by Tanta on 8/03/2007 12:21:00 PM

Friday, August 03, 2007

MMI: Intraday Volatility

Bloomberg wipes up the floor with WSJ today. I hope you weren't having lunch.

Credit Brothel Raided, Even Piano Player Not Safe: Mark Gilbert

By Mark Gilbert

Aug. 3 (Bloomberg) -- As the financial-liquidity police raid the credit-market brothel, even the piano player faces arrest. The malaise enveloping global markets is becoming increasingly indiscriminate in choosing its victims. . . .

At least 70 U.S. mortgage companies have shut, gone bust or sold themselves since the start of last year, according to Bloomberg data. As Dennis Gartman, economist and editor of the Suffolk, Virginia-based Gartman Letter, is fond of saying in his research reports, there's never only one cockroach.

Cockroach Counting

What investors have to decide, especially those still confident about the outlook for stocks, is how many cockroaches they are willing to endure before deciding the credit market is cracked, derivatives are doomed, and the economy imperiled.

The credit bordello has enjoyed some wild times in the past few years, luring customers into the room at the back where the exotica are displayed. As the raid ensnares more and more of the regulars, newcomers are likely to become increasingly wary of the derivatives market's wares. And when the piano player is led off to jail, the music stops.

Andrew Davidson on the Securitization Food Chain

by Tanta on 8/03/2007 08:19:00 AM

Andrew Davidson & Co. generally produces thoughtful stuff; they are a well-known provider of pricing and risk analytics models to the mortgage and securitization industry. This essay attempts to get at the problem of "degrees of separation" of risk in the current industry model, and it arrives at the conclusion that having larger capital stakes at the origination points--skin in the game--would probably help.

In aid of which argument the following graphical illustration is provided:

Every time I look at something like this, I confess, I am less struck by the question "Where's the capital stake?" than I am by the question "How many mouths can a homeowner feed?" Davidson, just as a for instance, provides high-quality software and consulting services. They aren't free. And this chart doesn't even show you the points were the mortgage insurers enter, where due-diligence firms get paid to look at loans, where banks with a trust department serve as document custodians for these securities (for a fee), or all of the other for-profit businesses that have grown up around not just mortgage lending as such, but secondary-market mortgage lending. Tax service contracts, for instance: in a thrift-style lend-and-hold model, you don't need to pay a vendor to track property tax bills for you; you need that if the servicing rights to the loan are going to change hands six times prior to maturity. Every loan needs a "flood hazard determination" to assure that the home isn't in a flood plain, but now you pay incrementally more to get a "transferrable" one. A company called MERS, Inc. exists solely to replace the old-fashioned assignment of mortgages in the old-fashioned county land records with an "electronic registration," the entire demand for which is a function of secondary market sales of loans.

Somebody is paying for all this, and it would be you, the homeowner. You pay part of it in your interest rate; you pay a lot of it in fees and closing costs and prepayment penalties. There's an argument that increasing technological innovation (like MERS, or those transferrable tax service contracts) does make it cheaper for all this to go on, and that you benefit by having "access" to secondary market lenders, who can now afford to take your risk. I'm not interested in arguing that today.

I simply want to point out that "due diligence" is not missing from the chart above, at certain points, because no one thought it necessary. It was missing because subprime borrowers cannot buy overpriced homes and still pay a high enough interest rate that we can afford to have Clayton look at every loan in the deal. Well, not if some fund manager is going to take 2 and 20 we can't.

I've listened to more investor conference calls than I should have, life being as short as it is, and I can tell you that I rarely hear anyone ask if enough money is being spent on "inefficiency" to assure that operational risk is being priced correctly. The usual political response by industry lobbyists to increased regulations is always that the costs of it will be passed on to you, the consumer. It is worth you, the consumer, asking what costs you're already covering.

July Employment Report

by Calculated Risk on 8/03/2007 08:18:00 AM

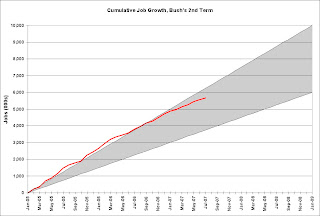

The BLS reports: U.S. nonfarm payrolls rose by 92,000 in June. The unemployment rate was up slightly at 4.6% in July.  Click on graph for larger image.

Click on graph for larger image.

Here is the cumulative nonfarm job growth for Bush's 2nd term. The gray area represents the expected job growth (from 6 million to 10 million jobs over the four year term). Job growth has been solid for the last 2 1/2 years and is near the top of the expected range.

Residential construction employment was flat in July, and including downward revisions to previous months, is down 141.2 thousand, or about 4.1%, from the peak in March 2006. (compare to housing starts off 30%).

Note the scale doesn't start from zero: this is to better show the change in employment.

The ADP report wasn't close to the BLS report this month. ADP estimated private employment grew by only 48K in July, and the BLS reported private employment grew by 120K.

MMI: Gamma Deltas the Alphas With a Beta

by Tanta on 8/03/2007 07:46:00 AM

Well, it sounds better in Greek. Via Seeking Alpha, I present The Slatin Report:

Led by seismic subprime holdings, the roiling debt markets are casting a pall over the entire real estate sector. And so they should: published reports put the total number of unsold loans sitting in financial institutions' warehouses waiting to be resold at around $260 billion in the US and another $200 billion in Europe. And with investment spigots turning off across the US, that money is going to sit for a while. . . .

Yes, it's quiet out there. Too quiet.

Thursday, August 02, 2007

More on 'Major Changes' in Home Lending

by Calculated Risk on 8/02/2007 06:49:00 PM

Bloomberg covers the IndyMac CEO's letter to employees, and mentions the following lenders: IndyMac, Rivals Make `Major Changes' in Home Lending

National City ... the 16th-largest home lender last year ... In its Aug. 1 notice ... said it won't buy loans that can't be resold to Fannie Mae or Freddie Mac, the two largest mortgage buyers, unless the borrowers' income and assets are fully documented.I expect the impact on home sales, from these 'major changes' in home lending, to show up first in the Census Bureau's August New Home sales report (released in September), but not show up in the NAR's existing home sales report until the September report (released in October).

... Wachovia, the seventh largest home lender, discontinued making Alt A mortgages through brokers because ``it's becoming more difficult to sell these mortgages in the secondary market as the financial markets continue to tighten,'' spokeswoman Christy Phillips-Brown said.

... Wells Fargo & Co., the second-biggest lender, said last week that it would no longer make subprime home loans through brokers, while continuing to make them in a retail channel.

... SunTrust Banks Inc., the 14th largest home lender, has ``pretty much gotten out of Alt A'' for now, said Sterling Edmunds, who heads its mortgage unit.

AHM Throws in the Towel

by Tanta on 8/02/2007 04:14:00 PM

American Home Mortgage Investment Corp. will be closing its doors Friday, after several attempts to sell of all or some of its divisions to rival lenders went up in smoke this week, numerous employees said.

Employees said they were contacted by senior management through the course of the day and told that none of their strategic options for remaining open had panned out.

Thanks, Gamma.

Even More on Alt-A

by Tanta on 8/02/2007 03:28:00 PM

Several of you have asked about the size of the Alt-A market. Here are some charts from Credit Suisse you may find informative.

Hat tip "Clyde"!

More on Alt-A

by Calculated Risk on 8/02/2007 12:53:00 PM

I've seen several unconfirmed reports of Alt-A products being discontinued at various lenders. Mathew Padilla has a follow-up on the Wells Fargo Alt-A story: Wells Fargo scales back Alt-A loans

I'm hearing similar reports regarding the discontinuation of products from IndyMac, WaMu and Wachovia. Note: none of these stories have been confirmed.

As I mentioned in the comments, it appears August rhymes with February. In February standards started to be tightened for many subprime products - or the products were eliminated completely. Now the same appears to be happening for Alt-A.

UPDATE: IndyMac comments (hat tip Brian) Click on graph for larger image.

Click on graph for larger image.

IndyMac CEO says mortgage markets "panicked and illiquid"

IndyMac CEO says AAA private MBS bonds are difficult to trade.

IndyMac CEO says disruption "broader and more serious" than past.

From IMB report:

... here is a copy of an email CEO Mike Perry sent out to all Indymac employees yesterday on this subject:

Unfortunately, the private secondary markets (excluding the GSEs and Ginnie Mae) continue to remain very panicked and illiquid. By way of example, it is currently difficult, at present, to trade even the AAA bond on any private MBS transaction. In addition, to give you an idea as to how unprecedented this market has become…I received a call from U.S. Senator Dodd this morning who seeking an understanding of “what is really going on and how can I and Congress help?” I also have talked to the Chairman of Fannie Mae this morning and have traded calls with the Chairman of Freddie Mac (Fannie Mae’s Chairman telling me that they are “prepared to step up and help the industry”).

Unlike past private secondary mortgage market disruptions, which have lasted a few weeks or so…our industry and Indymac have to be prudent and assume that this present disruption, which appears broader and more serious, might take longer to correct itself. As a result, we have seen just since yesterday, many major mortgage lenders announce additional product cutbacks…some leaving subprime, Alt-a, and other products altogether or restricting some products to only their own retail channel (and possibly wholesale) and significant, additional price widening.

While we have very strong liquidity, a good amount of excess capital and there are no realistic scenarios that I can foresee that would impair Indymac’s viability (thanks to our Federal Thrift structure), as I said on the earnings conference call yesterday…we cannot continue to fund $80 to $100 billion of loans through a $33 billion balance sheet….unless we know we can sell a significant portion of these loans into the secondary market…and right now, other than the GSEs and Ginnie Mae….the private secondary market is not functioning.

As a result, Indymac like all major lenders, will continue to widen its pricing and tighten product and underwriting guidelines to ensure that a much great percentage of our production qualifies for sale to the GSEs or through a GNMA security (we sold 40% to the GSEs in the 2nd quarter, up from 30% in Q107 and 19% in 2006, and we want to get it up to at least 60% asap). We are hopeful that private AAA MBS bonds begin to trade soon…and have encouraged the GSEs to step in and provide additional liquidity to the secondary markets (their primary role) for both these private securities and other loans.

While this is an abrupt and uncomfortable change, it is a change that all of our competitors are making just as abruptly, if not more abruptly…so it should not result in one mortgage company having a competitive advantage over another. The reality is I have a lot of confidence in our industry’s mortgage originators (and in particular Indymac’s customers and retail loan officers)….to quickly move as many borrowers as possible to this more full doc, conforming loan environment. I remain hopeful that these very major changes which are clearly negative for our and industry’s loan volumes…will be largely offset for Indymac by the fact that we have fewer players left in the business….we are certainly seeing it play out this way so far this week.

More specific details on products and channels will follow in the next few days. Thanks. Mike

P.S. We will still originate product that cannot be sold to the GSEs…just less of it and we will have to assume we retain it in portfolio (until the AAA private MBS market recovers).

LAT on Hedge Funds

by Tanta on 8/02/2007 11:36:00 AM

Kimono firmly closed, we learn:

Some hedge funds that have suffered losses on investments are closing the gate on clients who want to pull money out, a move that could further undermine confidence in already shaky financial markets.Hordes of well-heeled investors? Is that the opposite of a select group of unwashed masses?

Temporarily barring withdrawals, though legal, also could damage the image of the hedge fund industry, which in recent years has attracted hordes of well-heeled investors seeking high returns. The industry has mushroomed to 9,700 funds with $1.7 trillion in assets.

"Psychologically, separating people from their money is generally considered to be a hostile way to behave," said Ron Geffner, a partner at New York law firm Sadis & Goldberg.

MMI Update: Decliners Lead Advancers

by Tanta on 8/02/2007 10:29:00 AM

Murdoch hasn't even taken over the WSJ yet, either:

Subprime Detectives Search In Dark for Next VictimUm, I thought detectives were supposed to be lookin' for the, um, perp?

There's more:

Lenders Tighten Standards, Pare Loans in Face of DebtThat has recognizable English syntax--if you're not fussy--but I must say that if I have ever pared a loan in the face of debt I didn't know I was doing it at the time.