by Calculated Risk on 7/07/2015 05:51:00 PM

Tuesday, July 07, 2015

Phoenix Real Estate in June: Sales Up 20.5%, Inventory DOWN 16% Year-over-year

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

For the seventh consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from last year.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in June were up 20.5% year-over-year.

2) Cash Sales (frequently investors) were down to 23.0% of total sales.

3) Active inventory is now down 16.4% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

Now, with falling inventory, prices might increase a little faster in 2015 (something to watch if inventory continues to decline). Prices are already up 1.8% through April (increasing faster than in 2014).

| June Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| June 2008 | 5,748 | --- | 1,093 | 19.0% | 53,8262 | --- |

| June 2009 | 9,325 | 62.2% | 3,443 | 36.9% | 38,358 | ---2 |

| June 2010 | 9,278 | -0.5% | 3,498 | 37.7% | 41,869 | 9.2% |

| June 2011 | 11,134 | 20.0% | 5,001 | 44.9% | 29,203 | -30.3% |

| June 2012 | 9,133 | -18.0% | 4,272 | 46.8% | 19,857 | -32.0% |

| June 2013 | 8,150 | -10.8% | 3,055 | 37.5% | 19,541 | -1.6% |

| June 2014 | 7,239 | -11.2% | 1,854 | 25.6% | 27,954 | 43.1% |

| June 2015 | 8,273 | 20.5% | 2,005 | 23.0% | 23,377 | -16.4% |

| 1 June 2008 does not include manufactured homes, ~100 more 2 June 2008 Inventory includes pending | ||||||

Reis: Mall Vacancy Rate unchanged in Q2

by Calculated Risk on 7/07/2015 02:58:00 PM

Reis reported that the vacancy rate for regional malls was unchanged at 7.9% in Q2 2015. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was unchanged at 10.1% in Q2. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist and Director of Research Ryan Severino:

[Strip Mall] After three consecutive quarters of slightly declining vacancy, the national vacancy rate for neighborhood and community centers was unchanged this quarter at 10.1%. Although net absorption exceeded new supply growth, it was insufficient to cause a decline in vacancy. Nonetheless, rent growth continued to slightly accelerate this quarter, though it is barely running ahead of core inflation. [Regional] The vacancy rate for malls also was unchanged at 7.9% while asking rents grew by 0.6%, the seventeenth consecutive quarter of growth. Improvement in the two major subsectors continues, and at an accelerating pace, but their recoveries remain far slower than those of past cycles.

So what’s holding the market back? While ecommerce is not helping, it is not the death knell for bricksand‐ mortar retail that some perceive it to be. In reality, a bigger challenge comes from the proliferation of different retail subtypes over the last two decades. For example, power space inventory has more than doubled since 1998 as demand for this space has increased dramatically. Meanwhile, to put that into context, neighborhood and community center and mall inventory has only increased by roughly 15% over the same time period. The rise of power centers, lifestyle centers, town centers, and even outlet centers has siphoned demand away from traditional retail subtypes.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.

CoreLogic: House Prices up 6.3% Year-over-year in May

by Calculated Risk on 7/07/2015 11:59:00 AM

Notes: This CoreLogic House Price Index report is for May. The recent Case-Shiller index release was for April. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports National Homes Prices Rose by 6.3 Percent Year Over Year in May 2015

CoreLogic® ... today released its May 2015 CoreLogic Home Price Index (HPI®) which shows that home prices nationwide, including distressed sales, increased by 6.3 percent in May 2015 compared with May 2014. This change represents 39 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased by 1.7 percent in May 2015 compared with April 2015.

Including distressed sales, 33 states and the District of Columbia were at or within 10 percent of their peak prices in May 2015. Ten states and the District of Columbia reached new price peaks not experienced since January 1976 when the CoreLogic HPI started. These states include Alaska, Colorado, Iowa, Nebraska, New York, North Carolina, Oklahoma, Tennessee, Texas and Vermont.

Excluding distressed sales, home prices increased by 6.3 percent in May 2015 compared with May 2014 and increased by 1.4 percent month over month compared with April 2015. ...

emphasis added

Click on graph for larger image.

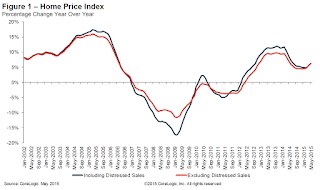

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.7% in May (NSA), and is up 6.3% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty nine consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty nine consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increase had been moving sideways over most of the last year, but has picked up a little recently.

BLS: Jobs Openings increased to 5.4 million in May, Highest on Record

by Calculated Risk on 7/07/2015 10:08:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 5.4 million on the last business day of May, the highest since the series began in December 2000, the U.S. Bureau of Labor Statistics reported today. The number of hires was unchanged at 5.0 million in May and the number of separations was little changed at 4.7 million. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.7 million quits in May, unchanged from April.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent employment report was for June.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in May to 5.363 million from 5.334 million in April.

The number of job openings (yellow) are up 16% year-over-year compared to May 2014.

Quits are up 8% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another solid report. It is a good sign that job openings are over 5 million - and at an all time high - and that quits are increasing solidly year-over-year.

Trade Deficit increased in May to $41.9 Billion

by Calculated Risk on 7/07/2015 08:41:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $41.9 billion in May, up $1.2 billion from $40.7 billion in April, revised. May exports were $188.6 billion, $1.5 billion less than April exports. May imports were $230.5 billion, $0.3 billion less than April imports.The trade deficit was close to the consensus forecast of $42.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through May 2015.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports also decreased in May.

Exports are 14% above the pre-recession peak and down 4% compared to May 2014; imports are at the pre-recession peak, and down 4% compared to May 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings over earlier this year were due to port slowdown.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings over earlier this year were due to port slowdown.Oil imports averaged $50.76 in May, up from $46.52 in April, and down from $96.12 in May 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China decreased to $28.8 billion in May, from $30.4 billion in May 2014. The deficit with China is a large portion of the overall deficit.