by Calculated Risk on 7/23/2015 11:00:00 AM

Thursday, July 23, 2015

Kansas City Fed: Regional Manufacturing Activity Declined Again in July

From the Kansas City Fed: Tenth District Manufacturing Activity Declined Again

The Federal Reserve Bank of Kansas City released the July Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined again in July but less so than in previous months.Some of this recent decline in the Kansas City region has been due to lower oil prices.

“Our headline index was closer to zero than in May or June but was still negative, indicating further contraction in regional factory activity. However, firms expect a modest pickup in activity in coming months.”

...

Tenth District manufacturing activity declined again in July, but less so than in previous months. Producers’ remained slightly optimistic about future activity, although the majority of contacts indicated difficulties finding qualified labor. Most price indexes indicated continued rising prices, but the rate of increase slowed a bit for raw materials.

The month-over-month composite index was -7 in July, up from -9 in June and -13 in May ... the new orders index eased from -3 to -6, and the employment index dropped to its lowest level since April 2009, with many firms noting difficulties finding qualified workers.

emphasis added

Chicago Fed: Index shows "Economic Growth Picked Up Slightly in June"

by Calculated Risk on 7/23/2015 09:48:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Growth Picked Up Slightly in June

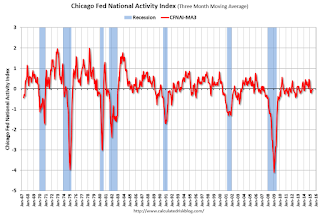

Led by improvements in production- and employment-related indicators, the Chicago Fed National Activity Index (CFNAI) moved up to +0.08 in June from –0.08 in May. Three of the four broad categories of indicators that make up the index increased from May, and two of the four categories made positive contributions to the index in June.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, edged up to –0.01 in June from –0.07 in May. June’s CFNAI-MA3 suggests that growth in national economic activity was very close to its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was close to the historical trend in June (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Weekly Initial Unemployment Claims decreased to 255,000

by Calculated Risk on 7/23/2015 08:34:00 AM

The DOL reported:

In the week ending July 18, the advance figure for seasonally adjusted initial claims was 255,000, a decrease of 26,000 from the previous week's unrevised level of 281,000. This is the lowest level for initial claims since November 24, 1973 when it was 233,000. The 4-week moving average was 278,500, a decrease of 4,000 from the previous week's unrevised average of 282,500.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 278,500.

This was below to the consensus forecast of 279,000, and the low level of the 4-week average suggests few layoffs. This was also the reference week for the BLS employment report, and suggests few layoffs during the reference week.

Wednesday, July 22, 2015

Thursday: Unemployment Claims

by Calculated Risk on 7/22/2015 08:59:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 279 thousand from 281 thousand.

• Also at 8:30 AM, the Chicago Fed National Activity Index for June. This is a composite index of other data.

• At 11:00 AM, the Kansas City Fed manufacturing survey for July.

A Few Random Comments on June Existing Home Sales

by Calculated Risk on 7/22/2015 03:04:00 PM

First, as always, new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc - but overall the economic impact is small compared to a new home sale. Also I wouldn't be surprised if the seasonally adjusted pace for existing home sales slows over the next several months - due to limited inventory and higher mortgage rates.

Second, in general I'd ignore the median sales price because it is impacted by the mix of homes sold (more useful are the repeat sales indexes like Case-Shiller or CoreLogic). The NAR reported the median sales price was $236,400 in June, above the median peak of $230,400 in July 2006. That is 9 years ago, so in real terms, median prices are close to 20% below the previous peak. Not close.

Third, Inventory is still very low (up only 0.4% year-over-year in June). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases. This will be important to watch.

Note: I'm hearing reports of rising inventory in some mid-to-higher priced areas. However many low priced areas still have little inventory.

Also, the NAR reported total sales were up 9.6% from June 2014, however normal equity sales were up even more, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed sales — foreclosures and short sales — fell to 8 percent in June (matching an August 2014 low) from 10 percent in May, and are below the 11 percent share a year ago. Six percent of June sales were foreclosures and 2 percent were short sales.Last year in June the NAR reported that 11% of sales were distressed sales.

A rough estimate: Sales in June 2014 were reported at 5.01 million SAAR with 11% distressed. That gives 551 thousand distressed (annual rate), and 4.46 million equity / non-distressed. In June 2015, sales were 5.49 million SAAR, with 8% distressed. That gives 439 thousand distressed - a decline of about 20% from June 2014 - and 5.05 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up around 13%.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in June (red column) were the highest for June since 2007 (NSA).

Earlier:

• Existing Home Sales in June: 5.49 million SAAR, Highest Pace in Eight Years