by Calculated Risk on 2/04/2011 10:13:00 AM

Friday, February 04, 2011

Employment Summary and Part Time Workers, Unemployed over 26 Weeks

Here are a few more graphs based on the employment report ...

Percent Job Losses During Recessions

Click on graph for larger image.

Click on graph for larger image.

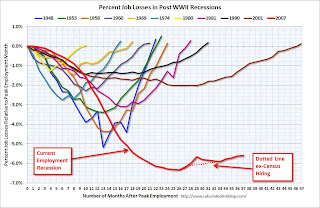

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the recession.

In terms of lost payroll jobs, the 2007 recession is by far the worst since WWII, and the "recovery" for payroll jobs is one of the slowest.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) declined from 8.9 to 8.4 million in January. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined to 8.407 million in January.

These workers are included in the alternate measure of labor underutilization (U-6) that declined sharply to 16.1% in January from 16.7% in December. Still very high, but improving.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.21 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 6.44 million in December. This is still very high.

Summary

This was a decent report with two obvious exceptions: the few payroll jobs added, and the slight decline in the average workweek - both potentially weather related.

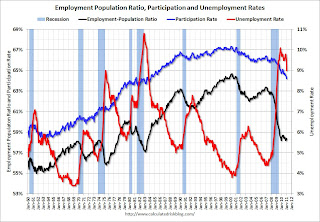

The best news was the decline in the unemployment rate to 9.0% from 9.4% in December. However this was partially because the participation rate declined to 64.2% - a new cycle low, and the lowest level since the early '80s. Note: This is the percentage of the working age population in the labor force (here is the graph in the galleries of the participation rate). The participation rate has now fallen 2 percentage points during the recession - a huge decline.

The 36,000 payroll jobs added was far below expectations of 150,000 jobs, however this was probably impacted by bad weather during the survey reference period. If so, there should be a strong bounce back in the February report.

The decreases for the long term unemployed, and for the number of part time workers for economic reasons, are good news - although both levels are still very high. The average workweek declined slightly to 34.2 hours (possibly weather related), and average hourly earnings ticked up 8 cents.

If we blame it on the weather, this was a solid report. And we will know about payrolls in February.

• Earlier Employment post: January Employment Report: 36,000 Jobs, 9.0% Unemployment Rate

January Employment Report: 36,000 Jobs, 9.0% Unemployment Rate

by Calculated Risk on 2/04/2011 08:30:00 AM

From the BLS:

The unemployment rate fell by 0.4 percentage point to 9.0 percent inAnd on the benchmark revision:

January, while nonfarm payroll employment changed little (+36,000),

the U.S. Bureau of Labor Statistics reported today.

The total nonfarm employment level for March 2010 was revised downward by 378,000 ... The previously published level for December 2010 was revised downward by 452,000.The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graph for larger image.

Click on graph for larger image.The unemployment rate decreased to 9.0% (red line).

The Labor Force Participation Rate declined to 64.2% in January (blue line). This is the lowest level since the early '80s. (This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years.)

The Employment-Population ratio increased to 58.4% in January (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms from the start of the recession. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms from the start of the recession. The dotted line is ex-Census hiring. For the current employment recession, the graph starts in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This was significantly below expectations for payroll jobs. Weather may have been a factor. I'll have much more soon ...

Thursday, February 03, 2011

Norris: From 1983, Hope for Jobs in 2011

by Calculated Risk on 2/03/2011 10:10:00 PM

Note: Earlier I posted some thoughts on employment: Employment Situation: A Lighter Shade of Gray

From Floyd Norris at the NY Times: From 1983, Hope for Jobs in 2011

In January 1983 ... the unemployment rate fell to 10.4 percent from 10.8 percent. It was the first such decline in five years, but few thought it significant.Norris points out some differences and similarities between now and then, and he is hopeful something similar will happen with unemployment this year. But I think he is too optimistic.

“The A.F.L.-C.I.O.,” The Washington Post reported, “said yesterday that there was no real improvement in unemployment last month because the decline was caused primarily by people dropping out of the labor force, rather than finding jobs.”

... the rate at the end of 1983 turned out to be 8.3 percent.

First, in 1983 the participation rate was all of 0.3 percentage points below the recent peak. Now it is 1.9 percentage points lower than the recent peak - suggesting some bounce back is more likely (keeping the unemployment rate elevated).

But a far more important difference between now and then is ... housing. There were just over 1 million housing starts in 1982, and starts picked up sharply in 1983 rising to over 1.7 million!

I've been pounding the table arguing that housing would add to both GDP and employment growth in 2011 for the first time since 2005. But does anyone think housing starts will increase by 650 thousand units in 2011 (more than doubling the just under 600 thousand units in 2010)?

Not. Gonna. Happen. Not with the huge overhang of existing vacant housing units (the overhang is declining, but we still have a ways to go). Housing was a key engine of job growth in 1983, but housing will have less of an impact in 2011.

I hope Mr. Norris is correct and the unemployment rate drops sharply in 2011, but my guess is the decline will be more sluggish this year than in 1983.

Report on Egypt: A Plan for Mubarak’s Exit

by Calculated Risk on 2/03/2011 08:19:00 PM

From the NY Times: White House, Egypt Discusses Plan for Mubarak’s Exit

The Obama administration is discussing with Egyptian officials a proposal for President Hosni Mubarak to resign immediately, turning over power to a transitional government headed by Vice President Omar Suleiman with the support of the Egyptian military, administration officials and Arab diplomats said Thursday.Here is the al Jazeera English site, and the live blog for Feb 4th (currently unavailable).

European Bond Spreads Update

by Calculated Risk on 2/03/2011 06:15:00 PM

With the key European meeting tomorrow, here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of Feb 1st):

Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

While there has been some improvement since the start of the year, most peripheral European bond spreads (over German bonds) continue to be elevated, particularly those of Greece, Ireland, and Portugal.The bond yields are up slightly today. The Portugal 10 year is at 6.99%, the Ireland 10-year bond yield is at 8.86%, and the Greece 10-year bond yield has fallen to 10.9%.

Since the start of the year, the 10-year Greece-to-German bond spread has narrowed by 183 basis points (bps), through February 1. Similarly, the spread for Ireland is 41 bps lower, 54 bps lower for Spain, and down 42 bps for Italy.

Portugal’s spread, however, is essentially unchanged over the period.

From MarketWatch: Merkel: EU to discuss competitiveness on Friday

"We're going to start the talks, and then between now and the March summit, we will firm up the details," [German Chancellor Angela Merkel] said ... The meeting is expected to see plans to expand the [EFSF], with Germany pushing for efforts to boost competitiveness and fiscal discipline

Employment Situation: A Lighter Shade of Gray

by Calculated Risk on 2/03/2011 02:36:00 PM

The numbers are grim: almost 15 million Americans are unemployed, another 9 million are working part time for economic reasons, and about 4 million more have left the labor force since the start of the recession (we can see this in the dramatic drop in the labor force participation rate). Of those unemployed, 6.4 million have been unemployed for six months or more.

And the situation is also bleak for many of those who have jobs. A recent report showed most of the employment growth has been in low-to-mid wage industries (more skewed than in previous recoveries). And real earnings for most Americans have been under pressure for some time.

Against that backdrop, the recent spate of good employment news might seem almost insignificant, but it is a start.

Tomorrow the BLS will release the January Employment Situation Summary at 8:30 AM ET. The consensus is for an increase of 150,000 payroll jobs in January, and for the unemployment rate to increase slightly to 9.5% (from 9.4% in December).

That would be an improvement – the U.S. economy only added about 95,000 jobs per month in 2010 - however 150,000 additional payroll jobs is still pretty small compared to the number of unemployed. And that is barely enough to keep up with the growth of the working age population.

So while news reports might suggest “improvement”, many of the unemployed and marginally employed will not see it, at least not yet, and probably not for some time.

Here is a look at a few of the recent employment related reports:

• ADP reported Private Employment increased by 187,000 in January, and has averaged 217,000 over the last two months.

• Weekly initial unemployment claims were down significantly over the last few months. The graph is here. The average over the last 5 weeks was 425,000 initial claims per week, down sharply from the October the average of 456,000.

• The ISM indexes showed significantly stronger employment growth. The ISM manufacturing manufacturing Employment Index registered 61.7 in January, 2.8 percentage points higher than the 58.9 percent reported in December. The ISM Non-manufacturing employment index showed faster expansion in December at 54.5%, up from 52.6% in December. (graph is here)

• All of the Regional Fed manufacturing surveys reported employment expansion.

Also Madeline Schnapp, Director, Macroeconomic Research at TrimTabs Investment Research sent me the following note:

Our withholding tax model for jobs was crippled this past month by the withholding tax changes (2% payroll tax deduction). We did come up with a "guestimate" for January job growth of 175,000 to 215,000 new jobs using data from the last week of January (poor substitute) and all of the other jobs related indicators we track. Those indicators are very bullish. In sum, from a qualitative (not quantitative) viewpoint, we expect the job growth reported by the BLS to surprise on the upside.In addition to the above indicators, Ms. Schnapp noted:

• The TrimTabs Online Job Postings Index rose 4.5% in January, the biggest gain since October 2010.We are a long way from blue skies, but maybe we are seeing a lighter shade of gray.

• Commercial and industrial loan growth accelerated to 1.0% in the past month. Stronger commercial and industrial loan growth often accompanies a pickup in job growth.

• The Federal Reserve’s Senior Loan Officer Opinion Survey reported that demand for business loans picked up in Q4 2010, and demand for commercial and industrial loans was the strongest since 2006.

• The Federal Reserve’s “Beige Book” reported that labor markets improved in most districts. Temporary staffing firms in six of 12 districts gave positive reports. Eight of 12 districts reported that their business contacts planned to hold hiring steady or increase hiring in 2011.

• Personal consumption expenditures rose 4.4% in Q4 2010, the largest increase since Q1 2006. Meanwhile, final sales increased 7.1%, the strongest growth since 1984.

A few notes:

1) The BLS will release the annual benchmark revision tomorrow. Last October the BLS released the preliminary annual benchmark revision of minus 366,000 payroll jobs as of March 2010. Usually the preliminary estimate is pretty close to the final benchmark estimate.

2) Some people are concerned about the impact of the January snow storms on the employment report. If there is a significant impact, the BLS will mention it in the release.

3) My forecast is for something close to 200 thousand private sector jobs on average per month this year.