by Calculated Risk on 6/02/2015 08:43:00 PM

Tuesday, June 02, 2015

Wednesday: Trade Deficit, ADP Employment, ISM Non-Mfg Index, Beige Book

This made me chuckle today ... "If the last seven years have taught investors anything, it’s to focus on the negatives and never change your mind." Josh Brown

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 200,000 payroll jobs added in May, up from 169,000 in April.

• At 8:30 AM, Trade Balance report for April from the Census Bureau. The consensus is for the U.S. trade deficit to be at $43.9 billion in April from $51.4 billion in March. Note: The trade deficit increased sharply in March after the West Coast port slowdown was resolved in February. The deficit should decline significantly in April.

• At 10:00 AM, the ISM non-Manufacturing Index for April. The consensus is for index to decrease to 57.2 from 57.8 in April.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Hatzius: September rate hike "sensible in the base case ", "but less than optimal on risk management grounds"

by Calculated Risk on 6/02/2015 05:32:00 PM

A few excerpts from a research piece by Goldman Sachs chief economist Jan Hatzius: A September Hike: Sensible in the Base Case, Premature on Risk Management Grounds

The monetary policy path in the March "dot plot", which implies rate hikes starting at the September FOMC meeting, is consistent with the implications of a Taylor 1999 rule with a focus on broad labor market slack. To us, this looks like sensible policy in the FOMC's base case for the economy (which is broadly similar to our own at this point).

Nevertheless, we think the risk management case for delaying the first hike until 2016 remains persuasive. There is substantial uncertainty around the economic outlook, the equilibrium funds rate, and the true amount of labor market slack. This uncertainty has asymmetric effects on optimal monetary policy, and generally favors waiting.

Meanwhile, we are unconvinced by the main risk management arguments that are typically deployed in favor of an earlier liftoff than implied by the baseline economic scenario, which include financial stability concerns, worries about "falling behind the curve", and a desire to test the machinery of exit.

For now, our forecast remains that the FOMC will hike rates at the September FOMC meeting. But our discussion today reinforces our existing view that this remains a close call.

U.S. Light Vehicle Sales increased to 17.8 million annual rate in May

by Calculated Risk on 6/02/2015 03:00:00 PM

Based on an AutoData estimate, light vehicle sales were at a 17.9 million SAAR in May. That is up 6.2% from May 2014, and up 7.3% from the 16.5 million annual sales rate last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 17.79 million SAAR from AutoData).

This was above the consensus forecast of 17.0 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This was above the consensus forecast, and the strongest sales pace since July 2005. It appears 2015 will be the best year for light vehicle sales since 2001.

Preliminary May Vehicle Sales at 17.7 million SAAR: Best sales rate since 2005, On pace for Best Year since 2001

by Calculated Risk on 6/02/2015 12:14:00 PM

From WardsAuto: May 2015 U.S. LV Sales Thread: May SAAR Should Top 17 Million

May WardsAuto report forecasted LV sales for May at 1.6 million units, equating to a SAAR of nearly 17.5 million units. Wtih 6 of the Top 7 automakers reporting sales are trending at 1.63 million units, equating to a SAAR slightly above 17.7 million units.From the WSJ: Auto Makers Posted Stronger-Than-Expected U.S. Sales in May

emphasis added

Several top auto makers logged stronger-than-expected U.S. vehicle sales in May, adding to the industry’s momentum this year.I'll post a graph in a few hours (after all of the results have been reported), but sales were well above the consensus forecast of 17.0 million for May.

...

The results came despite one less selling day compared with last May, which was expected to result in slight year-over-year declines for most major manufacturers.

Still, the U.S. auto industry is on its way to delivering 17 million new vehicles this year—a level unseen since 2001.

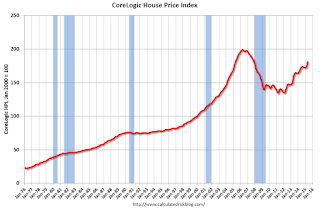

CoreLogic: House Prices up 6.8% Year-over-year in April

by Calculated Risk on 6/02/2015 09:41:00 AM

Notes: This CoreLogic House Price Index report is for April. The recent Case-Shiller index release was for March. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports National Homes Prices Rose by 6.8 Percent Year Over Year in April 2015

CoreLogic® ... today released its April 2015 CoreLogic Home Price Index (HPI®) which shows that home prices nationwide, including distressed sales, increased by 6.8 percent in April 2015 compared with April 2014. This change represents 38 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased by 2.7 percent in April 2015 compared with March 2015.

Including distressed sales, 30 states plus the District of Columbia were at or within 10 percent of their peak prices in April. Eight states and the District of Columbia reached new price peaks not experienced since January 1976 when the CoreLogic HPI started. These states include Alaska, Colorado, Nebraska, New York, Oklahoma, Tennessee, Texas and Wyoming.

Excluding distressed sales, home prices increased by 6.8 percent in April 2015 compared with April 2014 and increased by 2.3 percent month over month compared with March 2015. ...

“For the first four months of 2015, home sales were up 9 percent compared to the same period a year ago,” said Frank Nothaft, chief economist for CoreLogic. “One byproduct of the increased sales activity is rising house prices, and, as a result, month-over-month home prices are up almost 3 percent for April 2015 and up more than 6 percent from a year ago.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 2.7% in April (NSA), and is up 6.8% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty eight consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty eight consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increase had been moving sideways over the previous 7 or 8 months, but has picked up a little recently.