by Tanta on 9/28/2007 09:46:00 AM

Friday, September 28, 2007

There's a New Nerd in Town

Via Mr. Coppedge, I see Accrued Interest has a nice UberNerd (AccruederNerd?) on CDO structures that I missed first time around, with a follow-up here that will warm the heart of any poor downtrodden credit analyst who got stomped on by the quants. I recommend it; it makes a point I've tried but dismally failed to make clearly, which is that the big issue for a lot of these deals is timing of default, not level of default. If you're still confused about how a relatively low level of early default can hurt much more than a comparatively higher level of later default on a structured security, this post will certainly help you.

For contextual purposes, here's a set of charts from Moodys that you may ponder. (These are MBS/ABS issues, not CDOs, but they'll be the collateral in a lot of CDOs.) Notice how the slope of the 2006 vintage changes in just six months, as more of the deals in that vintage get old enough. Notice also that this chart is based on original balance (so the numbers won't match anything you see quoted based on current balances), and that the comparison is the 2000-2001 vintage. That's a meaningful comparison because, until 2005-2006 came along, the 2000-2001 vintages were about the ugliest anyone had seen in a long time.

Thursday, September 27, 2007

First Data: $9.4 Billion Sold

by Calculated Risk on 9/27/2007 10:21:00 PM

From the WSJ: Bond Market Starts Showing Relief Signals

... Wall Street investment banks yesterday sold investors $9.4 billion in risky bank loans issued by First Data Corp. to finance its leveraged buyout.Selling loans for 96 cents on the dollar is considered good news in this environment. Maybe Credit Suisse and Citigroup can sell more, and make up the loss with volume!

It was the largest sale of leveraged loans since that of HCA Inc. last year. It was also nearly double the $5 billion in loans the banks said they were attempting to sell.

Still, the underwriters, which include Credit Suisse and Citigroup Inc., hold on their own books the bulk of the $24 billion in loan financing they provided for First Data.

The key number is the $14 billion or so in pier loans. The total deal value was $26 billion with $24 billion in debt. This is still larger than the Chrysler pier loans that were only $10 Billion.

Roubini: "Too Optimistic on Housing"

by Calculated Risk on 9/27/2007 03:03:00 PM

Professor Roubini write: I Was Way Too Optimistic on the Housing Recession...

In March of this year this author published a long paper (with Christian Menegatti) titled “The Housing Recession is Still Far from Bottoming Out” that predicted a much worsening housing recession through all of 2008. In that paper the prediction was that housing starts – that had already fallen by 38% by January of 2007 to a level of 1.4 million - would fall much further and would bottom out at 1.1 million in 2008. Indeed, by looking at previous housing recession – where the average fall in starts was 51% - it was sensible to be that pessimistic. Again those predictions were dismissed as too gloomy and pessimistic and unrealistic.To add to Roubini's comments, here is the current Goldman Sachs housing forecast (New Home sales falling to 650K units and starts falling to 1.1 million units).

But it turned out that I was way too optimistic about housing, not too pessimistic. As recently reported housing starts have now fallen by 42% and now JP Morgan – one of the most respected research houses on Wall Street and a persistent proponent until recently of the view that the housing recession would bottom out – is predicting that housing starts will fall another 25% to a cumulative fall of 56% from peak and will bottom out at 999 thousand units some time in 2008. Compared to my initial March prediction of a bottom at 1.1 million I turn out to be an optimist. And indeed many other research firms (including Goldman Sachs, Citibank and others) are now predicting the bottom of housing starts at 1 million to 1.1 million units. So what in March was considered as borderline lunatic is now becoming conventional wisdom.

...

Right now I see housing start falling more than the 1.1 million that Menegatti and I predicted in March as the housing market has deteriorated since then much more than our then dire predictions. Given the continued fall in building permits and in home sales and the massive excess supply of new and existing homes housing starts could bottom out at level close to previous housing recession, i.e. between 800k and 900k.

Since I predicted a fall in starts to 1.1 million units a couple of years ago, people are now asking if I was also "too optimistic". First, I don't measure my predictions to the WS forecasts, but to the actual numbers. Starts have fallen to 1.331 million units (SAAR) in the latest report, so it is still too early to count coup. Second, I wasn't trying to forecast the exact number, rather the general size of the down turn - IMO there is little difference between 1.1 million starts and, say, 1.0 or 1.2 million starts. The overall downturn is about the same.

However Roubini's new bottom forecast for starts (800K to 900K) is a significant downward revision from his previous forecast. I'll update my forecast at the end of the year (the housing market moves in slow motion, so there is no need to change forecasts frequently). Right now I think my number still looks about right.

Fannie Says Housing Slump to Last Beyond 2008

by Calculated Risk on 9/27/2007 02:46:00 PM

On Bloomberg Video: Mudd of Fannie Says Housing Slump to Last Beyond 2008.

Click image for video.

September 27 (Bloomberg) -- Fannie Mae Chief Executive Officer Daniel Mudd talks with Bloomberg's Peter Cook in Washington about the state of the U.S. housing market, the prospects for raising Fannie's mortgage portfolio cap and the outlook for legislation to create a new regulator for the government-sponsored enterprises. Mudd, whose government-chartered company is the largest provider of money for U.S. home loans, said the housing slump will last beyond next year. (Source: Bloomberg)

More on August New Home Sales

by Calculated Risk on 9/27/2007 11:03:00 AM

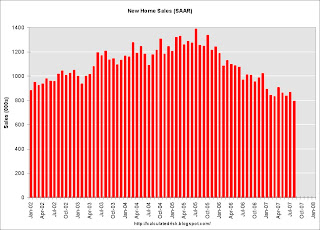

For more graphs, please see my earlier post: August New Home Sales Click on graph for larger image.

Click on graph for larger image.

The first graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession - possibly starting right now!

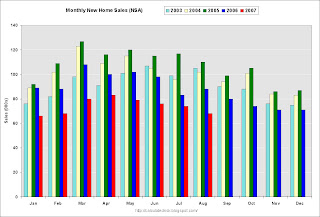

The second graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through August.

Typically, for an average year, about 70% of all new home sales happen before the end of August. Therefore the scale on the right is set to 70% of the left scale.

It now looks like New Home sales will be in the low 800s - the lowest level since 1997 (805K in '97). My forecast was for 830 to 850 thousand units in 2007 and that might be a little too high.

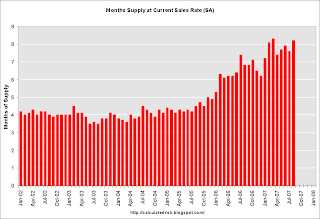

A comment on revisions:

The Census Bureau revises the New Home sales number three times (plus annual revisions). During a housing down turn, most of the revisions from the Census Bureau are down. This is important to keep in mind when looking at a new monthly report. This chart shows the cumulative revisions for each month since sales activity peaked in July 2005 (annual revisions are not shown). The last time there was a positive cumulative revision (red column) was in September 2005.

This chart shows the cumulative revisions for each month since sales activity peaked in July 2005 (annual revisions are not shown). The last time there was a positive cumulative revision (red column) was in September 2005.

The median change for the first revision is a decline of 1.6% (average decline of 1.8%) over the last two years.

The cumulative median change for the second revision is a decline of 3.6%.

The cumulative median change for the third revision is a decline of 4.8%. Since the last upward cumulative revision (Sept 2005), the range has been from a small decline of 0.2% in Dec '05, to a decline of almost 11% for May '06.

The new homes sales number today will probably be revised down too. Applying the median cumulative revision (4.8%) during this downtrend suggests a final revised Seasonally Adjusted Annual Rate (SAAR) sales number of 757 thousand for August (was reported as 795 thousand SAAR by the Census Bureau). Just something to remember when looking at the data.

August New Home Sales

by Calculated Risk on 9/27/2007 09:59:00 AM

According to the Census Bureau report, New Home Sales in August were at a seasonally adjusted annual rate of 795 thousand. Sales for July were revised down to 867 thousand, from 870 thousand. Numbers for May and June were also revised down.

Click on Graph for larger image.

Sales of new one-family houses in August 2007 were at a seasonally adjusted annual rate of 795,000 ... This is 8.3 percent below the revised July rate of 867,000 and is 21.2 percent below the August 2006 estimate of 1,009,000.

The Not Seasonally Adjusted monthly rate was 68,000 New Homes sold. There were 88,000 New Homes sold in August 2006.

Aug '07 sales were the lowest August since 1995 (63,000).

The median and average sales prices were down sharply. Caution should be used when analyzing monthly price changes since prices are heavily revised and do not include builder incentives.

The median sales price of new houses sold in August 2007 was $225,700; the average sales price was $292,000.

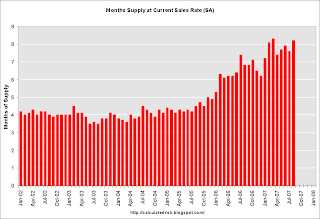

The seasonally adjusted estimate of new houses for sale at the end of August was 529,000.

The 529,000 units of inventory is slightly below the levels of the last year.

Inventory numbers from the Census Bureau do not include cancellations - and cancellations are once again at record levels. Actual New Home inventories are probably much higher than reported - some estimate are about 20% higher.

This represents a supply of 8.2 months at the current sales rate.

This is another very weak report for New Home sales. This is the first report after the start of the credit turmoil, and, as expected, the numbers are very ugly.

More later today on New Home Sales.

Who Should Pay the Rating Agencies?

by Tanta on 9/27/2007 09:48:00 AM

From the International Herald Tribune, we see that Congress is getting up on its hind legs and barking over the perennial issue of who pays for bond ratings:

Democratic and Republican senators said they were particularly concerned with one aspect of the agencies' business models: They get paid by the companies whose bonds they rate. That is like a film production company paying a critic to review a movie, and then using that review in its advertising, said Senator Jim Bunning, Republican of Kentucky.Right. Because we all know that film critics' salaries are paid by surcharges on movie tickets, not newspaper advertising revenue. Whatever.

I really do want to know why those who believe that rating agency fees should be paid by investors, not issuers, believe that this is going to improve anything. I'm not defending the status quo; I'm legitimately curious. There's no context we can imagine in which, say, large institutional investors who pay the lion's share of those fees might not put pressure on the RAs to keep them from downgrading an outstanding issue, against which the investor doesn't really want to hold more reserves or capital? There are no transparency concerns when only those "accredited investors" who pay subscription fees can see rating benchmarks? (It's working so well for the hedge fund industry . . .) Issuers would somehow become unable to pressure the agencies for the "right" rating if they didn't directly pay those invoices? You know a clear, bright-line distinction between "issuers" and "investors" you could share with me? If Bear Stearns, say, buys tranches for its own trading account, and also issues them off its own shelf, what difference does it make which cost center cuts the checks to Moodys?

Let's contrast this situation with the highly satisfactory smooth working of consumer credit reports. The information in those reports is provided by creditors, not the individuals who are subject to them. The fee for use of that information is paid by subscribers--creditors, mostly--although they turn around and pass that cost onto applicants and borrowers. You pay the cost of lenders getting your credit report from a for-profit company who considers its information on you to be its property, not yours. In an environment of rampant identity theft and privacy violation--an environment caused, basically, by the existence of electronic repositories of sensitive data that consumers don't profit from, although they take the incalculable privacy risk--there can be no "transparency" of FICOs, and you wouldn't want there to be.

However, in an attempt to fight back, a whole industry of manipulating consumer credit ratings has sprung up, driven by both consumers wanting more or cheaper credit and lenders wanting more or more profitable borrowers. In all of this, the mortgage industry in particular is reeling from the results of its overreliance on FICOs, which were designed more for evaluating the risk of unsecured lending than mortgage lending, and that can rather easily be used to find not the most credit-worthy borrowers but the most profitable ones: those who do not default, but who run up balances sufficiently and pay enough periodic late fees to be a credit card issuer's dream come true. As more people are granted more unsecured credit by savy users of FICOs, the FICOs themselves "improve" for a class of borrowers who now want mortgage loans based on those FICOs.

Some of you may not know this, but there used to be a chronic problem with subprime mortgage servicers refusing to report data to the credit repositories. That meant that those borrowers who got a subprime loan and then paid it on time were not benefitting, since their credit record didn't show the on-time payments; when they went to refinance, they got put into another subprime loan. You would also find subprime servicers not reporting current balances, only original ones, making these borrowers look more indebted than they really were. It took Fannie and Freddie coming out with the declaration that they would no longer buy loans from seller/servicers who did not "full file report" to the credit bureaus to put a stop to this practice. Anyone who is convinced that users of ratings always have an interest in the accuracy of ratings should ponder this: there's always money to be made off of information asymmetry. It's fashionable these days to see bond investors as the hapless innocent victims of issuers and their lapdog rating agencies, but I'm old enough to have seen lenders who foot the bill for consumer credit reports going out of their way to make sure those reports didn't tell the whole picture.

I really want to know why we think subscriber-paid fees in the bond rating world is going to result in something we'll be happy with.

Thursday Close Harmony Blogging

by Tanta on 9/27/2007 07:06:00 AM

I know, it's not Saturday yet, but CR's little caption contest below was just too tempting.

Wednesday, September 26, 2007

LA Times Photo Caption Contest

by Calculated Risk on 9/26/2007 09:06:00 PM

From the LA Times:

News item: "For 10 days now, a sagging house parked on the Hollywood Freeway's northbound shoulder in the Cahuenga Pass has had people gawking -- and talking."Some of the captions are great. My favorites:

"If you lived here, you'd be home now!"

Gary

"Halfway to Calabasas, Bob realizes his mistake and decides to mail in the keys instead."

Raughle

Subprime-Mortgage Defaults Increase

by Calculated Risk on 9/26/2007 08:50:00 PM

From Bloomberg: Subprime-Mortgage Defaults Rose Last Month, Data Show (hat tip John & Jim)

Late payments and defaults among subprime mortgages packaged into bonds rose last month ...

After August payments, 19.1 percent of loan balances in 20 deals from the second half of 2005 were at least 60 days late, in foreclosure, subject to borrower bankruptcy or backed by seized property, up from 17.5 percent a month earlier, according to a report yesterday from Wachovia Corp.

Prepayment speeds for the loans slowed, suggesting it's more difficult for borrowers to sell their homes or refinance, according to another report by New York-based analysts at UBS AG. Record levels of delinquencies and defaults on subprime mortgages are worsening as home prices decline and interest rates on loans adjust higher for the first time. As lenders tighten standards, borrowers are finding it harder to refinance into new mortgages with lower payments.

The ``reports showed the first inkling of the impact of shutdown of subprime market,'' the UBS analysts led by Thomas Zimmerman wrote late yesterday. ``In our opinion, the full impact is yet to come.''