJ: UPS Posts 3.7% Rise in Profit Amid International Growth

The world's largest package delivery company expects domestic package volume in the fourth quarter will grow at its slowest rate for the period in four years, amid weakened consumer spending in the U.S. ...Also from the WSJ: Burlington Northern Earnings Rise 8.4% Despite High Fuel Costs

"Retail sales growth is expected to remain weak and is a wild card going into the holiday shipping season," Chief Financial Officer Scott Davis said during a conference call with analysts. "It remains to be seen how quickly the U.S. economy will return to long-term growth trends," he added, noting that UPS sees economic growth of about 2% this year.

"Although we have concerns near-term about the economy, housing markets, high fuel prices and general consumer softness, we continue to be optimistic about the long-term future of BNSF," [Chairman and Chief Executive Matthew K. Rose] said.The UPS numbers are weak, but not too bad - the Burlington Northern volumes look recessionary.

...

In July, the railroad said it expected about a 3% decline in volume in the third quarter, mainly due to weak intermodal volume, which involves transferring freight from one method of transport to another. Tuesday, the company said volume fell 4.7%. A recession in freight volumes has been affecting the rail industry for nearly a year, partly because of weakness in the housing and automotive markets.