by Calculated Risk on 11/11/2006 12:29:00 AM

Saturday, November 11, 2006

NY Times: Deteriorating Corporate Credit Ratings

Almost no one defaults because almost everyone can borrow. That defaults are few reassures lenders there is little danger.From the NY Times: Are High Credit Ratings Just a Thing of the Past?

"You have an incredible amount of liquidity sloshing around in the market,” said Diana Vazza, the head of global fixed-income research for Standard & Poor’s, the bond rating company.

Much of that money is seeking higher returns, and is thus willing to accept higher risks. That willingness to buy has meant that borrowers with dubious credit end up paying relatively little for the money.

Of the companies receiving their first ratings from Standard & Poor’s this year, fewer than 10 percent received investment grade.

The median rating for all American nonfinancial companies is now BB, or relatively high-quality junk. A decade ago, the median rating was BBB, an investment grade rating.

...

And yet default rates remain low. S.& P. reported this week that just 1.3 percent of all corporate bonds went into default over the last 12 months, while the figure in Europe is just 0.5 percent. It expects the United States rate to rise to 3.5 percent by early 2008, but that is still below historic averages.

Some companies that would have defaulted in earlier times, Ms. Vazza said, can avoid that fate simply by refinancing their debts. Lenders, including hedge funds and private equity funds, retain a lively appetite for risk.

There is something circular here: Almost no one defaults because almost everyone can borrow. That defaults are few reassures lenders there is little danger.

There will be a catch one of these days. If and when credit tightens — in the sense that lenders are less willing to lend to poor credits — then many companies are likely to find that they are in trouble that they cannot ride out without new loans, which would be unavailable. The problem could be particularly acute if it came when the country was in a recession.

Friday, November 10, 2006

Home Builder “Death Spiral”

by Calculated Risk on 11/10/2006 02:38:00 PM

From Paper Money: “Death Spiral” Makes Home Builders Angry!

In a particularly revealing exchange, Ara Hovnanian, CEO of Hovnanian Enterprises Inc., squared off against a somewhat angry Robert Toll, CEO of Toll Brothers Inc., over the issue of tactics employed by “certain” home builders in their attempts to rid themselves of unwanted land parcels.Here is the referenced CNBC video clip.

“.. many [builders] are choosing a tactic, private and public, of popping a house on that land because you can sell it when it has a nice house on it more easily than you can sell the raw land.” said Hovnanian. Then Toll interrupts “[inaudible].. what.. are you suggesting builders are building specs to move land?” After a short and uncomfortable pause Hovnanian responds “.. ah.. not uniformly, but yea.. absolutely. I would say that… I don’t think Toll is but I think people are. [lots of laughter]”. Toll then responds enthusiastically “Toll is certainly not!”

San Diego: Economic Slowdown Continues

by Calculated Risk on 11/10/2006 11:29:00 AM

"... the [San Diego] economy is slowing down. It may not necessarily collapse."From the Voice of San Diego: Local Economic Slowdown Continues

Alan Gin, Economics Professor, USD.

The county's leading economic indicators sustained a sixth straight month of declines in September, attributed primarily to drops in residential building permits and consumer confidence.San Diego was the first to see the housing bust, and now San Diego is the first to see the spillover from the bust into the general economy.

Alan Gin, professor of economics at the University of San Diego, reported Thursday that four of the six indicators in the index slipped in September. Sharp drops in residential building permits, initial claims for unemployment insurance and consumer confidence played large roles in the decline.

"The thing's been trending down for six months now," Gin said in an interview. "It's more negative news for the county."

Fewer employers solicited help wanted ads, a trend that constitutes the fourth indicator to dip negative in September. The remaining components, local stock prices and an outlook on the national economy, edged up slightly from August's index.

"The changes on the downside are significantly larger than the advances by the positive components," Gin said in the report. Those factors lead to a pessimistic outlook for the local economy, which Gin predicts will slow significantly in early 2007, effecting cooling job growth, a further weakening housing market and tumbling retail sales.

Also from the article, Professor Thornberg discusses MEW, the wealth effect and the negative savings rate:

"One of the big risks to the economy right now isn't the direct effects of the real estate market," [UCLA Economics Professor Christopher] Thornberg said. "It's the indirect effect -- it's that consumers are spending more than they earn."

...

"The last time [the savings rate] was negative was in the Great Depression," he said. "Consumers are spending a great deal of money right now, way more than they should be."

Unprecedented run-ups in housing prices contributed to the problem, he said. But those loans that let homeowners borrow against their increased equity and spend the cash on cars or other goods aren't solely to blame. Even homeowners who didn't use their homes as an ATM can fit the category of people Thornberg's worried about.

He said the increase in home value acted like a check on the table in some people's minds. Homeowners who might otherwise save 10 percent of their paychecks started spending that portion and thinking of their home's value as their savings account.

"The percent of your disposable income you think you need to save really declined over the last few years," Thornberg said.

Freddie Mac: Housing and Economic Outlook

by Calculated Risk on 11/10/2006 01:31:00 AM

Excerpts from Freddie Mac Chief Economist Dr. Frank Nothaft: Housing and Economic Outlook

Housing starts and sales. Housing starts are expected to continue to decline in the fourth quarter before bottoming out in the first quarter of 2007 at an annualized rate of 1.62 million units. Total home sales are forecasted to average 6.3 million units in the fourth quarter, representing a 20,000 unit decrease from last month's forecast.The estimate on starts is consistent with the Fed's view of a soft landing for the U.S. economy. I disagree; I think starts will fall much further.

The "total home sales" forecast is confusing. Seasonally adjusted New Home sales are running close to a 1.0 million annual rate and Existing Home sales were at a 6.18 million annual rate in September, for a total SAAR of around 7.2 million in September. A drop to a total 6.3 million seasonally adjusted annual rate would be substantial and doesn't seem consistent with the rest of the forecast.

Home value appreciation. With recent housing market reports showing further weakness in prices of new and existing homes, we cut our forecast of home price growth in the 3rd quarter by nearly 2 percentage points from our October Outlook, to a 3.5% annual rate. House price appreciation is expected to edge down to 2.9% (annualized) in early 2007 and then average 3.3% for the year.This price forecast almost seems surreal to me. I believe the median home price, as measured by OFHEO, will likely decline in 2007.

Mortgage activity. Given the past increases in mortgage rates, refinance activity continues to be strong due to continued incentives to cash-out home equity and refinance ARMs scheduled to have a payment reset in the next several months. The refinance share of loan applications for the next two quarters is projected to average 44%. Mortgage debt will grow by a rate of 9.1% in the last quarter of this year and drop to 5.8% in early 2007.I agree that the rate of growth of mortgage debt will slow significantly in 2007. The last time mortgage debt increased less than 6% was in 1995, near the end of the previous housing bust. Once again this seems inconsistent with a forecast for housing starts of 1.62 million in 2007 and prices increasing 3.3% in 2007.

Thursday, November 09, 2006

September Trade Deficit: $64.3 Billion

by Calculated Risk on 11/09/2006 11:13:00 AM

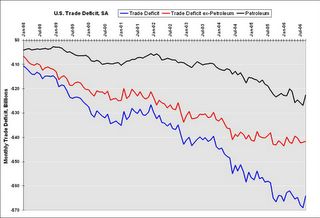

As expected, the trade deficit decreased in September due to falling oil prices. Looking at the trade balance, excluding petroleum products, the deficit has been fairly stable since the second half of 2005. Click on graph for larger image.

Click on graph for larger image.

The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit).

My questions are: Has the trade deficit, ex-oil, stabilized or even started to decline? If yes, is this because of a slowing U.S. economy or better growth internationally - or a combination of both?

Also, see Dr. Setser's comments: Oil helps the September trade balance, but how long will the improvement last

Wednesday, November 08, 2006

Fed's Hoenig: Is it Different this Time?

by Calculated Risk on 11/08/2006 04:07:00 PM

"We're too sophisticated to get into trouble."Kansas City Fed President Thomas Hoenig offered some cautionary words last week: This Time It's Different (Or Is It?).

Bank Manager, early '80s, just before getting into trouble.

Those of you with several years of business experience in this part of the country may recognize that many of the things we are hearing today about the economy have counterparts in the past: Asset values are appreciating, farmland values are strong ... In short, for many in this area of the country, times are good.Hoenig's speech is copy protected, so please read his speech. This excerpt sounds familiar:

At the start of the 1980s, we were told ... farmland was a solid investment ... housing and stock markets would continue to climb.

...

Of course, if you were involved in business or banking 20 years ago, you will recall that several of the financial decisions made on those speculative forecasts created their own sets of problems ...

Today, I am told that while there may be some similarities with current banking conditions and those of a quarter a century ago, things are different this time. You may be hearing the same thing from investors and bankers, and, in fact you be saying to yourself: This time, it's different.

Or is it?

When our examiners would ask about a loan with questionable characteristics during this period [early '80s], they too often heard bankers say, "If I don't make the loan, the banker down the street will." In many cases, unfortunately, this turned out to be a race to the bottom.Needless to say, Hoenig offers several cautionary tales about human nature, hubris and banking. He concludes:

My purpose in reviewing these stories with you today is not that I think a return to a 1980s-style crisis is imminent. Certainly, banking conditions today are good: strong earnings, good asset quality, no bank failures in more than two years. However, those who, in the early 1980s, predicted an endless rise in energy markets and real estate values were as confident in their outlook as we are today. And, certainly, the same rules and lessons continue to apply in banking and finance.

Although the world has changed during the last quarter of a century, at least one thing has not - human nature. As I mentioned earlier, greed, pride, arrogance and other human frailties are often at the root of bad banking decisions, and those qualities remain with us today. They still motivate behavior as they have in the past, and, in many cases, these frailties keep us from acting on the lessons we have learned from previous generations. In addition, no matter how sophisticated we think current analytical tools, management information systems and financial instruments are, the most critical element in banking is still individual experience and judgment. In the end, bank employees, and, I would stress to this audience, bank directors, are still making the important decisions. The quality of those decisions will always depend on human characteristics and our ability to learn from the past.

One banking scholar said, "There is really nothing new in banking and finance, each generation just thinks there is." So, are we in a different situation than 20 years ago? I would suggest that one way we can ensure a different outcome is if you, in your capacity as bank directors, are willing to be skeptical, willing to ask the difficult questions and unwilling to accept the answer "This time, it's different."

Centex CEO says housing downturn to play out more

by Calculated Risk on 11/08/2006 02:52:00 PM

From MarketWatch: Centex CEO says housing downturn to play out more

Centex Corp. Chief Executive Tim Eller ... said judging by previous housing downturns, it normally takes about two and a half years from the peak to the trough. "So we still have further to go" since most experts place the top of the housing boom in July 2005, the CEO said. He called the decline "supply-driven" ... Also, potential buyers are having trouble selling their existing homes and are canceling, which is creating more inventory and drove price declines, Eller said. "In hindsight, we didn't take our foot off the gas pedal soon enough," he added.

MBA: Mortgage Applications Rise

by Calculated Risk on 11/08/2006 01:08:00 AM

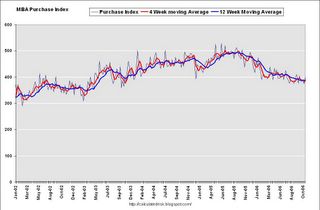

The Mortgage Bankers Association (MBA) reports: Mortgage Applications Rise (fixed)  Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 620.9, an increase of 8.8 percent on a seasonally adjusted basis from 570.8 one week earlier. On an unadjusted basis, the Index increased 8 percent compared with the previous week and was down 5 percent compared with the same week one year earlier.Mortgage rates were stable:

The seasonally-adjusted Refinance Index increased by 11 percent to 1897.9 from 1709.2 the previous week and the Purchase Index increased by 7.1 percent to 402.2 from 375.6 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages remained unchanged at 6.24 percent ...

The average contract interest rate for one-year ARMs decreased to 5.89 percent from 5.93 percent ...

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002.

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002.The four week moving average for the seasonally-adjusted Market Index is up 0.9 percent to 591.5 from 586.1. The four week moving average is up 1.2 percent to 386.2 from 381.5 for the Purchase Index, while this average is up 0.6 percent to 1788.9 from 1778.7 for the Refinance Index.

Tuesday, November 07, 2006

Credit Suisse: New Home Inventory Higher than Reported

by Calculated Risk on 11/07/2006 04:14:00 PM

Credit Suisse has estimated the actual inventory of New Home sales based on cancellations. First, for an excellent article on the impact of cancellations on reported New Home Inventories, see Caroline Baum at Bloomberg: Think Housing's Stabilized? See Cancellations

... cancellations are rising, and they aren't being captured in the aggregate statistics because of the way the survey is designed. Hence, sales are being overstated and inventories understated.From Credit Suisse today: "Inventory in the system is higher than reported."

...

The Census Bureau, which is one of the Commerce Department's statistical agencies, counts an initial new home sale: Sales go up and the ``for sale'' inventory is reduced. If the sale is canceled, it isn't reflected in revisions to previous months. What happens? When the home is ``resold,'' statisticians ignore that transaction.

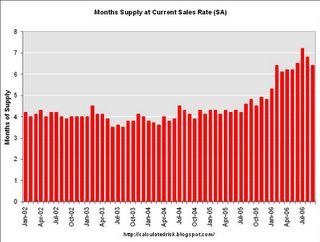

Click on Graph for larger image.

Click on Graph for larger image.This graph shows the months of inventory based on the Census Bureau report. Based on Credit Suisse's analysis, the actual months of inventory is closer to 8 months. Note: Credit Suisse excludes non-started units.

State Nontraditional Mortgage Guidance Release Date

by Calculated Risk on 11/07/2006 03:24:00 PM

Update from the CSBS: The Conference of State Bank Supervisors (CSBS) hopes to release the State Nontraditional Mortgage Guidance on Tuesday November 14th.

I'll post a link to the guidance when it is released.