by Calculated Risk on 7/06/2007 09:53:00 AM

Friday, July 06, 2007

Meritage Homes: Falling Revenue, Cancellations Increasing

"Weak demand and high inventory levels have increased competition among homebuilders, pressuring margins despite reductions in new home starts, lot supplies and operating costs."From a Meritage Homes press release on orders:

Steven J. Hilton, chairman and CEO of Meritage Homes.

Preliminary results for the quarter include approximately $569 million home closing revenue, $502 million home orders, and $1.2 billion ending backlog. These results represent declines of 37%, 28% and 39% from the second quarter of 2006 ...And on cancellations:

Cancellations rose to approximately 37% of gross orders for the quarter, compared to 32% in the second quarter 2006 and 27% in the first quarter 2007.

June Employment Report

by Calculated Risk on 7/06/2007 08:37:00 AM

The BLS reports: U.S. nonfarm payrolls rose by 132,000 in June, after a upward revised 190,000 gain in May. The unemployment rate was steady at 4.5% in June.  Click on graph for larger image.

Click on graph for larger image.

Here is the cumulative nonfarm job growth for Bush's 2nd term. The gray area represents the expected job growth (from 6 million to 10 million jobs over the four year term). Job growth has been solid for the last 2 1/2 years and is near the top of the expected range.

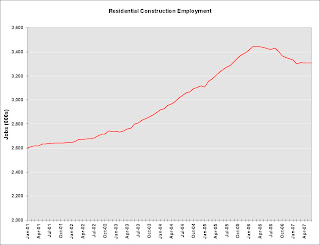

The following two graphs are the areas I've been watching closely: residential construction and retail employment.

Residential construction employment was flat in June, and including downward revisions to previous months, is down 135.3 thousand, or about 4.0%, from the peak in March 2006.

Note the scale doesn't start from zero: this is to better show the change in employment.

Retail employment lost 24,200 jobs in June. As the graph shows, retail employment has been fairly flat in recent months. YoY retail employment is slightly positive.

The expected reported job losses in residential construction employment still haven't happened, and any spillover to retail isn't apparent yet. With housing starts off over 30%, it's a puzzle why residential construction employment is only off about 4%.

Thursday, July 05, 2007

Wells Fargo Shuts Down Division

by Calculated Risk on 7/05/2007 06:37:00 PM

Here is an email Wells Fargo sent out last week. Note the shut down date was last Friday. I couldn't find any stories on this division (email via a reliable source):

If you have any loans that you would like to submit, they need to be sent by way of our Secured Document Delivery system ("SDD" e-mail address) into our Baton Rouge Operations Center and rec'd before 5 pm CT tomorrow, Friday, June 29th.

WELLS FARGO has decided not to continue operation of this division. However, we will be honoring the pipeline, and funding your loans for the next 60+ days. If you have questions about loans in process, purchase advice, etc… (info removed)

I will always be available by cell phone @ (phone number removed). This e-mail address will be "turned off" within the next 24 hours.

It was a pleasure doing business with you, I hope to do so in another capacity (WHEN this market turns back in our favor)

Troy Alexander

Correspondent Lending

WELLS FARGO Home Mortgage

(contact info removed)

...

For your protection, we remind you that this is an unsecured email service, which is not intended for sending confidential or sensitive information.

MarketWatch: Consumers are struggling

by Calculated Risk on 7/05/2007 05:45:00 PM

From Rex Nutting at MarketWatch: Consumers are struggling

Just when it appeared the U.S. economy would pick up steam after a year-long soft patch, the U.S. consumer is running out of gas.

The signs of stress are all around.

Prices are rising, but incomes and wealth aren't. With most households already overburdened with debt, consumers are being squeezed. There's only one thing to do, even though it goes against every fiber of their being: Cut back on expenses.

Kasriel: Housing Recession Starting to Strangle the Consumer

by Calculated Risk on 7/05/2007 04:13:00 PM

Northern Trust's Paul Kasriel writes: The Tentacles of the Housing Recession Are Beginning to Strangle the Consumer

Light motor vehicle sales in the U.S. dropped 3.4% month-to-month in June to a seasonally adjusted rate of 15.6 million units. Excluding the Katrina-depressed sales of September 2005, the June 2007 sales rate was the slowest since September 2002. Light motor vehicle sales have declined sequentially for six consecutive months. On a quarterly average basis, new light motor vehicle sales contracted at an annual rate of 12.7% in Q2 vs. a 6.2% increase in Q1. Although not all of the Q2 decrease will show up as a subtraction to consumer spending (some will subtract from business capex), there are other indications that consumer spending is flagging. As mentioned in our June 26 daily commentary, "So, the Housing Recession Is Contained?", a number of retailers in the discretionary consumer spending “space” have recently reported disappointing sales and have lowered sales guidance. Corroborating these individual retailers’ reports are the Johnson Redbook retail sales survey results for June ... retailing activity tailed off significantly in June. The April-May average of real personal consumption expenditures was up only 1.3% at an annual rate vs. its Q1 average. The June data on light motor vehicle sales and chain store sales are not pointing to an acceleration. The question the markets and the Fed will be wresting with over the remainder of summer is whether the sharp deceleration in Q2 real consumer spending is a one-off event or something with more longevity. My bet is the latter. The ongoing housing recession is sharply reducing one source of funding for household deficit spending – mortgage equity withdrawal (MEW). The continued decline in home prices and the tightening of mortgage underwriting standards will exacerbate the drying up of MEW. Job growth also is trending lower, which will restrain future consumer spending. Slowly but surely, the tentacles of the housing recession are strangling the consumer.As I asked last week, is the Q2 consumer slowdown related to the housing slump? Kasriel believes it is.

The economy is somewhat schizophrenic right now. Just look at the positive growth stories I posted this AM on ISM services, office rents and employment. And last week, Dr. Altig highlighted the positive ISM manufacturing report and detailed the current fairly positive consensus economic view for the second half of '07.

My view is:

1) Housing appears to be taking another down turn right now, and I expect residential investment to continue to decline.

2) The pickup in manufacturing appears to be due somewhat to exports and mostly because of an inventory correction. The inventory correction appears to be mostly over, and I'd expect less growth from manufacturing going forward.

3) Non-residential structure investment has been very strong this year, but I believe it will slow down later this year.

4) I think it is very likely that Kasriel is correct, and that the Q2 consumption slowdown is related to the housing slump. Since the housing slump is ongoing, and MEW will continue to decline, I expect weak consumer spending in the second half of '07.

When I add it all up, it seems to spell the R-word (or at least very sluggish growth in H2 '07). Maybe non-residential structure investment will stay strong. Maybe consumer spending will rebound in Q3. Maybe ...

"Soaring" Office Rents

by Calculated Risk on 7/05/2007 02:06:00 PM

From the WSJ: Soaring Rents Pinch Businesses Across the U.S.

Nationwide, effective rents on office properties -- the amount tenants pay after concessions -- jumped an average of 3.1% during this year's second quarter, up from gains of 2.8% in the first quarter and 2.1% in the year-earlier period, according to a report scheduled for release today by real-estate research firm Reis Inc.Just a few months ago, CB Richard Ellis reported that vacancy rates were rising:

That was the sharpest quarterly increase since the third quarter of 2000 ...

The U.S. office vacancy rate rose in the first quarter, according to CB Richard Ellis. ... The rate was 12.8 percent in the first quarter, up from 12.6 percent the previous quarter.And, in April, the WSJ reported that office absorption was "sluggish". According to the WSJ, Q1 office space absorption rate was about 8 to 10 million square feet per quarter, but "... developers will open 76 million square feet of new office space by the end of this year."

But today's report suggests absorption picked up in Q2:

Meanwhile, demand for office space has been growing. Net absorption -- a measure of the space taken up by commercial tenants -- increased markedly during the latest quarter, a sign that the economy is producing more office jobs, says Sam Chandan, chief economist for Reis. Nationwide, the office-vacancy rate, at 12.7%, is the lowest since the third quarter of 2001.One of the keys to economic growth in the second half of '07 is investment in non-residential structures. It is possible that the big investment slump in the early '00s has left many markets with too little supply of commercial and office buildings (and other non-residential structures). So, even though the typical pattern is for non-residential investment to follow residential investment by 5 or so quarters, it is possible that investment in non-residential structures will decouple (at least somewhat) from the typical pattern - and remain strong throughout '07.