by Calculated Risk on 7/03/2015 08:11:00 AM

Friday, July 03, 2015

Schedule for Week of July 5, 2015

It feels like a Saturday ...

The key report this coming week is the May Trade Deficit on Tuesday, and the June ISM non-manufacturing index on Monday.

Fed Chair Janet Yellen speaks on Friday on the U.S. Economic Outlook.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

10:00 AM: the ISM non-Manufacturing Index for June. The consensus is for index to increase to 56.0 from 55.7 in May.

8:30 AM: Trade Balance report for May from the Census Bureau.

8:30 AM: Trade Balance report for May from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through April. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $42.0 billion in May from $40.9 billion in April.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in April to 5.376 million from 5.109 million in March.

The number of job openings (yellow) were up 22% year-over-year compared to April 2014, and Quits were up 11% year-over-year.

3:00 PM: Consumer Credit for May from the Federal Reserve. The consensus is for an increase of $18.5 billion in credit.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of June 16-17, 2015

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 275 thousand from 281 thousand.

12:30 PM, Speech by Fed Chair Janet Yellen, U.S. Economic Outlook, at The City Club of Cleveland's Sally Gries Forum Honoring Women of Achievement, Cleveland, Ohio

Thursday, July 02, 2015

Earlier: Weekly Initial Unemployment Claims increased to 281,000

by Calculated Risk on 7/02/2015 08:24:00 PM

A quick graph of unemployment claims ... Note: Starting with this release, the DOL is including a table of unadjusted State-level "advance"claims.

The DOL reported:

In the week ending June 27, the advance figure for seasonally adjusted initial claims was 281,000, an increase of 10,000 from the previous week's unrevised level of 271,000. The 4-week moving average was 274,750, an increase of 1,000 from the previous week's unrevised average of 273,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 274,750.

This was above the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs.

Hotels: On Pace for Record Occupancy in 2015, RevPAR up almost 50% from 2009

by Calculated Risk on 7/02/2015 05:08:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 27 June

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 21-27 June 2015, according to data from STR, Inc.For the same week in 2009, ADR (average daily rate) was $97.49 and RevPAR (Revenue per available room) was $63.74. ADR is up over 25% since June 2009, and RevPAR is up almost 50%!

In year-over-year measurements, the industry’s occupancy increased 1.1 percent to 76.9 percent. Average daily rate for the week was up 4.6 percent to US$122.15. Revenue per available room increased 5.7 percent to finish the week at US$93.96.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate will be high during the summer travel season.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and above last year.

Right now 2015 is close to 2000 (best year for hotels) - and so far 2015 has run slightly above 2000 - and this year will probably be the best year ever for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Reis: Apartment Vacancy Rate unchanged in Q2 at 4.2%

by Calculated Risk on 7/02/2015 01:15:00 PM

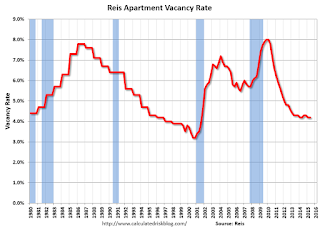

Reis reported that the apartment vacancy rate was unchanged in Q2 2015, compared to Q1, at 4.2% - and also the same as in Q2 2014. The vacancy rate peaked at 8.0% at the end of 2009.

A few comments from Reis Senior Economist and Director of Research Ryan Severino:

Vacancy was unchanged at 4.2% during the quarter with construction and net absorption effectively in balance. Vacancy is cyclical and moves in long phases. For most of the last five years, the market has been in a vacancy compression phase, falling from 8% at the start of 2010 before bottoming out at 4.2% during the first quarter of last year. However, since that time vacancy has been stuck at the 4.2% range for the sixth consecutive quarter. There could still be a quarter when vacancy falls slightly, but that would be an anomaly and not a trend. Clearly, the run of vacancy compression during this cycle is over. From this point forward, with supply projected to exceed demand, we anticipate that vacancy will rise, slowly at first and then more gradually as we move forward.

...

Asking and effective rents both grew by 1.0% during the second quarter. This was a rebound versus the first quarter when they both grew by about 0.6%. Although the apartment market typically exhibits some seasonality, which appears to be the case here, the longer vacancy remains at such low levels, the greater the probability that rent growth will remain this strong. Year‐over‐year rent growth for asking and effective rents have inched up around 3.5% and annualized rent growth during the quarter is around 4%. Both of these are well in excess of core inflation and ahead of any other property type.

...

Although construction continues to increase, we have yet to see the big surge in completions that we have been anticipating. That is not to downplay the relatively large amount of supply that continues to come online so much as it is to highlight the daunting situation yet to come. Even without construction volume leaping, vacancy compression has stalled. At 4.2% the national vacancy rate is unchanged over the last year and appears to have bottomed out. This intimates that once construction activity does increase demand is going to be unable to keep pace and vacancy will rise. Although demand remains relatively stout, construction volumes are set to test historically high levels in 2015. Therefore, the market should not become complacent because vacancy has yet to rise. In recent quarters we have seen an increase in the use of soft openings and push backs in completion dates. Both simply delay the inevitable – vacancy rates will rise. It is only a matter of time at this juncture.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate is mostly moving sideways now. As completions catchup with starts, the vacancy rate will probably start increasing (See: Are Multi-Family Housing Starts near a peak?)

Apartment vacancy data courtesy of Reis.

June Employment Report Comments and Graphs

by Calculated Risk on 7/02/2015 09:55:00 AM

Earlier: June Employment Report: 223,000 Jobs, 5.3% Unemployment Rate

This was a decent employment report with 223,000 jobs added, although April and May were revised down by a combined 60,000 jobs.

Unfortunately wage growth is still weak, from the BLS: "In June, average hourly earnings for all employees on private nonfarm payrolls were unchanged at $24.95. Over the year, average hourly earnings have risen by 2.0 percent." Weekly hours were unchanged for the fourth month in a row.

A few more numbers: Total employment increased 223,000 from May to June and is now 3.5 million above the previous peak. Total employment is up 12.2 million from the employment recession low.

Private payroll employment also increased 223,000 from May to June, and private employment is now 4.0 million above the previous peak. Private employment is up 12.8 million from the recession low.

In June, the year-over-year change was just over 2.9 million jobs.

Note: The unemployment rate falling to 5.3%, and still little real wage growth - and still a large number of people working part time for economic reasons - indicates slack in the labor market. My view, partially based on demographics, is that the unemployment rate can fall below 5% without a significant pickup in inflation.

Overall this was a decent report.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was declined in June to 80.8%, and the 25 to 54 employment population ratio was unchanged at 77.2%. As the recovery continues, I expect the participation rate for this group to increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth increased 2.0% YoY - and although the series is noisy - it does appear wage growth is trending up a little. Wages will probably pick up a little more this year.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers), at 6.5 million, changed little in June. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons decreased in June to 6.51 million from 6.65 million in May. This is the lowest level since Sept 2008 and suggests slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 10.5% in June (lowest level since July 2008).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.121 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.502 million in May.

This is trending down - and is at the lowest level since September 2008 - but is still high.

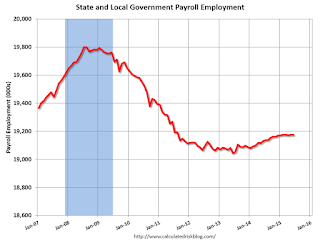

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In June 2015, state and local governments added zero jobs. State and local government employment is now up 132,000 from the bottom, but still 626,000 below the peak.

State and local employment is now generally increasing - slowly. And Federal government layoffs appear to have ended (Federal payrolls were unchanged in June, and Federal employment is up 5,000 year-to-date).

Overall this was a decent employment report for June.