by Calculated Risk on 6/10/2015 02:36:00 PM

Wednesday, June 10, 2015

The Shrinking Deficit

From the WSJ: U.S. Annual Budget Deficit Falls Near Seven-Year Low

Over the past 12 months, the budget deficit has narrowed to $412 billion, down from $460 billion in April and $491 billion a year earlier. That marks the lowest 12-month deficit since August 2008.The most recent CBO projection was for the fiscal 2015 budget deficit to be 2.7% of GDP. Right now it looks like fiscal 2015 will be closer to 2.4% (a significant change).

...

The brighter budget outlook means the deficit could fall below projections made by analysts just a few months ago. The Congressional Budget Office forecast in March that the federal deficit would rise to $486 billion this year, from $485 billion last year.

Meanwhile, Congress has yet to raise the federal debt limit. The Treasury has been using emergency measures since mid-March to avoid breaching the ceiling.

The Treasury hasn’t yet said how long it might be able to do that, but the CBO estimated in March that those measures should last until October or November.

Quarterly Services Survey suggests upward revision to Q1 GDP

by Calculated Risk on 6/10/2015 11:18:00 AM

From Reuters: U.S. services data suggest upward revision to Q1 GDP

The Commerce Department's quarterly services survey ... showed consumption, including healthcare spending, increased at a faster clip than the government had assumed in its second estimate of gross domestic product published last month.Here is the Q1 Quarterly Services Press Release

JPMorgan said the data suggested first-quarter consumer spending could be bumped up ... together with revisions for construction spending, trade and wholesale inventory data, suggests first-quarter GDP could be revised to show it contracting at a 0.2 percent rate instead of the 0.7 percent pace of decline the government reported last month.

FNC: Residential Property Values increased 5.3% year-over-year in April

by Calculated Risk on 6/10/2015 10:01:00 AM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their April 2015 index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 1.2% from March to April (Composite 100 index, not seasonally adjusted).

The 10 city MSA increased 1.7% in April, and the 20-MSA and 30-MSA RPIs both increased 1.6% and 1.4% respectively. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was higher in April than in March, with the 100-MSA composite up 5.3% compared to April 2014.

The index is still down 17.5% from the peak in 2006 (not inflation adjusted).

This graph shows the year-over-year change based on the FNC index (four composites) through April 2015. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change mostly steady at around 5% for the last several months.

Note: The March Case-Shiller index will be released on Tuesday, June 30th.

MBA: Mortgage Applications Increase in Latest Weekly Survey, Purchase Index up 15% YoY

by Calculated Risk on 6/10/2015 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 8.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 5, 2015. The previous week’s results included an adjustment for the Memorial Day holiday. ...

The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index increased 10 percent from one week earlier. The unadjusted Purchase Index increased 20 percent compared with the previous week and was 15 percent higher than the same week one year ago.

“Mortgage application volume rebounded strongly in the week following the Memorial Day holiday, indicating that the holiday had a larger impact on business activity than originally assumed. Comparing volume over the past two weeks, purchase activity is up over 6 percent, while refinance activity is down 5 percent. Strong job gains in May and initial signs of wage growth are supporting the purchase market,” said Mike Fratantoni, MBA’s Chief Economist.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.17 percent, its highest level since November 2014, from 4.02 percent, with points increasing to 0.38 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The increase this week was probably related to the holiday adjustment. With higher rates, refinance activity should decline.

2014 was the lowest year for refinance activity since year 2000.

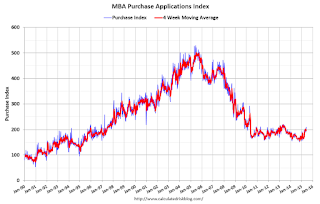

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 15% higher than a year ago.

Tuesday, June 09, 2015

Wednesday: Q1 Quarterly Services Report

by Calculated Risk on 6/09/2015 07:30:00 PM

Mortgage rates are still down year-over-year, but it is getting close.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Right Back to 2015 Highs

Mortgage rates bounced back up to the highest levels of 2015 today. ...Wednesday:

Most lenders remain at 4.125% for conventional 30yr fixed quotes on top tier scenarios, but an increasing number of them moved up to 4.25% today.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, the Q1 Quarterly Services Report from the Census Bureau.

• At 2:00 PM, the Monthly Treasury Budget Statement for May.