by Calculated Risk on 2/16/2011 08:30:00 AM

Wednesday, February 16, 2011

Housing Starts increase in January

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Total housing starts were at 596 thousand (SAAR) in January, up 14.6% from the revised December rate of 520 thousand, and up 25% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

The increase in starts in January was entirely because of multi-family starts.

Single-family starts decreased 1.0% to 413 thousand in January - the lowest level since early 2009.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This was above expectations of 540 thousand starts, but still very low. The low level of starts is good news for housing, and I expect starts to stay low until more of the excess inventory of existing homes is absorbed.

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 596,000. This is 14.6 percent (±15.7%)* above the revised December estimate of 520,000, but is 2.6 percent (±9.8%)* below the January 2010 rate of 612,000.

Single-family housing starts in January were at a rate of 413,000; this is 1.0 percent (±8.6%)* below the revised December figure of 417,000. The January rate for units in buildings with five units or more was 171,000.

Building Permits:

Privately-owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 562,000. This is 10.4 percent (±1.8%) below the revised December rate of 627,000 and is 10.7 percent(±1.2%) below the January 2010 estimate of 629,000.

Single-family authorizations in January were at a rate of 421,000; this is 4.8 percent (±2.3%) below the revised December figure of 442,000. Authorizations of units in buildings with five units or more were at a rate of 125,000 in January.

Multi-family starts will rebound in 2011, but completions will probably be at or near record lows since it takes over a year to complete most multi-family projects.

MBA: Mortgage Purchase Application activity decreases

by Calculated Risk on 2/16/2011 07:00:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 11.4 percent from the previous week and is the lowest Refinance Index recorded in the survey since the week ending July 3, 2009. The seasonally adjusted Purchase Index decreased 5.9 percent from one week earlier.

...

"Mortgage rates remained above 5 percent last week, up almost a full percentage point from their October lows, and refinance volume continued to drop," said Michael Fratantoni, MBA's Vice President of Research and Economics. "Applications for home purchases also declined on a seasonally adjusted basis. Buyers have not returned to the market as rising rates have reduced affordability, to some extent."

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.12 percent from 5.13 percent, with points increasing to 0.85 from 0.84 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

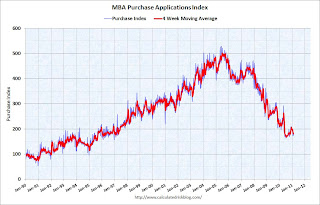

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index has fallen to the levels of last September - suggesting weak home sales through the first few months of 2011.

Tuesday, February 15, 2011

Bernanke: Hoocoodanode?

by Calculated Risk on 2/15/2011 08:56:00 PM

By request, a few excerpts from Fed Chairman Ben Bernanke's testimony to the Financial Crisis Inquiry Commission (ht Brian)

Note: "Hoocoodanode?" means "who could have known?" a running joke on CR (and the name of the comment site).

COMMISSIONER THOMPSON: So no calamity of this magnitude occurs without there being some early signals that something’s going wrong. In the case of this calamity, what were the signals?The "year before the crisis"? Come on! How about in 2005 and all through 2006 (there were many many many posts to choose from).

Why did we -- and had we acted on them, might we have averted the disaster?

MR. BERNANKE: Well, I don’t know, I have to think about that.

I think there were people -- there were people saying -- including people at the Fed but others as well -- saying, in the year before the crisis, that risk was being underpriced, that spreads were very narrow, that markets seemed ebullient, that liquidity was, in some sense, excessive.

Bernanke: There were -- you know, the way I would put it is, I think there were people -- not necessarily the same people -- identifying various parts of the problems. You know, there were people who were concerned about derivatives, there were people that were concerned about subprime mortgages, there were people concerned about the overall credit environment, there were people who were concerned about off-balance-sheet vehicles.True. No one identified all the interconnected risks, but I did point out the financial losses could be over $1 trillion (Roubini used my data in a presentation to Congress). It didn't take much from there to realize a large portion of the financial system might be insolvent.

Bernanke: But I think notwithstanding the claims of one or two people out there who are now sort of living on the fact that they, quote, anticipated in the crisis, I would still say that the interaction of these things, the “perfect storm” aspect was so complicated and large, that I was certainly not aware, for what it’s worth -- and it could be just my deficiency -- but I was not aware of anybody who had any kind of comprehensive warning.I don't know of anyone who got all the specifics correct. And hopefully I'm not "living on the fact" that I called the housing bubble (I think I've done OK over the last few years too).

But looking back ... in early 2005, Professor Jim Hamilton of Econbrowser asked me, if the loans are so bad, why are lenders making the loans? It was obvious that the lenders were just passing them on to Wall Street - and we discussed MBS and CDOs - and Wall Street was selling the pieces to investors. But why were investors buying the loans? It took me some time to piece together that the rating agencies were using historical performance from a completely different lending model (based on direct lender to borrow experience and the 3 Cs: Credit, Capacity, and Collateral) and then applying it to the originate-to-distribute model (with all the inherent agency problems). Perhaps if I had realized that sooner, I could have convinced more people that the ratings were wrong and there was a serious problem. But probably not - some random blogger saying the ratings are wrong? No one would have believed me.

Still it was pretty easy to see that house prices were out of line with fundamentals, and that lending standards were extremely loose (NINJA loans - No job, no income, no assets, mortgage brokers joking "fog a mirror get a loan", etc.). And that should have been enough of a red flag.

Bernanke: There are people identified -- and the trouble is -- and particularly in this blogosphere we live in now -- at any given moment, there are people identifying 19 different problems, crises.I agree completely with this - there are more imaginary crisis every week than real crisis in a lifetime. But I think people could have known in 2005 and I wish I had done a better job of explaining why.

Best to all

Home Buying: A Return to 20% Down Payments?

by Calculated Risk on 2/15/2011 08:43:00 PM

From Mitra Kalita at the WSJ: Banks Push Home Buyers to Put Down More Cash

The median down payment hovered around 20% in the late 1990s and began to creep downward in 2001 in the nine cities Zillow analyzed: Chicago; Stockton, Calif.; Las Vegas; Los Angeles; Miami-Fort Lauderdale; Phoenix; San Diego; San Francisco; and Tampa, Fla.Little or no skin in the game matters for home buyers too. I think 20% down (10% with mortgage insurance) is not unreasonable. If someone cannot save 10%, are they really ready for home ownership? I think that question was answered a few years ago.

It fell as low as 4% in the fourth quarter of 2006, and in some markets came close to zero.

CoreLogic: NAR’s 2010 existing home sales are overstated by 15% to 20%

by Calculated Risk on 2/15/2011 05:17:00 PM

CoreLogic released their U.S. Housing and Mortgage Trends Report: 2010 Year End Summary today.

From the report:

During 2010 CoreLogic estimates home sales totaled 3.6 million, down 12%from 4.1 million in 2009. Sales remain extremely low relative to the last decade as sales last year were more than 50% below the level in 2005 and about 33% below the level in 2000. Although it’s been widely reported that the National Association of Realtors’s (NAR) existing home sales data fell only 5% to 4.9 million in 2010, down from 5.2 million in 2009 and flat relative to 2008, the CoreLogic data indicates otherwise.CoreLogic also discusses the impact of lower sales on months-of-supply and potentially prices, however it also appears the NAR data overstates the level of inventory too - so it is hard to tell if months-of-supply will be revised up (or even down). As I've mentioned before, I expect that later this year, the NAR will revise down both sales and inventory numbers for the last few years.

...

Historically, the CoreLogic existing sales data have covered about 85% to 90% of all NAR’s existing home sales data. However, in 2006 NAR’s sales data became elevated relative to the CoreLogic, MBA, HMDA and Census sales related data, and that trend has continued and become more pronounced through 2010. There are several reasons for the divergence, including benchmarking drift, more sales going through MLS systems due to consolidation and a lower share of for sale by owners (FSBO) home sales. Net, NAR’s existing home sales data are overstated by about 15% to 20.

Also from the report:

Click on graph for larger image in graph gallery.

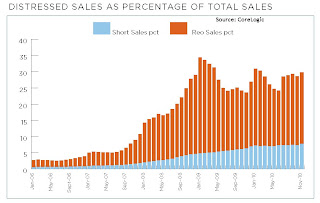

Click on graph for larger image in graph gallery.This graph (posted with permission) shows the percentage of short sales and REO (lender Real Estate Ownder) sales since January 2006 through November 2010. There is a seasonal pattern for conventional sales (strong in the spring and summer, and weak in the winter), however distressed sales happen all year - so the percentage of distressed sales increases every winter. Notice that the percentage of distressed sales increased in 2010 following the expiration of the tax credits. Recent reports suggest the percent of distressed sales will be very high in January.

SoCal: Weak Home Sales, Record Low New Home Sales

by Calculated Risk on 2/15/2011 02:29:00 PM

A few key points:

• Total home sales were weak in January.

• New home sales were at a record low.

• A large percentage of buyers were investors paying cash at the low end.

• Foreclosure activity - as a percent of sales - was higher in January (we've seen an increase in many areas of the country).

Weak sales, with a high level of distressed sales, means lower prices - and we should see new post-bubble lows on the repeat sales home prices indexes soon.

Note: the Case-Shiller house price index that will be released next Tuesday is for the three months ending in December - and there will be further weakness in early 2011. Also January existing-home sales will be released next Wednesday and new home sales on Thursday.

From DataQuick:

Last month 14,458 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties. That was down 26.0 percent from 19,528 in December, and down 5.9 percent from 15,361 in January 2010, according to DataQuick Information Systems of San Diego.

...

The total number of homes sold last month was the lowest for a January since 2008, when 9,983 sold, and the second-lowest since 1996. Last month’s sales fell 18.8 percent below the average January sales tally of 17,802.

January new-home sales were the lowest for any month in DataQuick’s records back to 1988. Builders have struggled to compete with prices on resale homes, especially distressed properties.

Absentee buyers – mostly investors and some second-home purchasers – bought a record 24.8 percent of the homes sold in January, paying a median $198,500. Over the last decade, absentee buyers purchased a monthly average of about 16 percent of all Southland homes. ... Buyers who appeared to have paid all cash – meaning there was no indication that a corresponding purchase loan was recorded – accounted for a near-record 29.5 percent of January sales ...

Foreclosure resales – homes foreclosed on in the past year – accounted for 37.0 percent of the resale market last month, up from 35.1 percent in December but down from 42.1 percent a year ago. Over the past year, foreclosure resales hit a low of 32.8 percent last June and have generally trended higher each month since then.