by Calculated Risk on 12/20/2010 08:04:00 PM

Monday, December 20, 2010

ATA Truck Tonnage Index decreases slightly in November

From the American Trucking Association: ATA Truck Tonnage Index Fell 0.1 Percent in November

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index edged 0.1 percent lower in November after increasing a revised 0.9 percent in October. In September and October, tonnage increased a total of 2.8 percent. The latest reduction put the SA index at 109.7 (2000=100) in November from 109.9 in October

...

ATA Chief Economist Bob Costello said that he is not overly concerned with the small decrease in tonnage during November. “Tonnage increased for two consecutive months in September and October and I don’t expect volumes to rise every month. Additionally, the decrease in November is much smaller than the gains during the previous two months.” Costello said he expects truck freight tonnage to grow modestly during the first half of 2011 before accelerating in the later half of the year into 2012.

Click on map for larger image.

Click on map for larger image.This graph from the ATA shows the Truck Tonnage Index since Jan 2006.

The line is added to show the index has been mostly moving sideways this year.

Moody's: Commercial Real Estate Prices increase in October

by Calculated Risk on 12/20/2010 03:29:00 PM

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index increased 1.3% in October. Note: Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices and make the index very volatile.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are about 42% below the peak in 2007.

It is important to remember that the number of transactions is very low and there are a large percentage of distressed sales.

Here is an article from Bloomberg: http://www.bloomberg.com/news/2010-12-20/u-s-commercial-property-rises-for-second-consecutive-month-moody-s-says.html

Analysis: Decline in home prices impacting small business borrowing

by Calculated Risk on 12/20/2010 02:16:00 PM

From Mark Schweitzer and Scott Shane at the Cleveland Fed: The Effect of Falling Home Prices on Small Business Borrowing

The researchers analyze small business borrowing, and note that homes equity borrowing is an "important source of capital for small business owners and that the impact of the recent decline in housing prices is significant enough to be a real constraint on small business finances."

Here is their conclusion:

Everyone agrees that small business borrowing declined during in the recession and has not yet returned to pre-recession levels. Lesser consensus exists around the cause of the decline. Decreased demand for credit, declining creditworthiness of small business borrowers, an unwillingness of banks to lend money to small businesses, and tightened regulatory standards on bank loans have all been offered as explanations.There is no easy replacement for this source of borrowing.

While we would agree that these factors have had an effect on the decline in small business borrowing through commercial lending, we believe that other limits on the credit of small business borrowers are also at play and could be harder to offset. Specifically, the decline in home values has constrained the ability of small business owners to obtain the credit they need to finance their businesses.

Of course, not all small businesses have been equally affected by the decline in home prices. While many small business owners use residential real estate to finance businesses, not all do. Those more likely do so to include companies in the real estate and construction industries, those located in the states with the largest increases in home prices during the boom, younger and smaller businesses, companies with lesser financial prospects, and those not planning to borrow from banks. These patterns are also evident in the data sources we examined.

The link between home prices and small business credit poses important challenges for policy makers seeking to improve small business owners’ access to credit. The solution is far more complicated than telling bankers to lend more or reducing the regulatory constraints that may have caused them to cut back on their lending to small companies. Returning small business owners to pre-recession levels of credit access will require an increase in home prices or a weaning of small business owners from the use of home equity as a source of financing. Neither of those alternatives falls into the category of easy and quick solutions.

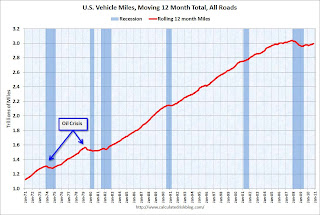

DOT: Vehicle miles driven increased in October

by Calculated Risk on 12/20/2010 11:28:00 AM

The Department of Transportation (DOT) reported that vehicle miles driven in October were up 1.9% compared to October 2009:

Travel on all roads and streets changed by +1.9% (4.9 billion vehicle miles) for October 2010 as compared with October 2009. Travel for the month is estimated to be 259.5 billion vehicle miles.

Cumulative Travel for 2010 changed by +0.6% (16.0 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the rolling 12 month total vehicle miles driven.

On a rolling 12 month basis, vehicle miles driven have only increased 1.2% from the bottom of the recession.

Miles driven are still 1.4% below the peak in 2007. This is another indicator of a sluggish recovery.

Note: in the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 35 months - another record that will be broken soon.

Chicago Fed: Economic Activity Slowed in November

by Calculated Risk on 12/20/2010 08:30:00 AM

Note: This is a composite index based on a number of economic releases.

From the Chicago Fed: Index shows economic activity slowed in November

Led by declines in employment-related indicators, the Chicago Fed National Activity Index decreased to –0.46 in November from –0.25 in October. Three of the four broad categories of indicators that make up the index deteriorated from October to November, with only the production and income category improving.

The index’s three-month moving average, CFNAI-MA3, ticked up to –0.41 in November from –0.42 in October. November’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. With regard to inflation, the amount of economic slack reflected in the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This index suggests the economy was sluggish in November.

Weekend:

• Ten Economic Questions for 2011

• The economic schedule for the coming week.

• Summary for Week ending December 18th

Sunday, December 19, 2010

Las Vegas: A tour of the Preposterous

by Calculated Risk on 12/19/2010 09:47:00 PM

Patrick Coolican at the Las Vegas Sun takes a drive around Las Vegas: Boom-bust era leaves architectural scars across valley

A couple of excerpts:

Now we’re on Gibson Road in Henderson, up the hill from Interstate 215, and there sits Vantage, a boxy, glassy modernist condo development; a historical artifact of the era of the credit boom, and, perhaps, delusional exuberance. It was a $160 million project, but no one lives there. It sits on the hill, surrounded by suburbia, like a hipster who’s stumbled into a church that he thought was a nightclub.This quote from the article captures the bubble insanity: "It seemed any project, no matter how preposterous, could make money." They were wrong.

...

We drive east on 215 to ManhattanWest on Russell Road, another half-finished mixed-use development. Dense, high-rise urbanism plopped down in the suburbs, its name a great irony. Some windows are covered with plywood, like an abandoned property in a city that suffered a natural disaster.

It’s like a Hollywood set. But of what? It imagines that it’s supposed to look this way because somewhere, there’s something that’s cool and authentic and looks like this, perhaps? But there is no such place.