by Calculated Risk on 2/11/2011 06:09:00 PM

Friday, February 11, 2011

Bank Failures #15 & 16 in 2011: Florida and Michigan

Bankers drank up all the juice

Leaving us the rind

by Soylent Green is People

From the FDIC: Premier American Bank, National Association, Miami, Florida, Assumes All of the Deposits of Sunshine State Community Bank, Port Orange, Florida

As of December 31, 2010, Sunshine State Community Bank had approximately $125.5 million in total assets and $116.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $30.0 million. ... Sunshine State Community Bank is the fifteenth FDIC-insured institution to fail in the nation this year, and the second in Florida.

First the bank, soon the City

Inevitable

by Soylent Green is People

As of December 31, 2010, Peoples State Bank had approximately $390.5 million in total assets and $389.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $87.4 million. ... Peoples State Bank is the sixteenth FDIC-insured institution to fail in the nation this year, and the first in Michigan.Also the FDIC announced the closing the temporary West Coast office.

The Board authorized the temporary office for an initial three-year term, with the option of extending it if workload supported such a move. Based on ongoing analysis and in recognition of the signs of the improving health of the banking industry in the western United States, the FDIC has determined that the current projected workload does not support continuing the temporary office beyond its initial three-year term. The official sunset date for the office will be January 13, 2012.

Options for the Long-Term Structure of Housing Finance

by Calculated Risk on 2/11/2011 02:20:00 PM

The Obama Administration released an outline this morning on winding down Fannie and Freddie, and for the future of government involvement in the housing finance market.

Here is the Treasury press release on Fannie and Freddie. And here is the report.

The wind down of Fannie and Freddie will be slow and take a number of years, but the key question is what, if anything, will replace them? The plan offers three options:

Option 1: Privatized system of housing finance with the government insurance role limited to FHA, USDA and Department of Veterans’ Affairs’ assistance for narrowly targeted groups of borrowers

The key problem with this first option is what happens when the private markets once again freeze up? With this option, when the next crisis arrives the government would have to scramble (like during the Depression) and come up with some programs to offer financing to qualified borrowers. Prior to the Depression, the most common mortgage loans was short term (like 1 to 5 years), interest only, with a balloon payment due at maturity (see: Mud-Luscious: Balloons for UberNerds for a discussion of balloons). Even though a 50% downpayment was common before the Depression, when these balloon payments came due, the borrower couldn't refinance - even if they had a job, because the private market was completely frozen. At that lack of financing lead to the formation of FHA and FNMA. (To understand the names, see Tanta's: On Maes and Macs)

So we could just scramble again, or have some sort of small program running that could be scaled up during the next crisis as proposed in Option 2.

Option 2: Privatized system of housing finance with assistance from FHA, USDA and Department of Veterans’ Affairs for narrowly targeted groups of borrowers and a guarantee mechanism to scale up during times of crisis

This backstop would maintain a minimal presence in the market during normal times, but would be ready to scale up to a larger share of the market as private capital withdraws in times of financial stress. One approach would be to price the guarantee fee at a sufficiently high level that it would only be competitive in the absence of private capital. It would thus only expand when needed, and that need would be dictated by the market. An alternative approach would restrict the amount of public insurance sold to the private market in normal times, but allow the amount of insurance offered to ramp up to stabilize the market in times of stress.Option 3: Privatized system of housing finance with FHA, USDA and Department of Veterans’ Affairs assistance for low- and moderate-income borrowers and catastrophic reinsurance behind significant private capital

This is another way of providing mortgages during the next crisis, however I think this approach takes on too much risk.

And while the capital requirements, oversight of the private mortgage guarantors, and premiums collected to cover future losses will together help to reduce the risk to the taxpayer, the reinsurance of private-lending activity, by its nature, exposes the government to risk and moral hazard. If the oversight of the private mortgage guarantors is inadequate or the pricing of the reinsurance too low or recoupment of costs too politically difficult, then private actors in the market may take on excessive risk and the taxpayer could again bear the cost.My initial reaction is that Option 2 is the best approach.

Mubarak Resigns

by Calculated Risk on 2/11/2011 11:35:00 AM

From the NY Times: Mubarak Steps Down, Ceding Power to Military

President Hosni Mubarak of Egypt turned over all power to the military, and left the Egyptian capital for his resort home in Sharm el-Sheik, Vice President Omar Suleiman announced on state television on Friday.al Jazeera Live blog Feb 11 - Egypt protests

6:03pm: He's gone. He's resigned. 30 years of Mubarak rule is over. Omar Suleiman says:

"President Hosni Mubarak has waived the office of president."

Consumer Sentiment increases slightly in February

by Calculated Risk on 2/11/2011 09:55:00 AM

NOTE: Here is the Fannie and Freddie press release and report (I'll post on it later).

The preliminary Reuters / University of Michigan consumer sentiment index increased to 75.1 in February from 74.2 in January.

Click on graph for larger image in graphics gallery.

Click on graph for larger image in graphics gallery.

This was at the consensus forecast of 75.0.

Sentiment is still at levels usually associated with a recession - and sentiment is well below the pre-recession levels.

In general consumer sentiment is a coincident indicator.

Trade Deficit increased in December

by Calculated Risk on 2/11/2011 08:30:00 AM

The Department of Commerce reports:

[T]otal December exports of $163.0 billion and imports of $203.5 billion resulted in a goods and services deficit of $40.6 billion, up from $38.3 billion in November, revised. December exports were $2.8 billion more than November exports of $160.1 billion. December imports were $5.1 billion more than November imports of $198.5 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through December 2010.

Imports had been mostly flat since May, but increased again in December. Exports have started increasing again after the mid-year slowdown.

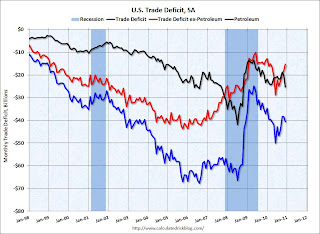

The second graph shows the U.S. trade deficit, with and without petroleum, through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit increased in December as both quantity and import prices continued to rise - averaging $79.78 in December. Prices will be even higher in January. Once again oil and China deficits are essentially the entire trade deficit (or even more).

Thursday, February 10, 2011

Comments on Ranking Economic Data

by Calculated Risk on 2/10/2011 07:23:00 PM

I've received some great feedback on the List: Ranking Economic Data post from earlier today.

In that post I tried to provide a ranking for a number of economic releases with links to source data and graphs.

I probably should have put the Trade Balance report a little higher (ht Dirk) - probably on the 'C List', although at times this belongs on the 'B List'.

And on Existing Home Sales: This was a tough choice. For me, the key to the NAR report is the inventory number - I watch it closely at times (I'd even say that existing home inventory is 'B List' data at times), but the sales number is much less important (Note: later this summer, I expect the NAR to revise down sales for the last few years).

The rise in existing home inventory in late 2005 helped me call the top of the housing bubble activity and predict that prices would start falling in 2006.

Please check out the list - I'll provide occasional updates. And thanks to all for the feedback.