by Calculated Risk on 3/11/2011 08:30:00 AM

Friday, March 11, 2011

Retail Sales increased 1.0% in February

On a monthly basis, retail sales increased 1.0% from January to February(seasonally adjusted, after revisions), and sales were up 8.9% from February 2010. The December 2010 to January 2011 percent change was revised from +0.3% to +0.7%.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 15.3% from the bottom, and now 1.9% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 8.0% on a YoY basis (8.9% for all retail sales).

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $387.1 billion, an increase of 1.0 percent (±0.5%) from the previous month, and 8.9 percent (±0.7%)above February 2010. ... The December 2010 to January 2011 percent change was revised from +0.3 percent (±0.5%)* to +0.7 percent (±0.3%).This was at expectations for a 1.0% increase. Retail sales ex-autos were up 0.7%; also at expectations of a 0.7% increase. Including the upward revision to January retail sales, this was a solid report.

Thursday, March 10, 2011

Misc: Libya, Europe and Summary

by Calculated Risk on 3/10/2011 08:58:00 PM

• The Libya situation is grim.

From the NY Times: U.S. Escalates Pressure on Libya Amid Mixed Signals

From the WSJ: Gadhafi Forces Escalate Attacks

• Friday is the so-called "Day of Rage" in Saudi Arabia

From Reuters: Shooting and injuries before Saudi day of protest

Saudi police fired in the air to disperse protesting Shi'ites and three people were injured on the eve of a day of protests called for Friday by activists using the Internet.U.S. WTI oil prices fell slightly to $102.75 today.

Protests were planned in other Gulf countries such as Yemen, Kuwait and Bahrain.

• European Financial Crisis

From Bloomberg: Spain's Rating Downgraded to Aa2 by Moody's Over Bank Cost Concerns

From the Financial Times: Eurozone leaders to meet on stabilisation pact. Not much is expected at this meeting - this was a prelude to the meeting of all 27 EU leaders in Brussels on March 24th and 25th.

• House Prices declined 2.5% in January, Prices at New Post-bubble low, see Graph here

• Trade Deficit increased in January to $46.3 billion, see Graph here

• Weekly Initial Unemployment Claims increase to 397,000, see Graph here.

• Q4 Flow of Funds: Household Real Estate assets off $6.3 trillion from peak

State Unemployment Rates generally unchanged in January

by Calculated Risk on 3/10/2011 05:25:00 PM

Earlier today from the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally unchanged in January. Twenty-four states recorded unemployment rate decreases, 10 states registered rate increases, and 16 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.The following graph shows the current unemployment rate for each state (red), and the max during the recession (blue). If there is no blue, the state is currently at the maximum during the recession.

...

Nevada continued to register the highest unemployment rate among the states, 14.2 percent in January. The states with the next highest rates were California, 12.4 percent, and Florida, 11.9 percent. North Dakota reported the lowest jobless rate, 3.8 percent, followed by Nebraska and South Dakota, 4.2 and 4.7 percent, respectively.

One state, Colorado, set a new series high, 9.1 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The states are ranked by the highest current unemployment rate.

The auto states - led by Michigan - seem to have seen the most improvement (blue area).

Seven states are still at the recession maximum (no improvement): Colorado (new high), Georgia, Idaho, Louisiana, Montana, New Mexico, and Texas.

Q4 Flow of Funds: Household Real Estate assets off $6.3 trillion from peak

by Calculated Risk on 3/10/2011 02:35:00 PM

The Federal Reserve released the Q4 2010 Flow of Funds report this morning: Flow of Funds.

According to the Fed, household net worth is now off $8.8 Trillion from the peak in 2007, but up $8.1 trillion from the trough in Q1 2009.

Update: Household net worked peaked at $65.7 trillion in Q2 2007. Net worth fell to $48.7 trillion in Q1 2009 (a loss of almost $17 trillion), and net worth was at $56.8 trillion in Q4 2010 (up $8.1 trillion from the trough).

The Fed estimated that the value of household real estate fell $260 billion to $16.37 trillion in Q4 2010. The value of household real estate has fallen $6.3 trillion from the peak - and is still falling in 2011.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2010, household percent equity (of household real estate) declined to 38.5% as the value of real estate assets fell by almost $260 billion.

Note: something less than one-third of households have no mortgage debt. So the approximately 50+ million households with mortgages have far less than 38.5% equity - and 11.1 million households have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $55 billion in Q4. Mortgage debt has now declined by $542 billion from the peak. Studies suggest most of the decline in debt has been because of defaults, but some of the decline is from homeowners paying down debt.

Assets prices, as a percent of GDP, have fallen significantly and are only slightly above historical levels. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

CoreLogic: House Prices declined 2.5% in January, Prices at New Post-bubble low

by Calculated Risk on 3/10/2011 11:04:00 AM

Notes: CoreLogic reports the year-over-year change. The headline for this post is for the change from December to January 2011. The CoreLogic HPI is a three month weighted average of November, December and January and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Home Price Index Shows Year-Over-Year Decline for Sixth Straight Month

CoreLogic ... January Home Price Index (HPI) which shows that home prices in the U.S. declined for the sixth month in a row. According to the CoreLogic HPI, national home prices, including distressed sales, declined by 5.7 percent in January 2011 compared to January 2010 after declining by 4.7 percent in December 2010 compared to December 2009. Excluding distressed sales, year-over-year prices declined by 1.6 percent in January 2011 compared to January 2010 and by 3.2 percent in December 2010 compared to December 2009. Distressed sales include short sales and real estate owned (REO) transactions.

The January data shows home prices continuing to slide. Mark Fleming, chief economist with CoreLogic, said, “A number of factors continue to dampen any recovery in the housing market. Negative equity, which limits the mobility of homeowners, weak demand and the overhang of shadow inventory all continue to exert downward pressure on housing prices. We are looking out for renewed demand in the coming months as the spring buying season gets underway to hopefully reduce the downward pressure.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 5.7% over the last year, and off 32.8% from the peak.

This is the sixth straight month of year-over-year declines, and the seventh straight month of month-to-month declines. The index is now 1.6% below the previous post-bubble low set in March 2009, and I expect to see further new post-bubble lows for this index over the next few months.

Trade Deficit increased in January to $46.3 billion

by Calculated Risk on 3/10/2011 09:12:00 AM

The Department of Commerce reports:

[T]otal exports of $167.7 billion and imports of $214.1 billion resulted in a goods and services deficit of $46.3 billion, up from $40.3 billion in December, revised. January exports were $4.4 billion more than December exports of $163.3 billion. January imports were $10.5 billion more than December imports of $203.6 billion.

Click on graph for larger image.

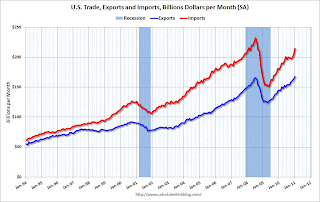

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through January 2011.

Exports are up sharply and are now above the pre-recession peak. Imports have surged over the last two months, largely due to the increase in oil prices.

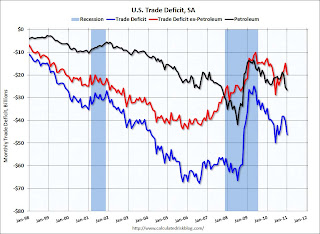

The second graph shows the U.S. trade deficit, with and without petroleum, through January.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit increased in January as both quantity and import prices continued to rise - averaging $84.34 in January, up from $79.78 in December. Prices will be even higher in February and March. The trade deficit with China was $23.3 billion (NSA) in January. Once again the oil and China deficits are essentially the entire trade deficit (or even more).