by Calculated Risk on 6/17/2011 10:45:00 AM

Friday, June 17, 2011

State Unemployment Rates "little changed" in May

From the BLS: Regional and State Employment and Unemployment Summary

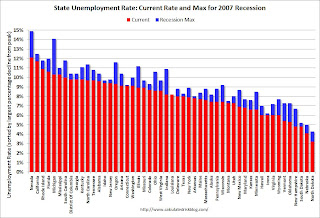

Regional and state unemployment rates were little changed in May. Twenty-four states recorded unemployment rate decreases, 13 states and the District of Columbia registered rate increases, and 13 states had no rate change, the U.S. Bureau of Labor Statistics reported today.The following graph shows the current unemployment rate for each state (red), and the max during the recession (blue). If there is no blue (only Louisiana in May), the state is currently at the maximum during the recession.

...

Nevada continued to register the highest unemployment rate among the states, 12.1 percent in May. California recorded the next highest rate, 11.7 percent. North Dakota reported the lowest jobless rate, 3.2 percent ...

Nevada recorded the largest jobless rate decrease from May 2010 (-2.8 percentage points). Two other states had rate decreases of more than 2.0 percentage points -- Michigan (-2.5 points) and Indiana (-2.2 points).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The states are ranked by the highest current unemployment rate.

Nevada saw the most improvement year-over-year in May, but still has the highest state unemployment rate.

One state is still at the recession maximum (no improvement): Louisiana. Every other state has seen some improvement and only seven states have double digit unemployment now (19 states had double digit unemployment during the worst of the great recession).

Consumer Sentiment declines in June

by Calculated Risk on 6/17/2011 09:55:00 AM

The preliminary June Reuters / University of Michigan consumer sentiment index declined to 71.8 from 74.3 in May.

Click on graph for larger image in graphic gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with gasoline prices falling, consumer sentiment is mostly moving sideways at a low level.

This was below the consensus forecast of 74.0.

Morning Greece: Merkel Agrees to "voluntary participation of private creditors"

by Calculated Risk on 6/17/2011 08:39:00 AM

From the NY Times: Germany Backs Down From Confrontation With E.C.B. Over Greece

Germany backed away Friday from a confrontation with the European Central Bank over a new bailout package for Greece, agreeing under pressure from France not to force private investors to shoulder some of the burden.I wonder how much pressure there will be on the private creditors? And how long will "voluntary" remain "voluntary"?

...

“We would like to have a participation of private creditors on a voluntary basis,” Mrs. Merkel said at joint news conference with Mr. Sarkozy.

“This should be worked out jointly with the E.C.B.,” she added. “There shouldn't be any dispute with the E.C.B. on this.”

The Greek 2 year yield is off sharply to 28.2%. Seems strange to say the yields have fallen to 28.2%!

The ten year yields are down to 17.1%.

From the WSJ: Greece Reshuffles Cabinet

Greece's embattled Socialist government announced a sweeping cabinet reshuffle Friday, replacing the country's finance minister in an effort to shore up support for unpopular economic reforms.I think being "unpopular" is part of Greek finance minister's job.

In a statement, spokesman George Petalotis said the government had appointed Evangelos Venizelos as finance minister, replacing George Papaconstantinou.

ECB's Trichet: Greek Default Should Be Avoided

by Calculated Risk on 6/17/2011 01:09:00 AM

From Dow Jones: Trichet: Clear Position Is Greek Default Should Be Avoided - Report

It is the clear position of the European Central Bank that a Greek default in any form should be avoided, as should any action in the Greek crisis that would spawn a credit event, ECB President Jean-Claude Trichet says in an interview to be released Friday.Trichet also said no one is considering that Greece, Portugal or Ireland leave the euro zone.

...

"We are telling them that doing anything that would create a credit event or selective default or default is not advisable," he says.

Still it remains the decision of political authorities and the ECB will act accordingly, based on decisions made, he notes. "But again, we are saying very clearly that they should avoid compulsion, credit event, or selective default or default. Our position is clear."

Earlier from the WSJ: EU Rehn Confident Next Greece Loan Tranche Approval Sunday

Euro-zone governments will agree at a meeting starting Sunday in Luxembourg to pay the next installment of rescue loans for Greece, while delaying the final decision on a longer-term Greek aid package until July, European Union economics commissioner Olli Rehn said in a statement Thursday.This would be a break from the IMF's history ... interesting times.

Rehn strongly implied that the International Monetary Fund, which must also sign off on the loan payment, would agree even if euro-zone governments haven't put a multi-year financing plan in place for the country.

Thursday, June 16, 2011

Another House Price Index shows a small gain in April

by Calculated Risk on 6/16/2011 07:18:00 PM

Back when I started this blog in January 2005, everyone followed the OFHEO index for house prices (now called the FHFA index), and none of the other indexes were publicly available. Although Case-Shiller was made available to the public in 2006, it wasn't widely followed until 2007.

Most reporters just used median prices from the NAR in 2005, but median prices are distorted by the mix of homes sold.

The first mention of the Case-Shiller index on my blog that I could find was in May 2007. The first report about the index in the LA Times appears to be on June 27, 2007 (ht Alex).

This is just a reminder that we were flying blind in 2005 and 2006!

Now the most followed house price indexes are Case-Shiller and CoreLogic; both repeat sales indexes. The FHFA index is still followed, but not as closely - it is also a repeat sales index, but only for homes with loans sold to or guaranteed by Fannie Mae or Freddie Mac.

There are several other house price indexes that I follow now: RadarLogic (based on a house price per square foot method), FNC Residential Price Index (a hedonic price index), Clear Capital, Altos Research and Zillow.

Recently Scott Sambucci, VP of Analytics at Altos Research, presented his outlook: Catfish Recovery: The Future Of US Housing

I'm planning on mentioning these other indexes, in addition to Case-Shiller and CoreLogic, and discussing some of the differences.

FNC released their house price indexes for April today. According to FNC, their Composite index of 20 cities (same cities as Case-Shiller) was up 0.7% in April. You can see the FNC composite indexes, and prices for 30 cities here.

Earlier this month, CoreLogic reported: CoreLogic® Home Price Index Shows First Month-over-Month Increase since mid-2010 (graphs here).

Other indexes - like Zillow - are still showing declines in April.

I prefer more data to almost no data, like back in 2005. But now we have to sort through all these indexes and figure out what they mean. It does appear the price declines have slowed - or prices might have increased slightly in April (CoreLogic and FNC). Some of this could be seasonal ...

Earlier:

• Housing Starts increase in May

• Residential Investment: Mutli-family Starts and Completions

• Philly Fed Survey: "Regional manufacturing activity weakened in June"

• Weekly Initial Unemployment Claims decrease to 414,000

Building Home Equity the Old-fashioned Way

by Calculated Risk on 6/16/2011 03:32:00 PM

From Prashant Gopal at Bloomberg: Homeowners Refinance to 15-Year Mortgages to Add Equity (ht Brian)

Cecelia Kirchman happily added $250 to her payment when she refinanced last August. ... [The Kirchmans] are among the growing number of “equity builders” -- creditworthy homeowners with steady jobs and enough cash to lock in near record-low interest rates and shorten the length of their loans ...Ahhh ... building equity the old-fashioned way.

The portion of borrowers refinancing in January who took 15-year mortgages rose to 29 percent from 11 percent two years earlier ...

The share of cash-in refinancings reached a record 44 percent in the fourth quarter, according to data from Freddie Mac dating to 1985. (see Freddie Mac: Very low Cash-Out Refinance Activity for more stats) ...

“They are people who -- rather than waiting for home values to rise -- are taking matters into their own hands,” [Stuart Feldstein, president of SMR Research Corp] said. “They are building equity on their own.”

And that brings up the topic of "burning the mortgage" - a quaint old traditional that might make a come back ...

The text reads: “Burning the Mortgage – a memorable event in the typical American home. The toast – with MILLER HIGH LIFE, of course”

The "typical American home"? I wonder what they would have thought of all the mortgage brokers a few years ago talking about home equity being "dead money"?

And from the Bloomberg article:

Switching to a 15-year term made sense for Kirchman, 55, who has no plans of moving anytime soon and is looking ahead to retirement. ... “I’ll be retiring in 10 to 12 years,” Kirchman said. “I don’t like the thought of still having that as an expense. I’d rather be taking trips.”I hope she plans a nice mortgage burning party!