by Calculated Risk on 7/26/2007 05:41:00 PM

Thursday, July 26, 2007

Bear Stearns Seizes Hedge Fund Assets

From the WSJ: Bear Stearns Seizes Hedge Fund Assets

The parent company has assumed ownership of the remaining assets ... in the High-Grade Structured Credit Strategies Fund. Those assets will now be hedged by Bear's trading team and likely sold when their values seem more attractive, says a person close to the situation.The High-Grade fund was the less levered fund, so I suppose this means both funds are (or will be) shut-down.

Predict Existing Home Sales Contest

by Calculated Risk on 7/26/2007 02:06:00 PM

If anyone missed the post yesterday, we are having a contest to predict Existing Home sales for 2007 (to be announced in January '08). Please post your predictions in the comments to the contest post: Contest: Forecast 2007 Existing Home Sales

As food for thought, here is an excerpt from a Goldman Sachs piece yesterday: How Much More Downside for Housing Activity?

Today’s comment assesses how far the US housing downturn has progressed, relative to historically “typical” trough levels for both housing starts and existing home sales. If we are on our way to such a “typical” trough, both indicators would have significantly further to fall, from a current 1.47 million to 1.1 million in the case of housing starts and—more dramatically—from 5.75 million to 3.6 million in the case of existing home sales.

Even though our housing views have long been on the bearish side, these figures are well below our baseline forecasts, especially in the case of existing home sales. We do believe these “typical trough” results are probably too pessimistic, mainly because of structural improvements in the workings of the housing and mortgage markets compared with the 1970s and 1980s. However, the recent upheavals in the mortgage finance industry have made us less confident on this score.

Excerpted with permission.

Wells Fargo to Close Non-Prime Wholesale Lending Business

by Calculated Risk on 7/26/2007 12:40:00 PM

Click on photo for larger image.

Wells Fargo Closes Nonprime Wholesale Lending Business

Wells Fargo Home Mortgage, a division of Wells Fargo Bank, N.A., said today that it will close its nonprime wholesale lending business, which processes and funds nonprime loans for third-party mortgage brokers. In 2006, this business represented 1.6 percent of Wells Fargo's total residential mortgage loan volume of $397.6 billionJPMorgan also tightened mortgage lending standards today too. From JPMorgan:

Will require an initial fixed rate for at least five years on adjustable-rate mortgages for non-prime borrowers to reduce payment shock risk

Will employ underwriting guidelines that require borrowers to demonstrate their ability to handle increases in interest rates on non-traditional mortgages

Has tightened credit standards, including making adjustments to acknowledge declining home values in certain markets and reducing the use of high loan-to-value ratios and stated-income products

Will continue to consider borrowers’ required property tax and homeowners’ insurance payments in determining affordability. Chase offers all its borrowers an option to escrow those payments with Chase

Will continue its practice of not offering option ARMs, which can expose borrowers to negative amortization when their monthly payment does not cover interest costs

More on June New Home Sales

by Calculated Risk on 7/26/2007 11:07:00 AM

For more graphs, please see my earlier post: June New Home Sales Click on graph for larger image.

Click on graph for larger image.

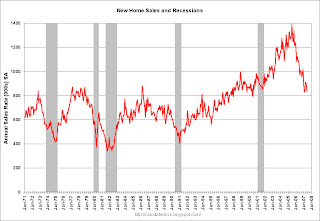

The first graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession in the months ahead.

The second graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through June.

Typically, for an average year, about 52% of all new home sales happen before the end of June. Therefore the scale on the right is set to 52% of the left scale.

At the current pace, new home sales for 2007 will probably be in the high 800 thousands - about the same level as in 1998 through 2000. This is significantly below the forecasts of even many bearish forecasters.

If sales slow in the 2nd half of 2007 - as I expect - New Home sales might be in the low 800s - the lowest level since 1997.

June New Home Sales

by Calculated Risk on 7/26/2007 10:00:00 AM

According to the Census Bureau report, New Home Sales in June were at a seasonally adjusted annual rate of 834 thousand. Sales for May were revised down significantly to 893 thousand, from 930 thousand. Numbers for April were also revised down.

Click on Graph for larger image.

Sales of new one-family houses in June 2007 were at a seasonally adjusted annual rate of 834,000 ... This is 6.6 percent below the revised May rate of 893,000 and is 22.3 percent below the June 2006 estimate of 1,073,000..

The Not Seasonally Adjusted monthly rate was 77,000 New Homes sold. There were 98,000 New Homes sold in June 2006.

June '07 sales were the lowest June since 2000 (71,000).

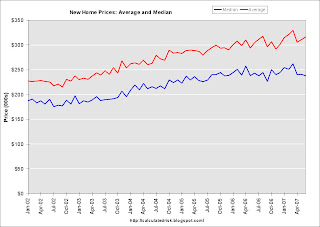

The median and average sales prices were mixed. Caution should be used when analyzing monthly price changes since prices are heavily revised and do not include builder incentives.

The median sales price of new houses sold in June 2007 was $237,900; the average sales price was $316,200.

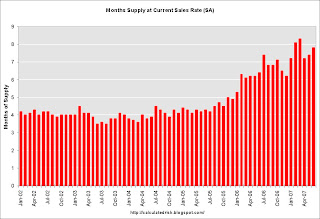

The seasonally adjusted estimate of new houses for sale at the end of June was 537,000.

The 537,000 units of inventory is slightly below the levels of the last year. Inventory for the previous months were revised up slightly.

Inventory numbers from the Census Bureau do not include cancellations - and cancellations are once again at record levels. Actual New Home inventories are probably much higher than reported - some estimate are about 20% higher.

This represents a supply of 7.8 months at the current sales rate.

It appears we are back to were sales are being revised down every month. As I noted last month, this probably indicates another downturn in the market. More later today on New Home Sales.

Wednesday, July 25, 2007

Citigroup Loves Piers

by Calculated Risk on 7/25/2007 08:17:00 PM

NOTE: Haloscan comments are acting up again. Please try refreshing the page if the posts do not display completely. Please accept my apologies for the poor performance of Haloscan.

We've been joking about short term bridge loans turning into "pier loans", and it appears Citigroup is the proud owner of many of these shiny new piers.

From the WSJ: Chrysler Throws Salt in Citigroup’s Wounds (hat tip Brian)

Citigroup is one of the banks that will ... be left holding the bag after investors took a pass on the sale of $10 billion of loans at Chrysler’s auto unit for the company’s leveraged buyout. ... It isn’t good news for either the banks or the buyout firms. There will come a point, if we aren’t there already, when banks refuse to make new loan commitments.That is a lot of piers.

...

Chatter among investment bankers lately has focused on Citigroup, which is said to be clamping down especially hard on making new loans. ... Citi has the misfortune of having been involved in a lot of the buyout loans that have soured lately, including Allison Transmission, U.S. Foodservice, Dollar General and ServiceMaster. It also has a role in three of the coming megadeals that still need to be financed: First Data, TXU and Clear Channel Communications.