by Calculated Risk on 3/18/2011 08:25:00 PM

Friday, March 18, 2011

Document: FDIC Sues WaMu Execs

It has been so busy I skipped over this ...

Kirsten Grind at the Puget Sound Business Journal has been following this story: FDIC sues WaMu execs and their wives

The Federal Deposit Insurance Corp. filed suit against former executives of Washington Mutual, including former CEO Kerry Killinger, former President Steve Rotella, and their wives, in a case that seeks to recover unspecified damages at trial.John Stark at The Bellingham Herald has the lawsuit: FDIC sues WaMu execs, seeks to freeze their assets

For those of you who share my horrid fascination with the mortgage meltdown, this document will make interesting reading.The FDIC might not be closing any banks today, but this lawsuit is interesting reading!

...

The lawsuit has lots of quotes from WaMu’s risk managers, sending Killinger and Rotella increasingly frantic warnings about the bank’s unsustainable lending strategies as the housing bubble inflated. The risk managers understood the dangers clearly, and history proved their warnings were correct ...

Florida: 18 Percent of Homes are Vacant

by Calculated Risk on 3/18/2011 04:27:00 PM

From Les Christie at CNNMoney: Nearly 20% of Florida homes are vacant

On Thursday, the Census Bureau revealed that 18% -- or 1.6 million -- of the Sunshine State's homes are sitting vacant. That's a rise of more than 63% over the past 10 years.Here is the data from the 2010 Census:

...

The vacancy problem is more dire in Florida than in any other bubble market: In California, only 8% of units were vacant, while Nevada, the state with the nation's highest foreclosure rate, had about 14% sitting empty. Arizona had a vacancy rate of about 16%.

| Arizona | California | Florida | Nevada | |

|---|---|---|---|---|

| Total: | 2,844,526 | 13,680,081 | 8,989,580 | 1,173,814 |

| Occupied | 2,380,990 | 12,577,498 | 7,420,802 | 1,006,250 |

| Vacant | 463,536 | 1,102,583 | 1,568,778 | 167,564 |

| Percent Vacant | 16.3% | 8.1% | 17.5% | 14.3% |

Once all of the state data is released (by April 1st), I'll compile a comparison of vacant units to the 2000 Census data - and to the quarterly Housing Vacancies and Homeownership data (that is commonly used by analysts to estimate excess vacant units).

It is no surprise that Florida still has a huge number of excess vacant units.

DataQuick: California Home Sales down in February

by Calculated Risk on 3/18/2011 02:53:00 PM

From DataQuick: California February Home Sales

An estimated 27,320 new and resale houses and condos were sold statewide last month. That was down 1.4 percent from 27,706 in January, and down 2.8 percent from 28,111 for February 2010. California sales for the month of February have varied from a low of 20,153 in 2008 to a high of 48,409 in 2004, while the average is 32,117.The number of distressed sales is worth repeating: nearly 60% of existing home sales in California were distressed in February. We are a long way from normal. Short sales are continuing to increase as a percent of all sales (short sales are one way to do principal reductions, although the seller needs to make sure all lenders agree not to pursue the borrower for any deficiency).

...

Distressed property sales made up nearly 60 percent of California’s resale market last month.

Of the existing homes sold in February, 40.1 percent were properties that had been foreclosed on during the past year. That was down from 40.4 percent in January and down from 44.3 percent in February 2010. The all-time high was 58.5 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 18.9 percent of resales last month. That was up from an estimated 18.7 percent in January, 17.6 percent a year earlier, and 11.2 percent two years ago.

Note: Economist Tom Lawler is forecasting the NAR will report existing home sales of around 5 million (SAAR) for February. The NAR is scheduled to report February sales on Monday, March 21st at 10 AM.

Federal Reserve completes Analysis of 19 Largest Banks, Allows some Dividends

by Calculated Risk on 3/18/2011 11:33:00 AM

Update: Dividend announcements from JPMorgan, Wells Fargo, BB&T, BNY Mellon, US Bancorp. SunTrust announces a buyback.

From the Federal Reserve:

The Federal Reserve on Friday announced it has completed the Comprehensive Capital Analysis and Review (CCAR), its cross-institution study of the capital plans of the 19 largest U.S. bank holding companies.The Fed is not releasing details of these stress tests, and they will notify the 19 banks if they can start paying dividends (expect announcement pretty soon).

As a result of the CCAR, some firms are expected to increase or restart dividend payments, buy back shares, or repay government capital. The Federal Reserve on Friday will discuss the reviews and its decisions with firms that requested a capital action. All 19 firms will receive more detailed assessments of their capital planning processes next month.

Japan Nuclear Update and Libya Ceasefire

by Calculated Risk on 3/18/2011 08:54:00 AM

• Libya

From CNBC: Libyan Foreign Minister Declares Immediate Ceasefire

Libya declared a ceasefire in the country to protect civilians and comply with a United Nations resolution passed overnight, Libyan Foreign Minister Moussa Koussa said on Friday.From NY Times: Following U.N. Vote, France Vows Libya Action ‘Soon’

"We decided on an immediate ceasefire and on an immediate stop to all military operations," he told reporters.

• Japan

From Reuters: Japan earthquake LIVE (an excellent site to follow events)

From NY Times: Frantic Repairs Go On at Plant as Japan Raises Severity of Crisis

From the WSJ: U.S. Drone Surveying Japan's Damaged Nuclear Complex

Thursday, March 17, 2011

Hotels: RevPAR up 9.2% compared to same week in 2010

by Calculated Risk on 3/17/2011 08:25:00 PM

I'm still mostly focused on the U.S. economy, although I'm also following the events in Japan and the situation in Libya. And Reuters reported: "Japan has agreed with central banks of the US, Britain and Canada as well as the European Central Bank to jointly intervene in the currency market"

Earlier on U.S. Economy:

• Weekly Initial Unemployment Claims decline to 385,000

• Industrial Production, Capacity Utilization decline in February

• Core Measures show increase in Inflation

• Philly Fed Survey highest since January 1984

Here is the weekly update on hotels from HotelNewsNow.com: STR: Luxury hotels top weekly increases

Overall, the U.S. industry’s occupancy increased 6.0% to 61.1%, ADR was up 3.1% to US$100.93, and RevPAR finished the week up 9.2% to US$61.69.Note: RevPAR: Revenue per Available Room.

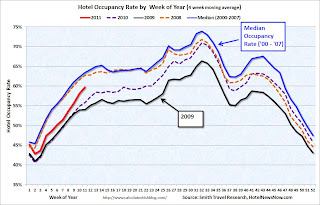

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the seasonal pattern for the hotel occupancy rate.

The occupancy rate was fairly low in January and February, but appears to be improving recently - and is now closer to the rate in 2008 than in 2010.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com