by Calculated Risk on 5/21/2011 07:07:00 PM

Saturday, May 21, 2011

Greece Soft Restructuring Talk, and Italy Outlook Downgraded

Since the world didn't end ...

• Summary for Week Ending May 20th

• Schedule for Week of May 22nd

From the WSJ: France Signals a Shift on Greece

French Finance Minister Christine Lagarde signaled Paris might support a rescheduling of Greek debt, warning that Greece is at risk of default if it doesn't do more to bring its public finances into order.Lagarde's comments carry significant weight, and she is the leading candidate to become the new IMF managing director, from the Irish Times: EU leaders set to nominate Lagarde for IMF post

...

"What we certainly don't want is a state bankruptcy, a default, in Europe," Ms. Lagarde said in an interview published Friday in Austria's Der Standard newspaper. "You can use a lot of words—reprofiling, restructuring, re-this, re-that—but what there won't be is a restructuring of Greek debt." At the same time, she said: "We would accept anything that is based on a voluntary accommodation by banks."

"If the banks decided unilaterally after contacting the Greek authorities to offer a lengthening of the repayment time frame, she wouldn't be against it," Ms. Lagarde's spokesman said

And from Bloomberg: Italy Outlook Revised to Negative by S&P, Prompting Vow of Faster Reforms

Italy’s “current growth prospects are weak, and the political commitment for productivity-enhancing reforms appears to be faltering,” S&P said. “Potential political gridlock could contribute to fiscal slippage. As a result, we believe Italy’s prospects for reducing its general government debt have diminished.”The yield on Greece ten year bonds increased to a record 16.6% and the two year yield was up slightly to 25.5%.

Here are the ten year yields for Ireland at 10.5%, Portugal at 9.4%, Italy at 4.8%, and Spain at 5.5%.

Schedule for Week of May 22nd

by Calculated Risk on 5/21/2011 02:11:00 PM

Earlier:

• Summary for Week Ending May 20th

The key reports this week will be New Home Sales on Tuesday (more depression for homebuilders), the second estimate for Q1 GDP on Thursday (expect an upward revision), and the Personal Income and Outlays report for April on Friday (an early hint at consumer spending in Q2).

There are also a number of regional Fed speeches this week, and the FDIC will probably release the Q1 quarterly banking profile, although no release date is scheduled.

It will be interesting to see if lower gasoline prices show up in the final Reuter's/University of Michigan's Consumer sentiment report on Friday. Also the initial weekly unemployment claims on Thursday will be closely watched for signs of renewed labor market weakness.

8:30 AM ET: Chicago Fed National Activity Index (April). This is a composite index of other data.

8:25 AM: Speech, Fed Governor Elizabeth Duke on Financial Education,

At the Conference on "The Future of Life-Cycle Saving and Investing," Boston, Massachusetts

10:00 AM: New Home Sales for April from the Census Bureau.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows New Home Sales since 1963. The dashed line is the March sales rate.

The consensus is for sales at a 300 thousand Seasonally Adjusted Annual Rate (SAAR) in April, unchanged from the March sales rate.

10:00 AM: Richmond Fed Manufacturing Survey for May. The consensus is for the survey to show modest expansion with a reading of 10.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through mid-year (not counting all cash purchases).

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 3.0% decrease in durable goods orders after increasing 4.1% in March.

10:00 AM: FHFA House Price Index for March. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

8:30 AM: The initial weekly unemployment claims report will be released. The number of claims increased over the last month, although claims appear to be trending down again.. The consensus is for a decrease to 404,000 from 409,000 last week.

8:30 AM: Q1 GDP (second estimate). This is the second estimate for Q1 GDP from the BEA.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The advance estimate was for 1.8% annualized growth in Q1. This was below trend growth (around 3.1%) - and very weak for a recovery, especially with all the slack in the system. The blue column is for Q1.

The consensus is for an upward revision to 2.1% annualized real GDP growth.

11:00 AM: Kansas City Fed regional Manufacturing Survey for May. The index was at 14 in April, down from a record 27 in March.

8:30 AM: Personal Income and Outlays for April. The following graph shows real Personal Consumption Expenditures (PCE) through March (2005 dollars).

PCE increased 0.5% in March, but real PCE only increased 0.2% as the price index for PCE increased 0.4 percent in March.

PCE increased 0.5% in March, but real PCE only increased 0.2% as the price index for PCE increased 0.4 percent in March.The consensus is for a 0.4% increase in personal income in April, and a 0.4% increase in personal spending, and for the Core PCE price index to increase 0.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for May). The consensus is for a slight increase to 72.5 from the preliminary reading of 72.4.

10:00 AM: Pending Home Sales Index for April.

Best wishes to All!

Summary for Week Ending May 20th

by Calculated Risk on 5/21/2011 08:15:00 AM

The economic data was soft last week. The Empire State and Philly Fed manufacturing surveys showed much slower growth in May. And industrial production from the Fed (for April) showed no change, although this was probably related to supply chain issues and the earthquake in Japan.

For housing, the data was weak as usual. The NAHB survey showed builders are still depressed and the Census Bureau reported housing starts declined in April. Existing home sales also declined in April, although inventory declined year-over-year (for anyone looking for a small silver lining). But there is still 9.2 months of supply on the market - and that doesn't include the shadow inventory.

The MBA reported the percentage of delinquent first lien loans, including loans in the foreclosure process, was unchanged at the end of Q1 on a seasonally adjusted basis. This was disappointing because other indicators suggested a decline in overall delinquencies.

There was a little good news for the U.S. economy - gasoline prices are now down about 10 cents per gallon nationally from the recent peak, and initial weekly unemployment claims declined last week.

Below is a summary of economic data last week mostly in graphs:

• April Existing Home Sales: 5.05 million SAAR, 9.2 months of supply

The NAR reported: April Existing-Home Sales Ease

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April 2011 (5.05 million SAAR) were 0.8% lower than last month, and were 12.9% lower than in April 2010. According to the NAR, inventory increased to 3.87 million in April from 3.52 million in March.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall and winter. The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory - so the increase in months-of-supply during the Spring is expected.

Although inventory increased from March to April (as usual), inventory decreased 3.9% year-over-year in April from April 2010. This is the third consecutive month with a YoY decrease in inventory.

Although inventory increased from March to April (as usual), inventory decreased 3.9% year-over-year in April from April 2010. This is the third consecutive month with a YoY decrease in inventory.

Inventory should increase over the next few months and peak in the summer (the normal seasonal pattern), and the YoY change is something to watch closely this year.

• Housing Starts declined in April

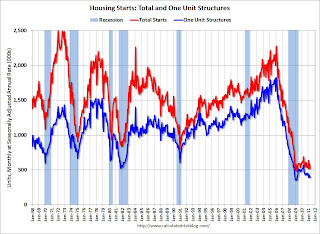

Total housing starts were at 523 thousand (SAAR) in April, down 10.6% from the revised March rate of 585 thousand. Single-family starts decreased 5.1% to 394 thousand in April.

Total housing starts were at 523 thousand (SAAR) in April, down 10.6% from the revised March rate of 585 thousand. Single-family starts decreased 5.1% to 394 thousand in April.

This graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit. This was well below expectations of 570 thousand starts in April.

• MBA: Total Delinquencies essentially unchanged in Q1 Seasonally Adjusted

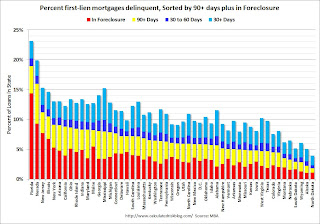

The MBA reported that 12.84 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q1 2011 (seasonally adjusted). This is essentially the same as in Q4. There was a significant decline in Not Seasonally Adjusted (NSA) delinquencies, but that is the usual seasonal pattern.

The following graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.35% from 3.26% in Q4. This is below the average levels of the last 2 years, but still higher than normal.

Loans 30 days delinquent increased to 3.35% from 3.26% in Q4. This is below the average levels of the last 2 years, but still higher than normal.

Delinquent loans in the 60 day bucket were unchanged at 1.35%; this is the lowest since Q2 2008. There was a slight increase in the 90+ day delinquent bucket. This increased from 3.62% in Q4 to 3.65% in Q1 2011.

The percent of loans in the foreclosure process decreased to 4.52%.

The following graph is for each state and includes all delinquent loans (sorted by percent seriously delinquent).

Florida and Nevada have the highest percentage of serious delinquent loans, followed by New Jersey, Illinois, New York, Arizona and California.

Florida and Nevada have the highest percentage of serious delinquent loans, followed by New Jersey, Illinois, New York, Arizona and California.

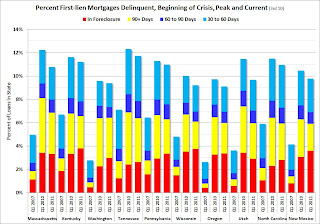

And the next graph shows the change in the percent delinquent based on Q1 2007, Q1 2010 (the peak of the crisis nationally), and Q1 2011. These are the 10 worst states sorted by the current percent seriously delinquent.

For each state there are 3 columns (Q1 2007, 2010, and 2011). In Ohio and Indiana, delinquency rates were already elevated by Q1 2007.

For each state there are 3 columns (Q1 2007, 2010, and 2011). In Ohio and Indiana, delinquency rates were already elevated by Q1 2007.

Some states have made progress: Arizona, Nevada and California. For other states like New Jersey and New York, serious delinquencies were higher in Q1 2011 than in Q1 2010.

But even though there has been some progress, there is a long way to go to get back to the 2007 rates.

Here is a post for the remaining 40 states.

• Industrial Production unchanged in April, Capacity Utilization declines slightly

From the Fed: Industrial production and Capacity Utilization

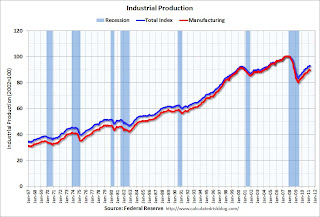

The next graph shows industrial production since 1967.

The next graph shows industrial production since 1967.

Industrial production was unchanged in April at 93.1; previous months were revised down, so this is a decline from the previously reported level in March.

Production is still 7.6% below the pre-recession levels at the end of 2007.

The consensus was for a 0.4% increase in Industrial Production in April, and an increase to 77.6% for Capacity Utilization. So this was well below expectations - partly because of the earthquake in Japan.

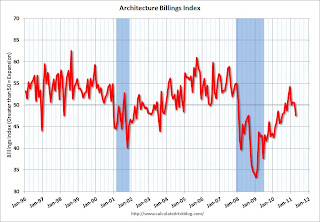

• AIA: Architecture Billings Index indicates declining demand in April

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From Reuters: US architecture billings index falls in April-AIA

This graph shows the Architecture Billings Index since 1996. The index showed billings decreased in April (index at 47.6, anything below 50 indicates a decrease in billings).

This graph shows the Architecture Billings Index since 1996. The index showed billings decreased in April (index at 47.6, anything below 50 indicates a decrease in billings).

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction.

• Other Economic Stories ...

• Empire State Manufacturing Survey indicates slower growth in May

• Philly Fed Survey shows "regional manufacturing activity grew slightly in May"

• Residential Remodeling Index increases in March

• NAHB Builder Confidence index unchanged at low level in May

Best wishes to all!

Friday, May 20, 2011

Bank Failure #43: Summit Bank, Burlington, Washington

by Calculated Risk on 5/20/2011 09:11:00 PM

From apogee to abyss

Thy name is Summit

by Soylent Green is People

From the FDIC: Columbia State Bank, Tacoma, Washington, Assumes All of the Deposits of Summit Bank, Burlington, Washington

As of March 31, 2011, Summit Bank had approximately $142.7 million in total assets and $131.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $15.7 million. ... Summit Bank is the 43rd FDIC-insured institution to fail in the nation this year, and the first in Washington.That makes 3 today ...

Bank Failures #41 & 42 in 2011: Two more in Georgia

by Calculated Risk on 5/20/2011 05:45:00 PM

Hives of scum and villainy

We must be cautious.

by Soylent Green is People

From the FDIC: CertusBank, National Association, Easley, South Carolina, Acquires All the Deposits of Two Georgia Institutions

As of March 31, 2011, Atlantic Southern Bank had total assets of $741.9 million and total deposits of $707.6 million; and First Georgia Banking Company had total assets of $731.0 million and total deposits of $702.2 million. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for Atlantic Southern Bank will be $273.5 million and for First Georgia Banking Company, $156.5 million. ... The closings are the 41st and 42nd FDIC-insured institutions to fail in the nation so far this year and the eleventh and twelfth in Georgia.Georgia again?

Mortgage Delinquencies by State: Before Crisis, Peak and Current (40 states)

by Calculated Risk on 5/20/2011 03:33:00 PM

As followup to the previous post (that showed the 10 highest state by serious delinquencies), here are graphs for the 40 remaining states.

The following graphs shows the percent delinquent by bucket of delinquency for the states in Q1 2007, Q1 2010 (the peak of the crisis nationally), and Q1 2011. The order is by the current percent of loans seriously delinquent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

For each state there are 3 columns (Q1 2007, 2010, and 2011).

Note that the y-axis scale change between the graphs. To use this graphs, find the state of interest - and compare 2007 to 2010 and 2011 (sorry there is so much data on each graph).

NOTE: when you use the graph gallery, you can scroll between graphs - and use the "print" button (below the image on the left) to see the full size image.

Some states always have a high rate for 30 day delinquencies (mostly southern states). These borrowers usually catch up, and this generates late fees for the lenders.

Some states always have a high rate for 30 day delinquencies (mostly southern states). These borrowers usually catch up, and this generates late fees for the lenders.

An example is Alabama on this graph. For some reason Alabama always has a high level of 30 day delinquencies - and that is why I sorted the states by serious delinquency rates (90+ days and in foreclosure).

Nebraska has seen the smallest increase in the serious delinquency rate - just over 60% from 2.0% in Q1 2007 to 3.3% now.

Nebraska has seen the smallest increase in the serious delinquency rate - just over 60% from 2.0% in Q1 2007 to 3.3% now.

At the other extreme, the serious delinquency rate in Florida increased from 1.8% in Q1 2007 to 18.97% in Q1 2011. Ouch.