by Calculated Risk on 6/09/2015 09:07:00 AM

Tuesday, June 09, 2015

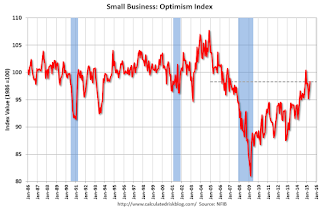

NFIB: Small Business Optimism Index increased in May

From the National Federation of Independent Business (NFIB): Small business optimism level is finally back to a normal level

The Index of Small Business Optimism increased 1.4 points to 98.3 ... May is the best reading since the 100.4 December reading but nothing to write home about. The 42 year average is 98.0 ... Eight of the 10 Index components posted improvements.

...

Small businesses posted another decent month of job creation in May, a string of 5 solid months of job creation. On balance, owners added a net 0.13 workers per firm over the past few months.... Twenty-nine percent of all owners reported job openings they could not fill in the current period, up 2 points, revisiting the February reading, and the highest reading since April 2006.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 98.3 in May from 96.9 in April.

Monday, June 08, 2015

Tuesday: Job Openings

by Calculated Risk on 6/08/2015 08:35:00 PM

The endless Greek tragedy continues, from the WSJ: Greece, Creditors Discuss Extending Bailout in Bid to Break Deadlock

The eurozone’s portion of Greece’s €245 billion ($276 billion) rescue program runs out at the end of June, raising questions over how Athens will pay off its debt beyond this month and remain in Europe’s currency union. ...Tuesday:

A nine-month extension would help carry Athens over its current funding gap. It would also give both Prime Minister Alexis Tsipras and his country’s creditors—the eurozone and the International Monetary Fund—more time to chart a new path for Greece’s economy. But it leaves open questions over whether the government would, indeed, be able to finance itself beyond March, or need even more support.

To help keep Greece solvent over the proposed bailout extension, Greece would receive financing from some €10.9 billion in aid money that had originally been set aside to prop up Greek banks, three people familiar with the negotiations said.

• At 9:00 AM ET, the NFIB Small Business Optimism Index for May

• At 10:00 AM, the Job Openings and Labor Turnover Survey for April from the BLS. Jobs openings decreased in March to 4.994 million from 5.144 million in February. The number of job openings were up 19% year-over-year in March, and Quits were up 14% year-over-year.

Tenth Anniversary of Greenspan's "Froth" Testimony

by Calculated Risk on 6/08/2015 04:21:00 PM

For fun ... tomorrow is the tenth anniversary of then Fed Chairman Alan Greenspan's "Froth" testimony on June 9, 2005:

Although a "bubble" in home prices for the nation as a whole does not appear likely, there do appear to be, at a minimum, signs of froth in some local markets where home prices seem to have risen to unsustainable levels.Yes. Maybe a little "froth" in housing, but no "substantial macroeconomic implications"! Oops ...

The housing market in the United States is quite heterogeneous, and it does not have the capacity to move excesses easily from one area to another. Instead, we have a collection of only loosely connected local markets. Thus, while investors can arbitrage the price of a commodity such as aluminum between Portland, Maine, and Portland, Oregon, they cannot do that with home prices because they cannot move the houses. As a consequence, unlike the behavior of commodity prices, which varies little from place to place, the behavior of home prices varies widely across the nation.

Speculation in homes is largely local, especially for owner-occupied residences. For homeowners to realize accumulated capital gains on a residence--a precondition of a speculative market--they must move. Another formidable barrier to the emergence of speculative activity in housing markets is that home sales involve significant commissions and closing costs, which average in the neighborhood of 10 percent of the sales price. Where homeowner sales predominate, speculative turnover of homes is difficult.

But in recent years, the pace of turnover of existing homes has quickened. It appears that a substantial part of the acceleration in turnover reflects the purchase of second homes--either for investment or vacation purposes. Transactions in second homes, of course, are not restrained by the same forces that restrict the purchases or sales of primary residences--an individual can sell without having to move. This suggests that speculative activity may have had a greater role in generating the recent price increases than it has customarily had in the past.

The apparent froth in housing markets may have spilled over into mortgage markets. The dramatic increase in the prevalence of interest-only loans, as well as the introduction of other relatively exotic forms of adjustable-rate mortgages, are developments of particular concern. To be sure, these financing vehicles have their appropriate uses. But to the extent that some households may be employing these instruments to purchase a home that would otherwise be unaffordable, their use is beginning to add to the pressures in the marketplace.

The U.S. economy has weathered such episodes before without experiencing significant declines in the national average level of home prices. In part, this is explained by an underlying uptrend in home prices. Because of the degree of customization of homes, it is difficult to achieve significant productivity gains in residential building despite the ongoing technological advances in other areas of our economy. As a result, productivity gains in residential construction have lagged behind the average productivity increases in the United States for many decades. This shortfall has been one of the reasons that house prices have consistently outpaced the general price level for many decades.

Although we certainly cannot rule out home price declines, especially in some local markets, these declines, were they to occur, likely would not have substantial macroeconomic implications.

Labor Force Participation Rate: There are few "Missing 41-Year-Olds"

by Calculated Risk on 6/08/2015 12:08:00 PM

Every month, with the release of the employment report, we see commentary that says "the labor force participation rate is at or near a 30 year low". Duh! That was expected based on demographics and is not worth reading (Note: the participation rate might move sideways for a couple of years, but is projected to decline for another decade or more).

There is usually some discussion about the decline in the prime working age participation rate - and this is more interesting. However a careful analysis shows that the participation rate for prime workers is now close to the expected rate.

A year ago I wrote: 41-Year-Olds and the Labor Force Participation Rate and I discussed a few key points:

1) Analyzing and forecasting the labor force participation requires looking at a number of factors. Everyone is aware that there is a large cohort has moved into the 50 to 70 age group, and that that has pushing down the overall participation rate. Another large cohort has been moving into the 16 to 24 year old age group - and many in this cohort are staying in school (a long term trend that has accelerated recently) - and that is another key factor in the decline in the overall participation rate.

2) But there are other long term trends. One of these trends is for a decline in the participation rate for prime working age men (25 to 54 years old).

3) There has been some discussion that the decline in prime working age workers is due to "weakness of the labor market", however this decline was happening long before the Great Recession. For some reasons, see: Possible Reasons for the Decline in Prime-Working Age Men Labor Force Participation and on demographics from researchers at the Atlanta Fed: "Reasons for the Decline in Prime-Age Labor Force Participation"

Here is a look at the trend for 40 to 44 year old men (BLS data, only available Not Seasonally Adjusted since 1976). I choose men only to simplify.

This graph shows the 40 to 44 year old men participation rate since 1976 (note the scale doesn't start at zero to better show the change).

There is a clear downward trend, and a researcher looking at this trend in the year 2000 might have predicted the 40 to 44 year old men participation rate would about the level as today (see trend line).

Clearly there are other factors than "economic weakness" causing this downward trend. I listed some reasons a few months ago, and new research from Pew Research suggests stay-at-home dads is one of the reasons: Growing Number of Dads Home with the Kids

Just looking at this graph, I don't think there are many "missing 41-Year-Old" men that will be returning to the labor force.

Note: This is a rolling 12 month average to remove noise (data is NSA), and the scale doesn't start at zero to show the change.

Clearly there is a downward trend for all 5 year age groups. When arguing about how many workers are "missing", we need to take these long term trends into account.

The trend is more complicated for women.

Here is a look at the participation rate of women in the prime working age groups over time.

Note: This is a rolling 12 month average to remove noise (data is NSA), and the scale doesn't start at zero to show the change.

For women, the participation rate increased significantly until the late 90s, and then started declining slowly. This is a more complicated story than for men, and that is why I used prime working age men above to show the gradual downward decline in participation that has been happening for decades (and is not just recent economic weakness).

The bottom line is that the participation rate was declining for prime working age workers before the recession, there are several reasons for this decline (not just recent "economic weakness") and many estimates of "missing workers" are probably way too high.

Merrill and Goldman Expect GDP to Rebound in Q2

by Calculated Risk on 6/08/2015 09:54:00 AM

Some excerpts from two research reports ...

From Merrill Lynch: To everything, there is a season

After a dismal start to the new year, we think that the worst is behind us. At its low, our tracking model for 1Q GDP pegged growth at -1.2%; now it is tracking -0.2%. The low for 2Q was 2.3%; now it is tracking 2.9%. On a similar note, key monthly data releases have shifted from negative to neutral. On a negative note, both core retail sales and manufacturing output were flat in April; on a positive note, the latest housing starts and auto sales data were strong and the labor market continues to motor along, with 200,000-plus job gains and a modest pick-up in wage growth.From Goldman Sachs: After the Pothole

emphasis added

We view the recent turnaround in the US economic data as further confirmation that weak Q1 GDP growth was largely a result of temporary factors and statistical distortions with little bearing on the outlook for the rest of the year. Once again, the US economy seems to be climbing out of a Q1 pothole.Based on recent data, Q1 GDP will probably be revised up with the next release. And it looks like there will be a bounce back in Q2 (although the Atlanta Fed GDPNow model is only tracking 1.1% for Q2.

...

We continue to expect strong growth for the remainder of 2015. We are currently tracking Q2 GDP growth at 2.7% and expect a slight acceleration to 3% in 2015H2. We expect a pick-up in consumer spending to provide the largest contribution to stronger growth over the remainder of this year. Consumption grew a puzzlingly soft 1.8% in 2015Q1 despite strong disposable income growth and high consumer confidence. While many have expressed concern about softer spending in recent months, it is worth recalling that consumption has risen a respectable 2.7% over the last year ... We expect a rebound in coming quarters as the 1 percentage point (pp) increase in the saving rate seen over the last six months reverses.