by Calculated Risk on 8/05/2015 04:10:00 PM

Wednesday, August 05, 2015

Phoenix Real Estate in July: Sales Up 17%, Inventory DOWN 15% Year-over-year

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

For the eight consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from last year.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in July were up 16.6% year-over-year.

2) Cash Sales (frequently investors) were down to 21.9% of total sales.

3) Active inventory is now down 15.3% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

Now, with falling inventory, prices might increase a little faster in 2015 (something to watch if inventory continues to decline). Prices are already up 2.1% through May (increasing faster than in 2014).

| July Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Jul-08 | 5,9741 | --- | --- | --- | 54,5272 | --- |

| Jul-09 | 9,095 | 52.2% | 3,269 | 35.9% | 38,024 | ---2 |

| Jul-10 | 7,101 | -21.9% | 2,901 | 40.9% | 42,887 | 12.8% |

| Jul-11 | 8,397 | 18.3% | 3,779 | 45.0% | 27,663 | -35.5% |

| Jul-12 | 7,152 | -14.8% | 3,214 | 44.9% | 20,384 | -26.3% |

| Jul-13 | 8,214 | 14.8% | 2,944 | 35.8% | 20,049 | -1.6% |

| Jul-14 | 6,790 | -17.3% | 1,681 | 24.8% | 27,081 | 35.1% |

| Jul-15 | 7,915 | 16.6% | 1,731 | 21.9% | 22,940 | -15.3% |

| 1 July 2008 does not include manufactured homes, ~100 more 2 July 2008 Inventory includes pending | ||||||

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in June

by Calculated Risk on 8/05/2015 01:45:00 PM

Economist Tom Lawler sent me an updated table below of short sales, foreclosures and cash buyers for selected cities in June.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Baltimore is up because of an increase in foreclosures).

Short sales are down in all of these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

As Lawler noted earlier: The Baltimore Metro area is included in the overall Mid-Atlantic region (covered by MRIS). Baltimore is also shown separately because a large portion of the YOY increase in the foreclosure share of home sales in the Mid-Atlantic region was attributable to the significant increase in foreclosure sales in the Baltimore Metro area.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | |

| Las Vegas | 6.7% | 10.8% | 7.6% | 10.1% | 14.3% | 20.9% | 28.4% | 34.7% |

| Reno** | 5.0% | 10.0% | 3.0% | 7.0% | 8.0% | 17.0% | ||

| Phoenix | 2.8% | 3.8% | 3.6% | 6.2% | 6.4% | 10.0% | 23.0% | 26.6% |

| Sacramento | 5.8% | 7.0% | 4.6% | 6.5% | 10.4% | 13.6% | 17.8% | 19.8% |

| Minneapolis | 2.0% | 3.0% | 5.6% | 9.7% | 7.6% | 12.7% | ||

| Mid-Atlantic | 3.1% | 4.8% | 8.7% | 7.4% | 11.7% | 12.2% | 15.2% | 16.5% |

| Baltimore MSA**** | 3.1% | 4.3% | 14.3% | 10.7% | 17.4% | 15.0% | 20.7% | 19.8% |

| Orlando | 3.7% | 7.8% | 24.9% | 26.5% | 28.6% | 34.3% | 35.7% | 40.5% |

| Tampa MSA SF | 3.7% | 6.4% | 17.4% | 21.3% | 21.1% | 27.6% | 33.1% | 36.3% |

| Tampa MSA C/TH | 2.5% | 4.2% | 12.1% | 17.0% | 14.6% | 21.2% | 57.1% | 60.4% |

| Miami MSA SF | 5.8% | 8.7% | 17.1% | 17.6% | 22.9% | 26.3% | 34.9% | 41.9% |

| Miami MSA C/TH | 2.9% | 5.3% | 19.2% | 19.6% | 22.2% | 24.8% | 63.1% | 68.9% |

| Florida SF | 3.4% | 5.9% | 16.5% | 20.3% | 20.0% | 26.2% | 33.4% | 39.3% |

| Florida C/TH | 2.4% | 4.4% | 14.6% | 17.5% | 17.1% | 21.9% | 60.9% | 65.8% |

| Bay Area CA* | 2.1% | 3.0% | 1.9% | 2.8% | 4.0% | 5.8% | 20.0% | 21.6% |

| So. California* | 3.1% | 4.6% | 3.8% | 4.7% | 6.9% | 9.3% | 22.3% | 25.9% |

| Chicago (city) | 12.4% | 18.7% | ||||||

| Hampton Roads | 16.6% | 20.1% | ||||||

| Northeast Florida | 25.6% | 32.4% | ||||||

| Spokane | 10.7% | 14.1% | ||||||

| Tucson | 25.1% | 26.1% | ||||||

| Toledo | 27.0% | 28.4% | ||||||

| Wichita | 21.9% | 22.6% | ||||||

| Des Moines | 14.4% | 14.6% | ||||||

| Peoria | 16.1% | 21.3% | ||||||

| Georgia*** | 20.3% | 24.6% | ||||||

| Omaha | 14.6% | 16.3% | ||||||

| Pensacola | 31.6% | 30.5% | ||||||

| Knoxville | 18.9% | 22.9% | ||||||

| Richmond VA MSA | 7.1% | 9.7% | 13.8% | 16.1% | ||||

| Memphis | 11.4% | 12.4% | ||||||

| Springfield IL** | 5.1% | 8.4% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS ****Baltimore is included in the Mid-Atlantic region, but is shown separately here | ||||||||

ISM Non-Manufacturing Index increased to 60.3% in July

by Calculated Risk on 8/05/2015 10:17:00 AM

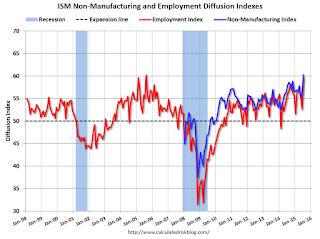

The July ISM Non-manufacturing index was at 60.3%, up from 56.0% in June. The employment index increased in July to 59.6%,up from 52.7% in June. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: July 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in July for the 66th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 60.3 percent in July, 4.3 percentage points higher than the June reading of 56 percent. This represents continued growth in the non-manufacturing sector at a faster rate. The Non-Manufacturing Business Activity Index increased to 64.9 percent, which is 3.4 percentage points higher than the June reading of 61.5 percent, reflecting growth for the 72nd consecutive month at a faster rate. The New Orders Index registered 63.8 percent, 5.5 percentage points higher than the reading of 58.3 percent registered in June. The Employment Index increased 6.9 percentage points to 59.6 percent from the June reading of 52.7 percent and indicates growth for the 17th consecutive month. The Prices Index increased 0.7 percentage point from the June reading of 53 percent to 53.7 percent, indicating prices increased in July for the fifth consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in July. The majority of the respondents continue to have a positive outlook on business conditions and the overall economy. This is reflected directly by a number of new highs for some of the indexes." "

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was well above the consensus forecast of 56.2% and suggests much faster expansion in July than in June. Very strong.

Trade Deficit increased in June to $43.8 Billion

by Calculated Risk on 8/05/2015 08:39:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $43.8 billion in June, up $2.9 billion from $40.9 billion in May, revised. June exports were $188.6 billion, $0.1 billion less than May exports. June imports were $232.4 billion, $2.8 billion more than May imports.The trade deficit was close to the consensus forecast of $43.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through June 2015.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports were mostly unchanged in June.

Exports are 14% above the pre-recession peak and down 4% compared to June 2014; imports are at the pre-recession peak, and down 2% compared to June 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).Oil imports averaged $53.76 in June, up from $50.76 in May, and down from $96.41 in June 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $31.5 billion in June, from $30.1 billion in June 2014. The deficit with China is a large portion of the overall deficit.

ADP: Private Employment increased 185,000 in July

by Calculated Risk on 8/05/2015 08:19:00 AM

Private sector employment increased by 185,000 jobs from June to July according to the June [July] ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 210,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 8,000 jobs in July, after adding 13,000 in June. The construction industry added 15,000 jobs in July, down from 17,000 last month. Meanwhile, manufacturing added 2,000 jobs in July, after gaining 9,000 in June.

Service-providing employment rose by 178,000 jobs in July, down from 216,000 in June. month. The 19,000 new jobs added in financial activities was an increase from last month’s 12,000. ...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth is strong, but it has moderated since the beginning of the year. Layoffs in the energy industry and weaker job gains in manufacturing are behind the slowdown. Nonetheless, even at this slower pace of growth, the labor market is fast approaching full employment.”

The BLS report for July will be released Friday, and the consensus is for 212,000 non-farm payroll jobs added in July.