by Calculated Risk on 5/30/2015 09:40:00 PM

Saturday, May 30, 2015

May 2015: Unofficial Problem Bank list declines to 324 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 2015.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for May 2015. During the month, the list fell from 342 institutions to 324 after 17 removals. Assets dropped by $13.9 billion to an aggregate $91.2 billion. Asset figures were updated during the month with the release of q1 financials, which added $2.2 billion. A year ago, the list held 496 institutions with assets of $154.1 billion.

Actions were terminated against FirstBank Puerto Rico, Santurce, PR ($12.4 billion Ticker: FBP); The Talbot Bank of Easton, Maryland, Easton, MD ($591 million Ticker: SHBI); Naugatuck Valley Savings and Loan, Naugatuck, CT ($497 million Ticker: NVSL); Suburban Bank & Trust Company, Elmhurst, IL ($488 million); Sterling Federal Bank, F.S.B., Sterling, IL ($458 million); Bloomfield State Bank, Bloomfield, IN ($383 million); Newton Federal Bank, Covington, GA ($229 million); United Midwest Savings Bank, De Graff, OH ($175 million); Greeneville Federal Bank, FSB, Greeneville, TN ($146 million); Marathon Savings Bank, Wausau, WI ($145 million); Home Federal Savings and Loan Association of Collinsville, Collinsville, IL ($96 million); Heritage Bank of St Tammany, Covington, LA ($90 million); Ozark Heritage Bank, National Association, Mountain View, AR ($85 million); Home Bank of Arkansas, Portland, AR ($75 million); and Eastside Commercial Bank, National Association, Bellevue, WA ($32 million).

Other removals include the failed Edgebrook Bank, Chicago, IL ($95 million) and two banks that found merger partners -- The West Michigan Savings Bank, Bangor, MI ($36 million) and Lake County Bank, Saint Ignatius, MT ($32 million).

The FDIC terminated a Prompt Corrective Action order against United American Bank, San Mateo, CA ($286 million).

This past Wednesday, the FDIC released industry results for the first quarter of 2015 and an update on the Official Problem Bank List. The FDIC said the official list had fallen from 291 to 253 institutions and that assets had dropped from $86.7 billion to $60.3 billion. Thus, the institutions count fell by 13.1 percent and assets declined by 30.4 percent. The official list peaked at 888 institutions with assets of $397 billion, so it is not surprising to see the official list continuing to decline. However, what is surprising is the pace of the decline this quarter in the institution count and assets, which are at their fastest quarterly rate since the official list peaked. It is a challenge to identify how problem bank assets declined by $26.4 billion during the first quarter. Perhaps the FDIC pre-maturely included the $12.4 billion from the action termination in May against FirstBank Puerto Rico.

Schedule for Week of May 31, 2015

by Calculated Risk on 5/30/2015 08:41:00 AM

The key report this week is the May employment report on Friday.

Other key indicators include the April Personal Income and Outlays report on Thursday, May ISM manufacturing index on Friday, May vehicle sales on Friday, April Trade Deficit on Tuesday, and the May ISM non-manufacturing index also on Tuesday.

8:30 AM ET: Personal Income and Outlays for April. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: ISM Manufacturing Index for May. The consensus is for an increase to 51.8 from 51.5 in April.

10:00 AM: ISM Manufacturing Index for May. The consensus is for an increase to 51.8 from 51.5 in April.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 51.5% in April. The employment index was at 48.3%, and the new orders index was at 53.5%.

10:00 AM: Construction Spending for April. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 17.0 million SAAR in May from 16.5 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 17.0 million SAAR in May from 16.5 million in April (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for April. The consensus is a 0.1% decrease in orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 200,000 payroll jobs added in May, up from 169,000 in April.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through March. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $43.9 billion in April from $51.4 billion in March. Note: The trade deficit increased sharply in March after the West Coast port slowdown was resolved in February. The deficit should decline significantly in April.

10:00 AM: the ISM non-Manufacturing Index for April. The consensus is for index to decrease to 57.2 from 57.8 in April.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 276 thousand from 282 thousand.

8:30 AM: Productivity and Costs for Q1. The consensus is for a 6.0% increase in unit labor costs.

8:30 AM: Employment Report for May. The consensus is for an increase of 220,000 non-farm payroll jobs added in May, up from the 213,000 non-farm payroll jobs added in April.

The consensus is for the unemployment rate be unchanged at 5.4%.

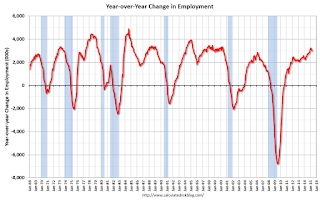

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In April, the year-over-year change was just under 3.0 million jobs.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

3:00 PM: Consumer Credit for March from the Federal Reserve. The consensus is for an increase of $16.0 billion in credit.

Friday, May 29, 2015

Restaurant Performance Index increased in April

by Calculated Risk on 5/29/2015 07:10:00 PM

Here is a minor indicator I follow from the National Restaurant Association: Restaurant Performance Index Posts Moderate Gain in April

Driven by stronger same-stores sales and customer traffic levels, the National Restaurant Association’s Restaurant Performance Index (RPI) posted a moderate gain in April. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.7 in April, up 0.5 percent from a level of 102.2 in March. In addition, April represented the 26th consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

"While individual indicators experienced some choppiness in recent months, the overall RPI stood above the 102 level for seven consecutive months,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “This was driven by consistent majorities of restaurant operators reporting positive same-store sales as well as an optimistic outlook for sales growth in the months ahead.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 102.7 in April, up from 102.2 in March. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. This is another solid reading.

Fannie Mae: Mortgage Serious Delinquency rate declined in April, Lowest since September 2008

by Calculated Risk on 5/29/2015 04:10:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in April to 1.73% from 1.78% in March. The serious delinquency rate is down from 2.13% in April 2014, and this is the lowest level since September 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier week, Freddie Mac reported that the Single-Family serious delinquency rate was declined in April to 1.66%. Freddie's rate is down from 2.15% in April 2014, and is at the lowest level since November 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has fallen 0.40 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will close to 1% in late 2016.

The "normal" serious delinquency rate is under 1%, so maybe serious delinquencies will be close to normal at the end of 2016. This elevated delinquency rate is mostly related to older loans - the lenders are still working through the backlog.

Business Executives are NOT experts in Economics

by Calculated Risk on 5/29/2015 02:53:00 PM

Excuse this pet peeve, but for some reason, when a business executive is interviewed on CNBC (and elsewhere), they are asked about economics in addition to their assumed areas of expertise. News flash: Business executives are NOT experts in economics (This should be called the "Jack Welch rule").

An example today: Richard Kovacevich, former chairman and CEO at Wells Fargo was on CNBC today, and said:

"We should be growing at 3 percent, given the difficulty of this last recession," he told CNBC's "Squawk Box." "We always get a higher and faster recovery from a tough recession, and this is the slowest ever, and I think it's the policies that are coming out of Washington DC that are causing this."Wrong.

Imagine an economy with an unchanging labor force, and no innovation (everyone just does things they way they've always been done). How much should GDP grow? Zero.

Now imagine a second economy with a labor force growing 5% per year, no resource constraints, a short learning curve, and no innovation. How much should GDP grow? About 5% per year.

That is why I wrote Demographics and GDP: 2% is the new 4% earlier this year.

Two lessons: 1) Experts in one field are not necessarily experts in another, and 2) demographics matter - and right now 2% is the new 4%.