by Calculated Risk on 7/08/2015 09:40:00 AM

Wednesday, July 08, 2015

Las Vegas Real Estate in June: Sales Increased 12.8% YoY

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports home sales, prices post double-digit increases from one year ago

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in June was 3,693, up from 3,274 one year ago. Compared to June 2014, 14.2 percent more homes and 6.3 percent more condos and townhomes sold this June.There are several key trends that we've been following:

...

Since 2013, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. In June, 6.7 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 10.8 percent one year ago. Another 7.6 percent of June sales were bank-owned, down from 10.1 percent one year ago.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in June was 13,740, down 0.7 percent from one year ago. GLVAR tracked a total of 3,474 condos, high-rise condos and townhomes listed for sale on its MLS in June, down 6.5 percent from one year ago.

By the end of June, GLVAR reported 7,432 single-family homes listed without any sort of offer. That’s up 4.3 percent from one year ago. For condos and townhomes, the 2,329 properties listed without offers in June represented a 0.2 percent decrease from one year ago.

emphasis added

1) Overall sales were up 12.8% year-over-year.

2) Conventional (equity, not distressed) sales were up 22% year-over-year. In June 2014, 79.1% of all sales were conventional equity. In June 2015, 85.7% were standard equity sales.

3) The percent of cash sales has declined year-over-year from 34.7% in June 2014 to 28.4% in June 2015. (investor buying appears to be declining).

4) Non-contingent inventory is up 4.3% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing - but still ongoing.

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

| Feb-15 | 15.8% |

| Mar-15 | 12.2% |

| Apr-15 | 7.6% |

| May-15 | 7.8% |

| Jun-15 | 4.3% |

MBA: Mortgage Applications Increase in Latest Weekly Survey, Purchase Index up Sharply YoY

by Calculated Risk on 7/08/2015 07:00:00 AM

Note: Results for holiday weeks can be very volatile.

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 3, 2015. This week’s results included an adjustment for the July 4th holiday. ...

The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 7 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 32 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.23 percent from 4.26 percent, with points increasing to 0.37 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With higher rates, refinance activity is very low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 32% higher than a year ago (probably distorted by holiday week).

Tuesday, July 07, 2015

Phoenix Real Estate in June: Sales Up 20.5%, Inventory DOWN 16% Year-over-year

by Calculated Risk on 7/07/2015 05:51:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

For the seventh consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from last year.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in June were up 20.5% year-over-year.

2) Cash Sales (frequently investors) were down to 23.0% of total sales.

3) Active inventory is now down 16.4% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

Now, with falling inventory, prices might increase a little faster in 2015 (something to watch if inventory continues to decline). Prices are already up 1.8% through April (increasing faster than in 2014).

| June Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| June 2008 | 5,748 | --- | 1,093 | 19.0% | 53,8262 | --- |

| June 2009 | 9,325 | 62.2% | 3,443 | 36.9% | 38,358 | ---2 |

| June 2010 | 9,278 | -0.5% | 3,498 | 37.7% | 41,869 | 9.2% |

| June 2011 | 11,134 | 20.0% | 5,001 | 44.9% | 29,203 | -30.3% |

| June 2012 | 9,133 | -18.0% | 4,272 | 46.8% | 19,857 | -32.0% |

| June 2013 | 8,150 | -10.8% | 3,055 | 37.5% | 19,541 | -1.6% |

| June 2014 | 7,239 | -11.2% | 1,854 | 25.6% | 27,954 | 43.1% |

| June 2015 | 8,273 | 20.5% | 2,005 | 23.0% | 23,377 | -16.4% |

| 1 June 2008 does not include manufactured homes, ~100 more 2 June 2008 Inventory includes pending | ||||||

Reis: Mall Vacancy Rate unchanged in Q2

by Calculated Risk on 7/07/2015 02:58:00 PM

Reis reported that the vacancy rate for regional malls was unchanged at 7.9% in Q2 2015. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was unchanged at 10.1% in Q2. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist and Director of Research Ryan Severino:

[Strip Mall] After three consecutive quarters of slightly declining vacancy, the national vacancy rate for neighborhood and community centers was unchanged this quarter at 10.1%. Although net absorption exceeded new supply growth, it was insufficient to cause a decline in vacancy. Nonetheless, rent growth continued to slightly accelerate this quarter, though it is barely running ahead of core inflation. [Regional] The vacancy rate for malls also was unchanged at 7.9% while asking rents grew by 0.6%, the seventeenth consecutive quarter of growth. Improvement in the two major subsectors continues, and at an accelerating pace, but their recoveries remain far slower than those of past cycles.

So what’s holding the market back? While ecommerce is not helping, it is not the death knell for bricksand‐ mortar retail that some perceive it to be. In reality, a bigger challenge comes from the proliferation of different retail subtypes over the last two decades. For example, power space inventory has more than doubled since 1998 as demand for this space has increased dramatically. Meanwhile, to put that into context, neighborhood and community center and mall inventory has only increased by roughly 15% over the same time period. The rise of power centers, lifestyle centers, town centers, and even outlet centers has siphoned demand away from traditional retail subtypes.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.

CoreLogic: House Prices up 6.3% Year-over-year in May

by Calculated Risk on 7/07/2015 11:59:00 AM

Notes: This CoreLogic House Price Index report is for May. The recent Case-Shiller index release was for April. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

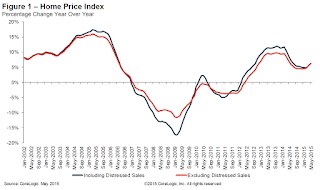

From CoreLogic: CoreLogic Reports National Homes Prices Rose by 6.3 Percent Year Over Year in May 2015

CoreLogic® ... today released its May 2015 CoreLogic Home Price Index (HPI®) which shows that home prices nationwide, including distressed sales, increased by 6.3 percent in May 2015 compared with May 2014. This change represents 39 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased by 1.7 percent in May 2015 compared with April 2015.

Including distressed sales, 33 states and the District of Columbia were at or within 10 percent of their peak prices in May 2015. Ten states and the District of Columbia reached new price peaks not experienced since January 1976 when the CoreLogic HPI started. These states include Alaska, Colorado, Iowa, Nebraska, New York, North Carolina, Oklahoma, Tennessee, Texas and Vermont.

Excluding distressed sales, home prices increased by 6.3 percent in May 2015 compared with May 2014 and increased by 1.4 percent month over month compared with April 2015. ...

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.7% in May (NSA), and is up 6.3% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty nine consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty nine consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increase had been moving sideways over most of the last year, but has picked up a little recently.