by Calculated Risk on 7/01/2015 08:19:00 AM

Wednesday, July 01, 2015

ADP: Private Employment increased 237,000 in June

Private sector employment increased by 237,000 jobs from May to June according to the June ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 220,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by12,000 jobs in June, after adding 11,000 in May. The construction industry had another solid month in June adding 19,000 jobs, down from 28,000 last month. Meanwhile, manufacturing added 7,000 jobs in June, after losing 2,000 in May.

Service-providing employment rose by 225,000 jobs in June, a strong rise from 192,000 in May. The ADP National Employment Report indicates that professional/business services contributed 61,000 jobs in June, almost double May’s 32,000. Trade/transportation/utilities grew by 50,000, the same as the previous month. The 19,000 new jobs added in financial activities was an increase from last month’s 12,000.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “The U.S. job machine remains in high gear. The current robust pace of job growth is double that needed to absorb the growth in the working age population. The only blemish in the job market is the loss of jobs in the energy sector. Most encouraging is the healthy rate of job growth among the nation’s smallest companies.”

The BLS report for June will be released tomorrow, Thursday, and the consensus is for 228,000 non-farm payroll jobs added in June.

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Purchase Index up 14% YoY

by Calculated Risk on 7/01/2015 07:00:00 AM

From the MBA: Mortgage Applications Drop in Latest MBA Weekly Survey as Rates Increase

Mortgage applications decreased 4.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 26, 2015. ...

The Refinance Index decreased 5 percent from the previous week to its lowest level since December 2014. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 14 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.26 percent, its highest level since October 2014, from 4.19 percent, with points decreasing to 0.33 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With higher rates, refinance activity is at the lowest level since December 2014.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 14% higher than a year ago.

Tuesday, June 30, 2015

Wednesday: ISM Mfg, ADP Employment, Auto Sales, Construction Spending

by Calculated Risk on 6/30/2015 06:48:00 PM

Statement by the IMF on Greece

Press Release No.15/310Wednesday:

June 30, 2015

Mr. Gerry Rice, Director of Communications at the International Monetary Fund (IMF), made the following statement today regarding Greece’s financial obligations to the IMF due today:

“I confirm that the SDR 1.2 billion repayment (about EUR 1.5 billion) due by Greece to the IMF today has not been received. We have informed our Executive Board that Greece is now in arrears and can only receive IMF financing once the arrears are cleared.

“I can also confirm that the IMF received a request today from the Greek authorities for an extension of Greece’s repayment obligation that fell due today, which will go to the IMF’s Executive Board in due course.”

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 220,000 payroll jobs added in June, up from 200,000 in May.

• At 10:00 AM, the ISM Manufacturing Index for June. The consensus is for an increase to 53.2 from 52.8 in May. The ISM manufacturing index indicated expansion at 52.8% in May. The employment index was at 51.7%, and the new orders index was at 55.8%.

• Also at 10:00 AM, Construction Spending for May. The consensus is for a 0.5% increase in construction spending.

• All day, Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 17.2 million SAAR in June from 17.7 million in May (Seasonally Adjusted Annual Rate).

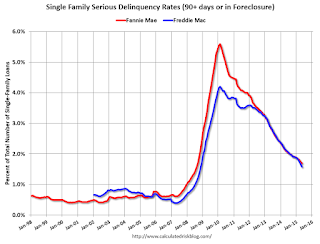

Fannie Mae: Mortgage Serious Delinquency rate declined in May, Lowest since August 2008

by Calculated Risk on 6/30/2015 04:07:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in May to 1.70% from 1.73% in April. The serious delinquency rate is down from 2.08% in May 2014, and this is the lowest level since August 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Last week, Freddie Mac reported that the Single-Family serious delinquency rate declined in May to 1.58%. Freddie's rate is down from 2.10% in May 2014, and is at the lowest level since November 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has only fallen 0.38 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will be below 1% in 2017.

The "normal" serious delinquency rate is under 1%, so maybe serious delinquencies will be close to normal in 2017. This elevated delinquency rate is mostly related to older loans - the lenders are still working through the backlog.

Restaurant Performance Index indicates expansion in May

by Calculated Risk on 6/30/2015 02:31:00 PM

Here is a minor indicator I follow from the National Restaurant Association: Restaurant Performance Index Remained in Positive Territory in May

Although same-stores sales and customer traffic levels softened somewhat in May, the National Restaurant Association’s Restaurant Performance Index (RPI) remained in positive territory. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.3 in May, down 0.4 percent from a level of 102.7 in April. Despite the decline, May represented the 27th consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

“The outlook for the restaurant industry remains positive, as the RPI stood above the 102 level for the 8th consecutive month,” said Hudson Riehle, Senior Vice President of the Research and Knowledge Group for the Association. “A majority of restaurant operators reported higher same-store sales in May, and operators are generally optimistic about an improving business environment in the months ahead.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 102.3 in May, down from 102.7 in April. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. This is another solid reading.