by Calculated Risk on 7/12/2015 08:29:00 PM

Sunday, July 12, 2015

Sunday Night Futures: Uncertainty in Europe

After some absurd demands from Germany, it appears there might be some movement towards a deal with Greece tonight. But maybe not ... crazy.

Monday:

• At 2:00 PM ET, the Monthly Treasury Budget Statement for June.

Weekend:

• Schedule for Week of July 12, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 11 and DOW futures are down 87 (fair value).

Oil prices were down over the last week with WTI futures at $52.13 per barrel and Brent at $58.00 per barrel. A year ago, WTI was at $102, and Brent was at $105 - so prices are down almost 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.77 per gallon (down about $0.85 per gallon from a year ago).

Greece Update: No Deal ... Yet

by Calculated Risk on 7/12/2015 11:43:00 AM

From the Financial Times: France and Germany split over bid to break Greece deadlock

While Paris is backing Greek plans for a deal, Berlin is leading a group of sceptical countries that insist that Athens first passes significant reform laws in the next few days before negotiations can begin on a new rescue programme.From the WSJ: Greek Deal Prospects Slim as Eurozone Leaders Convene

excerpt with permission

Finance ministers from the currency area convened earlier in the day, and discussed a draft statement that contains a “timeout” for Greece from the eurozone as a potential option, two European officials said Sunday. The statement, which may still change, will form the basis for crisis talks of eurozone leaders later Sunday, these officials said.Too funny. Offered "debt resturcturing" if Grexit? It is called bankruptcy.

The statement says that “in case no agreement [on a new bailout program] could be reached, Greece should be offered swift negotiations on a timeout from the euro area, with possible debt restructuring,” one official said. The sentence is still in brackets, indicating that it doesn’t have the backing of all 19 eurozone countries.

However, French President François Hollande later said, “There is no temporary Grexit. There is only Grexit or not Grexit.”

From Bloomberg: Tsipras Calls for Honest Compromise With EU Struggling to Trust

“The situation is extremely difficult if you consider the economic situation in Greece and the worsening in the last few months, but what has been lost also in terms of trust and reliability,” German Chancellor Angela Merkel told reporters as she arrived.

Saturday, July 11, 2015

Schedule for Week of July 12, 2015

by Calculated Risk on 7/11/2015 08:11:00 AM

The key economic reports this week are June Housing Starts on Friday, and June Retail sales on Tuesday.

For manufacturing, the June Industrial Production and Capacity Utilization report, and the July NY Fed (Empire State) and Philly Fed surveys, will be released this week.

For prices, CPI will be released on Friday, and PPI on Wednesday.

Fed Chair Janet Yellen will present the Semiannual Monetary Policy Report to the Congress on Wednesday and Thursday.

2:00 PM ET: The Monthly Treasury Budget Statement for June.

8:30 AM ET: Retail sales for June will be released.

8:30 AM ET: Retail sales for June will be released.This graph shows retail sales since 1992 through May 2015. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were up 1.2% from April to May (seasonally adjusted), and sales were up 2.7% from May 2014.

The consensus is for retail sales to increase 0.3% in June, and to increase 0.6% ex-autos.

9:00 AM: NFIB Small Business Optimism Index for June.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.2% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The Producer Price Index for June from the BLS. The consensus is for a 0.3% increase in prices, and a 0.1% increase in core PPI.

8:30 AM: NY Fed Empire State Manufacturing Survey for July. The consensus is for a reading of 3.5, up from -2.0 last month (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.1%.

10:00 AM: Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 282 thousand from 297 thousand.

10:00 AM: the Philly Fed manufacturing survey for July. The consensus is for a reading of 11.5, down from 15.2 last month (above zero indicates expansion).

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 59, unchanged from 59 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM: Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

8:30 AM: The Consumer Price Index for June from the BLS. The consensus is for a 0.3% increase in prices, and a 0.2% increase in core CPI.

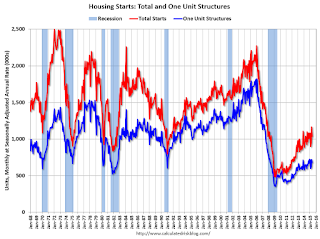

8:30 AM: Housing Starts for June.

8:30 AM: Housing Starts for June. Total housing starts decreased to 1.036 million (SAAR) in May. Single family starts decreased to 680 thousand SAAR in May.

The consensus is for total housing starts to increase to 1.125 million (SAAR) in June.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for July). The consensus is for a reading of 96.2, up from 96.1 in June.

Friday, July 10, 2015

Hotels: On Pace for Record Occupancy in 2015

by Calculated Risk on 7/10/2015 06:15:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 4 July

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 28 June through 4 July 2015, according to data from STR, Inc.For the same week in 2009, ADR (average daily rate) was $95.16 and RevPAR (Revenue per available room) was $54.94. ADR is up 25% since June 2009, and RevPAR is up almost 50%!

In year-over-year measurements, the industry’s occupancy increased 3.6 percent to 68.3 percent. Average daily rate for the week was up 6.2 percent to US$119.20. Revenue per available room increased 10.1 percent to finish the week at US$81.45.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate will be high during the summer travel season.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and above last year.

Right now 2015 is above 2000 (best year for hotels), and this year will probably be the best year ever for hotels.

The summer season will probably be strong with lower gasoline prices.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Sacramento Housing in June: Sales up 22%, Inventory down 10% YoY

by Calculated Risk on 7/10/2015 03:08:00 PM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But over the last 3 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In June, total sales were up 21.7% from June 2014, and conventional equity sales were up 25.4% compared to the same month last year.

In June, 10.7% of all resales were distressed sales. This was up from 9.8% last month, and down from 13.3% in June 2014.

The percentage of REOs was at 4.8% in June, and the percentage of short sales was 5.8%. Note: It has been some time since there were more short sales than REO sales in a given month.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 10.0% year-over-year (YoY) in June. This was the second consecutive monthly YoY decrease in inventory in Sacramento (a big change).

Cash buyers accounted for 16.0% of all sales (frequently investors).

Summary: This data suggests a healing market with fewer distressed sales, more equity sales, and less investor buying.