by Calculated Risk on 5/09/2011 02:25:00 PM

Monday, May 09, 2011

AAR: Rail Traffic "mixed" in April

The Association of American Railroads (AAR) reports carload traffic in April 2011 decreased 0.2 percent compared with the same month last year, and intermodal traffic (using intermodal or shipping containers) increased 9 percent compared with April 2010.

“April’s carload decline is the first year-over-year monthly decline since February 2010,” said AAR Senior Vice President John Gray. “April 2010 was a relatively strong month and therefore a difficult comparison, and coal traffic was down for the first time since July 2010. April’s carload decline was offset by continued intermodal growth. Rail traffic deserves a close watch over the next several months because it’s a useful gauge of the strength of the economy.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows U.S. average weekly rail carloads (NSA).

From AAR:

On a seasonally adjusted basis, total U.S. rail carloads fell 2.5% in April 2011 from March 2011, continuing the up-down-up-down trend of the past couple of years. As the chart shows, since the recession ended in mid-2009, the trend for seasonally adjusted U.S. carload traffic has clearly been upward, but over the past six months it’s been flat and over the past four months it’s actually been down a bit. Time will tell if the upward trend reappears.As the first graph shows, rail carload traffic collapsed in November 2008, and now, almost 2 years into the recovery, carload traffic has only recovered about half way.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):The news is much better on the intermodal side. In April 2011, U.S. railroads originated 914,518 intermodal trailers and containers, up 9.0% (75,706 units) over April 2010 and up 24.6% (180,417 units) over April 2009. April 2011’s weekly average was 228,630 units, up from 209,703 in April 2010 and the second highest average for any April in history (behind only April 2006).Intermodal traffic is close to old highs, but carload traffic is only about half way back to pre-recession levels.

Seasonally adjusted U.S. rail intermodal traffic was up 1.2% in April 2011 from March 2011, the fifth straight monthly increase.

excerpts with permission

Zillow on Negative Equity: 28.4% of all single-family homes with mortgages are "underwater"

by Calculated Risk on 5/09/2011 12:35:00 PM

Note: The most recent Negative Equity report from CoreLogic showed 11.1 million, or 23.1 percent, of all residential properties with a mortgage were in negative equity at the end of the fourth quarter of 2010. With falling house prices, CoreLogic will probably show more homeowners have negative equity in Q1.

From Zillow: Negative equity reached a new high with 28.4 percent of all single-family homes with mortgages underwater

Negative equity reached a new high mark with 28.4 percent of single-family homeowners with mortgages underwater at the end of the first quarter, up from 27 percent in the fourth quarter of 2010. A homeowner is in negative equity when they owe more on their mortgage than their home is worth.The following table from Zillow shows negative equity percentages for the 25 largests MSAs. In a number of MSAs, more than half of single-family homes with mortgages have negative equity: Phoneix, Tampa, Atlanta, Riverside (CA), and Sacramento. Chicago, Minneapolis and Miami are all close. Las Vegas isn't included on this list, but according to CoreLogic, Nevada has the highest percentage of homes with negative equity.

...

With substantial home value declines, as well as increasing negative equity and foreclosures, Zillow forecasts show it is unlikely that home values will reach a bottom in 2011. First quarter data has prompted Zillow to revise its forecast, now predicting a bottom in 2012, at the earliest.

Largest 25 Metropolitan Statistical Areas Covered by Zillow | Zillow Home Value Index | ||||

Q1 2011 | QoQ Change | YoY Change | Change From Peak | Negative Equity* | |

United States | $169,600 | -3.0% | -8.2% | -29.5% | 28.4% |

New York, N.Y. | $346,600 | -1.6% | -5.3% | -24.2% | 17.1% |

Los Angeles, Calif. | $386,400 | -3.0% | -7.6% | -36.1% | 21.0% |

Chicago, Ill. | $167,900 | -4.8% | -13.8% | -38.1% | 45.7% |

Dallas, Tex. | $125,400 | -1.2% | -6.9% | -13.2% | n/a |

Philadelphia, Pa. | $187,600 | -3.2% | -10.3% | -20.5% | 22.1% |

Miami-Fort Lauderdale, Fla. | $137,300 | -1.8% | -12.8% | -55.4% | 47.7% |

Washington, D.C. | $305,900 | -1.5% | -7.0% | -30.3% | 29.5% |

Atlanta, Ga. | $121,100 | -4.4% | -17.3% | -33.7% | 55.7% |

Detroit, Mich. | $70,600 | -5.2% | -17.3% | -55.5% | 36.3% |

Boston, Mass. | $305,800 | -2.6% | -5.3% | -23.2% | 16.9% |

San Francisco, Calif. | $467,000 | -3.8% | -10.2% | -33.9% | 25.7% |

Phoenix, Ariz. | $126,100 | -2.3% | -11.2% | -55.3% | 68.4% |

Riverside, Calif. | $185,800 | -1.8% | -3.2% | -53.8% | 50.7% |

Seattle, Wash. | $259,200 | -1.7% | -11.7% | -32.1% | 34.4% |

Minneapolis-St. Paul, Minn. | $159,000 | -4.8% | -15.1% | -35.6% | 46.2% |

San Diego, Calif. | $347,500 | -2.1% | -5.5% | -35.3% | 26.0% |

St. Louis, Mo. | $127,900 | -4.0% | -9.6% | -18.7% | 31.2% |

Tampa, Fla. | $107,200 | -3.8% | -10.9% | -50.6% | 59.8% |

Baltimore, Md. | $218,300 | -2.5% | -9.8% | -27.5% | 29.6% |

Denver, Colo. | $192,300 | -2.7% | -9.6% | -17.2% | 41.0% |

Pittsburgh, Pa. | $105,800 | -0.2% | -0.1% | -5.1% | 6.8% |

Portland, Ore. | $203,300 | -3.0% | -12.1% | -30.6% | 35.9% |

Cleveland, Ohio | $108,500 | -3.9% | -9.1% | -24.7% | 41.4% |

Sacramento, Calif. | $207,400 | -4.2% | -11.0% | -50.1% | 51.2% |

Orlando, Fla. | $115,700 | -2.9% | -7.8% | -55.2% | n/a |

*Negative equity refers to the % of single-family homes with mortgages. | |||||

NY Fed Q1 Report on Household Debt and Credit

by Calculated Risk on 5/09/2011 10:00:00 AM

From the NY Fed: New York Fed's Quarterly Report on Household Debt and Credit Shows Signs of Healing in Consumer Credit Markets Since Last Quarter

The Federal Reserve Bank of New York released the Quarterly Household Debt and Credit Report for the first quarter of 2011 today, which showed signs of healing in the consumer credit markets. Evidence of improvement includes:Here is the Q1 report: Quarterly Report on Household Debt and Credit. Here are a couple of graphs:

• an increase in credit limits, by about $30 billion or 1%, for the first time since the third quarter of 2008;

• a steady number of open mortgage accounts, following a period of decline beginning in early 2008;

• continued decline of new foreclosures and new bankruptcies, down 17.7% and 13.3% respectively in the last quarter;

• a 15% decline of total delinquent balances, compared to a year ago; and

• a broad flattening of overall consumer debt balances outstanding.

Non-housing related debt, including credit cards, student loans, and auto loans, declined slightly (less than 1%), driven by a noticeable 4.6% decline in credit card balances. Credit inquiries, an indicator of consumer demand for new credit, came off their recent peak in the fourth quarter of 2010.

“We are beginning to see signs of credit markets healing gradually and evidence of greater willingness of consumers to borrow and banks to lend,” said Andrew Haughwout, vice president and New York Fed research economist.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows aggregate consumer debt increased slightly in Q1. From the NY Fed:

Aggregate consumer debt held essentially steady in the first quarter, ending a string of nine consecutive declining quarters. As of March 31, 2011, total consumer indebtedness was $11.5 trillion, a reduction of $1.03 trillion (8.2%) from its peak level at the close of 2008Q3, and $33 billion (0.3%) above its December 31, 2010 level.

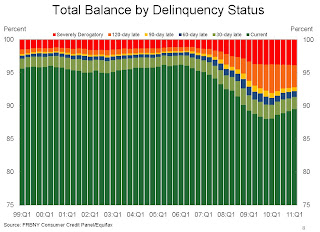

The second graph shows the percent of debt in delinquency. What stands out is that the percent of delinquent debt is declining, but the percent of severely derogatory debt is remaining the same.

The second graph shows the percent of debt in delinquency. What stands out is that the percent of delinquent debt is declining, but the percent of severely derogatory debt is remaining the same.From the NY Fed:

Total household delinquency rates declined for the fifth consecutive quarter in 2011Q1. As of March 31, 10.5% of outstanding debt was in some stage of delinquency, compared to 10.8% on December 31, 2010 and 11.9% a year ago. About $1.2 trillion of consumer debt remains delinquent and $890 billion is seriously delinquent (at least 90 days late or “severely derogatory”). Compared to a year ago, both delinquent and seriously delinquent balances have fallen 15%.There are a number of credit graphs at the NY Fed site.

Another Downgrade for Greece

by Calculated Risk on 5/09/2011 09:15:00 AM

From MarketWatch: Greek CDS spreads widen after downgrade

Standard & Poor's lowered its credit rating on Greece to B from BB-minus. The spread on five-year Greek credit default swaps, or CDS, widened further to 1,375 basis points from around 1,360 basis points earlier in the day ...I've heard from an excellent source that there are EMU people working on the details of what a restructuring would look like - as a contingency plan - but nothing is imminent. Some sort of restructuring seems priced in with the yield on Greece ten year bonds is at 15.6% today and the two year yield at 25.2%.

Sunday, May 08, 2011

WSJ: Home Market Takes a Tumble

by Calculated Risk on 5/08/2011 11:59:00 PM

From Nick Timiraos and Dawn Wotapa at the WSJ: Home Market Takes a Tumble

Home values fell 3% in the first quarter from the previous quarter and 1.1% in March from the previous month, pushed down by an abundance of foreclosed homes on the market, according to data to be released Monday by real-estate website Zillow.com. Prices have now fallen for 57 consecutive months, according to Zillow.As I noted on Friday, Fannie and Freddie sold over 90,000 REOs in Q1; a new record. These foreclosure sales are pushing down house prices - and there are many more REOs coming (I'll try to summarize all the house price indexes, but most are showing prices at a post-bubble low).

...

[Stan Humphries, Zillow's chief economist] now believes prices won't hit bottom before next year and expects they will fall by another 7% to 9%.

...

Prices are decelerating in large part because the many foreclosed properties that often sell at a discount force other sellers to lower their prices.

Weekend:

• Schedule for Week of May 8th

• Summary for Week ending May 6th

• Total Fannie, Freddie, FHA REO inventory declined in Q1, Fannie and Freddie REO Sales at Record Levels

Updates on Greece and Ireland

by Calculated Risk on 5/08/2011 06:33:00 PM

First on Ireland from the Daily Mail: We won't pay off our debt... Fine Gael Minister admits Ireland plans to restructure €250bn borrowings

Ireland will never repay the €250bn it has borrowed from the EU and IMF, senior government insiders have admitted – but we will not default until our EU partners agree we have no choice.And from the Irish Times: Rabbitte 'hopeful' of interest rate cut

A senior minister last night told the Irish Mail on Sunday that the Cabinet expects our crippling debts to be ‘restructured’ within three years.

...

As Europe tried to ease the pressure with a 1% cut in our bail-out interest rate, ministers were admitting that the full amount could never be repaid.

‘It is not called defaulting – it’s code for a restructuring,’ said one senior minister.

Minister for Communications Pat Rabbitte Pat Rabbitte said today he “hopes” that Ireland will secure a lower interest rate on its bailout loans from the European Union.And on Greece from the WSJ: Greece Slips Farther Behind Budget-Cut Target

EU finance ministers are to hold meetings on May 16th and 17th to discuss the bailout for Portugal. Ireland's bailout is also expected to be on the agenda.

Mr Rabbitte said today Ireland would continue to negotiate for reduced rates. "The decision has not yet been made," he said.

Greece has been slipping farther behind its targets for cutting its budget deficit and is expected to need nearly €30 billion ($43 billion) of extra financing for 2012, according to euro-zone officials.The meeting next week should be interesting ...

The country's growing reliance on aid from other euro members is fueling a debate over whether Greece should hold talks with its private creditors about extending the maturity of its bonds, a step that Germany is quietly pushing but other euro nations are resisting.

Euro-zone finance ministers meeting in Brussels early next week are expected to debate Greece's debt burden, its need for additional aid, and its request for more time to meet its fiscal targets.

Weekend:

• Schedule for Week of May 8th

• Summary for Week ending May 6th

• Total Fannie, Freddie, FHA REO inventory declined in Q1, Fannie and Freddie REO Sales at Record Levels

Friday employment posts (with graphs):

• April Employment Report: 244,000 Jobs, 9.0% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Employment: A dirty little secret and more graphs

• Employment Graph Gallery