by Calculated Risk on 4/10/2011 08:35:00 AM

Sunday, April 10, 2011

Schedule for Week of April 10th

NOTE: The Schedule is available all week in the menu bar above.

Earlier:

• Summary for Week ending April 8th

The key reports this week are March Retail Sales on Wednesday, and the Consumer Price Index (CPI) on Friday. The monthly Trade Balance report will be released on Tuesday, and Industrial Production/Capacity Utilization on Friday. Also J.P. Morgan (Weds) and Bank of America (Fri) report Q1 results this week and they might provide comments on foreclosure issues.

12:15 PM ET: Fed Vice Chair Janet Yellen speaks, "Commodity Prices, the Economic Outlook, and Monetary Policy", At the Economic Club of New York Luncheon, New York, New York

7:30 AM: NFIB Small Business Optimism Index for March. This index has been showing some increase in optimism.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the small business optimism index since 1986. The index increased to 94.5 in February from 94.1 in January.

Although still fairly low, this is the highest level for the index since December 2007.

8:30 AM: Trade Balance report for February from the Census Bureau.

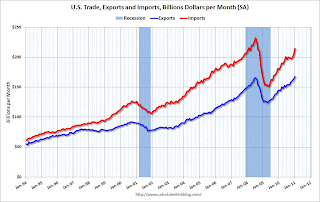

This graph shows the monthly U.S. exports and imports in dollars through January 2011.

This graph shows the monthly U.S. exports and imports in dollars through January 2011.Exports are up sharply and are now above the pre-recession peak. Imports have surged over the last two months, largely due to the increase in oil prices.

The consensus is for the U.S. trade deficit to be around $44.0 billion, down from $46.3 billion in January.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales in spring 2011.

7:00 AM: J.P. Morgan First Quarter 2011 Financial Results

8:30 AM: Retail Sales for March.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).Retail sales are up 15.3% from the bottom, and now 1.9% above the pre-recession peak.

The consensus is for retail sales to increase 0.5% in March (0.7% increase ex-auto).

10:00 AM: Manufacturing and Trade: Inventories and Sales for February. The consensus is for a 0.8% increase in inventories.

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS. This report has been showing a general increase in job openings, but very little turnover in the labor market.

2:00 PM ET: The Fed Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 380,000 from 382,000 last week.

8:30 AM: Producer Price Index for March. The consensus is for a 1.0% increase in producer prices (0.2% core).

7:00 AM: Bank of America First-Quarter Financial Results

8:30 AM: NY Fed Empire Manufacturing Survey for April. The consensus is for a reading of 17.0, down slightly from 17.5 in March.

8:30 AM: Consumer Price Index for March. The consensus is for a 0.5% increase in prices. The consensus for core CPI is an increase of 0.2%.

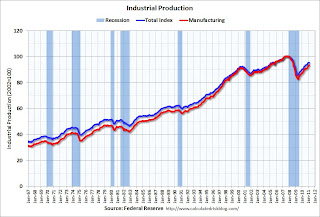

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for March.

This graph shows industrial production since 1967. Production is still 5.2% below the pre-recession levels at the end of 2007.

This graph shows industrial production since 1967. Production is still 5.2% below the pre-recession levels at the end of 2007.The consensus is for a 0.5% increase in Industrial Production in March, and an increase to 77.4% (from 76.3%) for Capacity Utilization.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for April. The consensus is for a slight increase to 69.0 from 67.5 in March.

Best wishes to All!

Saturday, April 09, 2011

Home Improvement Rebounds

by Calculated Risk on 4/09/2011 09:45:00 PM

Earlier:

• Summary for Week ending April 8th

From Sandra Jones at the Chicago Tribune: Slow housing market convinces owners to fix up rather than move out

Seasonal hiring at Lowe's Cos., the nation's No. 2 home improvement retailer, is up 15 percent this spring as homeowners, feeling more secure in their jobs, tackle maintenance projects delayed during the recession. Midwest regional chain Menard Inc. is expanding again. It plans to build 12 stores this year, up from four in 2010.Some of this increase is maintenance and repairs - and some of the increase is due to people sprucing up their homes:

And Home Depot Inc., the largest home improvement retailer, reported in February its first annual sales increase since 2006, before the housing market crashed.

Kris and Dennis Cortes of Flossmoor are typical of the post-recession home remodelers, industry experts said. The parents of five children said they chose to stay in the home they bought 20 years ago and to give the house a face-lift. They are adding a couple gables to the roof, installing a new garage door and updating the landscaping.The BuildFax remodeling index has been showing a strong rebound in remodeling too. Although new home construction is still struggling (usually the largest component of residential investment), two other key components of residential investment are increasing in 2011: multi-family construction and home improvement.

Fed's Yellen: Too soon to exit QE2

by Calculated Risk on 4/09/2011 06:26:00 PM

Earlier:

• Summary for Week ending April 8th

From Reuters: Fed's Yellen says too soon to start reversing policy

"Economic conditions do not yet call for the Fed to exit from its unconventional policies," Janet Yellen, Fed Vice Chair, said during a panel discussion at Yale University in New Haven, Connecticut.It is pretty clear that the Fed will complete the $600 billion QE2 as scheduled in June.

...

Fed officials are aware of the need to ease up on the policy gas pedal at the appropriate time, and has a "suite of tools" to help, Yellen said.

In particular, purchases of securities beyond the level the Fed has committed to could raise doubts about the Fed's ability to exit gracefully.

"That could lead to an undesired rise in inflation expectations," she said. A precise communications strategy will be key to guiding market expectations, Yellen noted.

Note: I'd like to see the actual comments about additional purchases (this article just paraphrases Yellen). If the economy weakens later this year, I'm pretty sure Yellen would support additional purchases.

Summary for Week ending April 8th

by Calculated Risk on 4/09/2011 11:15:00 AM

This was a light week for U.S. economic data mixed in with a little political theater in D.C. The ISM non-manufacturing index showed further expansion, but at a slower rate. Rail traffic increased in March, and house prices fell further in February (no surprise).

Reis reported their Q1 quarterly data for office, mall and apartment vacancy rates. The office vacancy rate declined slightly, the mall vacancy rate increased - but the big story was the sharp decline in the apartment vacancy rate.

In Europe, Portugal finally asked for a bailout. The package is estimated at €80 billion and the austerity will probably be severe.

Next week will be busy. Below is a summary of economic data last week mostly in graphs:

• ISM Non-Manufacturing Index indicates slower expansion in March

The March ISM Non-manufacturing index was at 57.3%, down from 59.7% in February. The employment index indicated slower expansion in March at 53.7%, down from 55.6% in February. Note: Above 50 indicates expansion, below 50 contraction.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below expectations of 59.5%.

• CoreLogic: House Prices declined 2.7% in February, Prices now 4.1% below 2009 Lows

From CoreLogic: CoreLogic Home Price Index Shows Year-Over-Year Decline for Seventh Straight Month

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 6.7% over the last year, and off 34.5% from the peak.

This is the seventh straight month of year-over-year declines, and the eighth straight month of month-to-month declines. The index is now 4.1% below the previous post-bubble low set in March 2009, and I expect to see further new post-bubble lows for this index over the next few months.

• House Prices: Nominal, Real, Price-to-Rent

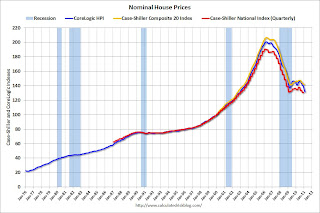

This graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 (through January release) and CoreLogic House Price Indexes (through February release) in nominal terms (as reported).

This graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 (through January release) and CoreLogic House Price Indexes (through February release) in nominal terms (as reported).

In nominal terms, the National index is back to Q1 2003 levels, the Composite 20 index is slightly above the May 2009 lows, and the CoreLogic index back to January 2003.

This graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter).

This graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter).

Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q1 2000 levels, the Composite 20 index is back to January 2001, and the CoreLogic index back to January 2000.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through January 2011 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph through January 2011 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

An interesting point: the measure of Owners' Equivalent Rent (OER) is at about the same level as two years - so the price-to-rent ratio has mostly followed changes in nominal house prices since then. Rents are starting to increase again, and OER will probably increase in 2011 - lowering the price-to-rent ratio.

On a price-to-rent basis, the Composite 20 index is just above the May 2009 levels, and the CoreLogic index is back to January 2000.

• Reis: Office, Mall and Apartment Vacancy Rates in Q1

On Offices from Bloomberg: Office Market in U.S. Begins Recovery as Vacancy Rate Declines

Reis is reporting the vacancy rate was at 17.5% in Q1 2011, down slightly from 17.6% in Q4 2010, and up from 17.3% in Q1 2010. This was a small decline in the vacancy rate - but it was the first decline since 2007.

Reis is reporting the vacancy rate was at 17.5% in Q1 2011, down slightly from 17.6% in Q4 2010, and up from 17.3% in Q1 2010. This was a small decline in the vacancy rate - but it was the first decline since 2007.

This graph shows office investment in real dollars (left axis in blue) seasonally adjusted annual rate (SAAR), and the office vacancy rate from Reis (right axis in red).

The two arrows point at two previous periods when investment picked up as the vacancy rate declined. In the mid-'90s, it isn't clear if we should say investment picked up at the beginning of '95 or '96, but it was when the vacancy rate was around 13% or 14% and falling.

On Apartments from Reuters: U.S. apartment vacancies fall in Q1, rents edge up

"Reis Inc's quarterly report showed the vacancy rate dropped to 6.2 percent in the first three months of the year, down from 6.6 percent in the fourth quarter. It was the steepest fall since the commercial real estate research firm began tracking the market in 1999."

"Reis Inc's quarterly report showed the vacancy rate dropped to 6.2 percent in the first three months of the year, down from 6.6 percent in the fourth quarter. It was the steepest fall since the commercial real estate research firm began tracking the market in 1999."

This is a very large decline from the record vacancy rate set a year ago at 8%.

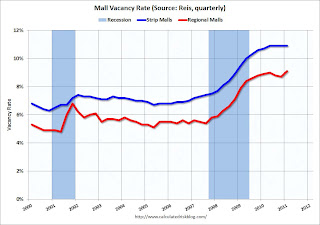

On Malls from Bloomberg: Mall Vacancies Climb to Highest in Decade as U.S. Retailers Close Stores

"The vacancy rate [at U.S. regional malls] climbed to 9.1 percent from 8.9 percent a year earlier and 8.7 percent in the fourth quarter, [Reis reported]. It was the highest since Reis began publishing data on regional malls in the beginning of 2000.

"The vacancy rate [at U.S. regional malls] climbed to 9.1 percent from 8.9 percent a year earlier and 8.7 percent in the fourth quarter, [Reis reported]. It was the highest since Reis began publishing data on regional malls in the beginning of 2000.

At neighborhood and community shopping centers, which usually are anchored by discount and grocery stores, the vacancy rate rose to 10.9 percent from 10.7 percent a year earlier. The rate was unchanged from the three previous quarters and the highest since it reached 11 percent in 1991, according to Reis."

The previous record for regional malls was 9.0% in Q2 2010 (Reis started tracking regional malls in 2000). The record vacancy rate for strip malls was in 1990 at 11.1%.

• Other Economic Stories ...

• AAR: Rail Traffic increases in March

• From Reuters: Portugal's Finance Minister: We Now Need EU Aid After All

• From the Irish Times: Portugal told to implement reforms ahead of bailout

• FOMC Minutes: Some Disagreement, Worry about Oil Prices, No Tapering of QE2

• Bernanke in Q&A: "Inflation will be transitory"

• Consumer Bankruptcy filings decrease in Q1 2011

• Unofficial Problem Bank list at 982 Institutions

Best wishes to all!

Unofficial Problem Bank list at 982 Institutions

by Calculated Risk on 4/09/2011 08:32:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Apr 8, 2011.

Changes and comments from surferdude808:

After a quiet week last week, activity picked-up on the Unofficial Problem Bank List as there were five removals and two additions. The changes results in the list having 982 institutions with assets of $433.2 billion compared with last week's total of 985 institutions and assets of $431.1 billion.

The five removals include two failures -- Western Springs National Bank and Trust, Western Springs, IL ($187 million); and Nevada Commerce Bank, Las Vegas, NV ($145 million); two action terminations -- Tradition Bank - Bellaire, Houston, TX ($422 million); and Community Bank of Manatee, Lakewood, FL ($276 million); and one unassisted merger -- Athol-Clinton Co-operative Bank, Athol, MA ($85 million).

The additions were Parkway Bank and Trust Company, Harwood Heights, IL ($2.6 billion); and Mercantile Bank, Quincy, IL ($684 million Ticker: MBR). Mercantile Bank is part of Mercantile Bancorp, Inc., a multi-bank holding company that also has subsidiaries in Florida (The Royal Palm Bank of Florida) and Kansas (Heartland Bank), which are on the Unofficial Problem Bank List as well. We send out props to the Illinois State Banking Department for their transparency as they are the only state banking department that publishes its formal safety & soundness enforcement actions.

Note: A shutdown of the federal government would not interrupt FDIC closing activities as the agency's funding is not appropriated through the budget process. Rather, the FDIC receives its funding from assessments charged to the banking industry. In short, the FDIC would only use taxpayer monies if it had to borrow on its line from the Treasury. Despite having a negative insurance fund, the FDIC has avoided using the borrowing line as they pre-charged the industry an assessment and they have used loss-sharing arrangements in most resolutions, which lessen the cash outlay at the time of failure. While the FDIC is not appropriated by Congress, its insurance fund is included in the federal budget totals. This was an accounting gimmick started in the Johnson Administration used to lower the deficit as the fund normally has a positive balance. Under the pay-go rules of the 1990s, the FDIC's budget came under scrutiny as a reduction in the insurance fund would have added to the federal deficit.

Articles on "Budget Deal"

by Calculated Risk on 4/09/2011 01:10:00 AM

No surprise ...

From the NY Times: Deal at Last Minute Averts Shutdown; $38 Billion in Cuts to Spending This Year

From the WSJ: Last-Minute Deal Averts Shutdown

From the WaPo: Government shutdown averted: Congress agrees to budget deal, stopgap funding