by Calculated Risk on 2/18/2011 05:13:00 PM

Friday, February 18, 2011

Bank Failure #19 in 2011: Habersham Bank, Clarkesville, Georgia

Leaving from the station

Bair: Oh, no, no no

by Soylent Green is People (Apologies to The Monkees)

From the FDIC: SCBT National Association, Orangeburg, South Carolina, Assumes All of the Deposits of Habersham Bank, Clarkesville, Georgia

As of December 31, 2010, Habersham Bank had approximately $387.6 million in total assets and $339.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $90.3 million. ... Habersham Bank is the nineteenth FDIC-insured institution to fail in the nation this year, and the fifth in Georgia.Georgia again ...

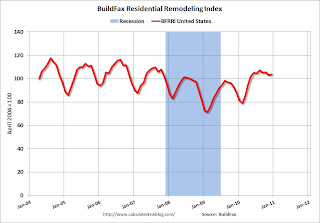

Residential Remodeling Index

by Calculated Risk on 2/18/2011 02:54:00 PM

Diana Olick at CNBC mentioned a remodeling index from BuildFax this week:

A remodeling index from Texas-based BuildFax shows a national surge in remodeling work toward the end of the year, which appears to be continuing now.It seem to me that requires a graph!

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The BuildFax Residential Remodeling Index is based on the number of properties pulling residential construction permits in a given month.

Sure enough - as Diana Olick noted - there has been a "surge in remodeling work" with November close to the levels of 2004 through 2006, and the strongest December since BuildFax started the index in 2004.

Note: permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Data Source: BuildFax, Courtesy of Index.BuildFax.com

Europe Update

by Calculated Risk on 2/18/2011 12:34:00 PM

A few notes and stories ...

• Portugal bond yields are soaring with the 10-year near 7.5%. There is growing speculation that Portugal will be the third European country (after Greece and Ireland), to require a bailout.

• The last European meeting failed to reach a consensus on a resolution mechanism. There is a meeting of several EU leaders, apparently including Angela Merkel and Nicolas Sarkozy, in Helsinki on March 4th, and then a special eurozone debt crisis summit on March 11th. (A Portugal bailout might be high on the agenda by then - especially since Portugal has large funding needs in April).

• The Irish election is on February 25th.

• From Reuters: ECB borrowing spike intensifies bank speculation

Emergency borrowing from the European Central Bank remained exceptionally elevated for a second straight day on Friday, intensifying speculation that one or more euro zone bank might be facing new funding problems.• From the NY Times: Spain Gives Savings Banks Six More Months to List Equity

• Here are the Ten Year yields for Spain, Ireland and Greece (mostly moving sideways other than Portugal, although Ireland seems to be drifting up too).

LA Port Traffic in January

by Calculated Risk on 2/18/2011 10:24:00 AM

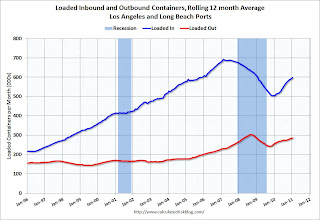

The first graph shows the rolling 12 month average of loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for January. LA area ports handle about 40% of the nation's container port traffic.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

To remove the strong seasonal component for inbound traffic, this graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic is up 18% and outbound up 11%.

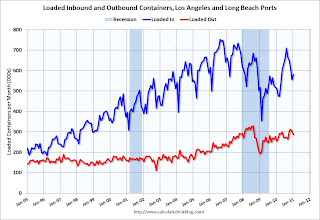

The 2nd graph is the monthly data (with strong seasonal pattern).

The 2nd graph is the monthly data (with strong seasonal pattern).

For the month of January, loaded inbound traffic was up 13% compared to January 2010, and loaded outbound traffic was up 12% compared to January 2010 - but down compared to December 2010. This suggests the trade deficit with China (and other Asians countries) probably increased in January.

Bernanke on Global Imbalances

by Calculated Risk on 2/18/2011 08:44:00 AM

Fed Chairman Ben Bernanke argued this morning that the Fed is not to blame for inflation in other countries, and that those countries have tools to fight inflation ("including exchange rate adjustment, monetary and fiscal policies, and macroprudential measures"). He also argued the global imbalances are back, and countries "need to allow exchange rates to better reflect market fundamentals" and increase domestic demand (probably aimed at China).

From Fed Chairman Ben Bernanke: Global Imbalances: Links to Economic and Financial Stability. Excerpt:

In light of the relatively muted recoveries to date in the advanced economies, the central banks of those economies have generally continued accommodative monetary policies. Some observers, while acknowledging that an aborted recovery in the advanced economies would be highly detrimental to the emerging market economies, have nevertheless argued that these monetary policies are generating negative spillovers. In particular, concerns have centered on the strength of private capital flows to many emerging market economies, which, depending on their policy responses, could put upward pressure on their currencies, boost their inflation rates, or lead to asset price bubbles.

... policymakers in the emerging markets have a range of powerful--although admittedly imperfect--tools that they can use to manage their economies and prevent overheating, including exchange rate adjustment, monetary and fiscal policies, and macroprudential measures. ... it should be borne in mind that spillovers can go both ways. For example, resurgent demand in the emerging markets has contributed significantly to the sharp recent run-up in global commodity prices. More generally, the maintenance of undervalued currencies by some countries has contributed to a pattern of global spending that is unbalanced and unsustainable.

...

To achieve a more balanced international system over time, countries with excessive and unsustainable trade surpluses will need to allow their exchange rates to better reflect market fundamentals and increase their efforts to substitute domestic demand for exports. At the same time, countries with large, persistent trade deficits must find ways to increase national saving, including putting fiscal policies on a more sustainable trajectory

Thursday, February 17, 2011

OCC's Walsh on Foreclosure Issues and MERS

by Calculated Risk on 2/17/2011 11:04:00 PM

An update ... acting Comptroller of the Currency John Walsh commented on the mortgage servicer and MERS reviews today. There are two documents: written and oral testimony.

From the written testimony:

Following reports of irregularities in the foreclosure processes of several major mortgage servicers in the latter part of 2010, the OCC, together with the FRB, the FDIC, and the OTS, undertook an unprecedented project of coordinated horizontal examinations of foreclosure processing at the 14 largest federally regulated mortgage servicers during fourth quarter 2010. In addition, the agencies conducted interagency examinations of MERSCORP and its wholly owned subsidiary, Mortgage Electronic Registration Systems, Inc. (MERS), and Lender Processing Servicers (LPS), which provide significant services to support mortgage servicing and foreclosure processing across the industry. The primary objective of the examinations was to evaluate the adequacy of controls and governance over bank foreclosure processes, including compliance with applicable federal and state law. ...There is a list of some of the objectives for uniform standards starting on page 16 of the written testimony.

From the oral testimony:

We are now finalizing remedial requirements and sanctions appropriate to remedy comprehensively the problems identified. Our actions will address identified deficiencies and will hold servicers to standards that require effective and proactive risk management, and appropriate remedies for customers who have been financially harmed. We are also discussing our supervisory actions with other Federal agencies and state Attorneys General with a view toward resolving comprehensively and finally the full range of legal claims arising from the mortgage crisis.It sounds like one of the clear goals of the servicer and MERS reviews is to resolve "comprehensively and finally the full range of legal claims arising from the mortgage crisis".

Equally important, we are drawing on lessons from these examinations to develop mortgage servicing standards for the entire industry. The OCC developed a framework of standards that we shared with other agencies, and we are now participating in an interagency process to establish nationwide requirements that are comprehensive, apply to all servicers, provide the same safeguards for all consumers, and are directly enforceable by the agencies. While we are still at a relatively early stage, we share the common objective to achieve significant reform in mortgage servicing practices.