by Calculated Risk on 1/14/2011 09:15:00 AM

Friday, January 14, 2011

Industrial Production, Capacity Utilization increased in December

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.8 percent in December after having risen 0.3 percent in November. ... At 94.9 percent of its 2007 average, total industrial production in December was 5.9 percent above its level of a year earlier. The capacity utilization rate for total industry rose to 76.0 percent, a rate 4.6 percentage points below its average from 1972 to 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up 11.5% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.0% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

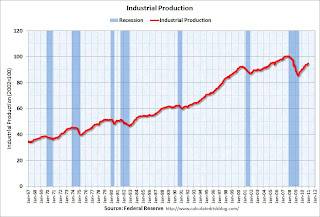

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in December, but production is still 5.8% below the pre-recession levels at the end of 2007.

This was above consensus expectations of a 0.5% increase in Industrial Production, and an increase to 75.6% for Capacity Utilization.

Retail Sales increased 0.6% in December

by Calculated Risk on 1/14/2011 08:30:00 AM

On a monthly basis, retail sales increased 0.6% from November to December(seasonally adjusted, after revisions), and sales were up 7.9% from December 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 13.5% from the bottom, and now 0.2% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 7.4% on a YoY basis (7.9% for all retail sales).

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $380.9 billion, an increase of 0.6 percent (±0.5%) from the previous month, and 7.9 percent (±0.7%) above December 2009. Total sales for the 12 months of 2010 were up 6.6 percent (±0.4%) from 2009. Total sales for the October through December 2010 period were up 7.8 percent(±0.5%) from the same period a year ago. The October to November 2010 percent change was unrevised from +0.8 percent (±0.2%).This was below expectations for a 0.8% increase. Retail sales ex-autos were up 0.5%; also below expectations of a 0.7% increase.

Although slightly lower than expected, retail sales are now above the pre-recession peak in November 2007.

Thursday, January 13, 2011

Report: Near Failure of Citigroup in 2008

by Calculated Risk on 1/13/2011 09:13:00 PM

From Shahien Nasiripour at the HuffPo: Citigroup Was On The Verge Of Failure, New Report Finds; Rescue Was Based On 'Gut Instinct'

"We were on the verge of having to close this institution [Citigroup] because it can't meet its liquidity Monday morning," said Sheila Bair, chairman of the Federal Deposit Insurance Corporation, during a meeting the previous Sunday night, according to the report by the Special Inspector General for the Troubled Asset Relief Program.We all knew it was close ...

"Without substantial government intervention," said another FDIC official, bank regulators and Citigroup "project that Citibank will be unable to pay obligations or meet expected deposit outflows next week," according to the report.

Banks Walking Away from Houses in Chicago

by Calculated Risk on 1/13/2011 05:32:00 PM

From Mary Ellen Podmolik at the Chicago Tribune: More banks walking away from homes, adding to housing crisis (ht, Mark, Walt, Bob)

Abandoned foreclosures are increasing as mortgage investors determine that, at sale, they can't recoup the costs of foreclosing, securing, maintaining and marketing a home, and they sometimes aren't completing foreclosure actions. The property, by then usually vacant, becomes another eyesore ...We've seen this before in areas with declining populations like Detroit. These are always low end homes that are worth less than the cost of foreclosing - and it leaves behind a mess for the community and the city.

Research ... identifies 1,896 "red flag" homes in Chicago ... that appear to have been abandoned by mortgage servicers during the foreclosure process, the Woodstock Institute found.

Europe: More "Successful" Auctions, Trichet comments on inflation

by Calculated Risk on 1/13/2011 02:39:00 PM

A few more "successful" auctions. Time will tell. Also Jean-Claude Trichet made some cautious statements about inflation in Europe ... and a history and analysis of the euro from Paul Krugman.

• From the WSJ: Strong Demand at European Debt Auctions

Both Spain and Italy sold the maximum intended amounts they had planned, with Spain selling €3 billion ($3.94 billion) of a five-year bond and Italy selling €6 billion in five- and 11-year bonds.• From the Financial Times: Hawkish Trichet comments boost euro

...

Spain's Treasury sold the bonds at an average yield of 4.542%, up from 3.576% at the previous auction Nov. 4 ... Italy sold its five-year bond at a yield of 3.67%, up from 3.24% on Nov. 12, while the yield on the longer bond rose to 5.06% from 4.81%.

“Overall, we see evidence of short-term upward pressure on overall inflation, stemming largely from global commodity prices. While this has not so far affected our assessment that price developments will remain in line with price stability over the policy-relevant horizon, very close monitoring of price developments is warranted,” [Jean-Claude Trichet, chairman of the European Central Bank] said.• And some history from Paul Krugman in the NY Times Magazine: Can Europe Be Saved?. Krugman explains the history and the problems with the euro - and there is an interesting discussion comparing and contrasting U.S. state issues with the government issues in Europe.

excerpt with permission

Fed Chairman Bernanke and FDIC Chair Bair on CNBC

by Calculated Risk on 1/13/2011 01:45:00 PM

Panel discussion on CNBC (link here)

Update: Economy to Grow 3-4% in 2011 But Hiring Still Lags: Bernanke

"We see the economy strengthening," Bernanke said during Small Business forum co-sponsored by the FDIC and CNBC. "It has looked better in the last few months. We think a 3 to 4 percent-type of growth number for 2011 seems reasonable."

"Now that's not going to reduce unemployment at the pace we'd like it to, but certainly it would be good to see the economy growing and that means more sales, more business," he added.

The Fed chairman also said the housing recovery is "a slow process."