by Calculated Risk on 5/06/2015 02:47:00 PM

Wednesday, May 06, 2015

MBA: Mortgage Delinquency and Foreclosure Rates Decrease in Q1, Lowest since Q2 2007

Earlier from the MBA: Mortgage Delinquencies and Foreclosures Fall in First Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 5.54 percent of all loans outstanding at the end of the first quarter of 2015. This was the lowest level since the second quarter of 2007. The delinquency rate decreased 14 basis points from the previous quarter, and 57 basis points from one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 2.22 percent, down five basis points from the fourth quarter of 2014 and 43 basis points lower than the same quarter one year ago. This was the lowest foreclosure inventory rate since the fourth quarter of 2007.

...

"Delinquency rates and the percentage of loans in foreclosure continued to fall in the first quarter and are now at their lowest levels since 2007," said Joel Kan, MBA's Associate Vice President of Industry Surveys and Forecasting. "The job market continues to grow, and this is the most important fundamental improving mortgage performance. Additionally, home prices continued to rise, as did the pace of sales, thus increasing equity levels and enabling struggling borrowers to sell if needed."

"The foreclosure inventory rate has decreased in the last twelve quarters, and now is at the lowest level since the fourth quarter of 2007. The rate, at 2.22 percent, was about half of where it was at its peak in 2010. With a declining 90+ day delinquency rate and the improving credit quality of new loans, we expect that the foreclosure inventory rate will continue to decline in coming quarters. Foreclosure starts decreased one basis point from the previous quarter, and continue to fluctuate from quarter to quarter mainly due to state-level differences in the speed of the foreclosure process. At 0.45 percent, the level of foreclosure starts is at its long run average.

...

Around 40 percent of loans serviced are in judicial states and these states continue to have a foreclosure inventory rate that is well above that of non-judicial states. For states where the judicial process is more frequently used, 3.64 percent of loans serviced were in the foreclosure process, compared to 1.22 percent in non-judicial states. States that utilize both judicial and non-judicial foreclosure processes had a foreclosure inventory rate closer that of to the non-judicial states at 1.43 percent.

...

"Legacy loans continue to account for the majority of all troubled mortgages. Within loans that were seriously delinquent (either more than 90 days delinquent or in the foreclosure process), 73 percent of those loans were originated in 2007 or earlier, even as the overall rate of serious delinquencies for those cohorts decreases. More recent loan vintages, specifically loans originated in 2012 and later, continue to exhibit low serious delinquency rates."

emphasis added

Click on graph for larger image.

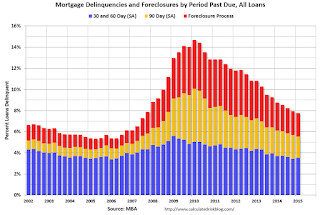

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 and 60 days delinquent are back to normal levels.

The 90 day bucket peaked in Q1 2010, and is about 75% of the way back to normal.

The percent of loans in the foreclosure process also peaked in 2010 and and is about 70% of the way back to normal.

So it has taken about 5 years to reduce the backlog of seriously delinquent and in-foreclosure loans by over 70%, so a rough guess is that serious delinquencies and foreclosure inventory will be back to normal near the end of 2016 (although progress has slowed). Most other mortgage measures are already back to normal, but the lenders are still working through the backlog of bubble legacy loans.

Preview: Employment Report for April

by Calculated Risk on 5/06/2015 11:45:00 AM

Friday at 8:30 AM ET, the BLS will release the employment report for April. The consensus, according to Bloomberg, is for an increase of 220,000 non-farm payroll jobs in April (with a range of estimates between 180,000 and 335,000), and for the unemployment rate to decline to 5.4%.

The BLS reported 126,000 jobs added in March.

Here is a summary of recent data:

• The ADP employment report showed an increase of 169,000 private sector payroll jobs in April. This was below expectations of 205,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month (see table at bottom), but in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index decreased in April to 48.3%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 30,000 in April. The ADP report indicated a 10,000 decrease for manufacturing jobs.

The ISM non-manufacturing employment index increased in April to 56.7%. A historical correlation (linear) between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 250,000 in April.

Combined, the ISM indexes suggests employment gains of 220,000. This suggests employment growth at expectations.

• Initial weekly unemployment claims averaged close to 283,000 in April, down slightly from March. For the BLS reference week (includes the 12th of the month), initial claims were at 296,000; this was up slightly from 293,000 during the reference week in March.

Generally this suggests about the same low level of layoffs in April as for the previous eight months (employment gains averaged 253,000 per month over that period).

• The final April University of Michigan consumer sentiment index increased to 95.9 from the March reading of 93.0. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like gasoline prices.

• On small business hiring: The small business index from Intuit showed a 15,000 increase in small business employment in April, the same strong level as in March.

• Trim Tabs reported that the U.S. economy added 327,000 jobs in April. This is up from their estimate of 268,000 last month. "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 140 million U.S. workers subject to withholding" .

• Conclusion: Below is a table showing several employment indicators and the initial BLS report (the first column is the revised employment). Two key points:

1) Unfortunately none of the indicators below is very good at predicting the initial BLS employment report.

2) In general it looks like this should be another 200+ month (based on ISM, unemployment claims, and small business hiring).

There is always some randomness to the employment report. My guess is something close to the consensus this month.

| Employment Indicators (000s) | ||||||

|---|---|---|---|---|---|---|

| BLS Revised | BLS Initial | ADP Initial | ISM | Weekly Claims Reference Week1 | Intuit Small Business | |

| Jan 2014 | 166 | 113 | 175 | 236 | 329 | 10 |

| Feb 2014 | 188 | 175 | 139 | -6 | 334 | 0 |

| Mar 2014 | 225 | 192 | 191 | 153 | 323 | 0 |

| Apr 2014 | 330 | 288 | 220 | NA | 320 | 25 |

| May 2014 | 236 | 217 | 179 | 130 | 327 | 35 |

| Jun 2014 | 286 | 288 | 281 | NA | 314 | 20 |

| Jul 2104 | 249 | 209 | 218 | NA | 303 | 15 |

| Aug 2014 | 213 | 142 | 204 | 285 | 299 | 0 |

| Sep 2014 | 250 | 248 | 213 | NA | 281 | 10 |

| Oct 2014 | 221 | 214 | 230 | 340 | 284 | 15 |

| Nov 2014 | 423 | 321 | 208 | 260 | 292 | 30 |

| Dec 2014 | 329 | 252 | 241 | 252 | 289 | 30 |

| Jan 2015 | 201 | 257 | 213 | 115 | 308 | 20 |

| Feb 2015 | 264 | 295 | 212 | 235 | 282 | 10 |

| Mar 2015 | 126 | 189 | NA | 293 | 15 | |

| Apr 2015 | Friday | 169 | 220 | 296 | 15 | |

| 1Lower is better for Unemployment Claims | ||||||

ADP: Private Employment increased 169,000 in April

by Calculated Risk on 5/06/2015 08:19:00 AM

Private sector employment increased by 169,000 jobs from March to April according to the March ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 205,000 private sector jobs added in the ADP report.

...

Goods-producing employment declined by 1,000 jobs in April, down from 3,000 jobs gained in March. The construction industry added 23,000 jobs, up from 21,000 last month. Meanwhile, manufacturing lost 10,000 jobs in April, after losing 3,000 in March.

Service-providing employment rose by 170,000 jobs in April, down slightly from 172,000 in March. The ADP National Employment Report indicates that professional/business services contributed 34,000 jobs in April, up from March’s 28,000. Expansion in trade/transportation/utilities grew by 44,000, up from March’s 41,000. The 7,000 new jobs added in financial activities is a drop from last month’s 12,000.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Fallout from the collapse of oil prices and the surging value of the dollar are weighing on job creation. Employment in the energy sector and manufacturing is declining. However, this should prove temporary and job growth will reaccelerate this summer."

The BLS report for April will be released on Friday and the consensus is for 220,000 non-farm payroll jobs added in April.

MBA: Mortgage Purchase Applications increase, Refinance Applications in Latest Weekly Survey

by Calculated Risk on 5/06/2015 07:01:00 AM

From the MBA: Mortgage Applications Decrease 4.6 % in Latest MBA Weekly Survey

Mortgage applications decreased 4.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 1, 2015. ...

The Refinance Index decreased 8 percent from the previous week to the lowest level since January 2015. The seasonally adjusted Purchase Index increased 1 percent from one week earlier to its highest level since June 2013. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 12 percent higher than the same week one year ago.

...

“Refinance volume dropped last week as rates in the US increased sharply towards the end of the week, with signs of recovery in Europe lifting rates across the globe. Purchase activity increased slightly over the week, and the average loan amount for a purchase application reached a record high, a sign that the mix of purchase activity is still skewed toward higher priced homes,” said Mike Fratantoni, MBA’s Chief Economist.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.93 percent from 3.85 percent, with points remaining unchanged from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It would take much lower rates - below 3.5% - to see a significant refinance boom this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 12% higher than a year ago.

Tuesday, May 05, 2015

Mortgage News Daily: Mortgage Rates Near 2015 Highs, Several major Lenders at 4%

by Calculated Risk on 5/05/2015 05:56:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 205,000 payroll jobs added in April, up from 189,000 in March.

• At 9:15 AM, Speech by Fed Chair Janet Yellen, Finance and Society, At the Institute for New Economic Thinking Conference on Finance and Society, Washington, D.C

From Matthew Graham at Mortgage News Daily: Mortgage Rates Dangerously Close to 2015 Highs

In terms of conventional 30yr fixed rate quotes, several major lenders are now up to 4.0%, even for top tier scenarios, though many remain at 3.875%. Just one short week ago, 3.625% was widely available.Here is a table from Mortgage News Daily:

In the broader context, there has only been one day in 2015 where rates were any higher. Before that, you'd need to go back to November to see higher rates.