by Calculated Risk on 6/30/2005 11:37:00 PM

Thursday, June 30, 2005

CNN Newsnight: Aaron Brown Discusses the Housing Bubble

On Tuesday night, CNN's Newsnight with Aaron Brown had a segment on the housing bubble. Here are excerpts from the transcript:

BROWN: Back in the mid '90s, when we were all thinking of early retirement after our Internet stocks tacked on another 10 or 15 points, there were naysayers who said it wouldn't last, who said rationality always returns eventually, who said it was a bubble and a dangerous one at that. Oh, those naysayers.There is more, but that was the most in-depth part of the discussion. Dean Baker didn't get much face time!

By the way, are you counting on home equity to fund your retirement? Like the fact that your home doubled in the last decade or so? Feeling rich again? So is this deja vu with a mortgage? Here's CNN's Andy Serwer.

(BEGIN VIDEOTAPE)

ANDY SERWER, CNN CORRESPONDENT (voice-over): Is there a housing bubble? It depends who you ask and where you ask.

DEAN BAKER, CTR FOR ECONOMIC POLICY RESEARCH: Well, there's absolutely a housing bubble. In the last seven or eight years, we've seen an unprecedented run-up in home prices nationwide.

SERWER: No question, certain markets are red hot. Since 2000, the price of a single family home has jumped 77 percent in New York City, 92 percent in Miami, and 105 percent in San Diego. And there are other signs besides just home prices, 86 books on real estate investing were published last year, nearly three times as many as 1998.

Speculators have added fuel to overheated markets. In Los Angeles, for example, the number of homes sold that have been owned for less than six months jumped 47 percent in a year.

Prices are so high in some areas that renting a home has become dirt cheap by comparison. In San Francisco, for example, rent on a median price house runs $1,532 a month. Owning the same house with a typical mortgage would cost $3,424 a month.

But not every market is on fire. Some experts say that bubbles are mostly in cities on the east and west coasts. If those bubbles were to burst, it would shock the entire economy. But some say prices won't collapse, they'll just ease up.

FRANK NOTHAFT, CHIEF ECONOMIST, FREDDIE MAC: As long as the local economy remains strong and there is good job creation, then we're not going to see a drop in home values.

SERWER: In cities such as Dallas or Salt Lake or Pittsburgh, prices haven't risen nearly so much. Radical differences in prices can make moving from a hot zone like LA to a colder one like Syracuse either a windfall or a slap in the face, depending on which way you're going.

So what does all this mean for the prospective buyer?

FRANK NOTHAFT: It's a very personal decision whether or not they should sell now and choose to rent. If you're happy with your home and you enjoy the home that you're in and the neighborhood you're in, there's no point to sell it right now and switch to renting.

SERWER: In other words, don't just buy a home because you think you'll make a ton of money on it in two years. And don't sell your home just because it's appreciated wildly either. Because in real estate, as in everything else in life, you can't count on getting a better deal down the road.

Andy Serwer, CNN, New York.

(END VIDEOTAPE)

BROWN: Taking the global view for a moment, globalization being the rage these days, in 2004, housing prices in Spain and France went up even faster than they did here in the United States, 15 percent up for the year. Compared to 9 percent nationwide in the U.S.

But before you bet the farm, or the house, consider this. In Japan, house prices have dropped for the last 14 years. And they are now down 40 percent from their peak back in 1991. Here at home again, the median price of a house is $207,000. That means half the houses cost more, half the houses cost less.

Any economic topic is difficult for TV News. No pictures. I can imagine the viewers reaching for the remote ... hmmm, any shark attacks today?

Real Estate "Summit" Comments

by Calculated Risk on 6/30/2005 09:21:00 PM

Following are some comments and stories from the Reuters Real Estate Summit in New York.

Property guru says U.S. market nearing peak Peter Korpacz, the head of real estate business advisory services for PriceWaterhouseCoopers told reporters:

"The thing the industry is focusing on now is jobs growth. For the most part its running at about 175,000 a month. It's a healthy economy, but it's not robust. During this point in the last recovery (in the early 1990s) jobs were growing at about 217,000 a month."Toll Bros sees possible correction in hot markets

Korpacz said real estate lenders and developers are far more disciplined now than in the past and so there was little threat to the market from speculative development, although the red-hot residential sector was giving rise to concerns among investors.

He added that if there is a major drop in prices for condos or single-family housing, it could hurt "real estate as a whole and just wash (away) the whole industry."

"In the hot markets, I wouldn't be surprised to see a 20 percent decline," [Robert Toll Brothers Inc.'s chief executive] said at the Reuters Real Estate Summit in New York. "You've got a price going from $1 million to $800,000, I don't have a problem with that.For more stories see the Reuters Summit site.

"I don't think you're going to have a pop, which means I don't think you've got a bubble," added the head of the luxury home builder at the summit held at Reuters U.S. headquarters in New York. "But I do think you're going to have a correction as the markets unnaturally overheat because of speculation."

Environmental Economics

by Calculated Risk on 6/30/2005 01:31:00 PM

An an undergrad, I was incredibly fortunate to take Chemistry from Drs.Sherwood Rowland and Mario Molina. At that time, the future Nobel Laureates (1995 Nobel Prize in Chemistry) Rowland and Molina were working on their ground breaking discoveries into how chlorofluorocarbons (CFCs) were impacting the ozone.

But Rowland and Molina's work was just the start. To correct the CFC caused ozone depletion problem it took a combination of great science, an open discussion of the environmental impact of various policy options, government action and international cooperation. Not only was the chemistry fascinating, but that was my introduction into market failures and externalities. When I spoke with Dr. Rowland a few months ago, he modestly told me the science might have been the easy part!

With that prelude, here is a new Environmental Economics blog with 17 contributing economists addressing many of the economic and political issues that are required to transform good science into good policy. Enjoy!

Britain: Headed for a Hard Landing?

by Calculated Risk on 6/30/2005 11:16:00 AM

According to MSNBC:

The Bank of England's attempt to bring Britain's highflying economy in for a soft landing is starting to reach the nail-biting stage.Of course less consumer spending is also related to the deflating housing bubble:

Fears are growing, even within the BOE, that consumer spending is faltering in response to past hikes in interest rates and soaring energy bills.

At the center of the drama is Britain's housing bubble, which began to lose air in the second half of last year. Although the growth rate of house prices has slowed sharply, a generally healthy economy has helped to allay worries over a collapse. Now the economic outlook is dimming.Housing slows, consumers retrench, and then the job market starts to soften:

In particular, consumers are pulling back more than anticipated.

The newest concern is the labor markets. In May the number of workers claiming jobless benefits rose for the fourth month in a row. That hasn't happened since 1993, and it could be a harbinger of softer job markets. Wage growth, excluding bonuses, is already slowing.And the next step in the downward vicious cycle? Falling housing prices, followed by even less consumer spending and more job losses and then a further reduction in house prices ...

Bloomberg columnist Matthew Lynn offers a similar view: U.K. Consumers Risk Recession With New Restraint.

The U.K. consumer shows every sign of having run out of steam and the economy is teetering as a result.The US has also had a "huge increase in household debt". Perhaps Britain's problems offer a glimpse of the future for the US housing market and economy.

British shoppers have become hypersensitive since the Bank of England increased interest rates five times from November 2003 through August 2004, and since their household debt skyrocketed to more than 1 trillion pounds ($1.82 trillion).

There may well be a lesson in that for policy makers in many other countries. Consumers who have piled up debt are far more responsive to rate changes than previously.

What used to be just a nudge on the interest-rate rudder is now sending the economy downhill. The U.K.'s growth rate has fallen in each of the past four quarters.

``The main factor has been the huge increase in household debt,'' said Stuart Thomson, a fixed-income strategist at Charles Stanley Sutherlands in Edinburgh, in a telephone interview. ``It is the highest in the developed world. So people are really getting squeezed as rates rise.''

UPDATE: Another take on UK: Economic growth weakest in 2 years

And the GDP data suggest an even greater link between the housing market and consumer spending than the BoE at first assumed, suggesting worse could be yet to come.

The saving ratio in 2004 fell to its lowest since 1963 as household spending was credited with making an even greater contribution to the economy over the last few years, before slowing in line with the housing market.

The Nationwide building society said house prices fell 0.2 percent in June, bringing the annual rate of increase to a nine-year low of 4.1 percent, compared with nearly 20 percent a year earlier.

"This obviously increases the danger that the saving ratio will rise over the coming quarters as the housing market weakens, slowing the growth of household spending even further," said Jonathan Loynes, chief economist at Capital Economics.

Tuesday, June 28, 2005

Housing: FDIC and California

by Calculated Risk on 6/28/2005 07:57:00 PM

According to the article in the previous post:

Today, the agency will release new state-by-state economic profiles. Taken together, the profiles conclude that most booming U.S. housing markets are sustained by strong growth in new jobs.Here is the California profile and two graphs.

"In general, that is where home prices are rising most rapidly," said Barbara Ryan, associate director of the FDIC's research division.

Click on graph for larger image.

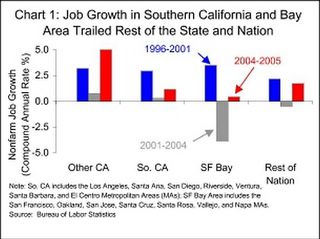

Job growth in the bay area and southern California trailed the rest of the Nation.

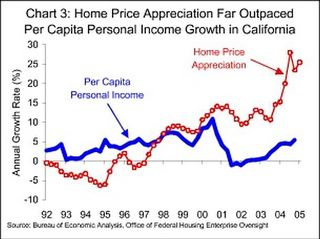

Price appreciation outpaced income growth.

The data for California does not seem to support the FDIC's conclusion.

Sec. Snow and FDIC: No Housing Bubble

by Calculated Risk on 6/28/2005 07:04:00 PM

Treasury Secretary Snow appeared on CNBC today. According to FOX:

"I think in some markets housing prices have risen out of alignment with underlying earnings," Snow said. But also answering the question whether there was a housing bubble in the United States his answer was a flat-out "no."And officials at the FDIC apparently believe that housing prices are the result of strong job growth. From this article:

Top officials at the Federal Deposit Insurance Corp. (FDIC), which regulates national banks, yesterday dismissed fears that rising home prices nationwide reflect a speculative bubble ready to burst.Here are the FDIC State Profiles.

...

Today, the agency will release new state-by-state economic profiles. Taken together, the profiles conclude that most booming U.S. housing markets are sustained by strong growth in new jobs.

"In general, that is where home prices are rising most rapidly," said Barbara Ryan, associate director of the FDIC's research division.

Snow also commented on Oil prices:

"Energy prices are way too high," Snow said on CNBC television. "Clearly, it's hurting."Don't worry, be happy!

"Clearly, energy prices serve as a tax, they reduce the disposable income available to do other things and they take some oxygen out of the economy," Snow said. "Energy is my concern. I think energy is the biggest concern," he added.

But Snow said the U.S. economy is currently managing to withstand the "headwinds" of oil at $60 a barrel. When asked if these energy prices portend a recession, Snow said: "No. I don't see it derailing the strong recovery we're in ... but it does take a few tenths of a (percentage) point off GDP growth, that's for sure."

Monday, June 27, 2005

BIS: US Urged to Act First on Global Imbalances

by Calculated Risk on 6/27/2005 10:44:00 PM

From the Financial Times, the Bank for International Settlements (BIS) warned Monday that "growing domestic and international debt has created the conditions for global economic and financial crises".

UPDATE: Macroblog links to the BIS report with key excerpts.

The Basel-based organisation's annual report said no one could predict if and when such international economic imbalances would unravel but "time might well be running out".The BIS urged the US to act first:

"Given the size of the [US] government deficit, the obvious first step would be to cut expenditures and raise taxes"...The report then turned pessimistic.

Without a smaller budget deficit, lower private sector consumption and higher savings, there was little likelihood of stabilising the ballooning US current account deficit. The ever widening deficit “could eventually lead to a disorderly decline of the dollar, associated turmoil in other financial markets, and even recession."

...the BIS report questioned the Bush administration's willingness to impose the required policies to back up its deficit reduction ambition ..."Time is running out" and no action will be taken "in the near term". How sad.

"If what needs to be done to resolve external imbalances is reasonably clear, it also seems clear that much of it is simply not going to happen in the near term."

Housing Misinformation

by Calculated Risk on 6/27/2005 02:57:00 PM

The LA Times publishes a small community newspaper for my neighborhood called the Daily Pilot. The business section of today's Pilot featured an article on housing. What caught my eye were some quotes from local real estate professionals.

"Much of the appreciation we're seeing is permanent."John Burns, president of Irvine-based John Burns Real Estate Consulting June, 2005

Compare to:

"Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months."Irving Fisher, Ph.D. Economics, Oct. 17, 1929

But far more discouraging are the comments attributed to Bill Cote of the Cote Realty Group. He doesn't believe there is a bubble, but he also apparently wants to withhold information from the home buying public:

[Cote]...is bothered by the potential of academics forecasting real estate deflation to discourage the public. He said it's tough for general audiences to discern between the various forecasts that are out there."People start talking ..." We wouldn't want that to happen.

"It affects the confidence of the market -- people start talking," Cote said. "People can't tell unless they're sophisticated in economics."

Houses and Interest Rates

by Calculated Risk on 6/27/2005 12:22:00 AM

My latest post is up on Angry Bear: The Impact of Interest Rates on House Prices. Several people are arguing that housing prices are appropriate based on current interest rates. I argue that this is incorrect.

And from the NY Times: How Home Prices Can Be Hot but Inflation Cool. This article discusses a potential problem with the CPI calculation. When houses prices fall that might increase the reported CPI:

... when housing prices fall, a trend that most people would deem anti-inflationary, and renting becomes more attractive than owning, the index might process the information as evidence that inflation is on the rise. "We got a great deal of criticism that we were overstating inflation in the early 1990's, because housing prices were declining and rents were going up steadily," Mr. Jackman said.And my friend Mike Shedlock is hearing "Warning bells from homebuilder suppliers".

Best to all.

Friday, June 24, 2005

Buffett Examines living in Squanderville

by Calculated Risk on 6/24/2005 09:17:00 PM

Kash covered the political reaction to the announcement that China National Offshore Oil Corporation, or CNOOC, is bidding for Unocal. MaxSpeak and Dr. Setser work the numbers.

This event reminds me of the following cautionary tale from Warren Buffett (Oct, 2003).

[T]ake a wildly fanciful trip with me to two isolated, side-by-side islands of equal size, Squanderville and Thriftville. Land is the only capital asset on these islands, and their communities are primitive, needing only food and producing only food. Working eight hours a day, in fact, each inhabitant can produce enough food to sustain himself or herself. And for a long time that's how things go along. On each island everybody works the prescribed eight hours a day, which means that each society is self-sufficient.UPDATE: Buffett was on CNBC Thursday June 23rd. Here are his comments on China:

Eventually, though, the industrious citizens of Thriftville decide to do some serious saving and investing, and they start to work 16 hours a day. In this mode they continue to live off the food they produce in eight hours of work but begin exporting an equal amount to their one and only trading outlet, Squanderville.

The citizens of Squanderville are ecstatic about this turn of events, since they can now live their lives free from toil but eat as well as ever. Oh, yes, there's a quid pro quo-but to the Squanders, it seems harmless: All that the Thrifts want in exchange for their food is Squanderbonds (which are denominated, naturally, in Squanderbucks). Over time Thriftville accumulates an enormous amount of these bonds, which at their core represent claim checks on the future output of Squanderville. A few pundits in Squanderville smell trouble coming. They foresee that for the Squanders both to eat and to pay off-or simply service - the debt they're piling up will eventually require them to work more than eight hours a day. But the residents of squanderville are in no mood to listen to such doom saying.

Meanwhile, the citizens of Thriftville begin to get nervous. Just how good, they ask, are the IOUs of a shiftless island? So the Thrifts change strategy: Though they continue to hold some bonds, they sell most of them to Squanderville residents for Squanderbucks and use the proceeds to buy Squanderville land. And eventually the Thrifts own all of Squanderville. At that point, the Squanders are forced to deal with an ugly equation: They must now not only return to working eight hours a day in order to eat - they have nothing left to trade - but must also work additional hours to service their debt and pay Thriftville rent on the land so imprudently sold. In effect, Squanderville has been colonized by purchase rather than conquest. It can be argued, of course, that the present value of the future production that Squanderville must forever ship to Thriftville only equates to the production Thriftville initially gave up and that therefore both have received a fair deal. But since one generation of Squanders gets the free ride and future generations pay in perpetuity for it, there are - in economist talk - some pretty dramatic "intergenerational inequities."

Buffett said he doesn't subscribe to the view that China is engaging in a trade war with the U.S. He said Chinese corporate takeovers, such as CNOOC Ltd's (CEO) recent bid for Unocal Corp. (UCL) were an "inevitable" consequence of the U.S. trade deficit. He noted that the U.S. imported far more goods from China than it sold to the nation.

"If we're going to consume more than we produce, we have to expect to give away a little bit of the country," said the "Oracle of Omaha."