by Calculated Risk on 6/23/2015 05:40:00 PM

Tuesday, June 23, 2015

Sacramento Housing in May: Less than 10% Distressed Sales, Inventory down YoY

Note: This was delayed this month.

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For some time, not much changed. But over the last 3 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In May, 9.8% of all resales were distressed sales. This was down from 11.9% last month, and down from 14.7% in May 2014. Since distressed sales happen year round, but conventional sales decline in December and January, the percent of distressed sales bumps up in the winter (seasonal).

The percentage of REOs was at 5.3% in May, and the percentage of short sales was 4.4%.

This is the lowest level of distressed sales since this data series started.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 0.1% year-over-year (YoY) in May. This was the first YoY decrease in inventory in Sacramento since April 2013.

Cash buyers accounted for 15.2% of all sales (frequently investors).

Total sales were up 4.1% from May 2014, and conventional equity sales were up 10.2% compared to the same month last year.

Summary: This data suggests a healing market with fewer distressed sales, more equity sales, and less investor buying.

Chemical Activity Barometer "Leading Economic Indicator Heats Up"

by Calculated Risk on 6/23/2015 02:20:00 PM

Here is a relatively new indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Leading Economic Indicator Heats Up

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), increased by 0.7 percent in June, followed by a similar gain in May, and an upwardly revised 0.5 percent gain in April. The pattern represents an acceleration of productivity not seen since the first quarter of 2011. Data is measured on a measured on a three-month moving average (3MMA). Accounting for adjustments, the CAB remains up 3.7 percent over this time last year, also an acceleration of annual growth as compared to the first half of 2015. ...

Applying the CAB back to 1919, it has been shown to provide a lead of two to 14 months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests some pickup in growth for industrial production.

Comments on New Home Sales and Prices

by Calculated Risk on 6/23/2015 11:59:00 AM

The new home sales report for May was solid, with sales above expectations at 546 thousand on a seasonally adjusted annual rate basis (SAAR), and upward revisions to prior months.

Earlier: New Home Sales increased to 546,000 Annual Rate in May

The Census Bureau reported that new home sales this year, through May, were 233,000, not seasonally adjusted (NSA). That is up 24.0% from 188,000 during the same period of 2014 (NSA). That is a strong year-over-year gain for the first five months!

Sales were up 19.5% year-over-year in May.

This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain will probably be strong through July (the first seven months were especially weak in 2014), however I expect the year-over-year increases to slow later this year - but the overall year-over-year gain should be solid in 2015.

Also, as part of the new home sales report, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in May 2015 was $282,800; the average sales price was $337,000."

The following graph shows the median and average new home prices.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery - with limited finished lots in recovering areas - builders moved to higher price points to maximize profits.

The average price in May 2015 was $337,000 and the median price was $282,800. Both are above the bubble high (this is due to both a change in mix and rising prices), but are below the recent peak. The recent decline in the median and average is probably because some builders have introduced new homes at lower price points.

The third graph shows the percent of new homes sold by price.

There has also been some pickup in homes sold in the $150K to $300K range.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move sideways (distressed sales will continue to decline and be partially offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 546,000 Annual Rate in May

by Calculated Risk on 6/23/2015 10:16:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 546 thousand.

The previous three months were revised up by a total of 34 thousand (SA).

"Sales of new single-family houses in May 2015 were at a seasonally adjusted annual rate of 546,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.2 percent above the revised April rate of 534,000 and is 19.5 percent above the May 2014 estimate of 457,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still close to the bottoms for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply decreased in May to 4.5 months.

The months of supply decreased in May to 4.5 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of May was 206,000. This represents a supply of 4.5 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

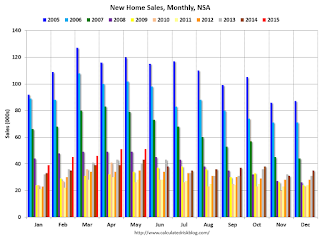

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In May 2015 (red column), 51 thousand new homes were sold (NSA). Last year 43 thousand homes were sold in May. This is the highest for May since 2007.

The all time high for May was 120 thousand in 2005, and the all time low for May was 26 thousand in 2011.

This was above expectations of 525,000 sales in May, and new home sales are on pace for solid growth in 2015. I'll have more later today.

FHFA: House Prices increased 0.3% in April, Up 5.3% Year-over-year

by Calculated Risk on 6/23/2015 09:09:00 AM

This house price index is only for houses with Fannie or Freddie mortgages.

From the FHFA: FHFA House Price Index Up 0.3 Percent in April 2015

U.S. house prices rose in April, up 0.3 percent on a seasonally adjusted basis from the previous month, according to the Federal Housing Finance Agency (FHFA) monthly House Price Index (HPI). The previously reported 0.3 percent change in March remains unchanged.

The FHFA HPI is calculated using home sales price information from mortgages sold to or guaranteed by Fannie Mae and Freddie Mac. From April 2014 to April 2015, house prices were up 5.3 percent. The U.S. index is 2.3 percent below its March 2007 peak and is roughly the same as the February 2006 index level.

For the nine census divisions, seasonally adjusted monthly price changes from March 2015 to April 2015 ranged from -0.8 percent in the East North Central division to +1.4 percent in the West North Central division. The 12-month changes were all positive, ranging from +2.3 percent in the Middle Atlantic division to +7.5 percent in the Pacific division.

emphasis added

This graph is from the FHFA and shows nominal house prices in April were 2.3% below the March 2007 peak for this index.

This graph is from the FHFA and shows nominal house prices in April were 2.3% below the March 2007 peak for this index.However, these are nominal prices. In real terms (inflation adjusted), national prices are still around 20% below the previous peak.