by Calculated Risk on 8/06/2015 08:33:00 AM

Thursday, August 06, 2015

Weekly Initial Unemployment Claims increased to 270,000

The DOL reported:

In the week ending August 1, the advance figure for seasonally adjusted initial claims was 270,000, an increase of 3,000 from the previous week's unrevised level of 267,000. The 4-week moving average was 268,250, a decrease of 6,500 from the previous week's unrevised average of 274,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 268,250.

This was lower than the consensus forecast of 273,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, August 05, 2015

Q2 2015 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 8/05/2015 08:01:00 PM

The BEA released the underlying details for the Q2 advance GDP report today.

Last Thursday, the BEA reported that investment in non-residential structures decreased slightly in Q2.

The decline was due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration declined from a $112.5 billion annual rate in Q1 to a $81.1 billion annual rate in Q2.

Excluding petroleum, non-residential investment in structures increased at a 6.8% annual rate in Q2 (solid growth).

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased a little recently, but from a very low level.

Investment in offices increased in Q2, is down about 33% from the recent peak (as a percent of GDP) and increasing from a very low level - and is still below the lows for previous recessions (as percent of GDP). .

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 54% from the peak. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased in Q2, and with the hotel occupancy rate near record levels, it is likely that hotel investment will increase further in the near future. Lodging investment peaked at 0.31% of GDP in Q3 2008 and is down about 57%.

Investment in single family structures is now back to being the top category for residential investment. Home improvement was the top category for twenty consecutive quarters following the housing bust ... but now investment in single family structures has been back on top for the last 7 quarters and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $210 billion (SAAR) (almost 1.2% of GDP).

Investment in home improvement was at a $176 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (just under 1.0% of GDP).

These graphs show investment is generally increasing, but is still very low.

Phoenix Real Estate in July: Sales Up 17%, Inventory DOWN 15% Year-over-year

by Calculated Risk on 8/05/2015 04:10:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

For the eight consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from last year.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in July were up 16.6% year-over-year.

2) Cash Sales (frequently investors) were down to 21.9% of total sales.

3) Active inventory is now down 15.3% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

Now, with falling inventory, prices might increase a little faster in 2015 (something to watch if inventory continues to decline). Prices are already up 2.1% through May (increasing faster than in 2014).

| July Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Jul-08 | 5,9741 | --- | --- | --- | 54,5272 | --- |

| Jul-09 | 9,095 | 52.2% | 3,269 | 35.9% | 38,024 | ---2 |

| Jul-10 | 7,101 | -21.9% | 2,901 | 40.9% | 42,887 | 12.8% |

| Jul-11 | 8,397 | 18.3% | 3,779 | 45.0% | 27,663 | -35.5% |

| Jul-12 | 7,152 | -14.8% | 3,214 | 44.9% | 20,384 | -26.3% |

| Jul-13 | 8,214 | 14.8% | 2,944 | 35.8% | 20,049 | -1.6% |

| Jul-14 | 6,790 | -17.3% | 1,681 | 24.8% | 27,081 | 35.1% |

| Jul-15 | 7,915 | 16.6% | 1,731 | 21.9% | 22,940 | -15.3% |

| 1 July 2008 does not include manufactured homes, ~100 more 2 July 2008 Inventory includes pending | ||||||

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in June

by Calculated Risk on 8/05/2015 01:45:00 PM

Economist Tom Lawler sent me an updated table below of short sales, foreclosures and cash buyers for selected cities in June.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Baltimore is up because of an increase in foreclosures).

Short sales are down in all of these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

As Lawler noted earlier: The Baltimore Metro area is included in the overall Mid-Atlantic region (covered by MRIS). Baltimore is also shown separately because a large portion of the YOY increase in the foreclosure share of home sales in the Mid-Atlantic region was attributable to the significant increase in foreclosure sales in the Baltimore Metro area.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | |

| Las Vegas | 6.7% | 10.8% | 7.6% | 10.1% | 14.3% | 20.9% | 28.4% | 34.7% |

| Reno** | 5.0% | 10.0% | 3.0% | 7.0% | 8.0% | 17.0% | ||

| Phoenix | 2.8% | 3.8% | 3.6% | 6.2% | 6.4% | 10.0% | 23.0% | 26.6% |

| Sacramento | 5.8% | 7.0% | 4.6% | 6.5% | 10.4% | 13.6% | 17.8% | 19.8% |

| Minneapolis | 2.0% | 3.0% | 5.6% | 9.7% | 7.6% | 12.7% | ||

| Mid-Atlantic | 3.1% | 4.8% | 8.7% | 7.4% | 11.7% | 12.2% | 15.2% | 16.5% |

| Baltimore MSA**** | 3.1% | 4.3% | 14.3% | 10.7% | 17.4% | 15.0% | 20.7% | 19.8% |

| Orlando | 3.7% | 7.8% | 24.9% | 26.5% | 28.6% | 34.3% | 35.7% | 40.5% |

| Tampa MSA SF | 3.7% | 6.4% | 17.4% | 21.3% | 21.1% | 27.6% | 33.1% | 36.3% |

| Tampa MSA C/TH | 2.5% | 4.2% | 12.1% | 17.0% | 14.6% | 21.2% | 57.1% | 60.4% |

| Miami MSA SF | 5.8% | 8.7% | 17.1% | 17.6% | 22.9% | 26.3% | 34.9% | 41.9% |

| Miami MSA C/TH | 2.9% | 5.3% | 19.2% | 19.6% | 22.2% | 24.8% | 63.1% | 68.9% |

| Florida SF | 3.4% | 5.9% | 16.5% | 20.3% | 20.0% | 26.2% | 33.4% | 39.3% |

| Florida C/TH | 2.4% | 4.4% | 14.6% | 17.5% | 17.1% | 21.9% | 60.9% | 65.8% |

| Bay Area CA* | 2.1% | 3.0% | 1.9% | 2.8% | 4.0% | 5.8% | 20.0% | 21.6% |

| So. California* | 3.1% | 4.6% | 3.8% | 4.7% | 6.9% | 9.3% | 22.3% | 25.9% |

| Chicago (city) | 12.4% | 18.7% | ||||||

| Hampton Roads | 16.6% | 20.1% | ||||||

| Northeast Florida | 25.6% | 32.4% | ||||||

| Spokane | 10.7% | 14.1% | ||||||

| Tucson | 25.1% | 26.1% | ||||||

| Toledo | 27.0% | 28.4% | ||||||

| Wichita | 21.9% | 22.6% | ||||||

| Des Moines | 14.4% | 14.6% | ||||||

| Peoria | 16.1% | 21.3% | ||||||

| Georgia*** | 20.3% | 24.6% | ||||||

| Omaha | 14.6% | 16.3% | ||||||

| Pensacola | 31.6% | 30.5% | ||||||

| Knoxville | 18.9% | 22.9% | ||||||

| Richmond VA MSA | 7.1% | 9.7% | 13.8% | 16.1% | ||||

| Memphis | 11.4% | 12.4% | ||||||

| Springfield IL** | 5.1% | 8.4% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS ****Baltimore is included in the Mid-Atlantic region, but is shown separately here | ||||||||

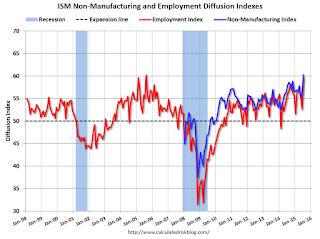

ISM Non-Manufacturing Index increased to 60.3% in July

by Calculated Risk on 8/05/2015 10:17:00 AM

The July ISM Non-manufacturing index was at 60.3%, up from 56.0% in June. The employment index increased in July to 59.6%,up from 52.7% in June. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: July 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in July for the 66th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 60.3 percent in July, 4.3 percentage points higher than the June reading of 56 percent. This represents continued growth in the non-manufacturing sector at a faster rate. The Non-Manufacturing Business Activity Index increased to 64.9 percent, which is 3.4 percentage points higher than the June reading of 61.5 percent, reflecting growth for the 72nd consecutive month at a faster rate. The New Orders Index registered 63.8 percent, 5.5 percentage points higher than the reading of 58.3 percent registered in June. The Employment Index increased 6.9 percentage points to 59.6 percent from the June reading of 52.7 percent and indicates growth for the 17th consecutive month. The Prices Index increased 0.7 percentage point from the June reading of 53 percent to 53.7 percent, indicating prices increased in July for the fifth consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in July. The majority of the respondents continue to have a positive outlook on business conditions and the overall economy. This is reflected directly by a number of new highs for some of the indexes." "

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was well above the consensus forecast of 56.2% and suggests much faster expansion in July than in June. Very strong.