by Calculated Risk on 1/27/2011 08:42:00 AM

Thursday, January 27, 2011

Weekly Initial Unemployment Claims increase sharply to 454,000

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 22, the advance figure for seasonally adjusted initial claims was 454,000, an increase of 51,000 from the previous week's revised figure of 403,000. The 4-week moving average was 428,750, an increase of 15,750 from the previous week's revised average of 413,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims for the last 10 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week by 15,750 to 428,750.

This was much higher than consensus expectations. The recent decline in the four week average has been good news - and this large increase (just one week) is concerning. Blame it on the snow ...

Wednesday, January 26, 2011

Merle Hazard on Italy

by Calculated Risk on 1/26/2011 08:57:00 PM

A ditty from Merle on Italy (short to fit the time slot on Paul Solman's Making $ense (Solman is discussing Europe this week).

New Home Inventory by Stage of Construction

by Calculated Risk on 1/26/2011 05:16:00 PM

The Census Bureau reported that new home inventory declined to 190,000 new houses for sale at the end of December. A common questions is: What inventory is included?

According to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale fell to 80,000 units in December. And the combined total of completed and under construction is at the lowest level since this series started.

In most areas the 'completed' and 'under construction' inventory of new homes is fairly lean. (Tom Lawler sent me a note just as I was finishing this post, he wrote: Currently new SF home inventories are “pretty lean,” which is good since new home sales are still “pretty soft.” )

Here are the New and Existing December home sales posts:

• New Home Sales increase in December

• December Existing Home Sales: 5.28 million SAAR, 8.1 months of supply

• Existing Home Inventory increases 8.4% Year-over-Year in December

• Home Sales: Distressing Gap

• Graph galleries for New Home and Existing Home sales

FOMC Statement: No change

by Calculated Risk on 1/26/2011 02:15:00 PM

• The target range for the federal funds rate remains at 0 to 1/4 percent

• The policy of reinvestment of principal payments remains

• no change to the plan to purchase an additional $600 billion of longer-term Treasury securities by the end of June 2011.

• the key sentence "likely to warrant exceptionally low levels for the federal funds rate for an extended period" remains

From the Federal Reserve:

Information received since the Federal Open Market Committee met in December confirms that the economic recovery is continuing, though at a rate that has been insufficient to bring about a significant improvement in labor market conditions. Growth in household spending picked up late last year, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising, while investment in nonresidential structures is still weak. Employers remain reluctant to add to payrolls. The housing sector continues to be depressed. Although commodity prices have risen, longer-term inflation expectations have remained stable, and measures of underlying inflation have been trending downward.No dissent. A mention of rising commodity prices, but not much change in the language.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Currently, the unemployment rate is elevated, and measures of underlying inflation are somewhat low, relative to levels that the Committee judges to be consistent, over the longer run, with its dual mandate. Although the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, progress toward its objectives has been disappointingly slow.

To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to continue expanding its holdings of securities as announced in November. In particular, the Committee is maintaining its existing policy of reinvesting principal payments from its securities holdings and intends to purchase $600 billion of longer-term Treasury securities by the end of the second quarter of 2011. The Committee will regularly review the pace of its securities purchases and the overall size of the asset-purchase program in light of incoming information and will adjust the program as needed to best foster maximum employment and price stability.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period.

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to support the economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Richard W. Fisher; Narayana Kocherlakota; Charles I. Plosser; Sarah Bloom Raskin; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen.

Home Sales: Distressing Gap

by Calculated Risk on 1/26/2011 12:10:00 PM

Here is an update to a graph I've been posting for several years (most of the text is a repeat).

This graph shows existing home sales (left axis) and new home sales (right axis) through December. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared (due mostly to distressed sales).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Initially the gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The two spikes in existing home sales were due primarily to the homebuyer tax credits (the initial credit in 2009, followed by the 2nd credit in 2010). There were also two smaller bumps for new home sales related to the tax credits.

Note: it is important to note that existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

In a few years - when the excess housing inventory is absorbed and the number of distressed sales has declined significantly - I expect existing home-to-new home sales to return to something close to this historical relationship.

New and Existing December home sales posts:

• New Home Sales increase in December

• December Existing Home Sales: 5.28 million SAAR, 8.1 months of supply

• Existing Home Inventory increases 8.4% Year-over-Year in December

• Graph galleries for New Home and Existing Home sales

New Home Sales increase in December

by Calculated Risk on 1/26/2011 10:00:00 AM

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 329 thousand. This is up from a revised 280 thousand in November.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted or annualized).

Note the Red columns for 2010. In December 2010, 22 thousand new homes were sold (NSA). This is a new record low for the month of December.

The previous record low for December was 23 thousand in 1966; the record high was 87 thousand in December 2005.

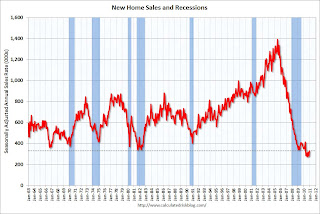

The second graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

The second graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in December 2010 were at a seasonally adjusted annual rate of 329,000 ... This is 17.5 percent (±17.7%)* above the revised November rate of 280,000, but is 7.6 percent (±17.0%)* below the December 2009 estimate of 356,000.And another long term graph - this one for New Home Months of Supply.

Months of supply decreased to 6.9 in December from 8.4 in November. The all time record was 12.1 months of supply in January 2009. This is still high (less than 6 months supply is normal).

Months of supply decreased to 6.9 in December from 8.4 in November. The all time record was 12.1 months of supply in January 2009. This is still high (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of December was 190,000. This represents a supply of 6.9 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. The 329 thousand annual sales rate for December is still very low, and this was just the weakest December on record. This was above the consensus forecast of 300 thousand homes sold (SAAR).

It says something when sales increase and are still below the previous record lows for all years prior to 2010. New Home sales are still bouncing along the bottom - the good news is inventory is still declining.