by Calculated Risk on 5/04/2011 07:19:00 AM

Wednesday, May 04, 2011

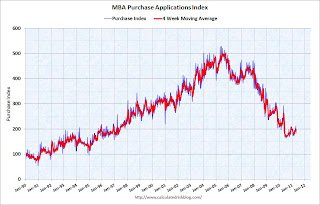

MBA: Mortgage Purchase application activity increases slightly, Mortgage Rates lowest in 2011

The MBA reports: Latest MBA Weekly Survey Shows Increase in Mortgage Applications, Driven by Refinances

The Refinance Index increased 6.0 percent from the previous week. The seasonally adjusted Purchase Index increased 0.3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased for the third consecutive week to 4.76 percent from 4.80 percent, with points decreasing to 0.76 from 1.00 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year fixed contract rate since December 3, 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

Refinance activity increased as mortgage rates fell to the lowest level since December 2010.

The four week average of purchase activity is at about 1997 levels, although this doesn't include the very high percentage of cash buyers. This suggests weak existing home sales through June (not counting cash buyers).

Tuesday, May 03, 2011

Portugal Bailout Agreement: €78 Billion

by Calculated Risk on 5/03/2011 10:08:00 PM

Earlier today from Bloomberg: Portugal Agrees on Aid Plan With Wider Deficit Targets

Portugal reached an agreement with officials preparing its European Union-led bailout that will provide as much as 78 billion euros ($116 billion) in aid and allow more time to reduce the country’s budget deficit.The yield on Portugal's ten year bonds decreased slightly to 9.6% today and the two year yield declined slightly to 11.8%.

The three-year plan set goals for a budget deficit of 5.9 percent of gross domestic product this year, 4.5 percent in 2012 and 3 percent in 2013, Prime Minister Jose Socrates said in Lisbon today.

Earlier:

• U.S. Light Vehicle Sales 13.2 million SAAR in April

• Lawler: Monthly Report to Commissioner Suggests Serious REO Inventory Problem at FHA

Housing: Another Price Reduction for Rhode Island Governor's Home

by Calculated Risk on 5/03/2011 07:05:00 PM

Ted Nesi at WPRI.com has been following the price reductions on Gov. Lincoln Chafee's house in Rhode Island: Chafee drops asking price for Providence home by $30,000

[T]he governor and his wife reduced the asking price for their 3,900-square-foot home on Providence’s East Side by another $30,000.When this house was first listed, I argued we'd see a price reduction. Although Case-Shiller doesn't (edit) provide a publicly available index for Providence, house prices have fallen about 15% in Boston and 23% in New York - and that would suggest a selling price in the $700s for the Chafees' home. So many homeowners are unwilling to price their homes realistically - at least the Chafees have been willing to reduce the price.

The Chafees are now seeking $799,000 ... That’s down 10% from the initial listing price of $889,000 they sought in mid-February. The Chafees had already reduced the price to $829,000 last month.

The Chafees bought the house for $939,000 in 2006

Update: There are Case-Shiller MSA indexes for 139 metro areas, but this data is quarterly and not publicly available. Fiserv was kind enough to provide me the MSA data for Providence-New Bedford-Fall River, RI-MA Metropolitan Statistical Area - and this shows prices were down 22.4% from Q4 2005 thourgh Q4 2010, and down 16.1% from Q4 2007 through Q4 2010. A 22.4% decline would put the Chafees home price around $729,000.

U.S. Light Vehicle Sales 13.2 million SAAR in April

by Calculated Risk on 5/03/2011 04:10:00 PM

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.17 million SAAR in April. That is up 17% from April 2010, and up 0.8% from the sales rate last month (March 2011).

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for April (red, light vehicle sales of 13.17 million SAAR from Autodata Corp).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

This was above the consensus estimate of 13.0 million SAAR.

Note: The Japanese supply chain disruptions will impact sales over the next several months and I expect sales to be below this level for the next 6 months or so.

Lawler: Monthly Report to Commissioner Suggests Serious REO Inventory Problem at FHA

by Calculated Risk on 5/03/2011 02:32:00 PM

Note: The FHA released the February Monthly Report. The report shows the FHA REO inventory was at 68,801 at the end of February, up 54.2% from February 2010! From economist Tom Lawler:

HUD finally got around to releasing the February Monthly Report to the FHA Commissioner, and while the report clearly continued to have “data reporting” problems, the REO section of the report – IF correct – suggests that FHA has some serious REO inventory management problems.

Here are data from various monthly reports on FHA-insured SF property “conveyances,” property sales, and SF REO properties.

| FHA SF Property Sales, Conveyances, and REO Inventory | |||

|---|---|---|---|

| Sales | Conveyances | REO Inventory | |

| 9-Dec | 6,748 | 7,393 | 41,166 |

| 10-Jan | 5,827 | 7,440 | 42,971 |

| 10-Feb | 6,091 | 7,835 | 44,605 |

| 10-Mar | 8,307 | 9,538 | 45,680 |

| 10-Apr | 7,826 | 7,745 | 45,795 |

| 10-May | 7,719 | 6,878 | 45,215 |

| 10-Jun | 8,893 | 8,487 | 44,850 |

| 10-Jul | 8,508 | 8,341 | 44,944 |

| 10-Aug | 7,686 | 9,810 | 47,007 |

| 10-Sep | 7,439 | 11,411 | 51,487 |

| 10-Oct | 7,289 | 9,908 | 54,609 |

| 10-Nov | 5,817 | 6,752 | 55,488 |

| 10-Dec | 2,749 | 7,728 | 60,739 |

| 11-Jan | 2,632 | 7,709 | 65,639 |

| 11-Feb | 4,221 | 7,383 | 68,801 |

Recall that the above table does not appear to be stock/flow consistent, mainly because there are occasionally “adjustments,” which I am not showing.

According to this report, the pace of FHA property sales began to slow significantly last November, was virtually at a crawl in December and January, and remained shockingly low given the inventory levels in February. As a result, the reported inventory of FHA REO has exploded upward to 68,801 at the end of February from 54,609 at the end of October and 44,605 at the end of last February.

I can’t recall any time in recent history when the FHA has “let” REO inventories jump at the pace observed since last summer, and if the numbers in the commissioner report are correct, it suggests that there may be a FHA REO property management “issue.” Last August HUD announced that it was launching the third generation of its REO Management and Marketing program, with new contracts that would “streamline HUD's operations, capitalize on the expertise of its potential vendors, and provide flexibility to meet changing market conditions in the REO industry.” Under “M&M III” the functions of the maintenance of REO properties and the marketing of REO properties was separated. I have no idea if this change has been responsible for the alarmingly slow sales pace of FHA REO, but someone should look into this.

General Motors: April U.S. April sales increase 26.4% year-over-year

by Calculated Risk on 5/03/2011 11:00:00 AM

Note: The real key is the seasonally adjusted annual sales rate (SAAR) compared to the last few months, not the year-over-year comparison provided by the automakers.

From MarketWatch: General Motors U.S. April sales rise 26.4%

[GM] said Tuesday that U.S. April sales rose 26.4% to 232,538 vehicles from 183,997 in the year-ago period.Once all the reports are released, I'll post a graph of the estimated total April light vehicle sales (SAAR) - usually around 4 PM ET.

Most estimates are for a decrease to 13.0 million SAAR in April from the 13.1 million SAAR in March. Sales in April 2010 were at a 11.25 million SAAR.

Update: From MarketWatch: Ford U.S. April sales increase by 16.4%

I'll add the reports from the other major auto companies as updates to this post. Even if sales in April were solid, the next several months will probably see weaker sales due to supply disruption issues related to the events in Japan.