by Calculated Risk on 4/12/2011 05:07:00 PM

Tuesday, April 12, 2011

Existing Home Inventory is confusing too

CR note: With all of the discussion of shadow inventory, it is important to note that there are questions about the "visible inventory" too. The following is an excerpt from an article by economist Tom Lawler:

When trying to “measure” the “months’ supply” of homes for sale, most folks compare the number of active homes listed for sale on a MLS (active listings) to the number of homes actually sold (some analysts prefer to look at listings vs. contracts signed, but most folks – and the NAR – compare listings to home closings.)

What may surprise some folks, however, is that there is actually some controversy over how the inventory of homes “for sale” should be measured. E.g., should one include listings on which there are contracts “pending”? Should one include only some pending sales, but not others – e.g., not “contingent” listings or listings that require the approval of a lender (e.g., short sales)?

The issue has become more “interesting” over the last few years as the number of “contingent” listings and short sales listings has surged.

As an example of this issue, here is a comparison of various “inventory” measures from the Tucson MLS, a wholly owned subsidiary of the Tucson Association of Realtors.

| Tucson MLS "Active" Inventory | |||

|---|---|---|---|

| 3/31/2011 | 3/31/2010 | 3/31/2009 | |

| Normal Active Listings | 6,703 | 6,799 | 7,415 |

| Normal Pending | 565 | 457 | 339 |

| Active Contingent | 1,228 | 928 | 753 |

| Active CAPA | 359 | 164 | 116 |

| Total Inventory | 8,855 | 8,348 | 8,623 |

“Active Contingent” means that the Seller has already accepted an offer, but that there is still some condition, or contingency, to be met, such as inspection, buyer’s final loan approval, appraisal, etc. For ‘Active CAPA,” CAPA stands for “can accept purchase offer,” and traditionally this category has been used when the seller has agreed to sell the home to the buyer, but the buyer must first sell his/her home. However, in March 2008 the Tucson MLS board of directors, in response to the rising number of short sales in the area, made the following recommendation:

Effective immediately, the MLS Board of Directors recommends the following regarding Short Sales: Short Sales are to be reported as ‘Active CAPA’ if there is supporting language written into the Purchase Contract. If the language supporting ‘Active Capa’ is not present and written into the Purchase Contract, the status should be reported as ‘Active Contingent’. This is in addition to the statement ‘Short Sale, subject to court or lender approval’ being written into the Agent Only Remarks.As best as I can tell, a short sale where the lender has not yet approved the sale could show up as either an “active CAPA” or a “Active Contingent,” depending on the contract language.

In its press release, the Tucson Association of Realtors’ summary tables show “active listings” as being the first line item in the above table. By this measure, the inventory of homes “for sale” in Tucson has declined from 7,415 in March 2009 to 6,799 in March 2010 to 6,703 in March 2011.

If instead one used the broader measure of “inventory” (shown later in the TAR report) to include all homes listed for sale, then the “inventory” of Tucson homes for sale last month was HIGHER not just a year ago, but two years ago as well! Note that the % of “total inventory” that is either “contingent” or “CAPA” has gone from 10.1% in March 2009 to 17.9% in March 2011!

As I’ve noted many times before, in a number of markets around the country the “fallout” rate for pending sales has been much higher over the last few years than was the case many years ago, especially in the “more depressed” markets. As such, an inventory number that excludes ALL pendings, including contingents and “CAPAs,” doesn’t seem “quite right.”

Now inquiring minds probably want to know: what do other MLS “mean” when they report the number of “active listings” or “months’ supply,” and what do they report to the National Association of Realtors, which uses the “months’ supply” measure supplied by the MLS in the sample it uses to estimate national home sales and the national inventory of existing homes for sale?

On the first question the answer for many is “I don’t know,” as only some report a breakdown by type of listing. And on the second question, the answer I got from a NAR spokesperson was “it depends on the local MLS!!!”

CR Note: This is from economist Tom Lawler.

Here come the downgrades for Q1 GDP Growth: Part III

by Calculated Risk on 4/12/2011 02:02:00 PM

More downgrades today ... Note: Part I (my call) and Part II.

From MarketWatch: Q1 GDP estimates slashed post-trade data (ht jb)

Morgan Stanley slashed their estimate to 1.5% from 1.9% after what they called "a very weak report." RBS Securities cut their estimates to 1.7% from 2% ...And from Catherine Rampell at Economix: G.D.P. Forecast for First Quarter Slides

Today, after an especially weak report on February’s trade deficit, the [Macroeconomic Advisers'] economists lowered their first quarter G.D.P. estimate to a sorry 1.5 percent annualized.So Macroeconomic Advisers' forecast has gone from a "paltry" 2.3% to a "sorry" 1.5%!

The advance GDP report will be released on Thursday April 28th. Still time for more downgrades. What comes after "paltry" and "sorry"? Putrid?

Ceridian-UCLA: Diesel Fuel index increases in March

by Calculated Risk on 4/12/2011 10:57:00 AM

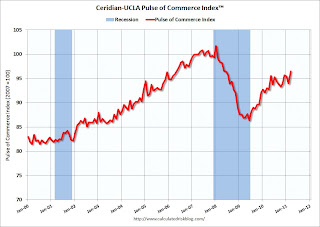

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the index since January 2000.

Press Release: Pulse of Commerce Index Jumps 2.7% in March

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), issued today by the UCLA Anderson School of Management and Ceridian Corporation rose 2.7% on a seasonally and workday adjusted basis in March, more than offsetting the 0.3% decline in January and the 1.5% decline in February. On a quarter over quarter basis, the PCI is up 3.9% at an annualized rate, a welcome acceleration from the weak growth of the PCI in the 3rd and 4th quarter of 2010. It’s better, but not yet exceptional ...This index was useful in tracking the slowdown last summer, and the increase in March - after back-to-back to monthly declines - is welcome news.

The PCI growth of 3.9% for the first quarter of 2011 is a middle-of the-road number, signaling that we are not in either one of the extremes: the recession is over, but a robust recovery isn’t here.

...

Over time, the PCI has shown a substantial correlation with Industrial Production. Last month, the PCI suggested Industrial Production for February would come in flat to slightly down at -.02% , and it did. The strong March PCI suggests a 0.8% gain in industrial production for March when that data are released by the Federal Reserve on April 15.

...

The Ceridian-UCLA Pulse of Commerce Index™ is based on real-time diesel fuel consumption data for over the road trucking ...

Note: This index does appear to track Industrial Production over time (with plenty of noise) and this suggests a strong reading for March. Industrial Production for March will be released on April 15th.

Trade Deficit decreased in February to $45.8 billion

by Calculated Risk on 4/12/2011 08:52:00 AM

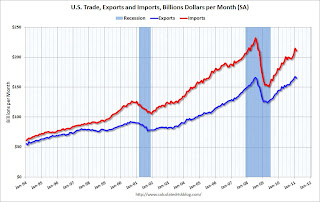

The Department of Commerce reports:

[T]otal February exports of $165.1 billion and imports of $210.9 billion resulted in a goods and services deficit of $45.8 billion, down from $47.0 billion in January, revised. February exports were $2.4 billion less than January exports of $167.5 billion. February imports were $3.6 billion less than January imports of $214.5 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through February 2011.

Both imports and exports declined slightly in February (seasonally adjusted). Still exports are now above the pre-recession peak.

The second graph shows the U.S. trade deficit, with and without petroleum, through February.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit decreased in February as the quantity declined even as import prices continued to rise - averaging $87.17 in February, up from $72.92 in February 2010. Prices will be even higher in March and April. The trade deficit with China was $18.8 billion (NSA) in February. The oil and China deficits are essentially the entire trade deficit.

The trade deficit was larger than the expected $44 billion.

NFIB: Small Business Optimism Index decreases in March

by Calculated Risk on 4/12/2011 07:30:00 AM

From National Federation of Independent Business (NFIB): Hiring Up, But Optimism Down in March

The Index of Small Business Optimism gave up 2.6 points in March, falling to 91.9. Four components rose or were unchanged, while six lost ground. The “hard” components of the Index (job creation, job openings, capital spending plans and inventory plans) added two points while the “soft” components (the other six in the table above) gave up 31 points. Index was driven by weaker expectations for real sales gains and business conditions and a marked deterioration in profit trends. The decline in the percent of owners expecting higher real sales and better business conditions in six months alone account for 76 percent of the decline in the Index.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

Twenty-five (25) percent of the owners reported that weak sales continued to be their top business problem

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the small business optimism index since 1986. The index decreased to 91.9 in March from 94.5 in February.

This has been trending up, although the level is still very low.

This graph shows the net hiring plans for the next three months.

This graph shows the net hiring plans for the next three months.Hiring plans decreased slightly in March. According to NFIB: “The percent of owners reporting hard to fill job openings was unchanged at 15 percent, supporting the modest reductions in the unemployment rate recently observed. Unfortunately, the net percent of owners planning to create new jobs (increasing the total number of workers employed) lost three points, falling to a net 2 percent of all firms, low, but still 12 points better than the recession low reading of negative 10 percent reached in March 2009."

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in March. In good times, owners usually report taxes and regulation as their biggest problems.

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in March. In good times, owners usually report taxes and regulation as their biggest problems.The recovery continues to be sluggish for this index (probably because of the high concentration of real estate related companies). Most of the decline was due to "soft" components, especially future expectations.

Monday, April 11, 2011

$4 Gasoline, Again

by Calculated Risk on 4/11/2011 08:21:00 PM

The average U.S. price is getting close to $4 per gallon.

From Ronald White at the LA Times: Gasoline prices continue climb

The U.S. average for a gallon of regular gasoline jumped 10.7 cents in the week ended Monday to $3.791, or 93.3 cents higher than a year earlier, according to the Energy Department's weekly survey of service stations.I think high gasoline prices are the top risk for the U.S. economy right now. Hopefully prices will decline soon; WTI crude futures declined slightly to $109 per barrel today.

The biggest regional increase was the 12.4-cent jump in the Midwest ... The Midwest average for regular gasoline reached $3.805 a gallon.

California drivers paid $4.161 for a gallon of self-serve regular gasoline ...