by Calculated Risk on 1/29/2011 02:18:00 PM

Saturday, January 29, 2011

Schedule for Week of January 30th

NOTE: The current weekly schedule is available all week in the menu bar above.

The key report for this week will be the January employment report to be released on Friday, Feb 4th.

Other key reports include the quarterly Housing Vacancies and Homeownership report to be released on Monday, the ISM manufacturing index on Tuesday, vehicle sales on Tuesday, and the ISM non-manufacturing (service) index on Thursday. Fed Chairman Ben Bernanke will speak on Thursday.

8:30 AM: Personal Income and Outlays for December. The consensus is for a 0.4% increase in personal income and a 0.5% increase in personal spending, and for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a decrease to a still strong 65.0 (down from 66.8 in December).

10:00 AM: Housing Vacancies and Homeownership report for Q4. This report contains an estimate for the homeownership rate, and for the homeowner and rental vacancy rates.

Click on graphs for larger image in graph gallery.

Click on graphs for larger image in graph gallery.The Q3 2010 homeownership rate was at 66.9% - about the level of early 1999.

For this report, the homeowner vacancy rate was at 2.5% in Q3 2010 (down from a peak of 2.9%) and the rental vacancy rate was at 10.3% in Q3 2010, down from a peak of 11.1%. Both vacancy rates probably fell further in Q4.

10:30 AM: Dallas Fed Manufacturing Survey for January. The Texas production index showed expansion last month (at 12.8), and is expected to show expansion again in January.

12:00 PM: Atlanta Fed President Dennis Lockhart speaks at Miami Dade College

2:00 PM: The January 2011 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve. The October survey showed banks have stopped tightening standards (they are already very tight), and demand has stopped falling (there is little demand for loans).

10:00 AM: ISM Manufacturing Index for January. The consensus is for an increase to 57.9 from 57.0 in December.

10:00 AM: Construction Spending for December. The consensus is for a 0.1% increase in construction spending.

All day: Light vehicle sales for January. Light vehicle sales are expected to increase to 12.6 million (Seasonally Adjusted Annual Rate), from 12.5 million in December.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate. Edmunds is forecasting:

"Edmunds.com analysts predict that January's Seasonally Adjusted Annualized Rate (SAAR) will be 12.57 million, up from 12.48 in December 2010."

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has declined over the last few weeks suggesting weak home sales through the first few months of 2011.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for +150,000 payroll jobs in January, down from the stunning +297,000 jobs reported in December.

5:30 PM: Fed Governor Elizabeth Duke speaks at the University of North Carolina "My Journey from Community Banker to Central Banker"

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims had been trending down over the last couple of months, although claims increased sharply last week to 454,000. The consensus is for a decline to 420,000.

10:00 AM: Manufacturers' Shipments, Inventories and Orders for December. The consensus is for a 1.0% increase in orders.

10:00 AM: ISM non-Manufacturing Index for December. The consensus is for a slight decrease to 57.0 from 57.1 in December.

12:30 PM: Fed Chairman Ben Bernanke will speak at the National Press Club Luncheon in Washington, D.C. "The Economic Outlook and Macroeconomic Policies"

8:00 PM: Minneapolis Fed President Narayana Kocherlakota speaks at the University of Minnesota.

8:30 AM: Employment Report for January.

The consensus is for an increase of 150,000 non-farm payroll jobs in January, after the disappointing 103,000 jobs added in December.

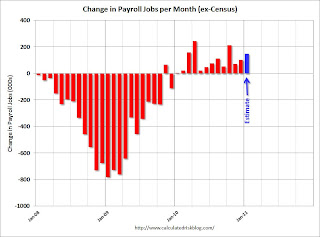

The consensus is for an increase of 150,000 non-farm payroll jobs in January, after the disappointing 103,000 jobs added in December. This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The estimate for January is in blue.

The consensus is for the unemployment rate to increase to 9.5% from 9.4% in December. Note: The annual benchmark revision will be released with this report, and the preliminary estimate "indicates a downward adjustment to March 2010 total nonfarm employment of 366,000."

Unofficial Problem Bank list increases to 949 Institutions

by Calculated Risk on 1/29/2011 10:26:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 28, 2011.

Changes and comments from surferdude808:

Not the safest week in banking as the FDIC released its formal enforcement actions for December 2010 and closed four institutions including the largest bank headquartered in New Mexico. This week there were 15 additions and three removals. The changes leave the Unofficial Problem Bank list at 949 institutions with assets of $410.9 billion, up from 937 institutions with assets of $409.4 billion.

The removals include three of the four failures -- First Community Bank, Taos, NM ($2.3 billion Ticker: FSNM); Firstier Bank, Louisville, CO ($782 million); and Evergreen State Bank, Stoughton, WI ($246 million). The other failure this week -- The First State Bank, Camargo, OK was only placed under enforcement action in December 2010 (35 days before it failed) by the FDIC so it never made an appearance on the Unofficial Problem Bank List.

Among the 13 additions are First Federal Savings Bank of Elizabethtown, Elizabethtown, KY ($1.2 billion Ticker: FFKY); The Heritage Bank, Hinesville, GA ($952 million); First American International Bank, Brooklyn, NY ($604 million); Park Federal Savings Bank, Chicago, IL ($216 million Ticker: PFED); and Premier Service Bank, Riverside, CA ($157 million Ticker: PSBK).

Other changes include the issuance of Prompt Corrective Action orders by the FDIC against The Bank of Commerce, Wood Dale, Il ($174 million) and the Federal Reserve against Virginia Business Bank, Richmond, VA ($129 million). Positively, the FDIC terminated the PCA order against AmericanWest Bank, Spokane, WA ($1.5 billion Ticker: AWBCQ).

After the monthly release of actions by the FDIC, it would not be unusual for the Unofficial Problem Bank List to trend down until the middle of next month as closings tend to outpace new order issuance during this part of the month. Overall, if trends persist, the list could hit CR's anticipated [1000] mark by the end of May 2011.

ATA Truck Tonnage Index increased in December

by Calculated Risk on 1/29/2011 08:55:00 AM

From the American Trucking Association: ATA Truck Tonnage Index Jumped 2.2 Percent in December

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 2.2 percent in December after falling a revised 0.6 percent in November. The latest improvement put the SA index at 111.6 (2000=100) in December, which was the highest level since September 2008. In November, the SA index equaled 109.2.

...

ATA Chief Economist Bob Costello said that December’s improvement fits well with the see-saw pattern that many carriers are reporting. “Fleets continue to tell me that freight volumes are very choppy – up one week, but down the next. That is a trend that is likely to continue this year as the economy is not growing across the board yet.” Still, Costello said it was a positive sign for the economy that SA tonnage reached the highest level in 27 months. “I continue to expect truck freight tonnage to grow modestly during the first half of 2011 and accelerate in the later half of the year into 2012.”

Click on map for graph gallery.

Click on map for graph gallery.This graph from the ATA shows the Truck Tonnage Index since Jan 2006.

This is the highest level since September 2008 - and it appears truck tonnage is increasing again after stalling out last spring and summer.

Late Night: Egypt

by Calculated Risk on 1/29/2011 01:47:00 AM

From Al Jazeera English (All times are local in Egypt.). Latest entries ...

6:38 am Internet and mobile phone networks are still down in Egypt.

6:30 am The headquarters of the ruling National Democratic Party in Cairo are still on fire.

A couple of stories ...

From the WaPo: Cairo in near-anarchy as protesters push to oust president

From the NY Times: Mubarak Orders Crackdown, With Revolt Sweeping Egypt

Friday, January 28, 2011

Bank Failure #11 for 2011: First Community Bank, Taos, New Mexico

by Calculated Risk on 1/28/2011 08:38:00 PM

The high price of low living

Malfeasance results

by Soylent Green is People

From the FDIC: U.S. Bank, National Association, Minneapolis, Minnesota, Assumes All of the Deposits of First Community Bank, Taos, New Mexico

As of September 30, 2010, First Community Bank had approximately $2.31 billion in total assets and $1.94 billion in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $260.0 million. ... First Community Bank is the eleventh FDIC-insured institution to fail in the nation this year, and the first in New Mexico.A billion here, a billion there ...

Bank Failure #10 for 2011: FirsTier Bank, Louisville, Colorado

by Calculated Risk on 1/28/2011 07:42:00 PM

Without it, which banks might fail?

Today: First Tier Bank.

by Soylent Green is People

From the FDIC: FDIC Creates the Deposit Insurance National Bank of Louisville to Protect Insured Depositors of FirsTier Bank, Louisville, Colorado

As of September 30, 2010, FirsTier Bank had $781.5 million in total assets and $722.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $242.6 million. FirsTier Bank is the tenth FDIC-insured institution to fail in the nation this year, and the second in Colorado.That makes three today - and another one with no buyer.