by Calculated Risk on 7/16/2015 05:01:00 PM

Thursday, July 16, 2015

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in June

Economist Tom Lawler sent me a preliminary table below of short sales, foreclosures and cash buyers for a few selected cities in June.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Baltimore is up because of an increase in foreclosures).

Short sales are down in all of these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

As Lawler noted before: The Baltimore Metro area is included in the overall Mid-Atlantic region (covered by MRIS). Baltimore is also shown separately because a large portion of the YOY increase in the foreclosure share of home sales in the Mid-Atlantic region was attributable to the significant increase in foreclosure sales in the Baltimore Metro area.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | |

| Las Vegas | 6.7% | 10.8% | 7.6% | 10.1% | 14.3% | 20.9% | 28.4% | 34.7% |

| Reno** | 5.0% | 10.0% | 3.0% | 7.0% | 8.0% | 17.0% | ||

| Phoenix | 23.0% | 26.6% | ||||||

| Sacramento | 5.8% | 7.0% | 4.6% | 6.5% | 10.4% | 13.6% | 17.8% | 19.8% |

| Minneapolis | 2.0% | 3.0% | 5.6% | 9.7% | 7.6% | 12.7% | ||

| Mid-Atlantic | 3.1% | 4.8% | 8.7% | 7.4% | 11.7% | 12.2% | 15.2% | 16.5% |

| Baltimore MSA**** | 3.1% | 4.3% | 14.3% | 10.7% | 17.4% | 15.0% | 20.7% | 19.8% |

| Orlando | 3.7% | 7.8% | 24.9% | 26.5% | 28.6% | 34.3% | 35.7% | 40.5% |

| Chicago (city) | 12.4% | 18.7% | ||||||

| Hampton Roads | 16.6% | 20.1% | ||||||

| Spokane | 10.7% | 14.1% | ||||||

| Northeast Florida | 25.6% | 32.4% | ||||||

| Toledo | 27.0% | 28.4% | ||||||

| Wichita | 21.9% | 22.6% | ||||||

| Des Moines | 14.4% | 14.6% | ||||||

| Tucson | 25.1% | 26.1% | ||||||

| Georgia*** | 20.3% | 24.6% | ||||||

| Omaha | 14.6% | 16.3% | ||||||

| Richmond VA MSA | 7.1% | 9.7% | 13.8% | 16.1% | ||||

| Memphis | 11.4% | 12.4% | ||||||

| Springfield IL** | 5.1% | 8.4% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS ****Baltimore is included in the Mid-Atlantic region, but is shown separately here | ||||||||

Lawler: Early Read on Existing Home Sales in June

by Calculated Risk on 7/16/2015 02:05:00 PM

From housing economist Tom Lawler:

Based on reports released by various realtor associations/MLS from across the country, I predict that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.45 million in June, up 1.9% from May’s pace, and up 8.8% from last June’s seasonally adjusted pace. Unadjusted home sales should an even larger YOY increase, reflecting the higher business day count this June compared to last June.

Realtor/MLS data suggest that the inventory of existing homes for sale as estimated by the NAR should be about 2.33 million at the end of June, up 1.7% from May and up 1.7% from a year earlier.

And finally, realtor/MLS data are consistent with a year-over-year increase in the median existing single-family home sales price of about 6.5%.

CR Note: The sales rate in June will likely be the highest since early 2007.

Earlier: Philly Fed Manufacturing Survey decreased to 5.7 in July

by Calculated Risk on 7/16/2015 12:14:00 PM

From the Philly Fed: July Manufacturing Survey

Manufacturing activity in the region increased modestly in July, according to firms responding to this month’s Manufacturing Business Outlook Survey.This was below the consensus forecast of a reading of 11.5 for July.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 15.2 in June to 5.7 this month. ...

Firms’ responses suggest steady employment in July. The percentage of firms reporting an increase in employees in July was equal to the percentage reporting a decrease (12 percent). The current employment index fell for the third consecutive month, from a reading of 3.8 in June to -0.4.

emphasis added

Click on graph for larger image.

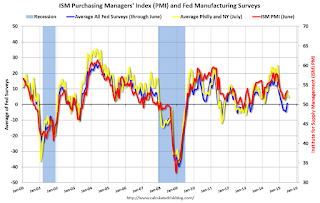

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The average of the Empire State and Philly Fed surveys decreased in July, and this suggests a reading similar to June for the ISM survey.

NAHB: Builder Confidence at 60 in July, Highest Level Since November 2005

by Calculated Risk on 7/16/2015 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 60 in July, unchanged from June (but June was revised up). Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Hits Highest Level Since November 2005

Builder confidence in the market for newly built, single-family homes in July hit a level of 60 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today while the June reading was revised upward one point to 60 as well. The last time the HMI reached this level was in November 2005.

...

“This month’s reading is in line with recent data showing stronger sales in both the new and existing home markets as well as continued job growth,” said NAHB Chief Economist David Crowe. “However, builders still face a number of challenges, including shortages of lots and labor.”

...

Two of the three HMI components posted gains in July. The component gauging current sales conditions rose one point to 66 and the index charting sales expectations in the next six months increased two points to 71. Meanwhile, the component measuring buyer traffic dropped a single point to 43.

Looking at the three-month moving averages for regional HMI scores, the West and Northeast each rose three points to 60 and 47, respectively. The South and Midwest posted respective one-point gains to 61 and 55.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast of 59.

Weekly Initial Unemployment Claims decreased to 281,000

by Calculated Risk on 7/16/2015 08:41:00 AM

The DOL reported:

In the week ending July 11, the advance figure for seasonally adjusted initial claims was 281,000, a decrease of 15,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 297,000 to 296,000. The 4-week moving average was 282,500, an increase of 3,250 from the previous week's revised average. The previous week's average was revised down by 250 from 279,500 to 279,250.The previous week was revised down by 1,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 282,500.

This was close to the consensus forecast of 282,000, and the low level of the 4-week average suggests few layoffs.