by Calculated Risk on 8/07/2015 09:52:00 AM

Friday, August 07, 2015

July Employment Report Comments and more Graphs

Earlier: July Employment Report: 215,000 Jobs, 5.3% Unemployment Rate

This was a solid employment report with 215,000 jobs added, and employment gains for May and June were revised up slightly.

There was even a little wage growth, from the BLS: "In July, average hourly earnings for all employees on private nonfarm payrolls rose by 5 cents to $24.99. Over the year, average hourly earnings have risen by 2.1 percent." Weekly hours increased slightly in July.

A few more numbers: Total employment increased 215,000 from June to July and is now 3.7 million above the previous peak. Total employment is up 12.4 million from the employment recession low.

Private payroll employment increased 210,000 from June to July, and private employment is now 4.2 million above the previous peak. Private employment is up 13.0 million from the recession low.

In July, the year-over-year change was just over 2.9 million jobs.

Note: The unemployment rate at 5.3%, and still little real wage growth - and a higher than normal level of people working part time for economic reasons - indicates slack in the labor market. My view, partially based on demographics, is that the unemployment rate can fall below 5% without a significant pickup in inflation.

Overall this was a solid report.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate declined in July to 80.7%, and the 25 to 54 employment population ratio declined to 77.1%. As the recovery continues, I expect the participation rate for this group to increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth increased 2.1% YoY - and although the series is noisy - it does appear wage growth is trending up a little. Wages will probably pick up a little more this year.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in July at 6.3 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons decreased in July to 6.32 million from 6.51 million in June. This is the lowest level since Sept 2008 and suggests slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 10.4% in July (lowest level since June 2008).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.18 million workers who have been unemployed for more than 26 weeks and still want a job. This was up slightly from 2.12 million in June.

This is trending down, but is still high.

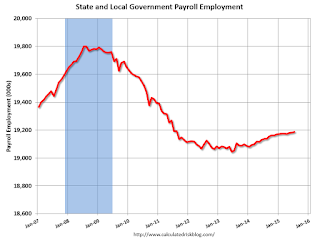

State and Local Government

This graph shows total state and government payroll employment since January 2007. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. (Note: Scale doesn't start at zero to better show the change.) In July 2015, state and local governments added five thousand jobs. State and local government employment is now up 145,000 from the bottom, but still 613,000 below the peak.

State and local employment is now generally increasing - slowly. And Federal government layoffs appear to have ended (Federal payrolls were unchanged in July, and Federal employment is up 3,000 year-to-date).

Overall this was a solid employment report for July and indicates further improvement in the labor market.

July Employment Report: 215,000 Jobs, 5.3% Unemployment Rate

by Calculated Risk on 8/07/2015 08:44:00 AM

From the BLS:

Total nonfarm payroll employment increased by 215,000 in July, and the unemployment rate was unchanged at 5.3 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in retail trade, health care, professional and technical services, and financial activities.

...

The change in total nonfarm payroll employment for May was revised from +254,000 to +260,000, and the change for June was revised from +223,000 to +231,000. With these revisions, employment gains in May and June combined were 14,000 higher than previously reported.

...

In July, average hourly earnings for all employees on private nonfarm payrolls rose by 5 cents to $24.99. Over the year, average hourly earnings have risen by 2.1 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 215 thousand in July (private payrolls increased 210 thousand).

Payrolls for May and June were revised up by a combined 14 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In July, the year-over-year change was over 2.9 million jobs.

That is a solid year-over-year gain.

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate was unchanged in July at 62.6%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.3% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in July at 5.3%.

This was slightly above expectations of 212,000 jobs, and revisions were up, and some wage growth ... a solid report.

I'll have much more later ...

Thursday, August 06, 2015

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 8/06/2015 06:37:00 PM

From Goldman Sachs:

We forecast nonfarm payroll growth of 225k in July, in line with consensus expectations. Many labor market indicators were softer in July, but some important service sector indicators, such as ISM nonmanufacturing employment, were significantly stronger. On balance, we expect job growth roughly consistent with the 223k increase in June. We expect the unemployment rate to hold steady at 5.3%. Participation should at least partially rebound following an unexpected dip in June that likely reflected calendar effects. Finally, average hourly earnings are likely to rise 0.2% month-over-month in July.From Merrill Lynch:

We expect a solid 215,000 gain in payrolls and a 0.3% rise in average hourly earnings. The unemployment rate should hold steady at 5.3%.From Nomura:

[W]e forecast a 225k increase in private payrolls, with a 5k increase in government jobs, implying that total nonfarm payrolls will gain 230k workers. ... We forecast that average hourly earnings for private employees rose by 0.24% m-o-m in July, bouncing back from the weak flat reading in June. Last, we expect the unemployment rate to remain unchanged at 5.3% as the drop in labor force participation in June appeared anomalous and could show some rebound in July.Friday:

• At 8:30 AM ET, the Employment Report for July. The consensus is for an increase of 212,000 non-farm payroll jobs added in July, down from the 223,000 non-farm payroll jobs added in June. The consensus is for the unemployment rate to be unchanged at 5.3%.

• At 3:00 PM, Consumer Credit for June from the Federal Reserve. The consensus is for an increase of $17.4 billion in credit.

Payroll Employment and Seasonal Factors

by Calculated Risk on 8/06/2015 03:10:00 PM

The seasonal adjustment for July is a little tricky, so this might be a good time to review the seasonal pattern for employment.

Even in the best of years there are a significant number of jobs lost in the months of January and July. In 1994, when the economy added almost 3.9 million jobs, there were 2.25 million lost in January 1994 Not Seasonally Adjusted (NSA), and almost 1 million payroll jobs lost in July of that year (NSA).

Last year, in July 2014, 1.11 million total jobs were lost (NSA), however all of the decline in non-farm payrolls NSA was from the public sector (teacher layoffs). Usually those teachers return to the payrolls in September and early October. Since this happens every year, the BLS applies a seasonal adjustment before reporting the headline number.

Although there were 1.11 million jobs lost in July 2014 (NSA), after the seasonal adjustment, the BLS reported 209 thousand non-farm jobs were added (SA) .

For the private sector, there are always a large number of jobs lost in January (retailers and others cutting jobs) and some jobs lost in September (summer hires let go).

This graph shows the seasonal pattern since 2002 for both total non-farm jobs and private sector only payroll jobs. Notice the large spike down every January.

Also notice the second large spike down every July for public sector jobs (teachers).

In July 2014, there are about 1.3 million teacher jobs lost (NSA), and that was seasonally adjusted to a 5 thousand job gain. This will be something to check in the jobs report tomorrow.

The key point is this series needs a seasonal adjustment, but the adjustment can be tricky.

Preview: Employment Report for July

by Calculated Risk on 8/06/2015 12:14:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus, according to Bloomberg, is for an increase of 212,000 non-farm payroll jobs in July (with a range of estimates between 210,000 to 262,000), and for the unemployment rate to be unchanged at 5.3%.

The BLS reported 223,000 jobs added in June.

Here is a summary of recent data:

• The ADP employment report showed an increase of 185,000 private sector payroll jobs in July. This was below expectations of 210,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index decreased in July to 52.7%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 5,000 in July. The ADP report indicated a 2,000 increase for manufacturing jobs.

The ISM non-manufacturing employment index increased in July to 59.6%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 330,000 in July. This employment reading was unusually strong, and the correlation might not be as useful.

Combined, the ISM indexes suggests employment gains of 325,000. This suggests employment growth well above expectations.

• Initial weekly unemployment claims averaged close to 275,000 in July, about the same as in June. For the BLS reference week (includes the 12th of the month), initial claims were at 255,000; down from 268,000 during the reference week in June.

This suggests a lower level of layoffs in July.

• The final July University of Michigan consumer sentiment index decreased to 93.1 from the June reading of 96.1. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like gasoline prices.

• On small business hiring: The small business index from Intuit showed a 10,000 increase in small business employment in July, lower than in June. From Intuit: Small Businesses Employment Increases in June

Small business employment rose by 10,000 jobs in July, an annual rate of 0.5 percent. However, Susan Woodward, the economist who works with Intuit to produce the indexes, said this is slower than the growth rate of 1.0 percent over the past year.• Trim Tabs reported that the U.S. economy added 268,000 jobs in July. Note: "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 142 million U.S. workers subject to withholding."

“Small business employment is still 2.3 percent below its pre-recession peak,” said Woodward. “The continued low level of construction employment, which is 17.5 percent below the pre-recession peak in mid-2006, accounts for the slow rate of small business recovery.

“A sign of continuing recovery in small business activity is the hiring rate, which has risen slowly but steadily since July 2009. An increase in the hiring rate reflects improved opportunities for workers,” Woodward said.

• Conclusion: Unfortunately none of the indicators above is very good at predicting the initial BLS employment report. And the data was mixed.

There were several weaker indicators such the ADP report, ISM manufacturing, and small business hiring.

The ISM non-manufacturing, TrimTabs, and the low level of unemployment claims for the BLS reference week, all suggest a stronger report.

Historically the initial report for July tends to be weak, and I'll take the under on the consensus this month.