by Calculated Risk on 7/11/2015 08:11:00 AM

Saturday, July 11, 2015

Schedule for Week of July 12, 2015

The key economic reports this week are June Housing Starts on Friday, and June Retail sales on Tuesday.

For manufacturing, the June Industrial Production and Capacity Utilization report, and the July NY Fed (Empire State) and Philly Fed surveys, will be released this week.

For prices, CPI will be released on Friday, and PPI on Wednesday.

Fed Chair Janet Yellen will present the Semiannual Monetary Policy Report to the Congress on Wednesday and Thursday.

2:00 PM ET: The Monthly Treasury Budget Statement for June.

8:30 AM ET: Retail sales for June will be released.

8:30 AM ET: Retail sales for June will be released.This graph shows retail sales since 1992 through May 2015. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were up 1.2% from April to May (seasonally adjusted), and sales were up 2.7% from May 2014.

The consensus is for retail sales to increase 0.3% in June, and to increase 0.6% ex-autos.

9:00 AM: NFIB Small Business Optimism Index for June.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.2% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The Producer Price Index for June from the BLS. The consensus is for a 0.3% increase in prices, and a 0.1% increase in core PPI.

8:30 AM: NY Fed Empire State Manufacturing Survey for July. The consensus is for a reading of 3.5, up from -2.0 last month (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.1%.

10:00 AM: Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 282 thousand from 297 thousand.

10:00 AM: the Philly Fed manufacturing survey for July. The consensus is for a reading of 11.5, down from 15.2 last month (above zero indicates expansion).

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 59, unchanged from 59 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM: Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

8:30 AM: The Consumer Price Index for June from the BLS. The consensus is for a 0.3% increase in prices, and a 0.2% increase in core CPI.

8:30 AM: Housing Starts for June.

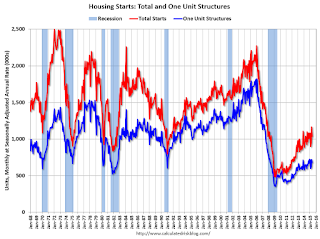

8:30 AM: Housing Starts for June. Total housing starts decreased to 1.036 million (SAAR) in May. Single family starts decreased to 680 thousand SAAR in May.

The consensus is for total housing starts to increase to 1.125 million (SAAR) in June.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for July). The consensus is for a reading of 96.2, up from 96.1 in June.

Friday, July 10, 2015

Hotels: On Pace for Record Occupancy in 2015

by Calculated Risk on 7/10/2015 06:15:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 4 July

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 28 June through 4 July 2015, according to data from STR, Inc.For the same week in 2009, ADR (average daily rate) was $95.16 and RevPAR (Revenue per available room) was $54.94. ADR is up 25% since June 2009, and RevPAR is up almost 50%!

In year-over-year measurements, the industry’s occupancy increased 3.6 percent to 68.3 percent. Average daily rate for the week was up 6.2 percent to US$119.20. Revenue per available room increased 10.1 percent to finish the week at US$81.45.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate will be high during the summer travel season.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and above last year.

Right now 2015 is above 2000 (best year for hotels), and this year will probably be the best year ever for hotels.

The summer season will probably be strong with lower gasoline prices.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Sacramento Housing in June: Sales up 22%, Inventory down 10% YoY

by Calculated Risk on 7/10/2015 03:08:00 PM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But over the last 3 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In June, total sales were up 21.7% from June 2014, and conventional equity sales were up 25.4% compared to the same month last year.

In June, 10.7% of all resales were distressed sales. This was up from 9.8% last month, and down from 13.3% in June 2014.

The percentage of REOs was at 4.8% in June, and the percentage of short sales was 5.8%. Note: It has been some time since there were more short sales than REO sales in a given month.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 10.0% year-over-year (YoY) in June. This was the second consecutive monthly YoY decrease in inventory in Sacramento (a big change).

Cash buyers accounted for 16.0% of all sales (frequently investors).

Summary: This data suggests a healing market with fewer distressed sales, more equity sales, and less investor buying.

Fed Chair Yellen: Expect to raise the federal funds rate later this year

by Calculated Risk on 7/10/2015 12:34:00 PM

From Fed Chair Janet Yellen: Recent Developments and the Outlook for the Economy Excerpt:

My own outlook for the economy and inflation is broadly consistent with the central tendency of the projections submitted by FOMC participants at the time of our June meeting. Based on my outlook, I expect that it will be appropriate at some point later this year to take the first step to raise the federal funds rate and thus begin normalizing monetary policy. But I want to emphasize that the course of the economy and inflation remains highly uncertain, and unanticipated developments could delay or accelerate this first step. We will be watching carefully to see if there is continued improvement in labor market conditions, and we will need to be reasonably confident that inflation will move back to 2 percent in the next few years.

Let me also stress that this initial increase in the federal funds rate, whenever it occurs, will by itself have only a very small effect on the overall level of monetary accommodation provided by the Federal Reserve. Because there are some factors, which I mentioned earlier, that continue to restrain the economic expansion, I currently anticipate that the appropriate pace of normalization will be gradual, and that monetary policy will need to be highly supportive of economic activity for quite some time. The projections of most of my FOMC colleagues indicate that they have similar expectations for the likely path of the federal funds rate. But, again, both the course of the economy and inflation are uncertain. If progress toward our employment and inflation goals is more rapid than expected, it may be appropriate to remove monetary policy accommodation more quickly. However, if progress toward our goals is slower than anticipated, then the Committee may move more slowly in normalizing policy.

emphasis added

FNC: Residential Property Values increased 5.4% year-over-year in May

by Calculated Risk on 7/10/2015 11:31:00 AM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their May 2015 index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 1.2% from April to May (Composite 100 index, not seasonally adjusted).

The 10 city MSA increased 1.2% in May, the 20-MSA RPI increased 1.3%, and the 30-MSA RPI increased 1.2%. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was lower in May than in April, with the 100-MSA composite up 5.4% compared to May 2014.

The index is still down 16.2% from the peak in 2006 (not inflation adjusted).

This graph shows the year-over-year change based on the FNC index (four composites) through May 2015. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change mostly steady at around 5% for the last several months.

Note: The May Case-Shiller index will be released on Tuesday, July 28th.