by Calculated Risk on 1/16/2006 11:48:00 AM

Monday, January 16, 2006

MarketWatch: U.S. economy slows to below trend

MarketWatch reports: U.S. economy slows to below trend

The U.S. economy grew at the slowest pace in nearly three years in the just-concluded fourth quarter, economists now estimate.

Led by what could be the weakest consumer spending since 1991, the economy likely grew at about a 2.7% annual pace in the quarter after 11 straight quarters of growth above 3%, economists say.

...

Few economists expect the slump to worsen significantly. For the first quarter, economists are estimating growth at 3.6% ... Most economists do see growth slowing again at the end of the year as the housing market weakens.

...

Housing was one of the few bright spots in the fourth quarter's growth mix, along with inventory rebuilding. The weak sectors were consumer spending, business investment, exports and government spending.

"We do not believe the apparent weakness in the fourth quarter represents a clear change in the trend," said James O'Sullivan, an economist for UBS. GDP will likely slow from about 3.6% in 2005 to 3% in 2006 and 2.7% in 2007.

Saturday, January 14, 2006

Sasha Wins!

by Calculated Risk on 1/14/2006 02:56:00 PM

Congratulations Sasha!

Sasha Cohen is the new US Ladies Figure Skating champion.

Please excuse this off topic post: I happen to know Sasha, and in addition to being an incredible athlete, Sasha is an intelligent, warm and funny person. She is very deserving and will be a great representative for skating and America in Turin.

Friday, January 13, 2006

White House:Deficit Could Top $400 Billion

by Calculated Risk on 1/13/2006 01:33:00 AM

The Washington Post reports: Deficit Could Top $400 Billion

Driven by the cost of hurricane relief, the federal budget deficit is expected to balloon back above $400 billion for the fiscal year that ends in September, reversing the improvements of 2005, a White House official told reporters yesterday.The General Fund deficit will be close to $600 Billion this year - the White House is reporting the Enron style "unified budget deficit". But kudos to WaPo writer Jonathan Weisman for correctly describing the political game the White House has been playing with the budget for the last few years.

But some budget analysts cautioned that the estimate should be considered more of a political mark to inform the coming budget debate than an economic forecast.

This is the third straight year in which the White House has summoned reporters well ahead of the official budget release to project a higher-than-anticipated deficit. In the past two years, when final deficit figures have come in at record or near-record levels, White House officials have boasted that they had made progress, since the final numbers were below estimates.

"This administration has a history of overestimating the deficit early in the year, lowering expectations, then taking credit when it comes in below forecast," said Stanley E. Collender, a federal budget expert at Financial Dynamics Business Communications. "It's not just a history. It's almost an obsession."

The bottom line is simple: the General Fund budget is a disaster and the situation continues to get worse.

Thursday, January 12, 2006

The Economist: Danger time for America

by Calculated Risk on 1/12/2006 01:24:00 PM

From The Economist cover story: Danger time for America

In [Greenspan's] final days of glory, it may therefore seem churlish to question his record. However, Mr Greenspan's departure could well mark a high point for America's economy, with a period of sluggish growth ahead. This is not so much because he is leaving, but because of what he is leaving behind: the biggest economic imbalances in American history ...

Handovers to a new Fed chairman are always tricky moments. They have often been followed by some sort of financial turmoil, such as the 1987 stockmarket crash, only two months after Mr Greenspan took over. This handover takes place with the economy in an unusually vulnerable state, thanks to its imbalances. ...

How should Mr Bernanke respond to falling house prices and a sharp economic slowdown when they come? While he is even more opposed than Mr Greenspan to the idea of restraining asset-price bubbles, he seems just as keen to slash interest rates when bubbles burst to prevent a downturn. He is likely to continue the current asymmetric policy of never raising interest rates to curb rising asset prices, but always cutting rates after prices fall. This is dangerous as it encourages excessive risk taking and allows the imbalances to grow ever larger, making the eventual correction even worse. If the imbalances are to unwind, America needs to accept a period in which domestic demand grows more slowly than output.

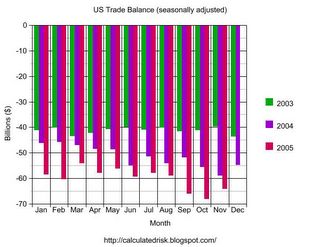

November U.S. Trade Deficit: $64.2 Billion

by Calculated Risk on 1/12/2006 12:14:00 AM

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis reports that the U.S. trade deficit for November was $64.2 Billion. Imports fell slightly to a $173.5 billion from a record $175.5 billion in October.

Click on graph for larger image.

Imports from China were $22.4 Billion, down from a record of $24.4 Billion in October, while exports to China were steady at $3.9 Billion. Imports from Japan decreased to $11.9 billion from $12.2 Billion in October.

The Petroleum deficit was $22.9 billion, down from the October record of $23.9 Billion. The decrease in the petroleum deficit was primarily due to a drop in the price of crude oil.

Dr. Setser (US November trade data) and Kash comment on the trade data.

Wednesday, January 11, 2006

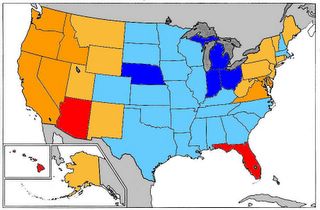

US Migration Patterns

by Calculated Risk on 1/11/2006 07:54:00 PM

United Van Lines released their annual analysis of US migration patterns: Southeast, West Continue to Attract Residents as Midwest, Northeast See More Leave

United classifies each state in one of three categories -- "high inbound" (55% or more of moves going into a state); "high outbound" (55% or more of moves coming out of a state); or "balanced." Although the majority of states were in the "balanced" category last year, several showed more substantial population shifts.

What stands out to me is that California is seeing a net outflow for the first time since 1995. And Florida is "balanced" after years of net inflow. This is probably related to housing prices in both states.

So lets compare migration to housing prices ... the following graph is house price appreciation based on the OFHEO House Price Index.

Click on graph for larger image.

Quarterly Appreciation:

Red: Greater than 20%

Dark Orange: 15% to 20%

Light Orange: 10% to 15%

Light Blue: 5% to 10%

Dark Blue: less than 5%

NOTE: D.C. is also red. These are annual rates of appreciation for Q4 2004 through Q3 2005. So this is not the exact same time period as the United analysis (calendar 2005). Q4 2005 is not yet available.

There are two regions seeing significant migration inflow: the West (excluding California) and the Southeast (excluding Florida). It is no surprise that western states like Arizona, Oregon, Nevada and Idaho have seen housing prices surge based on the migration data.

However, a similar pattern is not happening the Southeast. The states seeing inflows, like the Carolinas and Georgia, are not seeing above average house price increases. Perhaps there is more available land and higher rental vacancy rates.

Its no surprise that high outbound states like Michigan and Indiana are price laggards.

FED's Geithner: Monetary policy must account for Asset Prices

by Calculated Risk on 1/11/2006 05:41:00 PM

From Reuters: Fed must take asset prices into account on policy

U.S. monetary policy must take asset price fluctuations into account even if it cannot target them explicitly, New York Federal Reserve President Timothy Geithner said on Wednesday.Here is the text of Geithner' speech: Some Perspectives on U.S. Monetary Policy

The comments set Geithner apart from others at the central bank who had been quicker to dismiss the impact of significant price rises in assets like stocks or housing.

Some economists worry that, like the stock market in the late 1990s, housing prices may haven gotten out of whack with the fundamental value of home assets after a five-year boom.

While some of his colleagues have argued that there is simply nothing the Fed can do about it, Geithner said action was indeed warranted under certain circumstances.

"When policy-makers have already witnessed a significant move in asset values and are confident in what that move means for the outlook, it (the Fed) should be prepared to adjust policy accordingly," Geithner told an economics luncheon at the Harvard Club.

Geithner also reiterated his concerns over the longer-term stability of the global financial system, saying that the calm of recent years should not be taken as a green light for complacency.

He said the U.S. current account deficit, and the eventual need for an adjustment, posed serious risks.

"It would be hard for anyone looking at the size of the U.S. current account deficit to not be worried," Geithner said.

MBA: Mortgage Activity Rebounds

by Calculated Risk on 1/11/2006 12:14:00 PM

The Mortgage Bankers Association (MBA) reports: Mortgage Rates Down for Fifth Consecutive Week

Click on graph for larger image.

The Market Composite Index — a measure of mortgage loan application volume was 600.1 -- an increase of 9.9 percent on a seasonally adjusted basis from 545.9 one week earlier. A holiday adjustment was included in the seasonally adjusted numbers to help account for the reduced application activity during the holiday week. On an unadjusted basis, the Index increased 27.2 percent compared with the previous week but was down 19.1 percent compared with the same week one year earlier.Rates on fixed rate mortgages decreased, while rates for ARMs were steady:

The seasonally-adjusted Purchase Index increased by 9.3 percent to 457.4 from 418.3 the previous week whereas the Refinance Index increased by 9.9 percent to 1497.5 from 1363.2 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.08 percent from 6.15 percent on week earlier ...

The average contract interest rate for one-year ARMs increased to 5.42 percent from 5.41 percent one week earlier ...

Tuesday, January 10, 2006

China and the Dollar

by Calculated Risk on 1/10/2006 02:15:00 PM

It seems that every time there is a discussion of some foreign central bank diversifying away from the dollar, it is promptly denied by the rumored country. These two articles follow that pattern ...

From the WaPo: China Set To Reduce Exposure To Dollar

China has resolved to shift some of its foreign exchange reserves -- now in excess of $800 billion -- away from the U.S. dollar and into other world currencies in a move likely to push down the value of the greenback, a high-level state economist who advises the nation's economic policymakers said in an interview Monday.And from the AP: China's central bank denies dollar plans

As China's manufacturing industries flood the world with cheap goods, the Chinese central bank has invested roughly three-fourths of its growing foreign currency reserves in U.S. Treasury bills and other dollar-denominated assets. The new policy reflects China's fears that too much of its savings is tied up in the dollar, a currency widely expected to drop in value as the U.S. trade and fiscal deficits climb.

...

Some economists have long warned that if foreigners lose their appetite for American debt, the dollar would fall, interest rates would rise and the housing boom could burst, sending real estate prices lower.

The comments of the Chinese senior economist, made on the condition of anonymity because the government disciplines those who speak to the press without express authorization, confirmed an analysis in Monday's Shanghai Securities News stating that China is inclined to shift some its savings into other currencies such as the euro and the yen, or into major purchases of commodities such as oil for a long-discussed strategic energy reserve.

China said Tuesday it has no plans to sell dollars from its $800 billion-plus foreign reserves, rejecting speculation that had jolted financial markets and fed speculation about the possible impact on the U.S. dollar.

"We won't sell off our dollar-denominated assets," a central bank official, Tang Xu, told Dow Jones Newswires.

China's foreign currency regulator said last week its plans for 2006 include "widening the foreign exchange reserves investment scope." That sparked speculation that Beijing might shift some reserves from dollars, the bulk of its holdings, into other currencies.

...

Tang, director-general of the central bank's Research Bureau, said foreign reserves were expected to top $800 billion at the end of 2005, up from $769 billion when the last quarterly report was issued in September, according to Dow Jones.

ALSO: see Martin Feldstein's: Uncle Sam’s bonanza might not be all that it seems Note: Dr. Thoma provides excerpts: Martin Feldstein: Capital Inflows Primarily from Foreign Governments, not Private Investors

And Dr. Setser's comments: Martin Feldstein joins the dollar doomsday cult.

This is a key reason of why one of my top economic predictions of the year was that long rates would rise when the Fed starts cutting rates later this year.

Monday, January 09, 2006

The End of Defined Benefit Plans

by Calculated Risk on 1/09/2006 02:06:00 AM

First, my post on Angry Bear, Stiglitz and Bilmes: The Real Cost of Iraq War

The NY Times reports: More Companies Ending Promises for Retirement

The death knell for the traditional company pension has been tolling for some time now. Companies in ailing industries like steel, airlines and auto parts have thrown themselves into bankruptcy and turned over their ruined pension plans to the federal government.This will put the burden on the employee and from my experience, the employees that will probably need the benefits the most, will contribute the least (as a percentage of income), and invest poorly.

Now, with the recent announcements of pension freezes by some of the cream of corporate America - Verizon, Lockheed Martin, Motorola and, just last week, I.B.M. - the bell is tolling even louder. Even strong, stable companies with the means to operate a pension plan are facing longer worker lifespans, looming regulatory and accounting changes and, most important, heightened global competition. Some are deciding they either cannot, or will not, keep making the decades-long promises that a pension plan involves.

...the pension freeze is the latest sign that today's workers are, to a much greater extent, on their own. Companies now emphasize 401(k) plans, which leave workers responsible for ensuring that they have adequate funds for retirement and expose them to the vagaries of the financial markets.

When I was a trustee for a 401(k) plan, I saw the following behavior repeated many times: Less sophisticated investors would tend to be overly conservative putting most of their money in money market funds. Then they would occasionally invest in whatever went up in the most recent quarters. If they had a losing quarter, they would scurry back to the money market fund. Their overall results were poor.

This will leave Social Security Insurance as the only defined benefit portion of an individual's retirement income - an insurance policy for life's vagaries.