by Calculated Risk on 6/09/2015 07:30:00 PM

Tuesday, June 09, 2015

Wednesday: Q1 Quarterly Services Report

Mortgage rates are still down year-over-year, but it is getting close.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Right Back to 2015 Highs

Mortgage rates bounced back up to the highest levels of 2015 today. ...Wednesday:

Most lenders remain at 4.125% for conventional 30yr fixed quotes on top tier scenarios, but an increasing number of them moved up to 4.25% today.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, the Q1 Quarterly Services Report from the Census Bureau.

• At 2:00 PM, the Monthly Treasury Budget Statement for May.

CoreLogic: "Number of Loans in Foreclosure Lowest Since 2007"

by Calculated Risk on 6/09/2015 04:37:00 PM

From CoreLogic: Number of Loans in Foreclosure Lowest Since November 2007

CoreLogic reported today that the national foreclosure inventory fell by 24.9 percent year over year in April 2015 to approximately 521,000 homes, or 1.4 percent of all homes with a mortgage. This marks 42 months of consecutive year-over-year declines ... Also in April 2015, the 12-month sum of completed foreclosures continued to decline, dropping by 19.8 percent to 538,000 since April 2014. The seriously delinquent inventory fell to 1.4 million loans, a 22.1-percent year-over-year decline.

Click on graph for larger image.

Click on graph for larger image.The report today was for April. Here is a map from the March report that shows foreclosure inventory by state.

Some key "bubble" states - like Arizona and California - have mostly recovered.

Several judicial foreclosure states - like New Jersey and Florida - are still struggling.

From CoreLogic today:

Judicial foreclosure states, on average, continued to have higher foreclosure rates than non-judicial states, averaging 2.3 percent and 0.7 percent, respectively, in April 2015. The foreclosure rate for judicial states peaked in February 2012 at 5.4 percent, while non-judicial states experienced peak foreclosure rates in January 2011. As of April 2015, 42 percent of outstanding mortgages were in judicial states, but 70 percent of total loans in foreclosure were in those states.

Las Vegas Real Estate in May: Sales Decreased 2.5% YoY

by Calculated Risk on 6/09/2015 12:31:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports steady home sales and prices with tight housing supply

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in May was 3,363, down from 3,450 one year ago. Compared to May 2014, 2.6 percent fewer homes and 2.2 percent fewer condos and townhomes sold this May.There are several key trends that we've been following:

...

GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. In May, 7.3 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 7.9 percent one year ago. Another 8.0 percent of May sales were bank-owned, down 9.1 percent from one year ago.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in May was 13,569, down 0.5 percent from one year ago. GLVAR tracked a total of 3,470 condos, high-rise condos and townhomes listed for sale on its MLS in May, down 4.8 percent from one year ago.

By the end of May, GLVAR reported 7,133 single-family homes listed without any sort of offer. That’s up 7.8 percent from one year ago. For condos and townhomes, the 2,268 properties listed without offers in May represented a 0.4 percent increase from one year ago.

emphasis added

1) Overall sales were down 2.5% year-over-year.

2) Conventional (equity, not distressed) sales were unchanged year-over-year. In May 2014, 83.0% of all sales were conventional equity. In May 2015, 84.7% were standard equity sales. Note: In May 2013 (two years ago), only 57.9% were equity! There was a significant change from 2013 to 2014.

3) The percent of cash sales has declined year-over-year from 40.2% in May 2014 to 29.1% in May 2015. (investor buying appears to be declining).

4) Non-contingent inventory is up 7.8% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing - but still ongoing.

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

| Feb-15 | 15.8% |

| Mar-15 | 12.2% |

| Apr-15 | 7.6% |

| May-15 | 7.8% |

BLS: Jobs Openings increased to 5.4 million in April, Highest on Record

by Calculated Risk on 6/09/2015 10:07:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings rose to 5.4 million on the last business day of April, the highest since the series began in December 2000, the U.S. Bureau of Labor Statistics reported today. The number of hires was little changed at 5.0 million in April and the number of separations was little changed at 4.9 million. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.7 million quits in April, little changed from March.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April, the most recent employment report was for May.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in April to 5.376 million from 5.109 million in March.

The number of job openings (yellow) are up 22% year-over-year compared to April 2014.

Quits are up 11% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another solid report. It is a good sign that job openings are over 5 million - at an all time high, and that quits are increasing solidly year-over-year.

NFIB: Small Business Optimism Index increased in May

by Calculated Risk on 6/09/2015 09:07:00 AM

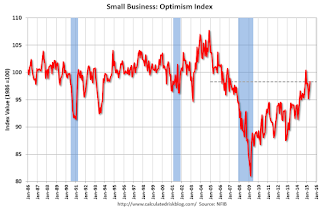

From the National Federation of Independent Business (NFIB): Small business optimism level is finally back to a normal level

The Index of Small Business Optimism increased 1.4 points to 98.3 ... May is the best reading since the 100.4 December reading but nothing to write home about. The 42 year average is 98.0 ... Eight of the 10 Index components posted improvements.

...

Small businesses posted another decent month of job creation in May, a string of 5 solid months of job creation. On balance, owners added a net 0.13 workers per firm over the past few months.... Twenty-nine percent of all owners reported job openings they could not fill in the current period, up 2 points, revisiting the February reading, and the highest reading since April 2006.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 98.3 in May from 96.9 in April.