by Calculated Risk on 6/26/2007 05:00:00 PM

Tuesday, June 26, 2007

JPMorgan: Planned CDO Sales Dry Up Amid Bailout

From Bloomberg: Planned CDO Sales Dry Up Amid Bailout, JPMorgan Says (hat tip Brian)

Planned sales of collateralized debt obligations backed mainly by subprime mortgages are drying up and may shut down amid concerns about the integrity of the market following the near collapse of hedge funds run by Bear Stearns Cos., JPMorgan Chase & Co. said.No wonder Dr. Altig asks: What's That Unpleasant Sound?

The amount of U.S. high-grade, structured finance CDOs that are being offered to investors has plunged to $3 billion, from $20 billion a month ago ...

"We expect events surrounding warehousing liquidations last week to further slow, if not halt entirely, the new issue market," JPMorgan analysts led by Chris Flanagan in New York said in the report.

...

The damage to the $1 trillion CDO market could freeze what has been a large source of liquidity for the credit markets, Tim Backshall, chief strategist at Credit Derivatives Research LLC, said yesterday.

According to Lombard Street Research, it's a credit crunch. From the U.K. Telegraph:Altig is rightly skeptical of the report, but I do think the sector specific credit crunch is definitely getting more severe, and might expand to other sectors (like M&A loans and CRE investments).The United States faces a severe credit crunch as mounting losses on risky forms of debt catch up with the banks and force them to curb lending and call in existing loans, according to a report by Lombard Street Research.

More on May New Home Sales

by Calculated Risk on 6/26/2007 03:32:00 PM

For more graphs, please see my earlier post: May New Home Sales Click on graph for larger image.

Click on graph for larger image.

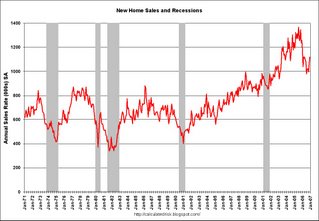

The first graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession in the months ahead.

For Fun: Here is the same graph after the December 2006 sales were reported just a few months ago. The housing bust was "over". Not! The bounce back was revised away.

Once again, this reminds us to take the "just reported" data with a grain of salt. As reported this morning, much of the surprise "bounce back" in April has already been revised away.

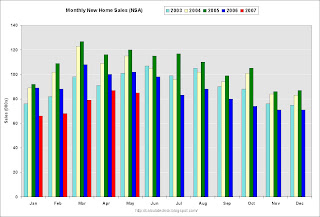

The third graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through April.

Typically, for an average year, about 44% of all new home sales happen before the end of May. At the current pace, new home sales for 2007 will probably be under 900 thousand - about the same level as the late '90s. This is significantly below the forecasts of even many bearish forecasters.

As a final note, this puts total reported inventory at a record 4.967 million units (4.431 existing homes and 0.536 new homes).

Bear Stearns: A Brat Sneers

by Anonymous on 6/26/2007 02:08:00 PM

Instead of writing intellectually-serious posts that provide cogent analyses of financial and economic issues of profound import, I've been playing on the internet. And I found this, the Internet Anagram Server.

So I had to test it by typing in "Bear Stearns."

Bareness Rat. Bean Arrests. Barren Asset. Banes Raters. Absent Rears. Barest Snare. Bases Errant. Barn Teasers. Bars Nearest. Stabs Earner. Baa Nests Err. Bare Ass Rent. Betas An Errs. (I left out all the ones with "breast" and "bra" because this is a family blog.)

Enjoy yourself, from Data Click Rules (a/k/a A Crack Duellist).

BONG HiTS 4 BILL GROSS!

by Anonymous on 6/26/2007 12:00:00 PM

I want some of of what the man is smoking:

Well prudence and rating agency standards change with the times, I suppose. What was chaste and AAA years ago may no longer be the case today. Our prim remembrance of Gidget going to Hawaii and hanging out with the beach boys seems to have been replaced in this case with an image of Heidi Fleiss setting up a floating brothel in Beverly Hills. AAA? You were wooed Mr. Moody’s and Mr. Poor’s by the makeup, those six-inch hooker heels, and a “tramp stamp.” Many of these good looking girls are not high-class assets worth 100 cents on the dollar. And sorry Ben, but derivatives are a two-edged sword. Yes, they diversify risk and direct it away from the banking system into the eventual hands of unknown buyers, but they multiply leverage like the Andromeda strain. When interest rates go up, the Petri dish turns from a benign experiment in financial engineering to a destructive virus because the cost of that leverage ultimately reduces the price of assets. Houses anyone?

If I followed all that, somebody just got called a ho.

But look at it this way: using the current default rate of 7% (3-4% total losses), the holders of some BBB investment grade subprime-based CDOs will lose all of their moolah because of the significant leverage. No need to worry about fictitious 100 cents on the dollar marks here. One hundred percent of nothing equals nothing. If subprime total losses hit 10% then even some single-A tranches face the grim reaper. AAA’s? Folks the point is that there are hundreds of billions of dollars of this toxic waste and whether or not they’re in CDOs or Bear Stearns hedge funds matters only to the extent of the timing of the unwind. To death and taxes you can add this to your list of inevitabilities: the subprime crisis is not an isolated event and it won’t be contained by a few days of headlines in The New York Times.

Wow. Maybe Mr. Gross should take a yoga class. He sounds a little stressed out.

May New Home Sales

by Calculated Risk on 6/26/2007 10:10:00 AM

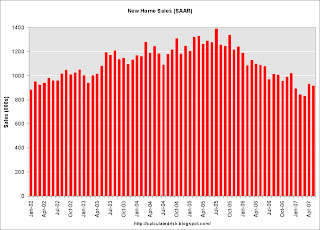

According to the Census Bureau report, New Home Sales in May were at a seasonally adjusted annual rate of 915 thousand. Sales for April were revised down significantly to 930 thousand, from 981 thousand. Numbers for February and March were also revised down.

Click on Graph for larger image.

Sales of new one-family houses in May 2007 were at a seasonally adjusted annual rate of 915,000 ... This is 1.6 percent below the revised April rate of 930,000 and is 15.8 percent below the May 2006 estimate of 1,087,000.

The Not Seasonally Adjusted monthly rate was 85,000 New Homes sold. There were 102,000 New Homes sold in May 2006.

May '07 sales were the lowest May since 2001 (80,000).

The median and average sales prices were up. Caution should be used when analyzing monthly price changes since prices are heavily revised.

The median sales price of new houses sold in May 2007 was $236,100; the average sales price was $313,000.

The seasonally adjusted estimate of new houses for sale at the end of May was 536,000.

The 536,000 units of inventory is slightly below the levels of the last year. Inventory for the previous months were revised up slightly. For April, the inventory was initially reported at 532,000 (so May would show an increase), but was revised up to 542,000 (so May shows a slight decrease).

Inventory numbers from the Census Bureau do not include cancellations - and cancellations are at record levels. Actual New Home inventories are much higher - some estimate about 20% higher.

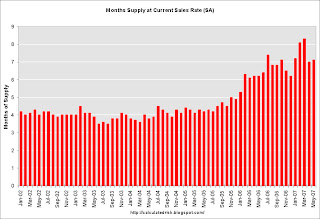

This represents a supply of 7.1 months at the current sales rate.

The large downward revision for April removed some of the strength from April's report. It appears we are back to were sales are being revised down every month - probably indicating another downturn in the market - and I expect the trend to continue. More later today on New Home Sales.

BONG HiTS 4 BEAR*

by Anonymous on 6/26/2007 07:55:00 AM

Gretchen Morgenson on the Everquest IPO. Being the vicious nasty blogger with no redeeming social qualities that I am, I must take the opportunity to point out that I have no idea how accurate this reporting on the Everquest deal is, but sentences like this do not raise my confidence level:

The funds that sold the securities to Everquest invested in big pools of loans backed by home mortgages, known as collateralized debt obligations.

"Pools of loans backed by home mortgages"? I'm drinking some good coffee this morning--for which I have our generous tippers to thank--but I don't think there's enough coffee in the continental U.S. to make that sentence mean anything. I believe the linguists call it "word salad."

That doesn't mean that the rest of the reporting is equally confused, of course, but then again it makes me tread cautiously. UberNerds 4 Warned.

*Dear Chief Justice Roberts: the title of this post is not an "incitement to imminent lawless action." It is a "joke." And you people can't throw my sorry little butt out of high school because I've already got my diploma and I don't need you anymore.