by Calculated Risk on 6/03/2015 02:00:00 PM

Wednesday, June 03, 2015

Fed's Beige Book: Economic Activity Expanded, Respondents "generally optimistic"

Fed's Beige Book "Prepared at the Federal Reserve Bank of Dallas based on information collected on or before May 22, 2015"

Reports from the twelve Federal Reserve Districts suggest overall economic activity expanded during the reporting period from early April to late May. Activity in the Richmond, Chicago, Minneapolis, and San Francisco Districts was characterized as growing at a moderate pace, while the New York, Philadelphia, and St. Louis Districts cited modest growth. Contacts in the Boston District reported mixed conditions, and the Cleveland and Kansas City Districts indicated a slight pace of expansion. Compared to the previous report, the pace of growth slowed slightly in the Dallas District but held steady in the Atlanta District. Outlooks among respondents were generally optimistic, with growth expected to continue at a modest to moderate pace in several districts. ...And on real estate:

Manufacturing activity generally held steady or increased over the reporting period, except for in the Dallas District where it was slightly weaker and in the Kansas City District where it fell markedly.

Residential real estate activity and construction expanded in most districts since the prior report, and outlooks were largely positive. Homes sales rose strongly in the Minneapolis District on a year-over-year basis, while more modest to moderate gains were reported by all of the remaining districts, except for Philadelphia where builders reported mixed conditions for new home sales and brokers noted slightly slower existing-home sales in April on a year-over-year basis. ... Residential construction was flat to up during the reporting period, although a few districts reported a slower pace of homebuilding activity due to financing and capacity constraints and severe weather.

Commercial real estate leasing and construction activity improved in most districts, and outlooks were optimistic.

emphasis added

ISM Non-Manufacturing Index decreased to 55.7% in May

by Calculated Risk on 6/03/2015 10:04:00 AM

The May ISM Non-manufacturing index was at 55.7%, down from 57.8% in April. The employment index decreased in May to 55.3%, down from 56.7% in April. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: May 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in May for the 64th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 55.7 percent in May, 2.1 percentage points lower than the April reading of 57.8 percent. This represents continued growth in the non-manufacturing sector although at a slower rate. The Non-Manufacturing Business Activity Index decreased to 59.5 percent, which is 2.1 percentage points lower than the April reading of 61.6 percent, reflecting growth for the 70th consecutive month at a slower rate. The New Orders Index registered 57.9 percent, 1.3 percentage points lower than the reading of 59.2 percent registered in April. The Employment Index decreased 1.4 percentage points to 55.3 percent from the April reading of 56.7 percent and indicates growth for the 15th consecutive month. The Prices Index increased 5.8 percentage points from the April reading of 50.1 percent to 55.9 percent, indicating prices increased in May for the third consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in May. Overall there has been a slight slowing in the rate of growth for the non-manufacturing sector. Respondents’ comments are mostly positive about business conditions and indicate economic growth will continue."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 57.2% and suggests slower expansion in May than in April. Overall this was a decent report.

Trade Deficit declined in April to $40.9 Billion

by Calculated Risk on 6/03/2015 08:46:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $40.9 billion in April, down $9.7 billion from $50.6 billion in March, revised. April exports were $189.9 billion, $1.9 billion more than March exports. April imports were $230.8 billion, $7.8 billion less than March imports.The trade deficit was smaller than the consensus forecast of $43.9 billion.

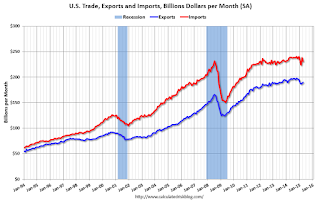

The first graph shows the monthly U.S. exports and imports in dollars through April 2015.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports increased in April. Note: Imports surged in March due to the resolution of the West Coast port slowdown and the unloading of waiting ships, so a decrease in imports was expected in April.

Exports are 14% above the pre-recession peak and down 3% compared to April 2014; imports are at the pre-recession peak, and down 3% compared to April 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings over last few months due to port slowdown.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings over last few months due to port slowdown.Oil imports averaged $46.52 in April, up slightly from $46.47 in March, and down from $95.00 in April 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China decreased to $26.5 billion in April, from $27.3 billion in April 2014. The deficit with China is a large portion of the overall deficit.

ADP: Private Employment increased 201,000 in May

by Calculated Risk on 6/03/2015 08:18:00 AM

Private sector employment increased by 201,000 jobs from April to May according to the May ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was at the consensus forecast for 200,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 9,000 jobs in May, after adding just 1,000 in April. The construction industry had another good month in May adding 27,000 jobs, up from 24,000 last month. Meanwhile, manufacturing lost 5,000 jobs in May, after losing 8,000 in April.

Service-providing employment rose by 192,000 jobs in May, a strong rise from 164,000 in April. The ADP National Employment Report indicates that professional/business services contributed 28,000 jobs in May, down from April’s 35,000. Trade/transportation/utilities grew by 56,000, up from April’s 41,000. The 12,000 new jobs added in financial activities is double last month’s 6,000.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market posted a solid gain in May. Employment growth remains near the average of the past couple of years. At the current pace of job growth the economy will be back to full employment by this time next year. The only blemishes are the decline in mining jobs due to the collapse in oil prices and the decline in manufacturing due to the strong dollar.”

The BLS report for May will be released on Friday and the consensus is for 220,000 non-farm payroll jobs added in May.

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Purchase Index up 14% YoY

by Calculated Risk on 6/03/2015 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 7.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 29, 2015. This week’s results include an adjustment to account for the Memorial Day holiday. ...

The Refinance Index decreased 12 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 14 percent compared with the previous week and was 14 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.02 percent from 4.07 percent, with points decreasing to 0.33 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It would take much lower rates - below 3.5% - to see a significant refinance boom this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 14% higher than a year ago.