by Calculated Risk on 2/09/2011 05:45:00 PM

Wednesday, February 09, 2011

NY Fed's Brian Sack: Implementing the Federal Reserve’s Asset Purchase Program

From NY Fed Vice President Brian Sack: Implementing the Federal Reserve’s Asset Purchase Program. This is for those interested in how the asset purchase program (QE2) works. A couple of excerpts:

[T]he Desk has been able to purchase large volumes of securities in a rapid manner, as required by the policy decisions made by the FOMC. Indeed, over the period since the FOMC's decision to expand the SOMA portfolio, the Desk has purchased about $300 billion of Treasury securities. That total includes about $220 billion of purchases out of the intended $600 billion expansion of the portfolio, and another $80 billion of purchases associated with the reinvestment of principal payments on agency debt and mortgage-backed securities. In terms of the monthly pace, the purchases so far have been running at about $105 billion per month, consisting of roughly $75 billion in new investments and $30 billion of reinvestments. To meet this pace, the Desk has been operating in the market on nearly every available day.And on the recent increase in rates:

Since early November, one of the notable developments in financial markets has been the sharp increase in longer-term interest rates. At first glance, this change may seem at odds with the portfolio balance channel. However, it is important to understand the factors that led to the increase in interest rates in the current circumstances.

The upward movement in longer-term interest rates in large part reflects the greater optimism among investors about the outlook for economic growth. Investors revised up their baseline forecasts for the economy and reduced the perceived downside risks that they see around that outlook. This shift in the outlook led the market to price in the possibility of earlier increases in short-term interest rates and to scale back the size of asset purchases that they expect from the Federal Reserve. Both of those developments contributed to the significant rise in yields.

In contrast, the rise in yields does not appear to be driven by the concerns expressed by some that the asset purchase program would unleash a considerable rise in U.S. inflation and inflation expectations to levels well above those consistent with the Federal Reserve's mandate. Such an outcome would be detrimental to the economic outlook, leading to downward pressure on risky asset prices and a substantial weakening in the value of the dollar. However, what has taken place in U.S. markets to date does not resemble this outcome. Indeed, over the period since the November FOMC meeting, longer-term inflation expectations have remained at levels consistent with the Federal Reserve's mandate, risky asset prices have advanced and the dollar has held its ground.

Reuters: WikiLeaks BofA Documents a "Dud"?

by Calculated Risk on 2/09/2011 04:10:00 PM

Last year I mentioned a rumor that WikiLeaks might release some BofA documents.

Here is an update from Reuters: WikiLeaks Founder Suggests BofA Documents Are a Dud

The bombshell that WikiLeaks founder Julian Assange has said could "take down a bank or two" may in fact be something of a dud.Note: I only mention this because I posted the rumor last year.

...

Assange said it consists of e-mails from the hard-drive of a Bank of America executive's computer and that the latest messages are dated sometime in 2006. ... Assange's private characterizations of the Bank of America material as being dated and difficult to interpret contrasts with inflammatory public statements he has made ... touting the significance of bank-related materials WikiLeaks has been planning to publish.

I come to praise Bernanke

by Calculated Risk on 2/09/2011 12:58:00 PM

Fed Chairman Ben Bernanke has come under fire recently from many directions.

Of course I've been a frequent critic of Ben Bernanke over the years. I thought he missed the housing and credit bubble when he was a member of the Fed Board of Governors from 2002 to 2005. And I frequently ridiculed his comments when he was Chairman of the President Bush's Council of Economic Advisers from June 2005 to January 2006.

And we can't forget Bernanke's "contained" to subprime comments in March 2007. That became a running joke.

But I've also noted that once Bernanke started to understand the financial problems, he was very effective at providing liquidity for the markets. And there is no question that the short-term liquidity facilities were very effective and successful.

And I think Fed Chairman Ben Bernanke deserves praise today. His speech was very clear and he made several key points during the Q&A:

• QE is an extension of conventional monetary policy at the zero bound. As Bernanke noted

[T]he two types of policies affect the economy in similar ways. ... Conventional monetary policy easing works by lowering market expectations for the future path of short-term interest rates ... By comparison, the Federal Reserve's purchases of longer-term securities do not affect very short-term interest rates, which remain close to zero, but instead put downward pressure directly on longer-term interest rates.And with the unemployment rate near 10% (when QE2 started), and inflation well below the target rate, the Fed had no choice but to provide additional accommodation.

With the Fed funds rate at the zero bound, the Fed had to resort to unconventional policy to provide further accommodation.

• Inflation in emerging markets is the responsibility of emerging market countries. The Fed is focused on inflation in the U.S., and the key measures of inflation show that inflation is below the Fed’s target of around 2%. For more on inflation, see Dr. Altig at Macroblog: Inflation confusion

• The U.S. needs a credible plan to reduce the long term deficit, but this doesn’t mean cutting the deficit in the short term since the U.S. economy still needs fiscal support.

• The debt and deficit are serious issues, but the debt ceiling debate is just political grandstanding. (I’ve made fun of both parties on this issue).

Right now I think the Fed is doing an excellent job with monetary policy, and I was very pleased that Bernanke stayed away from specifics on the deficit (not his responsibility).

Bernanke Testimony before House Budget Committee at 10 AM

by Calculated Risk on 2/09/2011 10:00:00 AM

Fed Chairman Ben Bernanke will testify before the House Budget Committee at 10 AM. "The Economic Outlook and Monetary and Fiscal Policy"

Here is the CNBC feed.

Prepared testimony: The Economic Outlook and Monetary and Fiscal Policy

Ceridian-UCLA: Diesel Fuel index decreases slightly in January

by Calculated Risk on 2/09/2011 09:00:00 AM

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the index since January 2000.

Press Release: PCI Posts 14th Consecutive Month of Year-Over-Year Growth

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), issued today by the UCLA Anderson School of Management and Ceridian Corporation fell 0.3% on a seasonally and monthly workday adjusted basis in January, giving up some of December’s exceptional 1.8% sequential gain. Because of the very strong December showing, the three-month annualized moving average is up 5.1% and gaining strength.Note: This index does appear to track Industrial Production over time (with plenty of noise). Industrial Production for December will be released February 16th.

...

The combined effect of very strong sequential gains in December and holding onto most of those gains in January suggest growth in industrial production for January equal to 0.3% when reported on February 16th.

...

The Ceridian-UCLA Pulse of Commerce Index™ is based on real-time diesel fuel consumption data for over the road trucking ...

MBA: Mortgage Applications Decrease as Rates Jump

by Calculated Risk on 2/09/2011 07:33:00 AM

The MBA reports: Mortgage Applications Decrease as Rates Jump in Latest MBA Weekly Survey

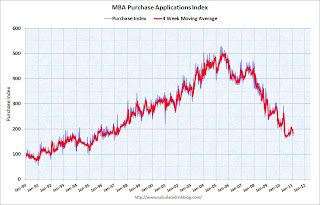

The Refinance Index decreased 7.7 percent from the previous week. The seasonally adjusted Purchase Index decreased 1.4 percent from one week earlier.

...

"Mortgage rates increased last week as many incoming economic indicators continue to show stronger growth than had been anticipated. Refinance volume continues to be low, as fewer homeowners with equity have any incentive to refinance," said Michael Fratantoni, MBA’s Vice President of Research and Economics. "We are at the beginning of the spring buying season, but purchase volume remains weak on a seasonally adjusted basis."

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.13 percent from 4.81 percent, with points decreasing to 0.84 from 1.02 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the highest contract 30-year rate recorded in the survey since the week ending April 9, 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index suggests weak home sales through the first few months of 2011. That is quite an increase in mortgage rates!