by Calculated Risk on 5/07/2015 07:42:00 PM

Thursday, May 07, 2015

Friday: Jobs, Jobs, Jobs

Here is the employment preview I posted earlier: Preview: Employment Report for April

Goldman Sachs is forecasting 230,000 jobs added, and for the unemployment rate to decline to 5.4%.

Merrill Lynch is forecasting 235,000 jobs added in April, and the unemployment rate declining to 5.4%.

Nomura is forecasting 210,000 jobs, a 0.28% increase in wages month-to-month, and a 5.4% unemployment rate.

Friday:

• At 8:30 AM ET, the Employment Report for April. The consensus is for an increase of 220,000 non-farm payroll jobs added in April, up from the 126,000 non-farm payroll jobs added in March. The consensus is for the unemployment rate to decline to 5.4%.

Phoenix Real Estate in April: Sales Up 9.3%, Inventory DOWN 13% Year-over-year

by Calculated Risk on 5/07/2015 05:31:00 PM

For the fifth consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from last year.

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in April were up 9.3% year-over-year.

2) Cash Sales (frequently investors) were down to 25.3% of total sales.

3) Active inventory is now down 13.2% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow.

Now, with falling inventory, prices might increase a little faster in 2015 (something to watch if inventory continues to decline).

| April Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash | Percent Cash | Inventory | YoY Change | |

| Apr-08 | 4,8751 | --- | 986 | 20.2% | 55,7261 | --- |

| Apr-09 | 8,564 | 75.7% | 3,464 | 40.4% | 44,165 | -20.7% |

| Apr-10 | 9,261 | 8.1% | 3,641 | 39.3% | 41,756 | -5.5% |

| Apr-11 | 9,328 | 0.7% | 4,489 | 48.1% | 34,515 | -17.3% |

| Apr-12 | 8,438 | -9.5% | 4,013 | 47.6% | 21,125 | -38.8% |

| Apr-13 | 8,744 | 3.6% | 3,670 | 42.0% | 20,083 | -4.9% |

| Apr-14 | 7,656 | -12.4% | 2,469 | 32.2% | 29,889 | 48.8% |

| Apr-15 | 8,368 | 9.3% | 2,120 | 25.3% | 25,950 | -13.2% |

| 1 April 2008 does not include manufactured homes, ~100 more | ||||||

Goldman Sachs April Employment Preview

by Calculated Risk on 5/07/2015 03:15:00 PM

Yesterday I discussed several indicators: Preview: Employment Report for April

Some excerpts from a research piece by Goldman Sachs economist David Mericle:

We expect nonfarm payroll job growth of 230k in April ... We expect the unemployment rate to decline by one-tenth to 5.4% and average hourly earnings to rise 0.2%.

...

Based on our method for estimating the payrolls effect of deviations in weather conditions from seasonal norms, we expect that warmer temperatures should be a substantial positive factor for April payrolls. The weeks leading into the March reference week were much colder than usual, while the weeks leading into the April reference period were quite a bit warmer than usual. Furthermore, the change in employment in both the construction and leisure and hospitality industries was about 30k below trend in March.

...

We also see some upside risk to our baseline forecast from a calendar effect. There were five rather than four weeks between the reference weeks for the March and April payrolls surveys this year. While the relevant history is limited and the BLS's seasonal adjustment procedure does attempt to control for the four-versus-five week effect, we have found that five-week Aprils tend to see above-trend payroll growth. Moreover, we have found that this calendar effect is not fully captured by other employment-related data. We expect an unusually large and positive calendar effect this month.

Part II: Demographics are Now Improving, Projections

by Calculated Risk on 5/07/2015 01:15:00 PM

Yesterday I pointed out that a blog post on demographics at the Financial Times would make more sense if it had been written a decade ago.

A decade ago it was obvious that demographics would be a drag on the economy. Even without the financial crisis, we would have expected a slowdown in growth.

But now the prime working age population is growing again, and we can expect growth to pick up over the next decade.

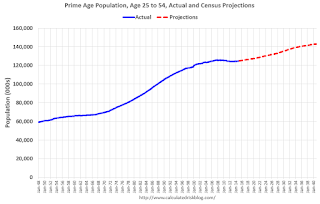

Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through March 2015 - with projections from the Census Bureau through 2040.

In the '80s, the prime working age population was growing 2% or more per year. Over the last 10 years (March 2005 through March 2015), the prime working age population was mostly unchanged (up less than 1% for the decade).

That is key reason that growth has slowed (see Demographics and GDP: 2% is the new 4%). Add the residual effects of the financial crisis to the drag from demographics - and the last decade was no surprise.

Going forward, the prime working age population will grow at a 0.5% to 1.0% annual rate (Census projections). This isn't the 2%+ per year of the 1980s, but it is still decent growth.

Demographics are now improving in the U.S..

Las Vegas Real Estate in April: Sales Increased 5.1% YoY

by Calculated Risk on 5/07/2015 10:31:00 AM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports local housing market seeing steady growth this spring

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in April was 3,379, up from 3,358 in March and up from 3,215 one year ago. Compared to the previous month, GLVAR reported that sales were up 1.7 percent for single-family homes, but down 3.8 percent for condos and townhomes. Compared to April 2014, 5.3 percent more homes and 4.3 percent more condos and townhomes sold this April.There are several key trends that we've been following:

...

GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. In April, 7.2 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 8.3 percent in March and from 12.4 percent one year ago. Another 8.3 percent of April sales were bank-owned, down from 9.3 percent in March and down from 11.4 percent last April.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in April was 13,750, up 1.6 percent from 13,532 in March, but down 0.6 percent from one year ago. GLVAR tracked a total of 3,626 condos, high-rise condos and townhomes listed for sale on its MLS in April, up 0.4 percent from 3,613 in March, but down 1.9 percent from one year ago.

By the end of April, GLVAR reported 7,296 single-family homes listed without any sort of offer. That’s up 0.5 percent from March and up 13.6 percent from one year ago. For condos and townhomes, the 2,437 properties listed without offers in April represented a 0.3 percent decrease from March and a 7.6 percent increase from one year ago.

emphasis added

1) Overall sales were up 5.1% year-over-year.

2) Conventional(equity, not distressed) sales were up 16.5% year-over-year. In April 2014, only 76.2% of all sales were conventional equity. In April 2015, 84.5% were standard equity sales. Note: In April 2013 (two years ago), only 57.5% were equity! A significant change.

3) The percent of cash sales has declined year-over-year from 41.4% in April 2014 to 30.4% in April 2015. (investor buying appears to be declining).

4) Non-contingent inventory is up 7.6% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing - but still ongoing.

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

| Feb-15 | 15.8% |

| Mar-15 | 12.2% |

| Apr-15 | 7.6% |